1715d1db_3

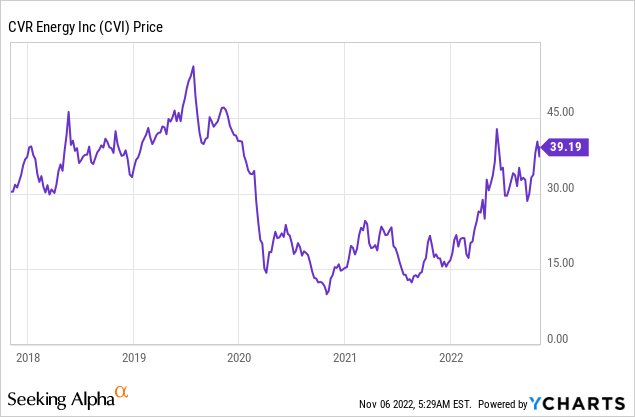

CVR Energy (NYSE:CVI) is a U.S based company that specializes in Oil refining and fertilizers. It may not sound that exciting at first glance, but the business is has benefited massively from rising gasoline and fertilizer prices which have been driven by the Russia-Ukraine War and macroeconomic factors. The company is also backed by legendary billionaire investor Carl Icahn who owns approximately 70% of the business. This gives a seal of approval to the company in my eyes and offers a great starting point for further analysis. In this post I’m going to break down the company’s business model, financials and valuation, let’s dive in.

Business Model

CVR Energy is a diversified holding company that has two core businesses; Petroleum refining and fertilizer production. Refineries convert crude oil into “refined” petroleum products such as Gasoline, Diesel etc. The facilities do this through a process called “fractional distillation” which consists of heating the crude oil to 350 degrees Celsius to turn it into a mixture of gasses.

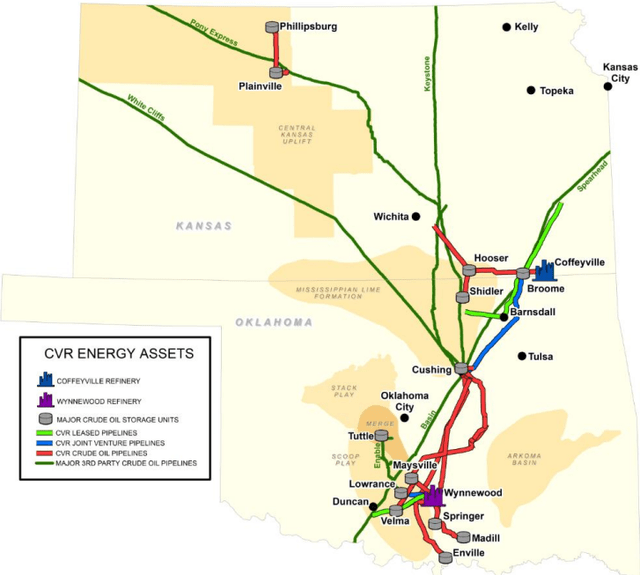

CVR Energy owns refineries in Wynnewood, Oklahoma, and Coffeyville in Kansas. As you can see on the map below, the company also owns 7 million barrels of total crude oil and product storage capacity. In addition to 1,100 miles of owned or Joint Venture pipelines. Its Oil storage units were immensely popular and at full capacity during the pandemic when the travel lockdown forced oil prices negative. Oil prices can be volatile and therefore I look at its storage units as solid strategic assets, as most oil refineries were at full capacity during this lockdown. The company has approximately 206,500 bpd [barrels per day] of nameplate crude oil capacity across its facilities in total.

CVR Energy (Q3 Presentation)

CVR energy has made solid investments in renewable fuels and has recently constructed a renewable diesel unit at Wynnewood, with an estimated production capacity of 100 mm gal per year. This is part of a multi-stage plan to boost renewable diesel across its facilities. Its next stage is a unit at its Coffeyville plant, which is forecasted to have a production capacity of 150 million gallons per year, with ~25 million gallons being available for use as sustainable aviation fuel. The organization sells its products via a “rack marketing” strategy which focuses on supplying nearby locations with product easily.

Carl Icahn and the Competitive Advantage

According to SEC filings, CVR energy has 70% of its outstanding shares owned by legendary investor Carl Icahn who has a net worth of $18.6 billion. In a recent interview (November 2022) with Forbes, Carl Icahn revealed some interesting insights about the Fertilizer part of CVR Energy’s business. Icahn explained that the company bought 36% of a Nitrogen Fertilizer plant that “nobody wanted 6 or 7 years ago”, but now it is paying dividends. Traditional refineries usually require natural gas to make fertilizer, but CVR energy makes it using another fairly unique method. Icahn states “We are the only one in the country that can make Fertilizer without natural gas”. This is a bold statement and given the rising price of gas thanks to the Russia-Ukraine war and inflation as a whole. These factors combined with higher corn prices and reduced fertilizer supply at a macro level, have led to higher product pricing for nitrogen fertilizer as a whole. There is also a huge opportunity for U.S manufacturers to export fertilizer to Europe given the Russia-Ukraine war and shortage in the continent.

Third Quarter Financials

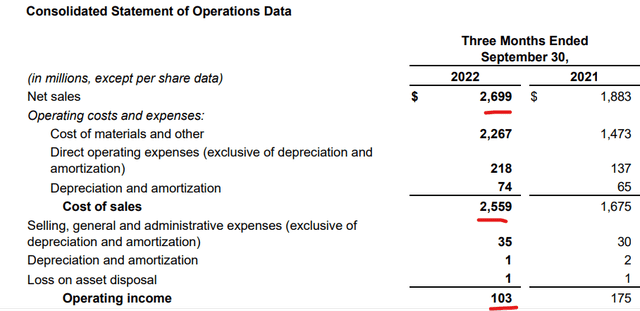

CVR Energy generated strong financial results for the third quarter of 2022. Revenue was $2.7 billion, which increased by ~50% year over year and beat analyst expectations by $297 million. This has been driven by widening “crack spreads” which is the difference in price between crude oil and refined products such as gasoline and diesel. The company also reported “record exports” of gasoline and diesel out of the U.S. The business did experience a 53% increase in operating expenses from $1.675 billion in Q3,21 to $2.56 billion. This was mainly driven by higher repair and maintenance costs, in addition to increased natural gas and electricity costs.

Income statement (Q3 earnings report)

The higher operating expenses led to a 41% decrease in operating income. EPS [normalized] was $1.90 which missed analyst estimates by $0.01. This may seem like a disaster but when we take into account taxes and income from noncontrolling assets, net income (to CVR Energy stockholders) was actually higher at $93m for Q3,22 vs $83m for Q3,21.

Adjusted EBITDA for the Fertilizer segment was $10 million for the third quarter. This was impacted by lower production volumes and higher operating expenses due to 2 planned turnarounds in the quarter and 11 days of downtime at its Coffeyville, due to outages at a third-party plant. These issues now look to be resolved and thus I don’t deem them to be a major problem moving forward.

Balance Sheet, Cash Flow and Dividends

The company generated $93 million in free cash flow during the third quarter of 2022, this was a solid increase from the negative $25 million generated in the prior years. The company has a solid balance sheet with $618 million in cash or $746 million in total liquidity, including funds from an asset-based loan facility. In addition, the business has $1.5 billion in long-term debt. The company has a dividend yield of ~2% which is fairly consistent.

Advanced Valuation

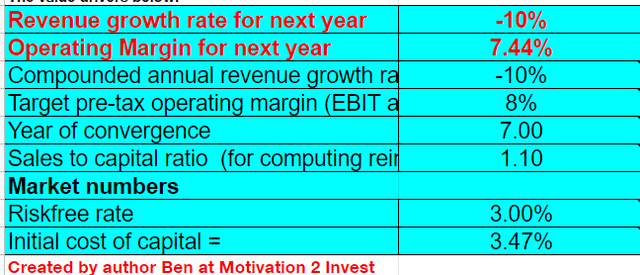

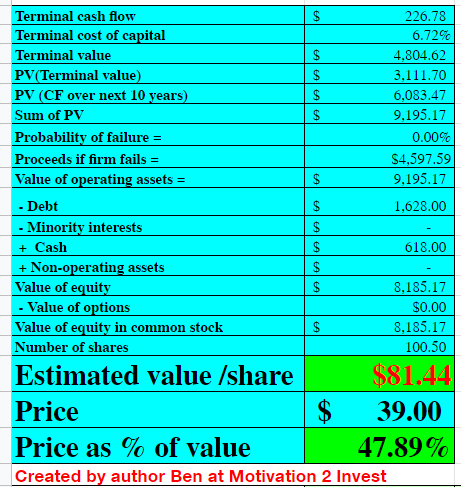

Valuing CVR energy as its profitability is highly dependent upon future gasoline, diesel, and fertilizer prices. Macroeconomic situations such as inflation and the Russia-Ukraine could keep these prices elevated. However, slowing economic demand due to the pending recession could also reduce prices longer term. In order to quantify these assumptions, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have conservatively forecasted its revenue to decline by 10% per year over the next 1 to 5 years as refined product prices correct.

CVR energy stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted the business to keep its operating margin steady at between 7.44% and 8%.

CVR energy stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $81.44 per share, the stock is trading at $39 per share at the time of writing and is thus ~53% undervalued.

As an extra datapoint, CVR energy is trading at a forward Price to Earnings ratio = 6.6 which is 55% cheaper than its 5-year average.

Legendary Investor Paul Tudor Jones was buying shares at an average price of $31 per share in the second quarter of 2022, according to SEC filings, therefore that could also be an extra data point.

Risks

Recession/Renewable Energy

As mentioned prior the high inflation and rising interest rate environment has caused many analysts to forecast a recession. This environment usually consists of an economic slowdown which could curb some demand for its products. Then we also have the elephant in the room which is climate change and the global push towards electric vehicles and renewable energy.

Final Thoughts

CVR Energy is a diversified company which two solid business units and a growing renewable fuel segment. The backing of billionaire investor Carl Icahn really does give the company a stamp of approval and it looks to have a competitive advantage in the fertilizer market. The stock looks to be undervalued intrinsically and relative to historic multiples. However, be aware that commodity and fuel prices are rapidly changing and thus expect volatility.

Be the first to comment