imaginima

In late 2020, Maxar Technologies Inc. (NYSE:MAXR) peaked at $50 when ARK Investment Management LLC announced a space exploration exchange-traded fund (ARKX). The catalyst for Maxar, a satellite imagery supplier, did not last long. Maxar reported multiple project delays. This hurt investor confidence and sent the stock on a prolonged downtrend between 2021-2022.

Despite Maxar’s stumbles, my call for Maxar to blast off in 2022 played out today. Advent International proposed to buy the company for $6.4 billion in cash. Upon rewarding shareholders with a nearly 130% gain, is MAXR stock still a hold?

Advent International To Acquire Maxar – Transaction Details

Advent has over 35 years of investment experience. It has significant experience in global security and defense. The company said that the transaction would accelerate its interest in next-generation satellite technologies and data insights for its customers.

Seeking Alpha reader RickJensen highlighted the most important paragraph in the $6.4 billion, or $53 all-cash offer. Maxar has 60 days to find a higher bidder. If it does not find a better price by 11:59 pm EST on Feb. 14, 2023, Maxar will accept the deal.

The agreement includes a 60-day “go-shop” period expiring at 11:59 pm EST on February 14, 2023. During this period, the Maxar Board of Directors and its advisors will actively initiate, solicit and consider alternative acquisition proposals from third parties. The Maxar Board will have the right to terminate the merger agreement to enter into a superior proposal subject to the terms and conditions of the merger agreement. There can be no assurance that this “go-shop” will result in a superior proposal, and Maxar does not intend to disclose developments with respect to the solicitation process unless and until it determines such disclosure is appropriate or otherwise required. The Company, Advent and BCI will contemporaneously pursue regulatory reviews and approvals required to conclude the transaction.

Closing Date

Advent expects the deal to close in mid-2023. The company did not attach any unnecessary conditions. It did not subject to the launch, deployment, or performance of Maxar’s WorldView Legion satellite program.

Advent’s buyout proposal is good for shareholders. It will pay with cash, simplifying the closing value. Advent is not using debt or exchanging equity with an unknown future value. In addition, Maxar has the flexibility to continue its business as usual on the WorldView satellite launch for Q1/2023.

Higher Offer

Trading at around $51.00, markets are not expecting another bidder to offer more. I initially set a $55 to $60 price target on Maxar back in 2020. Another defense contractor might consider the value added to its business if it bid for Maxar. However, persistent delays over the last few quarters hurt MAXR stock price.

Investors have nothing to lose by holding the stock until the deal closes at $53.00. Still, investors might forfeit the extra $2.00 a share and a potentially higher bid for tax reasons. As 2022 draws to a close, investors might offset Maxar’s gains with capital gains losses.

War Economy Investing in 2023

The world is recognizing Maxar’s strategic importance in warfare. Timely satellite imagery provided Ukraine with critical information on Russia’s advances. For example, Ukraine saw Russia’s army convoy advancements in the early days of the war.

Related Investments

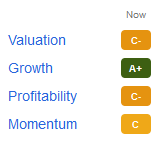

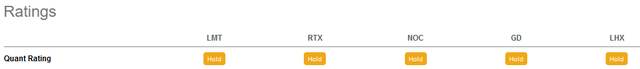

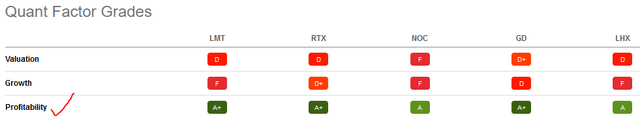

Markets rewarded investors who prepared a War Economy portfolio before Russia invaded Ukraine. More recently, aerospace and defense stocks trade at a premium. Seeking Alpha’s quant ratings on Lockheed Martin (LMT), Raytheon (RTX), Northrop (NOC), General Dynamics (GD), and L3Harris (LHX) are neutral:

Investors are paying a premium on valuation and growth. However, companies like Raytheon are announced huge military contracts with the U.S. government almost daily.

As a result, all of the defense contractors score an A or higher on profitability.

Since Advent is buying it, the quant grades on Maxar do not matter. As shown below, investors who patiently held Maxar for its growth are content with today’s gains.

Seekingalpha

Advent benefited from Maxar’s weak momentum. MAXR stock failed to break out of a trading range between $18 and $26.

Your Takeaway

Maxar stock is a hold. Another investment firm or defense contractor might consider offering a higher price. For now, the stock trades at around $2.00 below the buyout price. Although this represents a 3.9% additional return, this is a 7.8% annualized return. Even after the rise, Maxar should reward investors with more than the 2023 Fed Funds rate of 5.00%.

Be the first to comment