Derek White/Getty Images Entertainment

Earlier this week, Aaron Judge signed a record free agent contract with the New York Yankees totaling $360 million over 10 years (Judge will be 41 when the contract ends). This came shortly after oft-injured flamethrower Jacob DeGrom signed a 5 year, $185 million deal with the spendthrift Texas Rangers and the NL Pennant winning Phillies signed Trea Turner to an 11 year $300 million contract (which concludes when Turner is 40). Following last year’s labor agreement, MLB salaries are clearly on the rise.

Fortunately for Liberty Braves (NASDAQ:BATRA) fans and shareholders alike, the team boasts a talented lineup and doesn’t need to go out and acquire over-priced free agents. Even better, the Braves have locked up their core players in long-term deals (discussed below) prior to the salary inflation we are seeing.

This positions the Braves to continue to generate profits for shareholders while experiencing on-field success (Braves won the NL East for a 5th consecutive year in 2022) for and are likely to do so for several years.

Expensive Free Agents vs. Braves Homegrown Talent

Beyond the contracts outlined in my introduction, there have been many other signings of long, expensive contracts. This offseason the Mets have signed the following free agent deals:

- a 2 year, $43 million annual commitment to 39 year old AL Cy Young award winner Justin Verlander,

- a $21 million annual commitment ($105 million total over 5 years) to closer Edwin Diaz,

- and a $20 million annual deal for outfielder Brandon Nimmo (an 8 year deal which pays Nimmo until age 38)

- $26 million over 2 years ($13 million annually) to 35-year-old Jose Quintana

- $10 million one-year deal with 38-year-old relief pitcher David Robertson

In all, the division rival New York Mets are on track to spend over $330 million in 2023 (bankrolled by hedge funder Steve Cohen) which will be an all-time MLB team spending record. The Mets are probably set to spend more as Cohen looks for the World Series title which led the billionaire to buy the team in the first place.

The Phillies (division rival) who defeated to Braves in the NLDS (and went on to the world series) not only signed the aforementioned deal with speedster Trea Turner but also spent over $70 million to sign starting pitcher Taijuan Walker ($18 million annual value for a #4 or 5 starting pitcher).

Despite what I consider to be madness in the market for free agents, the Braves benefit from having ample home-grown, relatively low-cost talent. Taking a responsible, long-term view has allowed the Braves to win 5 consecutive NL East Divisions (won over the Mets who have significantly outspent the Braves the past two years).

Unlike their free spending divisional counterparts, the Braves develop talent in house. Stars Ronald Acuna Junior, Ozzie Albies, Austin Riley and Max Fried were all developed internally (at a lower cost- I’ll explain the MLB salary structure below) as were 2022 Rookie of the Year Michael Harris Jr and 2022 Rookie of the Year runner up Spencer Strider.

Further once the Braves identify a player’s talent as being sustainable, the team signs these players to long-term deals early in their careers (while they are cheap and seek the security of a long-term deal to mitigate risk of career ending injury or lack of performance). Acuna was the first in a string of very team-friendly signings in 2019 with a contract up to 10 years but at a low average annual value ($13 million) and not extending past age 31. , Albies, Strider, and Harris were all signed to long-term deals (on very team friendly terms). NL MVP finalist Austin Riley signed the richest contract in Braves History but terms here are quite reasonable at $212 million over 10 years (finishing when Riley is still productive at age 34). Importantly, unlike the free agent deals outlined above (all of which require teams to pay players into their late 30s when they are unproductive), the contracts the Braves have signed with their players do not extend beyond the players aged 34 seasons.

MLB Salary Structure – Avoiding the Winner’s Curse

To combat the curse of free agency, it is imperative to develop talent in house. MLB’s salary structure is one where cheap, young productive players subsidize old washed up, expensive players. This is because teams have control over their players for 6 years (3 of which are very cheap at basically the league minimum salary of $800k; the second 3 go to arbitration though players still receive sub-market wages though these can approach $30 million).

After 6 years of service, a player is granted free agency and that’s where things get crazy (as outlined above). Anyone who has pondered playing General Manager of an MLB teams knows that there are tempting choices which appear to offer a short term reward (winning the World Series!) but have longer term consequences such as taking on long term high value liabilities in the form of signing free agent contracts (think Albert Pujols deal -there are dozens of ‘Bust’ free agent contracts to choose from).

All teams are to some extent a mix of homegrown players, players acquired in trades, and players ‘bought’ in the open market via free agency. Successful teams like the Braves and Astros (both perennial division winners and World Series contenders) develop talent in house in order to sustainably compete.

Other Positives: Demographics trends & Reach

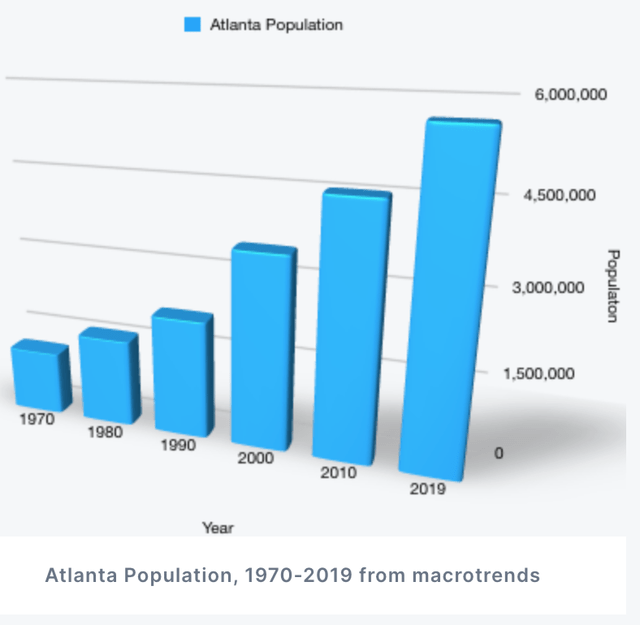

Atlanta is a long-term growth story, here’s a quick look at its long-term population growth:

Atlanta Population over Time (Macrotrends)

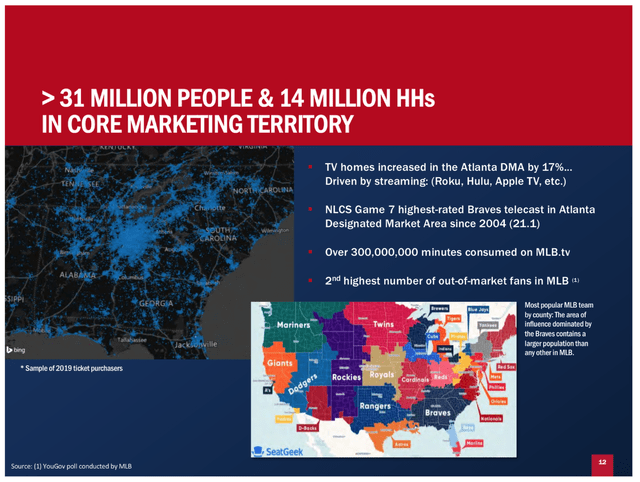

A successful team and growing population have led to consistent increases in attendance and ticket prices while building the value of the Braves TV rights. Importantly, the Braves fanbase extends well beyond Atlanta – the team has a large regional fan base:

Regional Fan Base (Investor Presentation)

The regional fanbase is a function of having aired on TBS for decades (similar to the Cubs/WGN) and having neighboring states who lack a team of their own (no other team within ~400 miles). A wider fan base creates a larger total revenue pie through both media rights and merchandise sales.

Valuation

For 2022, the Braves will have generated $515-545 million (bulk of revenue occurs in the second and third quarters which encompass most of the baseball season) and be somewhere in the neighborhood of $20-50 million in adjusted EBITDA. Fortunately, baseball teams are valued based on revenue rather than EBITDA.

In the private market, baseball teams have sold for 4.5-6.7x revenue in recent years. The most recent comparable transaction was the New York Mets who were bought in late 2020 by billionaire Steve Cohen for $2.5 billion or 6.7x revenue. Stripping out the value of the Braves real estate assets (the Battery – $25 million in NOI at a 7% cap rate) and adjusting for debt, as we sit today, the Braves are valued at just 4x 2022e revenue – below the 4.4x the Seattle Mariners sold for in 2016. The Mariners do not have the same storied history of the Braves (nor has Seattle seen the same type of growth as Atlanta). The struggling Miami Marlins (poor attendance, poor on field performance, issues with stadium) garnered 5.5x revenue in their 2017 sale.

It is interesting to think about the Braves valuation relative to the recently sold Mets. On the one hand, the Mets operate in a considerably larger market – New York is the largest metro in the country. On the other hand, New York has a slower growth profile and more importantly, the NY region is shared with another team…what are they called?…oh right the Yankees- the most popular team of all time. The Braves have a local monopoly and operate in a faster-growing market.

Prior to their recent acquisition, the Mets have been poorly run (no success at MLB level and one of the worst farm systems). Also the timing of the sale was far from optimal given that there were no fans in the stands in 2020. The flipside is that there are more billionaires in NY/with ties to NY – that same buyer might have a lower willingness to pay for a team outside New York (or no interest at all).

We should get some more data points in the next 6-12 months as there are 2-3 teams up for sale (discussed in next section).

Using the range of comparable transactions, I get a range of $37/share (4.5x revenue) to $59/share (6.7x revenue). Ultimately the valuation relies on a timely sale to the right person (read: billionaire baseball enthusiast).

Things to Keep An Eye On

Other than more free agent signings, it is worth noting that two (Los Angeles Angels and Washington Nationals) and possibly three (Orioles) MLB teams are up for sale. While I don’t have financial statements for these teams (again Braves are only publicly traded MLB team), I’d note that these are all lower quality assets as:

- Limited on-field success – the Nationals and Angels both had losing records the past few years

- Teams have been run poorly – the Angels are the poster child for continually signing high priced free agents (and not winning).

- Less favorable population growth trends – medium and long-term population growth in Anaheim and Baltimore is considerably below Atlanta

While these are lower quality assets, I am curious to see both who buys them (tech billionaire or club deal) and what the price of these assets works out to on a price/revenue basis (and relative to Forbes value). Should these sales come in at high prices, this could drive the Braves share price higher.

Conclusion

The Braves are a high quality, well run, and likely undervalued asset. However the Braves are only marginally profitable and don’t distribute any cash flow to shareholders. The catalyst to close the valuation discount would be a sale of the team – however, given that three teams are currently up for sale, now is not a good time to sell the team (there are only so many buyers of baseball teams). Currently I do not have a position in the Braves but should pending team sale prices surprise to the upside (transactions north of 5.5x revenue), I may buy shares.

Be the first to comment