Marina113/iStock Editorial via Getty Images

Introduction

CNH Industrial (NYSE:CNHI) just reported earnings and we can find some useful information to keep on assessing this company and, more in general, the agriculture and farming machinery manufacturing industry.

Summary of previous coverage

When I shared my first article on CNHI my thesis was as follows: CNH Industrial is set to benefit from the spin-off of its On-Highway Unit that now is a separate company that goes under the name of Iveco Group (OTCPK:IVCGF). This demerger has made CNH Industrial a more profitable company that competes in an industry with a clear and established market leader: John Deere (DE). CNH Industrial is the second largest player in the industry with revenues that are going to breach the $20 billion barrier this year. In third place comes AGCO (AGCO) that owns, among its brand portfolio, Fendt, a premium brand well-recognized in Europe that is now expanding into the North-American markets.

Now, my thesis also focused on some macro trends that I saw as more favorable to CNH Industrial. First of all, we have seen a big surge in demand for agriculture and farming machinery. Meanwhile, supply chain bottlenecks have delayed production and deliveries. At the same time, demand for commodities such as crops has increased not only because of a growing world population but also as a consequence of the conflict in Ukraine. Two other macro trends are becoming more and more meaningful: scarcity of land as the urbanization process goes on and scarcity of labor force.

This paints an almost perfect environment for farming machinery manufacturers that hold a sort of oligopoly on the industry. In particular, there is more and more demand for autonomous and precision agriculture than can boost productivity and efficiency without having to use more land or hire new workers.

Why did I think that, although the environment is favorable for the industry as a whole, CNH Industrial was set to benefit the most?

Here is my reasoning. In normal market conditions, the leader has an acknowledged brand value that enables it to sell its products at a premium that usually translates into higher margins compared to its peers. It is exactly the case with Deere. But what happens if the market leader isn’t able to fulfill all the incoming orders and starts to tell its customers that lead time has lengthened and that for many tractors and combines it is more than a year?

Some customers may be so bonded to the brand that they may accept this. But others are pressed because they urgently need new machinery for their needs. As a consequence, they are willing to move to other brands as long as they find a better delivery time. It is what Scott Wine, CNH Industrial’s CEO, has highlighted in the recent earnings calls: this year the real sales driver has been availability. This means that the second largest player of the industry starts receiving orders from customers who are used to paying a premium because they usually buy from the leader. These customers don’t bargain on prices as much as other lower-tier customers. And, since machinery availability is the driver, whoever has the best lead time can charge the price it deems right for the product, without discounting it as usual. The consequence is that margins go up.

While Deere suffered in the first half of the year from margin compression due to wage increases and raw material costs, CNH Industrial has kept on improving its margins well above 10%, a barrier AGCO still struggles with and that was reached only in the most recent quarter.

So far, CNH Industrial has proven my thesis correct. What is to be seen is whether or not the company is taking full advantage of this situation for the years to come, making itself accepted more and more as a true alternative to Deere and, in some markets, to AGCO’s premium brand Fendt.

CNH Industrial after Q3

Let’s recall briefly the main highlights the company released in its Q3 earnings report:

- Consolidated revenues of $5.881 billion (up 23.9% compared to Q3 2021 for continuing operations, up 29% at constant currency)

- Net income of $559 million, Adjusted Net Income of $557 million, with diluted EPS and adjusted diluted EPS of $0.41 Adjusted EBIT of Industrial Activities of $670 million (up $250 million compared to Q3 2021)

- Net cash provided by operating activities of $272 million and Industrial Free Cash Flow of $202 million

- Net sales for Industrial Activities expected up 16% to 18% for the full year, despite foreign exchange rates headwinds

CNH did grow its revenues at a faster pace than AGCO, whose performance YoY was +14.5%.

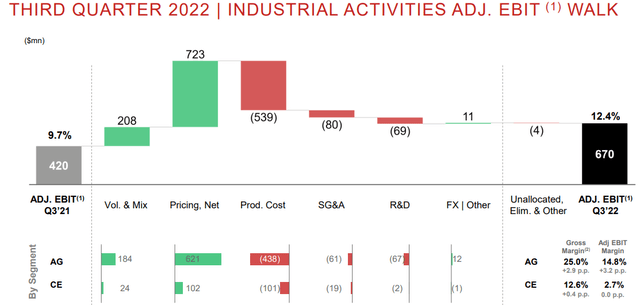

Let’s see what happened to the margins. We see that CNH was able to completely offset production costs through pricing and its gross margin in agriculture grew from 22.1% in Q3 2021 to 25% this year. Even more important is that the agriculture adj. EBIT margin grew once again to 14.8%.

Weaker results were achieved in construction, where, although sales increased 20%, the gross margin was 12.6%, and the adj. EBIT margin was at 2.7%.

Since Construction accounts for only 16% of total revenues, CNH Industrial’s adj. EBIT margin came in at 12.4% compared to a 9.7% margin last year.

The same trend is confirmed for the first nine months of the year, with Agriculture increasing its adj. EBIT margin from 13.2% to 13.9% and Construction stepping it up from 3.1% to 3.5%.

One of the slides I have looked at more carefully in the past quarterly presentations was the adj. EBIT walk because it shows how a company is able to deal with inflationary pressure on production costs.

As we said above, we see that CNH Industrial had enough strength not only to offset production costs by net pricing but also to take advantage of market conditions to increase its margins. This proves, once again, that CNH Industrial is playing a stronger role in the market, with the power to close a bit of the gap that separates its results from Deere’s.

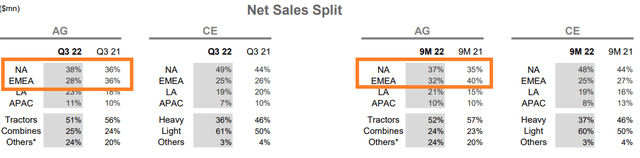

I think this result was also due to a shift in revenue geographies. As we can see from the tables below, in just a year North America has become the real first market for the company with quarterly net sales of $1.71 billion versus $1.28 billion in the same quarter of the prior year. In the meantime, EMEA kept its overall revenue flat ($1.28 billion in Q3 2021 versus $1.26 billion this year) and, in this way, it has reduced its share on the total revenues. Given the difficult situation Europe is facing, I see this as a good shift that gives a lead to CNH Industrial over AGCO, whose exposure to North America is still low.

CNH Industrial Q3 Results Presentation

Even if we consider the performance YTD we see that North America has overcome EMEA. Though EMEA has grown its revenues from $4.24 billion last year to $4.41 billion in the first nine months of this year, the growth that both Americas have experienced has reduced the overall share of total sales this region has. Once again, this makes the company more balanced between different geographies and economies and, in my opinion, makes CNH Industrial stronger in case of regional economic slow-downs.

Order book

Another thing to look at is the order book. CNH Industrial disclosed data that AGCO, for example, didn’t. It said that its Agriculture order book was down less than 10% year over year for tractors while order book for combines was down 21%, with declines in North America and South America offset partially by growth in EMEA. While this may sound terrible, if we consider the context, the company is still at above 2.5 times the pre-pandemic levels regarding its order books. This can make us feel the pulse of how great a demand is still there in the market.

Good news for investors

It is no mystery that CNH Industrial’s stock has trailed behind Deere and AGCO in the past years. I think this is partly due to the fact that the company is not as popular among American investors as the other two. But the new CEO is now American and is leading the company making it also more American-investor friendly. For example, the company just recently started a new buyback program. Secondly, the company announced that, beginning with the reporting of third quarter 2022 financial results, it:

intends to voluntarily report its financial results under the periodic reporting forms for U.S. domestic filers (i.e., CNH Industrial will now voluntarily file annual and quarterly reports on Forms 10-K and 10-Q). Management determined that following the spin-off of the Iveco Group and the refocus as an agricultural and construction equipment leader with significant presence in the US, reporting according to the standards for US public companies is more consistent with the Company’s operating profile and its investor base.

I believe that this could also lead to a change in dividend policy which could make the company distribute it not annually as it does now, but at least semi-annually or, why not, even quarterly. Besides, I also think that in the past CNH Industrial wasn’t clearly perceived as an agriculture stock because of its conglomerate nature. The spin-off of Iveco Group helps investors perceive the new company as a key player of a key industry.

Even this year, the stock has underperformed Deere and AGCO, although in the past 6 months (and even in the past 3 and in the past 1) it has performed better than AGCO, showing that investors may begin to see CNH Industrial as a better opportunity.

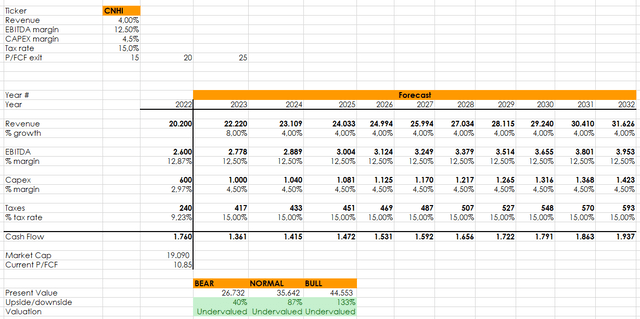

Valuation

In my past article, I shared a discounted cash flow model that gave at least a 40% upside for the stock. Since then, the stock’s market cap has increased by 12.5%, but the underlying fundamentals have been revised upwards too. This is why I still stick to this upside valuation, given this updated model that reflects better what we can expect from the company this year.

Author, with data from SA and personal forecast

Conclusion

I do think CNH Industrial will be the best surprise in the industry in the following years, as it now clearly focuses on agriculture and construction and is thus able to increase margins and improve its products. This is why I didn’t take advantage of the recent surge to exit my position, but I am still long the stock, thinking of it as a long-term value play that will reward me with good results.

For those who want to see what I have written on the industry, here are the articles that show the research I have done so far on the agriculture and farming machinery industry:

- John Deere At Fair Value Ahead of Q2 Earnings Report

- AGCO: A Buy With Plenty Of Room To Grow

- Could Supply Chain Constraints Help AGCO Face A Recession?

- CNH Industrial Is A Buy As It Harvests Growing Margins

- AGCO And CNH Industrial: A Comparison Of 2 ‘Buys’

- AGCO Corporation: Turnaround Quarter Has Come

Be the first to comment