Monica Schipper/Getty Images Entertainment

A Quick Take On Reynolds Consumer Products

Reynolds Consumer Products (NASDAQ:REYN) went public in early 2020, raising approximately $1.23 billion in gross proceeds from an IPO priced at $26.00 per share.

The firm sells various consumer products via its well-known global brands.

While management is talking about seeking to return to pre-pandemic profitability by the end of 2023, I’m more cautious and will wait to see how the first half of 2023 proceeds.

I’m on Hold for REYN in the near term.

Reynolds Consumer Overview

Lake Forest, Illinois-based Reynolds was founded to provide household essentials under the brands Reynolds Wrap, Reynolds Kitchens, The Hefty and Alcan in the North America region as well as the Diamond brand internationally.

Management is headed by President and CEO Lance Mitchell, who has been with the firm since 2010 and was previously President and CEO at Closure Systems International.

The firm’s ‘Reynolds Waste & Storage’ product line, which includes foil, disposable aluminum pans, parchment paper, freezer paper, wax paper, plastic wrap, baking cups, oven bags and slow cooker liners, is marketed under the KITCHENS and E-Z Foil brands in the US, ALCAN brand in Canada, as well as its Diamond brand, intended for international sales.

Reynolds’ Hefty waste and store segment, whose products are marketed under the Hefty Ultra Strong, Hefty Strong Trash Bags, Hefty Renew and Hefty Slider Bags brands, includes branded and store-brand trash and food storage bags.

The company’s Hefty tableware products are marketed under disposable and compostable plates, bowls, platters, cups and cutlery. Its Hefty branded products also include dishes and party cups.

Reynolds also sells other products, including its private-label Presto line.

According to a recent market research report by Market Research Future, the global food storage containers’ market is projected to grow at a CAGR of nearly 4.2% between 2019 and 2023.

The Asia-Pacific region is projected to grow at a higher CAGR due to high demand for fast-moving consumer goods.

Major competitors that provide food storage products include:

-

Amcor and Bemis

-

Tupperware Brands (TUP)

-

Newell Brands (NWL)

-

Hamilton Housewares

-

Ball Corporation

-

Constar International

Reynold’s Recent Financial Performance

-

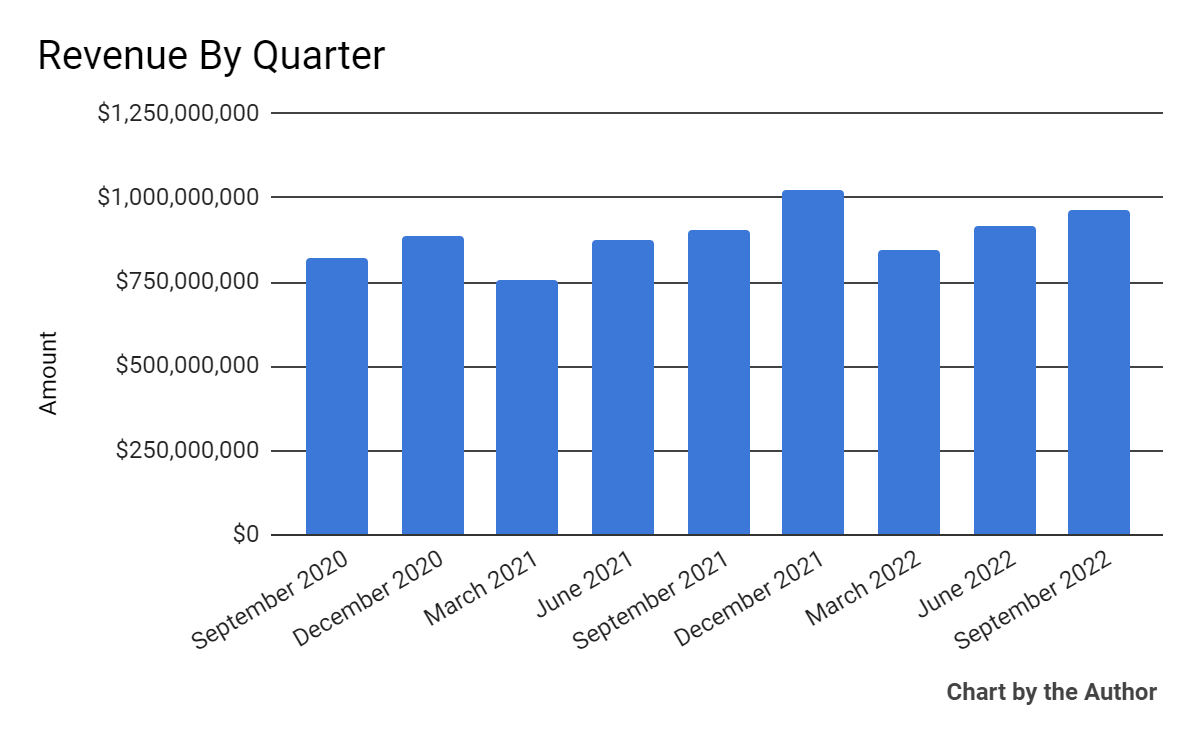

Total revenue by quarter has risen moderately, per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

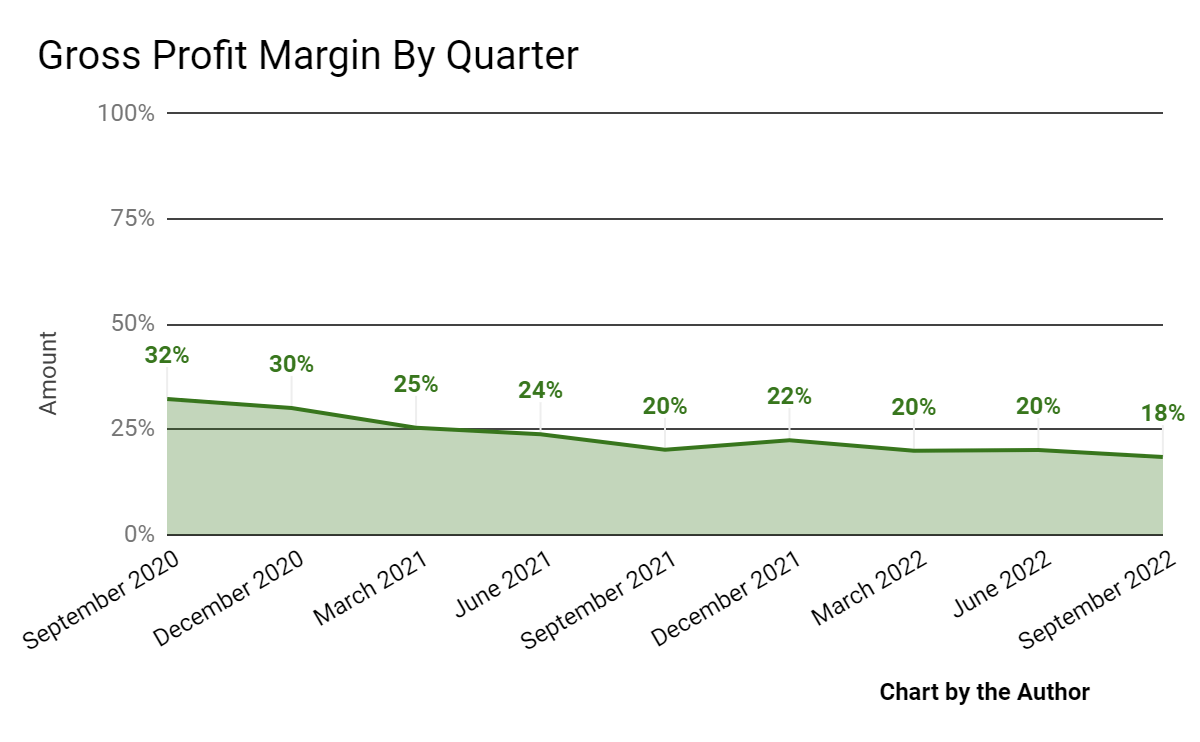

Gross profit margin by quarter has trended lower in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

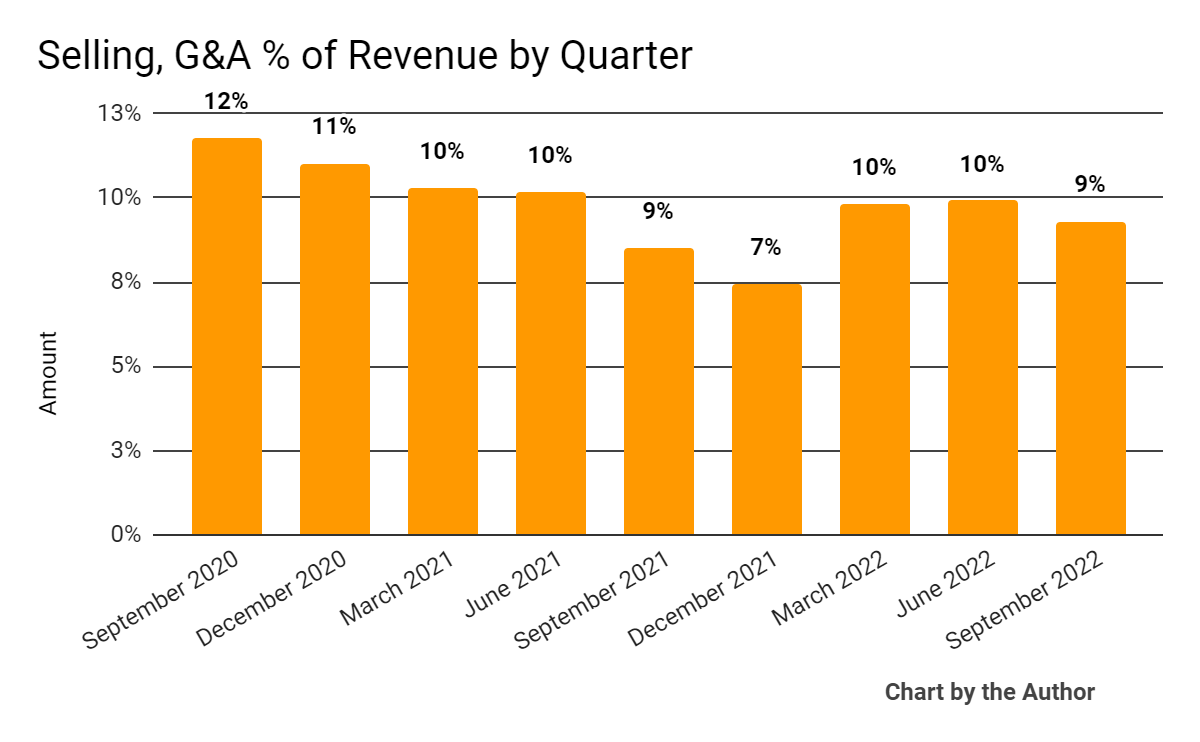

Selling, G&A expenses as a percentage of total revenue by quarter have followed the trajectory shown below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

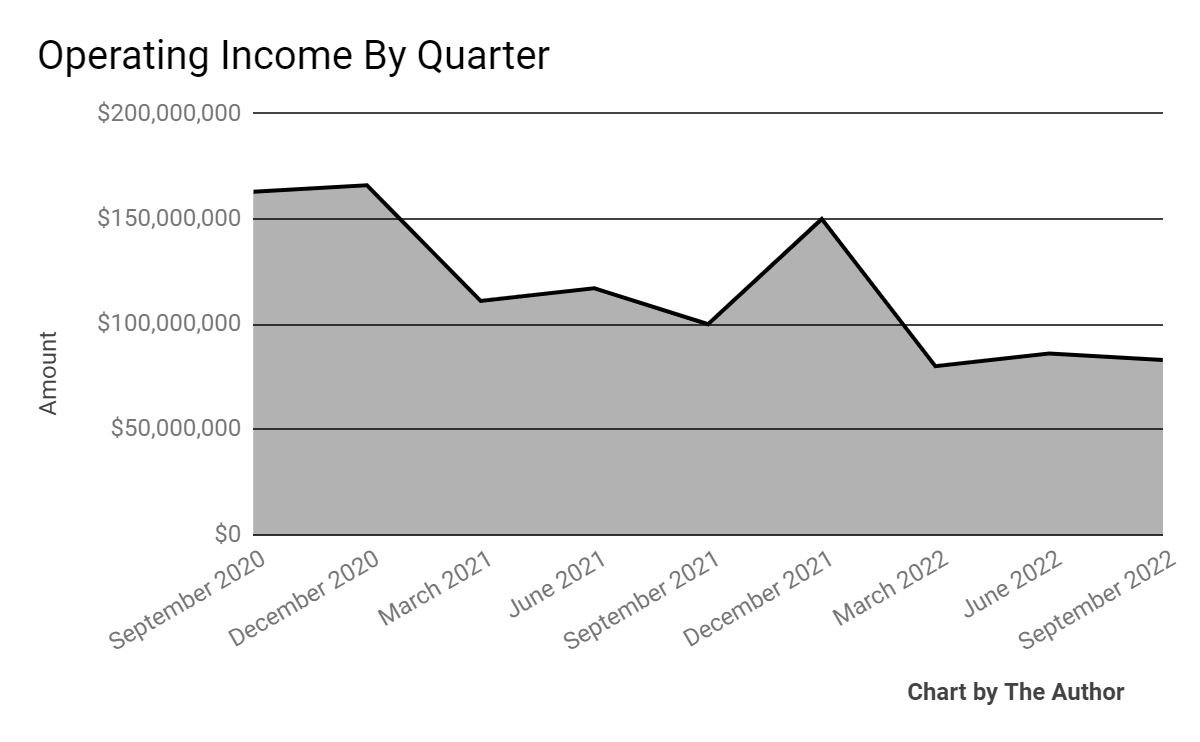

Operating income by quarter has trended lower in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

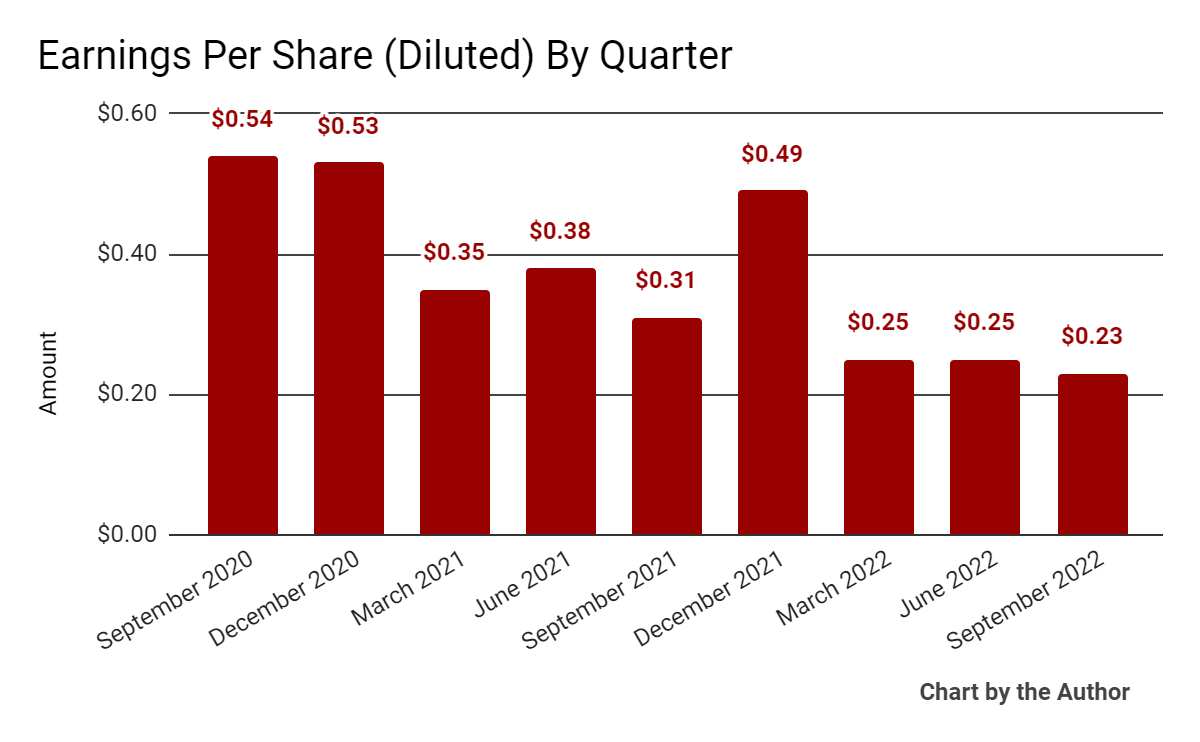

Earnings per share (Diluted) have deteriorated recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

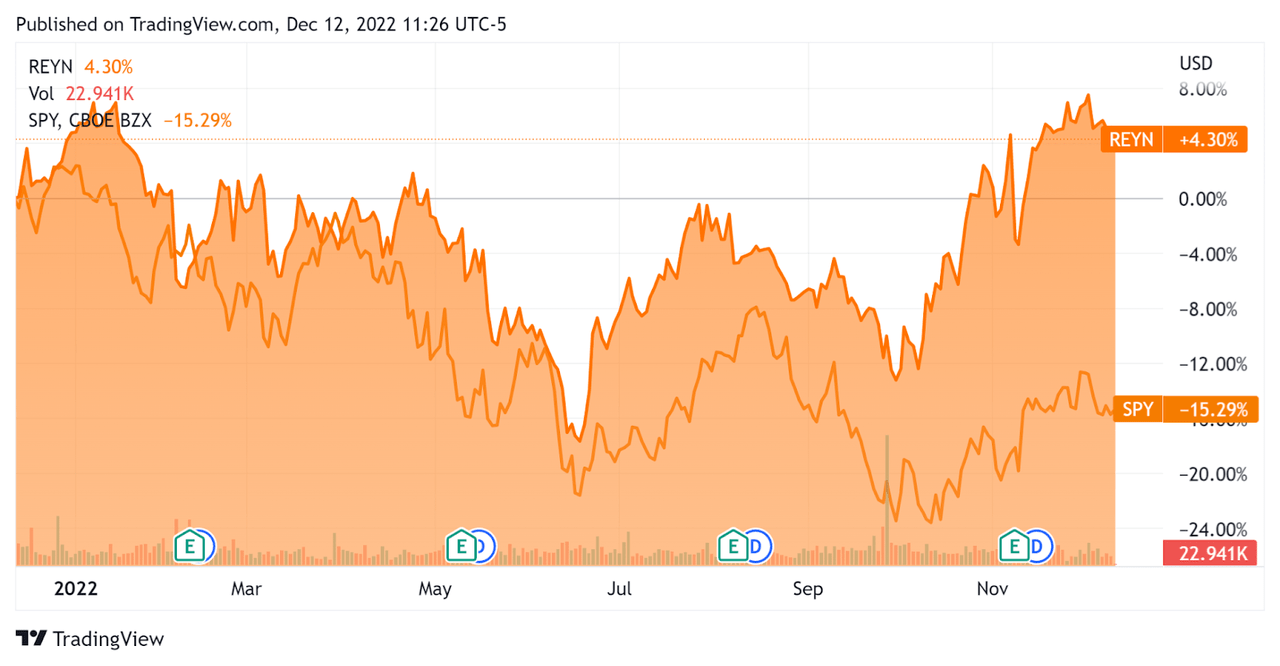

In the past 12 months, REYN’s stock price has risen 4.3% vs. the U.S. S&P 500 index’ drop of around 15.3%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Reynolds

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.3 |

|

Enterprise Value / EBITDA |

16.9 |

|

Revenue Growth Rate |

9.6% |

|

Net Income Margin |

6.8% |

|

GAAP EBITDA % |

13.7% |

|

Market Capitalization |

$6,572,898,300 |

|

Enterprise Value |

$8,686,898,200 |

|

Operating Cash Flow |

$306,000,000 |

|

Earnings Per Share (Fully Diluted) |

$1.22 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Newell Brands; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Newell Brands |

Reynolds Consumer Products Inc. |

Variance |

|

Enterprise Value / Sales |

1.2 |

2.3 |

101.7% |

|

Enterprise Value / EBITDA |

8.9 |

16.9 |

90.5% |

|

Revenue Growth Rate |

-4.7% |

9.6% |

–% |

|

Net Income Margin |

5.7% |

6.8% |

20.5% |

|

Operating Cash Flow |

-$173,000,000 |

$306,000,000 |

–% |

(Source – Seeking Alpha)

A complete comparison of the two companies’ available performance metrics may be viewed here.

Commentary On Reynolds Consumer

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the ‘very dynamic environment’ that the firm faces in macroeconomic terms.

The company has implemented price increases to pass on the cost of rising raw materials and transportation prices.

Management also ‘accelerated’ its cost-savings efforts to hopefully close ‘the gap between pricing and cost increases.’

As to its financial results, revenue rose 7% year-over-year as a result of price increases partially reduced by lower volume.

Adjusted EBITDA was 12% lower year-over-year on lower volume and increased Selling, G&A expenses.

Operating income and EPS have both been trending lower in recent quarters as the firm has been hit by lower consumer demand pull-through.

For the balance sheet, the firm finished the quarter with $33 million in cash and equivalents and $2.1 billion in total debt.

Over the trailing twelve months, free cash flow was $180 million, of which capital expenditures accounted for $126 million of cash use.

Looking ahead, management expects 8% revenue growth for the remainder of the year and adjusted EPS of $1.33 at the midpoint of the range.

Regarding valuation, the market may be valuing REYN at elevated levels, especially compared to competitors.

The primary risk to the company’s outlook is the continued macroeconomic slowdown into 2023 and a limit to the firm’s ability to pass on price increases to consumers.

The company has also seen manufacturing challenges with unplanned equipment downtime for its Reynolds and Cooking & Baking products.

A potential upside catalyst to the stock could include a ‘short and shallow’ recession or slowdown or an unexpectedly strong consumer bolstering demand.

While management is talking about seeking to return to pre-pandemic profitability by the end of 2023, I’m more cautious and will wait to see how the first half of 2023 proceeds.

I’m on Hold for REYN in the near term.

Be the first to comment