Elena Bionysheva-Abramova/iStock via Getty Images

It’s been a rollercoaster ride of a year for investors in the Gold Juniors Index (GDXJ), with many names starting the year in positive territory, only to suffer 50% plus drawdowns. One theme for the worst performers has been those with high-cost operations, weak balance sheets, and poor track records of execution, evidenced by sharp production misses or meaningful cost guidance revisions, such as Argonaut (OTCPK:ARNGF), Pure Gold (OTCPK:LRTNF), and Victoria Gold (OTCPK:VITFF). Unfortunately, Calibre Mining (OTCQX:CXBMF) has found itself in the same bucket of underperformers from a share-price standpoint, suffering a 70% drawdown from its Q2 2022 highs despite near-flawless execution.

This significant drawdown can be attributed to worries about what effects sanctions imposed by the United States Treasury Department on the Nicaraguan Mining Authority General Directorate of Mines. Calibre and other Nicaraguan producers have confirmed that they’ve seen no impact and don’t expect any impact on their Nicaraguan operations from the sanctions. However, whether material or not, the news has dented the technical picture and could lessen appetite for the stock due to the perception of added risk vs. peers going forward. Let’s take a look at the Q3 results below:

Calibre – Nicaraguan Operations (Company Presentation)

Q3 Production & Sales

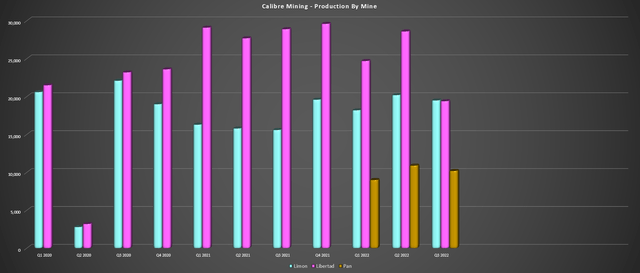

Calibre released its Q3 results earlier this month, reporting quarterly production of ~49,100 ounces, a 10% increase from the year-ago period. The increase in quarterly production was related to the new contribution from the closed acquisition of Fiore Gold, whose Pan Mine produced ~10,200 ounces in the period vs. no contribution last year. On an adjusted basis, without the benefit of Pan, production declined just over 12% year-over-year, with ~39,900 ounces produced from its Nicaraguan operations. However, this was partially related to a failure in the Strip Circuit at the Libertad ADR plant, which impacted capacity in the period.

Calibre – Quarterly Production by Mine (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Libertad and Limon both produced approximately 19,500 ounces in Q3. The 24% increase in production at Limon year-over-year was attributed to higher throughput and higher grades, benefiting from the sequencing of higher grades from Limon Central, La Tigra, and Santa Pancha. At Libertad, production was down over 32% year-over-year (~19,400 ounces vs. ~28,900 ounces), impacted by a significant decline in throughput (~270,900 tonnes processed vs. ~376,800 tonnes processed) offset by higher grades. As noted, this was due to an unplanned outage at the ADR plant, and since quarter-end, the ADR plant is back to operating normally.

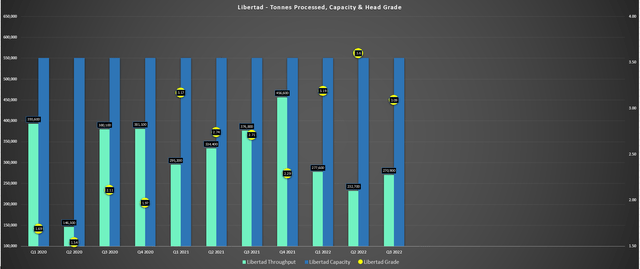

Calibre – Libertad Operations & Excess Capacity (Company Filings, Author’s Chart)

While the short-term decline in production at Libertad in Q3 is disappointing, it’s important to make three points. First, the company has delivered ~71% of its guidance mid-point and remains on track to deliver into guidance with a much better Q4 ahead. Second, mined grades are up substantially, with grades up 19% year-over-year in Q3 and over 30% year-to-date, and production would have been up considerably in Q3 if not for the issue from a processing standpoint. Finally, Libertad is still only running at half of its total capacity (~550,000 tonnes per quarter), and this excess capacity will be filled with even higher grades as Pavon Central and Eastern Borosi come online over the next year. So, there’s no reason to fret about the softer Q3 production at Libertad.

Finally, at the company’s Pan Mine, production came in at ~10,200 ounces, and ~1.34 million tonnes were placed on the leach pad at an average grade of 0.37 grams per tonne of gold in Q3. Unfortunately, there was an inventory write-down of $3.3 million due to reflecting the potential net realized value of ounces on the heap leach pad based on the lower gold price. The result was a $289/oz negative impact on costs in the period, pushing all-in-sustaining costs [AISC] to $1,781/oz. The much higher costs at Pan have weighed on Calibre’s consolidated AISC, with AISC increasing to $1,322/oz for the quarter when combined with inflationary pressures across its operations and fewer ounces sold.

Pan Mine Operations (Company Presentation)

Overall, while the headline results might not suggest it, this was a solid quarter for Calibre. This was evidenced by key permits granted at Eastern Borosi, Pavon development setting up the Pavon Central Mine to deliver higher-grade feed starting next year and continued exploration success across the portfolio. Given that Calibre will be benefiting from 6.0+ gram per tonne grades from Eastern Borosi and Pavon Central in the future, we should see record years for production in 2023 and 2024 as the company taps into excess capacity at Libertad with above-average grades.

Costs & Margins

Moving over to costs, Calibre saw a nearly 21% increase in costs year-over-year, with AISC rising from $1,097/oz to $1,322/oz. Like its peers, Calibre was negatively impacted by higher fuel, consumables, and labor costs but also saw the impact of adding a higher-volume, low-grade operation vs. the year-ago period, the Pan Mine in Nevada. Combined with fewer ounces sold in the period and the write-down at Pan, its unit costs were much higher. However, its year-to-date costs continue to track in line with cost guidance of $1,200/oz to $1,275/oz, with year-to-date costs of $1,268/oz and a much stronger Q4 ahead.

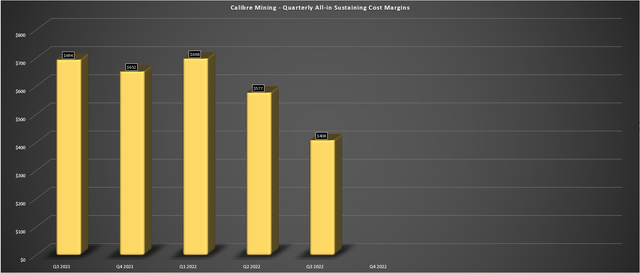

Calibre Mining – Quarterly AISC Margins (Company Filings, Author’s Chart)

Unfortunately, while the rise in costs already negatively impacted margins, the decline in the gold price didn’t help either. The combination of higher costs and a lower gold price ($1,730/oz vs. $1,781/oz) led to a more than 40% decline in AISC margins to just $408/oz (Q3 2021: $694/oz). That said, this was an abnormal quarter due to the inventory write-down and a weaker quarter from its breadwinner, Libertad, due to the unplanned outage. So, while margins took a beating in Q3, they are not down nearly as much on a year-to-date basis ($565/oz vs. $656/oz). Besides, as noted, we should see a meaningful cost improvement as higher grades are fed to Libertad starting next year.

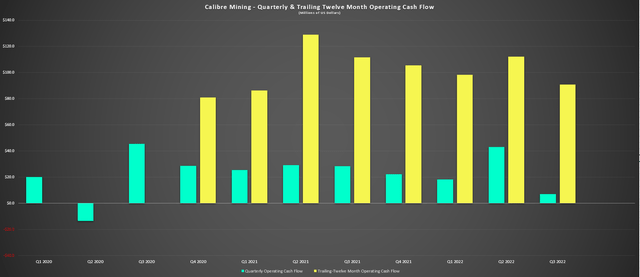

Calibre Mining – Quarterly Operating Cash Flow & Trailing-Twelve-Month Cash Flow (Company Filings, Author’s Chart)

Finally, looking at the financial results, Calibre reported cash flow from operations of $7.1 million, down from $28.3 million in the year-ago period. This was related to much weaker margins and fewer ounces sold. This resulted in a cash outflow of $24.2 million in the period vs. positive free cash flow in the year-ago period. However, this was largely related to a significant increase in growth capital ($31.3 million vs. $15.7 million), with $10.5 million spent on Eastern Borosi equipment, increased development costs at Panteon, and higher development costs at Limon Norte and Tigra. I don’t see any reason to be concerned about this decline in free cash flow generation, with Calibre self-funding a relatively capex-light growth strategy compared to other producers.

Recent Developments

As for recent developments, the gold price has recovered from its plunge below $1,650/oz, and if it can hold up, this would positively impact margins from a sequential standpoint (Q4 2022 vs. Q3 2022). However, the major elephant in the room is the sanctions imposed on the General Directorate of Mines in Nicaragua. As it stands, this doesn’t appear to have any negative impact whatsoever on Calibre’s operations, which the company discussed in more detail below:

In conjunction with the amended executive order, OFAC, a U.S. Treasury Department, announced 2 additional sanctions. The first thing against an individual who was unrelated to Calibre’s business. The second was against the General Director of Mines, which is under the direct control of the Ministry of Energy and Mines and which I will refer to as the DGM going forward. Before discussing the sanctions against the DGM, it is important to provide clarity on what constitutes a sanction violation.

To violate the sanction, there would need to be dealing in the sanction person’s property interest in some way, like payments, agreements to transfer of property or exchange of services. There would also need to be some connection with the United States, which means the involvement of either U.S. person, U.S. dollars or U.S. assets. So now let’s consider Calibre’s relationship with DGM. We do not make direct payments to the DGM.

We do not have contract agreements or joint ventures of any kind with the DGM. We do not exchange services or property interest with DGM. However, like all mining jurisdictions, we have requirements to report routine business information to the regulatory authorities, which in Calibre’s case is the Ministry of Energy and Mines which the DGM is a representative office. Therefore, after consultation with our advisers, we are confident Calibre is not in violation of existing sanctions.

– Calibre Mining Q3 Conference Call

Overall, I do not see these sanctions as a deal-breaker when it comes to investing in Calibre. Still, the problem with uncertainty in an already complex sector is that some prefer to avoid stocks with added uncertainty entirely. This can be an issue from a re-rating standpoint, with an example being Torex which has seen no illegal blockades and no kidnappings or adverse events over the past year at its El Limon-Guajes Mine, yet it continues to be painted with the same negative brush as Los Filos, impacting its valuation. The result has been continued underperformance for the stock for no material reason other than perceptions given that it’s executing just as flawlessly as Calibre. Let’s take a look at Calibre’s valuation below:

Valuation & Technical Picture

Based on ~497 million fully diluted shares and a share price of US$0.62, Calibre Mining trades at a market cap of ~$308 million. This is an extremely attractive valuation for a company that has the potential to grow production to 290,000+ ounces by FY2024, leaving the stock trading at just ~$100 million per 100,000 ounces of future annual production. From a price-to-cash flow standpoint, the company remains one of the cheapest names sector-wide, trading at just ~2.4x conservative FY2023 cash flow estimates of $130 million. This leaves the stock valued similarly to companies with sub-par track records of meeting promises, like Equinox Gold (EQX) and IAMGOLD (IAG), which also have weaker balance sheets.

That said, even if Calibre has noted that the sanctions imposed on the Nicaraguan Directorate of Mines by the United States Treasury Department do not impact its operations, the perception of risk matters and can weigh on a stock’s ability to re-rate. One example is Torex Gold (OTCPK:TORXF) which has spent over a year trading at a massive discount to peers despite having an operation with near Tier-1 size (~450,000 ounces), industry-leading AISC, and phenomenal execution under its CEO Jody Kuzenko. This does not mean that Calibre must suffer a similar fate of underperformance, but the perception of risk must be acknowledged. Plus, even if there hasn’t been any change to operations, the technical picture has deteriorated following the perceived risk.

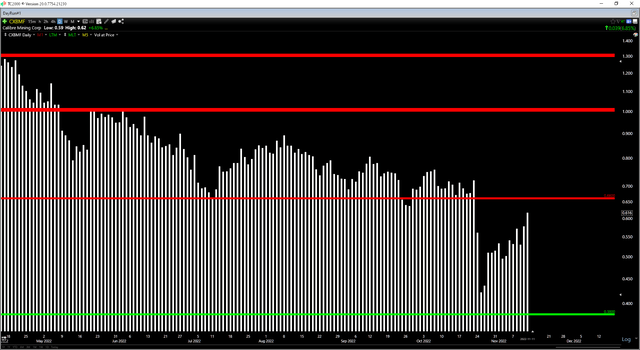

CXBMF Daily Chart (TC2000.com)

As the chart above shows, the panic selling following the news of sanctions sent Calibre’s stock tumbling through a critical support level near US$0.68, and previous support levels often become new resistance levels once broken, assuming a significant drawdown has occurred following the support break. This is precisely what we’ve seen, with a 43% decline in the stock. So, with an updated support level for the stock coming in at US$0.405 and resistance just overhead at US$0.68, Calibre is now trading in the upper end of its new support/resistance range, even if there was no material change to operations.

Some investors will argue that this isn’t an issue and that the fundamentals are much more important to the long-term story, and I would agree. That said, human nature doesn’t change. Those investors/traders sitting at a loss will often take the opportunity to exit at break-even or a small loss after suffering a significant drawdown (which refers to those buying at previous support). So, if I wanted to go long Calibre as a speculative bet and were comfortable investing in a less favorable jurisdiction, I wouldn’t be chasing the stock above US$0.62 but instead would be waiting for a pullback to the lower portion of its updated trading range.

Summary

Calibre continues to execute flawlessly, and this was showcased yet again in Q3. In fact, it’s hard to find a mid-tier with such an attractive business model, highlighted by its aggressive exploration budget and significant organic growth with limited capital spending required (excess mill capacity). That said, while its diversification in Nevada helps, its Nicaraguan operations are responsible for a disproportionate amount of cash flow generation and production. This makes the investment thesis trickier.

The reason is that, as we saw last month, the stock can lose 40% of its value on simply negative headlines related to its primary mining jurisdiction without any material change to operations. Based on this added risk and the fact that the stock is now up 60% off its lows in 13 trading days which makes it prone to profit-taking, I am currently focused elsewhere in the sector. In addition, if I were interested in the stock, I would be sizing future positions conservatively due to the headline risk, even if this company continues to fire on all cylinders, doesn’t appear to be impacted by current sanctions, and would normally be a candidate to overweight in one’s portfolio.

Be the first to comment