Editor’s note: Seeking Alpha is proud to welcome Z Kassotakis as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

CARG stock analysis

Shisanupong Khankaew/iStock via Getty Images

My Thesis On CarGurus

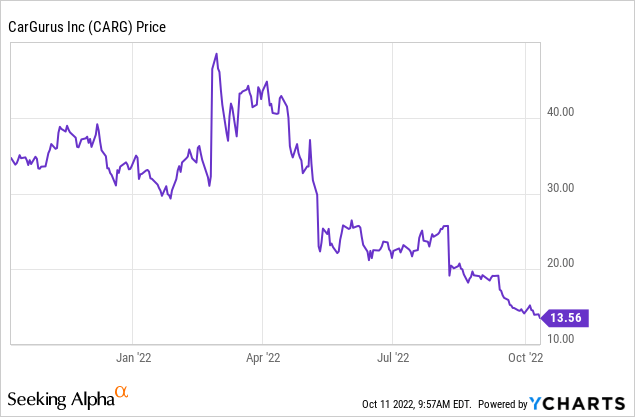

Since the beginning of this year, investors have shed tech stocks at quite a fast pace. Amid this pessimistic environment, CarGurus (NASDAQ:CARG) stands out as a high-growth stock – from both the top and bottom line perspectives – that is currently trading at a cheap price. When COVID hit, it drove many dealerships to shut down their businesses, and CarGurus took heavy hits both on revenue and profit, driving its stock price down 60%.

But the story is different now. Car sales are hot again and CarGurus is back in growth mode derived not only from its core business but also from its recent acquisition of CarOffer. It is a matter of time until these changes are reflected in the stock price when the stock market gets out of this late bear run.

These and some more reasons that I mention below make me bullish on this stock. In my view, it is safe to say that CARG will beat the market in the long term.

How does CarGurus make money?

CarGurus is an online automotive marketplace connecting buyers and sellers to new and used cars. It has:

- 30,000 paying dealers on the marketplace.

- 40 million unique users per month.

CarGurus makes money from four different ways, as detailed below.

1. Product Revenue

CarGurus makes almost half (48%) of its money from vehicles sold to dealers that CarOffer (CarGurus’ subsidiary) acquires directly from customers.

2. Marketplace Revenue

CarGurus makes 35% of its money from subscription fees they charge car dealers on the platform. The company offers four (4) paid dealer subscription plans: Standard, Enhanced, Featured, and Featured Priority, and each of these comes with its own set of perks.

3. Wholesale Revenue

Wholesale revenue includes transaction fees earned by CarOffer from facilitating the purchase and sale of vehicles between dealers, where CarOffer collects fees from both the buyer and seller and represents 18% of CarGurus revenue.

4. Other Revenue

CarGurus makes the remaining portion of its money from “Other Revenue,” as the company describes it. Other revenue is defined as revenue through consumer financing partnerships and peer-to-peer marketplaces.

CarGurus – Financials

As shown above, the stock has plummeted during the last year. Therefore, the question becomes: Is this a bargain or just one more value trap?

The stock is now trading at an EV/FCF ratio of 13.1 which is exceptionally good considering the fact that the future revenue growth is expected to be around 20-30% for at least the next 3 years, according to analysts. The online car buying market is projected to reach $722.79 billion by 2030 from $237.93 billion in 2020, registering a CAGR of 12.2% from 2021 to 2030. If CarGurus manages to get a bigger share of this rapidly growing TAM throughout the next years, it should easily achieve a CAGR of 17%-20%. Also, its P/S ratio of 1.1 is significantly lower than the average P/S of its peers (1.5) although the company is growing at a much greater pace than its peers (11% average growth for its peers, according to analysts). Moreover, CarGurus has a Return on Invested Capital of 16.4% which indicates that they do a brilliant job investing the money they make back into the business. This could lead to higher ROI for CarGurus investors if they purchase the stock at a reasonable price.

However, it should be mentioned that because the revenue from vehicles sold to dealers that CarOffer (CarGurus’ subsidiary) acquires directly from customers is the aspect of the business with the most growth (100% annually) and it has pretty low margins, the overall net profit margin of the business should be expected to fall from 12% that it is currently at. This should not be a deal-breaker as the growth in revenue should be more than enough to offset shrinking margins.

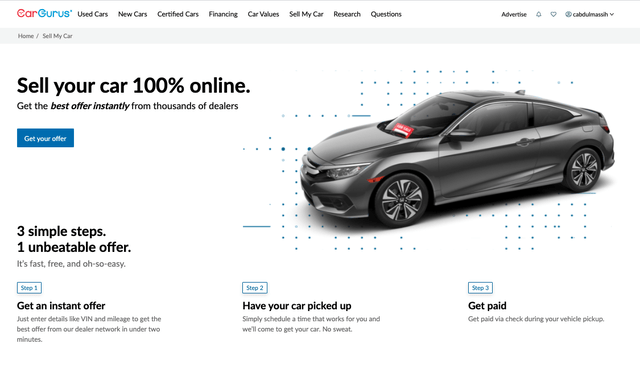

Instant Max Cash Offer

investors.cargurus.com

Another program that CarGurus recently launched is Instant Max Cash Offer. This program allows consumers to sell their vehicles through CarGurus’ website by submitting the vehicle details online and instantly receiving the top bid from thousands of dealers across the country. By doing so, CarGurus manages to combine its own audience of 29.5 million monthly unique visitors in the U.S. with the power of CarOffer’s wholesale bidding system for automotive.

CarGurus expects that this solution can provide a new and previously untapped inventory channel for dealerships, and it can allow consumers to sell their vehicles seamlessly from the comfort of their homes making the whole selling experience more user-friendly.

This made-to-thrive program is expected to become an important aspect of the business as it is growing rapidly and becoming an increasingly part of its revenue.

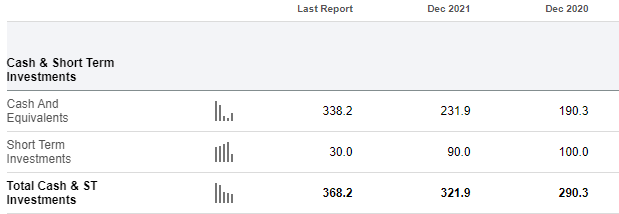

CarGurus – Balance Sheet & Investments

CarGurus’ cash- SeekingAlpha ( )

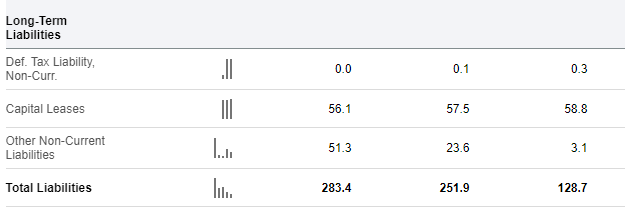

CarGurus’ total liabilities- SeekingAlpha ( )

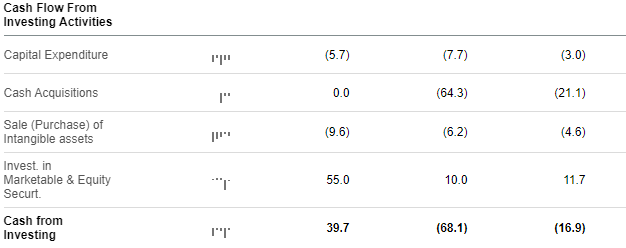

CarGurus investing cash flow- SeekingAlpha ( )

CarGurus has a healthy balance sheet which is what every investor likes to see.

As shown above, CarGurus has more cash in hand than total liabilities. This means that it could pay off all its debt immediately if the management decided to do so. Thus, bankruptcy is not something that investors should be worried about.

CarGurus has a history of acquiring companies. This shows that the company not only invests in its future growth but also tries to expand its TAM by acquiring smaller companies that are rapidly growing in a similar sector as CarGurus. A recent example of this is CarOffer, a company in which CarGurus acquired a 51% stake.

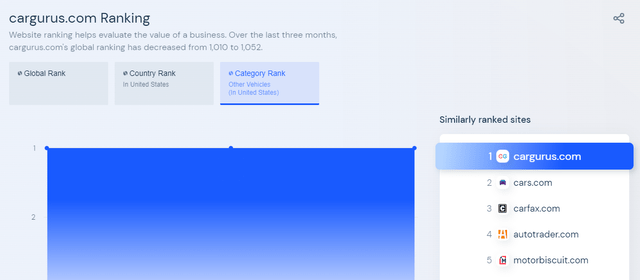

CarGurus – Popularity

CarGurus is the #1 most Googled site in its category. The fact that its site has more visitors than any site of its competitors gives the company a great moat. Also, the fact that CarGurus is considered by dealerships to be a necessary partner due to the amount of web traffic flowing through its site nationwide adds more to its moat.

This is reassuring to a great extent as investors know that it would take a lot for CarGurus to not be one of the most popular destinations for people who want to sell their vehicle or buy a used one, let alone to go out of business.

CarGurus searches (similarweb.com)

CarGurus – Valuation

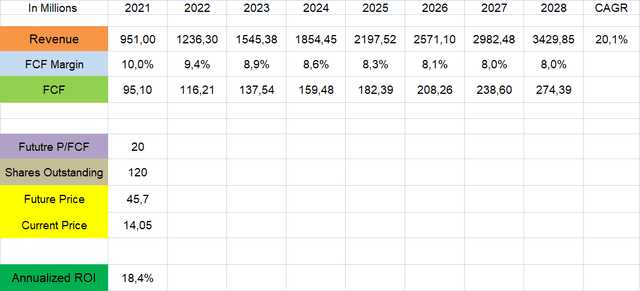

Author’s Calculations

As shown above assuming a CAGR of 20.1% until 2028, which I consider to be a fairly reasonable assumption, and a future P/FCF of 20, which is a bit conservative in my opinion, by buying this company at $14.05 (the price CARG stock is currently trading at) you could enjoy an 18.4% annualized return for the next 6 years, which translates to almost tripling your money in six years. For example, if you decided to invest $1,000 in CarGurus today and the assumptions above do come true, six years from now you will have $2,755, compared to about $1,771 that you would have if you decided to invest the same $1,000 in the S&P500 having an annualized ROI of 10%.

Risks

Although CarGurus is a great company with a great moat, we should not forget that if the management doesn’t manage to bring the expected results we could see the company losing market share to some of its competitors such as Carvana (CVNA) and Vroom (VRM). This would translate to the company losing some of its revenue and possibly having its margins shrink even further. If this becomes the case, then it would be irrational to expect to have an ROI that high (18%).

However, both Carvana and Vroom are new companies that have not yet proven themselves to be sustainable businesses. Both Carvana and Vroom are unprofitable and analysts do not see a way for them to become profitable soon. CarGurus on the other hand is a consistently profitable business that has proven its worth over the years. Moreover, both Carvana and Vroom are meaningfully diluting their shareholders, giving them a smaller piece of the company as time goes on in contrast to CarGurus, which does not drastically change its shares outstanding.

Conclusion

CarGurus stock is down 60% YTD and is now trading at really attractive risk/reward levels. At the current price of $14.05 per share, CARG is a clear value and GARP stock as it offers many fundamental strengths and growth drivers for a cheap price. I see this company beating the market in the long term and I rate it as a Buy.

Be the first to comment