DenisTangneyJr/E+ via Getty Images

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) recently announced the company’s 3Q 2022 earnings. In the midst of concern around a nationwide railroad strike, one key line item was earnings from the company’s energy and utility business, which came in at $1.585 billion versus $1.442 for railroads and a loss for insurance underwriting.

The key takeaway from the company’s almost $8 billion in operating earnings, a 20% YoY increase, is that energy and utility is now the company’s largest business.

Berkshire Hathaway Overview

Berkshire Hathaway is a unique and consolidated holding company.

The company’s holding portfolio in many ways tracks the broader U.S. economy, however, the company has made a number of bets where it feels it can outplay overall market returns. Additionally, the company’s unique setup provides strong integration across its goals, i.e. by allowing insurance float to be invested in equities.

The company’s businesses consist of the largest railroad in North America, more than $300 billion in equities, numerous smaller companies, all integrated together. Despite the opportunity in these other businesses, highlighted by the company’s continued repurchase of its shares, we’ll focus on the opportunity provided by Berkshire Hathaway Energy here.

Berkshire Hathaway Energy

Berkshire Hathaway Energy is a rapidly growing business with an asset value already topping $100 billion.

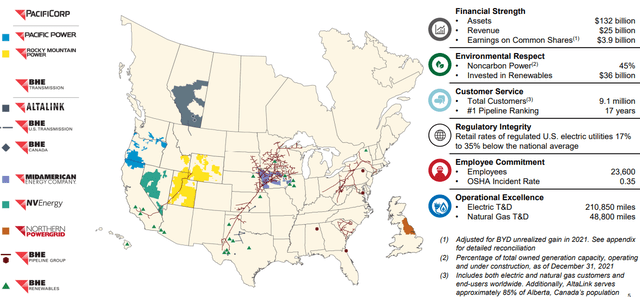

Berkshire Hathaway Energy Investor Presentation

The company has more than $130 billion worth of assets resulting in $25 billion in annualized revenue and almost $4 billion in earnings. That’s a significant amount of earnings to Berkshire Hathaway, with the portfolio making up more than 10% of Berkshire Hathaway’s overall earnings with the parent company.

The company’s assets are distributed throughout the United States and Canada with minor assets as well in the United Kingdom. The company’s massive grid is an essential part of many states power sources, which means continued reliable revenue from its grid. The grid is its own integrated utility company.

The Reason Energy Rocks

There’s several reasons why energy rocks as a business for Berkshire Hathaway to have a substantial investment in.

The first is that it’s essential to our standard of living and will remain so. Even the most utopian long-term future societies still have energy sources to power everything about day-to-day life. The specific nature of those energy sources varies but at the end of the day, the need of energy for a modern society can be expected to continue for decades if not centuries.

The second is that it’s a volatile industry. The oil collapses in both early-2016 and 2020 comfortably prove that. Berkshire Hathaway’s investment opportunities in Occidental Petroleum, Chevron, and Dominion Energy all prove that as well. For long-term investors, volatility is a great deal, it provides new opportunities to make investments.

Last is that the energy industry is massive and mostly unconsolidated. Saudi Aramco, the second largest publicly traded company with a multi-trillion dollar market cap, produces only 10% of the world’s crude oil production let alone having any connections to the consumption of the oil as energy. That size means that there’s always places for Berkshire to deploy billions.

Especially with the company’s recent growth that last aspect is incredibly important.

Growth Opportunity

The growth opportunities available to Berkshire Hathaway Energy are visible in the company’s capital spending.

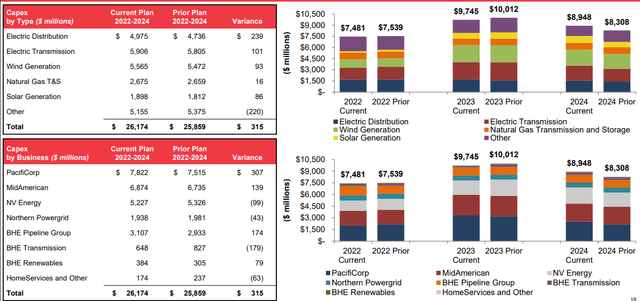

Berkshire Hathaway Energy Investor Presentation

The company’s current 2022-2024 capital spending plan is for a massive $26 billion in spending. For perspective, that’s almost $9 billion a year in capital spending, a massive source of the company’s capital usage. It’s recently ramped up its electrical distribution and transmission capital spending substantially implying that the company sees additional opportunity there.

It’s also worth noting that the company has also slightly decreased some 2022-2023 capital spending while ramping up 2024 capital spending as the timeline of opportunities changes. Lastly, it’s worth noting how much the company is spending on renewables, roughly 3x as much on wind + solar versus natural gas.

This highlights how the company is adeptly adapting to a changing market environment.

Our View

Our view is that there remains substantial opportunity for both Berkshire Hathaway and Berkshire Hathaway Energy.

Berkshire Hathaway Energy has grown at a double-digit growth rate for the past decades and we expect that to continue. The business has the ability to consume a substantial amount of capital and use that capital for growth as well. In a changing energy market there remains trillions of dollars of new opportunities to consume capital.

We expect in an expensive market with continued opportunities to consume capital that the business will continue to grow rapidly.

On top of that Berkshire Hathaway as a whole is undervalued. The company has been aggressively buying back its shares to the tune of $1 billion quarterly. It’s a number that the company can comfortably afford although we’d like to see the company ramp it up. Regardless of how the company spends its cash we expect strong long-term returns.

Thesis Risk

The largest risk to the thesis is the capital spending that the company’s businesses require. The company is spending close to $10 billion annualized on this capital spending and while it expects it to pay off there’s no guarantee. The market could rapidly subsidize nuclear for example. We expect the company’s capital spending to pay off, however, investors should pay attention to the fact that all investments are risky.

Conclusion

Berkshire Hathaway Energy has grown to the largest component of Berkshire Hathaway’s earnings in the most recent quarter. That highlights the growth of a business that now has a valuation of more than $100 billion in assets while generating billions every year in annual cashflow. These businesses enable substantial cash flow or investment.

One substantial aspect of the value of Berkshire Hathaway Energy is its ability to consume substantial capital for growth. The company’s investments can consume close to $10 billion annually. Berkshire Hathaway also has numerous other investments. And, combining all of that, we expect the company to deliver substantial long-term shareholder returns.

Be the first to comment