Liudmila Chernetska/iStock via Getty Images

Investment Thesis

Despite the stellar FQ4’22 earnings call, it is evident by now that Microsoft Corporation’s (NASDAQ:MSFT) rally has been digested by now, plunging by -22.47% since its recent peak. Otherwise, a tragic -32.66% YTD. With the market’s extreme level of fear, the S&P 500 Index has also plunged by -25.18% YTD, breaking its previous June lows again to Mr. Market’s chagrin. Thereby, indicating the latter’s ever-growing concerns about the potential destruction of demand, triggering even more bleak sentiments in the short term.

It’s also not helping matters that the US labor market was relatively robust in September, with payrolls increasing by 263K and the unemployment rate falling by 3.5% consecutively. Therefore, it is not overly presumptuous that the September CPI will still indicate high inflation rates by 13 October 2022. Thereby, triggering more pain for the stock market in general, with 78% of analysts projecting another 75 basis point hike for the Fed’s November meeting.

There are already devastating whispers in the market, potentially pointing to the Fed’s raised terminal rate to 5% through 2023, from the current projection of 4.6%. Assuming so, we expect to see more carnage in the stock market, pulling the S&P 500 Index down to new lows never seen before. Therefore, we may potentially see MSFT hit $200 in the short term, depending on how things turn out over the next few months. Investors, hang on tight.

MSFT’s Fundamental Performance Remains Robust For Now

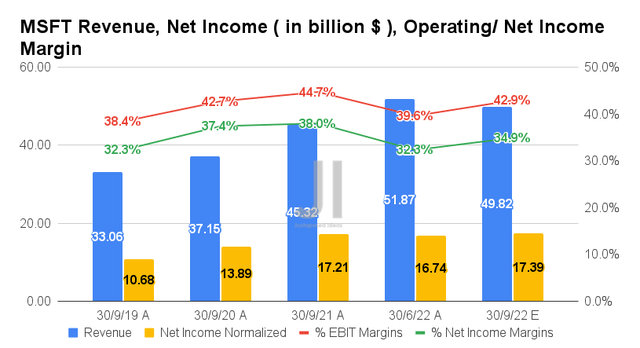

For its upcoming FQ1’23 earnings call, MSFT is expected to report revenues of $49.82B and EBIT margins of 42.9%, indicating the usual decline of -3.95% though an increase of 3.3 percentage points QoQ, respectively. Otherwise, an excellent YoY growth of 9.92% though a moderation of -1.8 percentage points, respectively, attributed to the rising inflationary costs and operating expenses. Stellar indeed, despite the tougher YoY comparison.

In the meantime, MSFT is still expected to report impressive profitability for the next quarter, with net incomes of $17.39B and net income margins of 34.9%. It represents a decent QoQ growth of 3.88% and 2.6 percentage points, respectively. Otherwise, relatively in line YoY with the projected EPS of $2.30 in FQ1’23, indicating an increase of 3.13% QoQ and 1.32% YoY.

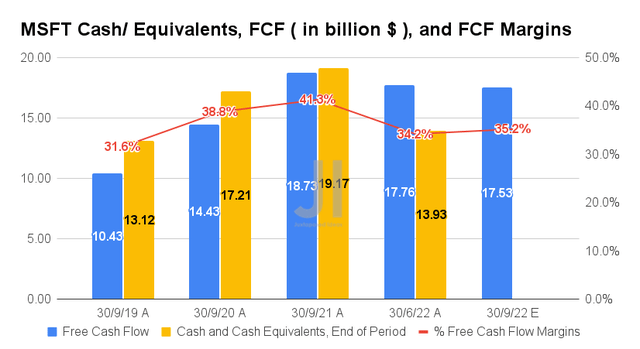

MSFT is also expected to report excellent Free Cash Flow (FCF) generation of $17.53B and an FCF margin of 35.2% in FQ1’23, indicating in line QoQ though a decrease of -6.4% and -6.1 percentage points YoY, respectively. Nonetheless, still boosting its cash and equivalents on its balance sheet reasonably well through the worsening macroeconomics ahead.

MSFT’s Profitability Will Grow Through The Roof Despite Recessionary Fears

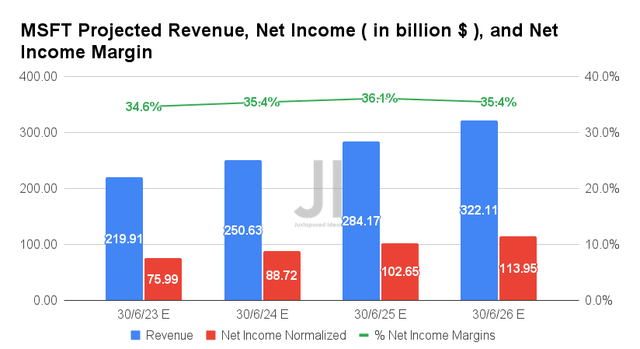

Over the next four years, MSFT is expected to report excellent revenue and net income growth at a CAGR of 12.9% and 11.88%, respectively. Despite the recessionary fears, consensus estimates remain relatively optimistic about its forward execution. The company’s projected top and bottom line growth remains intact since our previous analysis in August, while still representing an improvement of 5.34% in bottom line estimates since July 2022.

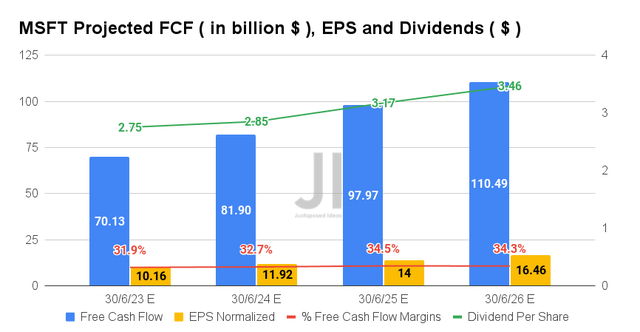

MSFT’s profitability is also growing at an astonishing rate, from net income/FCF margins of 21.4%/30.4% in FY2019, to 26.2%/32.9% in FY2022, and finally reaching a stellar 35.4%/34.3% by FY2026. Thereby, highlighting the strength of MSFT’s cloud strategy in the rapidly accelerating digital transformation ahead post-reopening cadence.

In the meantime, MSFT is expected to report revenues of $219.91B and net incomes of $75.99B, representing excellent YoY growth of 10.91% and 4.48%, respectively, despite the perceived destruction of demand as the macroeconomics worsens over the next few quarters. We shall see.

MSFT’s projected FCF is impressive as well, with the generation of $70.13B and an FCF margin of 31.9% in FY2023, representing a stellar increase of 7.66% though a decline of a percentage point YoY, respectively. These will directly contribute to its improved dividend payouts of approximately $2.75 for the next fiscal year. This will indicate an excellent increase of 8.26% YoY, with a speculative dividend yield of 1.21% then assuming a stock price of $200, compared to an average of 1.07% for the past four years.

Impressive indeed, justifying MSFT’s stock premium against pre-pandemic levels, given the excellent 5Y Total Price Returns of 211.1% and 10Y Returns of 841.2% thus far.

In the meantime, we encourage you to read our previous article on MSFT, which would help you better understand its position and market opportunities.

So, Is MSFT Stock A Buy, Sell, or Hold?

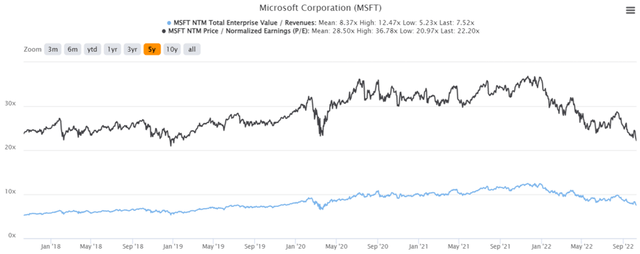

MSFT 5Y EV/Revenue and P/E Valuations

MSFT is currently trading at an EV/NTM Revenue of 7.52x and NTM P/E of 22.20x, lower than its 5Y mean of 8.37x and 28.50x, respectively. The stock is also trading at $225.41, down -35.53% from its 52 weeks high of $349.67, nearing its 52 weeks low of $224.11. Nonetheless, consensus estimates remain bullish about MSFT’s prospects, given their price target of $325.68 and a 44.48% upside from current prices.

MSFT 5Y Stock Price

Naturally, the market will always be full of pitfalls for anyone who tries to pitch the perfect timing, since there may still be some downsides from current levels. As a result, investors with higher risk tolerances may consider nibbling at these levels, fully anticipating the great importance of MSFT’s offerings through the next decade. In the meantime, bottom-fishing investors may try waiting for $200 for maximum portfolio returns, given the extreme levels of FUD in the stock market. Good luck, all.

Be the first to comment