Dan Kitwood/Getty Images News

Credit Suisse’s (NYSE:CS) shares have been having a difficult period since 2021 when the Greensill and Archegos scandals shook investors’ confidence in the bank. But the bank has just announced its transformation or restructuring plans. The details are still unknown but will become so on 27 October after the bank publishes its quarterly earnings results. Bear in mind “restructuring” does not mean “liquidation”. A good example of a relatively successful transformation was that of Deutsche Bank (DB). A piece of good news was the bank’s announcement it would buy back some of its debt. Here I will explain why Credit Suisse is facing problems but is not going bankrupt.

Recent news and developments

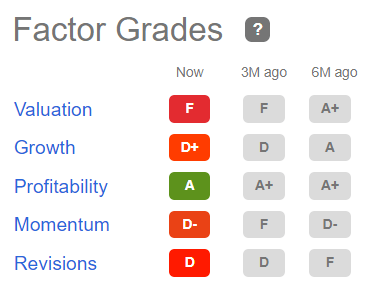

There were some recent news and developments that made the investor community panic. Prices of the bank’s shares and bonds have plunged substantially in the last several weeks due to doubts about Credit Suisse’s ability to pay for a restructuring plan that is about to be announced later this month. Seeking Alpha, meanwhile, has provided the bank with a really bad rating.

Seeking Alpha’s grades of Credit Suisse

Seeking Alpha

Source: Seeking Alpha

The growth, the momentum, the revisions, and even the valuations are horrible. But what has really happened to the bank and why is it under so much pressure right now?

Sure, Credit Suisse has suffered from many scandals and management missteps. It was reported by Bloomberg that CS was seeking an outside investor to attract fresh capital to be able to change its structure. But this information was not confirmed by the bank. It is clear the bank is about to restructure its businesses but the management did not say they needed to attract further funding from outside investors. Moreover, they even assured the bank’s stakeholders of Credit Suisse’s sufficient liquidity.

A good proof of this was the news Credit Suisse offered to buy back up to $3 billion of its debt, thus taking advantage of the bank’s falling bond prices. This made Credit Suisse’s shares rise. The recent debt buyback may raise investor confidence in Credit Suisse’s financial position.

Obviously, the management decision also allowed the bank to lower its interest expenses, to save cash and to improve its balance sheet.

Some of Credit Suisse’s debt is denominated in Euros and some in USDs. The bank is offering to buy back its debt at a discount. For example, it will pay less than 96% of the face value for the EUR 750M note. Although this might not sound like extraordinary news, Credit Suisse’s bonds have always traded over and above their face value. So, buying the bank’s bonds at a discount is already a win.

In spite of some positive news, many analysts and commentators claimed the bank was about to be liquidated. But some went even further by questioning whether the Credit Suisse “collapse” would trigger a Lehman Brothers crisis event. The truth is the current macroeconomic environment is full of risks. But the current situation with Credit Suisse is not the end of the world for the bank and even CS itself.

Why restructuring is not the end of the world for Credit Suisse

Restructuring has happened in the histories of many banks. The most recent and obvious story was that of Deutsche Bank. It is hard to say that DB is doing fantastically well. But its results have shown some positive dynamics compared to the earnings reported in the past. The point I am making is that “restructuring” is not the same as “liquidation”. Moreover, restructuring should help banks get “leaner and fitter” by focusing on the most profitable businesses and getting rid of the loss-making ones. I do not pretend to have a crystal ball and have clear knowledge of the future. But restructuring itself is not the end for Credit Suisse. Let us hope it would be successful.

The 2008 crisis and the current situation

Crises have many things in common. At the same time, many recessions start in one particular sector. For example, in the early 2000s the Dot.com bubble burst. As its name suggests, it was due to the high-tech sector that was ridiculously overvalued. The high-tech stocks fell below their all-time lows, whilst many high-tech companies went bankrupt. Other sectors of the US economy were also affected but to a much lesser degree.

The 2008 crisis started in the housing sector but the financial sector also suffered terribly due to many banks’ horrible investment portfolios. But in spite of this, many banks survived thanks to unprecedented help from the governments in the form of bailouts. Credit Suisse was also bailed out by the Swiss government. The reason why I am saying this is that in this situation when the bank’s management made very serious mistakes and the bank was about to get liquidated, the government stepped in since Credit Suisse was “too big to fail”. Right now nothing of the kind is happening to Credit Suisse. The management is due to announce their restructuring measures on 27 October.

I cannot guarantee these reforms would make the bank sound and profitable overnight. At the same time, restructuring does not mean “liquidation”, whilst the measures taken by the management should hopefully make Credit Suisse leaner and fitter.

Risks

Right now the central banks are getting very hawkish. Many countries around the world are facing abundant pressures due to multi-decade high inflation readings. Consumers are facing declining incomes, whilst the ECB, the SNB (the central bank of Switzerland), and most importantly the Federal Reserve are forced to substantially raise the interest rates to cope with the rising price pressures. How far they would go is still not entirely clear. It seems highly likely a recession is near. At the same time, it is clear the banking sector would suffer just like any cyclical industry.

Also unpleasant is the panic dominating the markets. I find the rumors surrounding Credit Suisse particularly concerning. As I have mentioned before, nothing particularly bad weakening the bank’s financial position has happened in the last few weeks. At the same time, highly pessimistic publications could play the role of a “self-fulfilling prophecy”. But in my view, this very likely won’t be the case.

Valuation

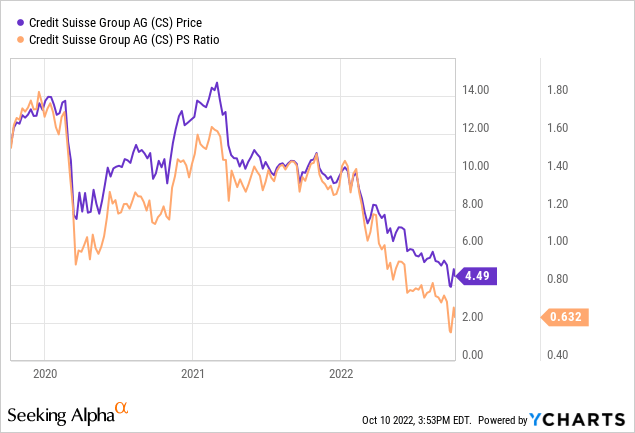

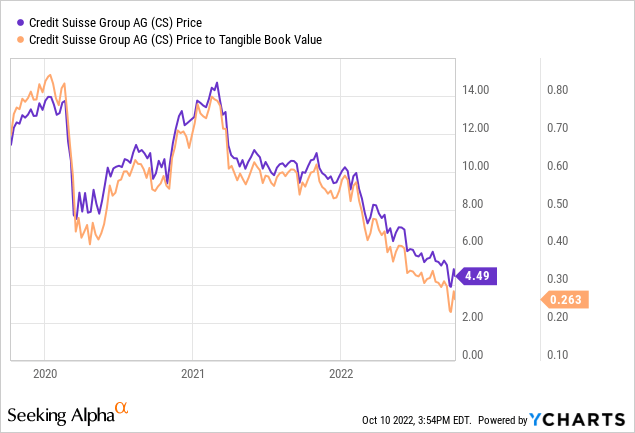

CS stock is highly undervalued. I did not use the price-to-earnings (P/E) ratio since Credit Suisse has not been particularly profitable in the last year. So, I decided to use the price-to-sales (P/S) and the price-to-tangible book value per share measures to judge the value of Credit Suisse’s shares. Y-Charts generated the following graphs for me:

The P/S ratio is sufficiently below the levels seen during the 2020 market crash, which is significant. Please bear in mind that a normal P/S for a bank is around 1. A P/S of around 0.6 is low, indeed.

The situation is no better with the P/TBV per share indicator. It is now almost two times below the levels seen during the March 2020 stock market crash. It seems as if the market expects Credit Suisse to be liquidated. This scenario is, in my view, highly unlikely.

Conclusion

Although the situation leaves us with more questions than answers, the report of Credit Suisse’s death was exaggerated. The restructuring reforms are still unknown to us, whilst we also do not know how long and how serious the next recession would be. Moreover, the bond market in the UK and the Bank of England’s interventions raise concerns. And yet we see some positive news from Credit Suisse’s front, whilst its shares are extremely cheap. Although conservative investors might not want to invest now, patient and risk-tolerant investors might do extremely well by buying CS stock now.

Be the first to comment