Дмитрий Коростылев/iStock Editorial via Getty Images

Introduction

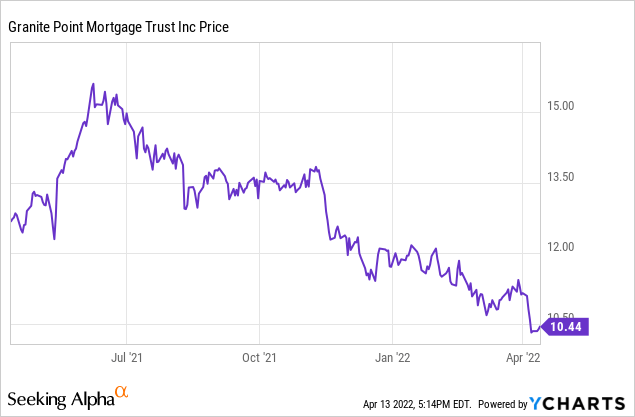

In November last year, I had a closer look at the Granite Point Mortgage (NYSE:GPMT) preferred share which was issued in 2021 by the mortgage REIT. Trading as (NYSE:GPMT.PA), this is the only preferred share issued by Granite Point and with a 7% preferred dividend yield I was already quite charmed by the issue from both the perspective of dividend safety as well as asset coverage. As interest rates are increasing, the preferred share is now trading at a discount of approximately 6% to the par value of $25/share which further boosts the preferred dividend yield.

We need to look at the financial results before determining how attractive the preferred shares are

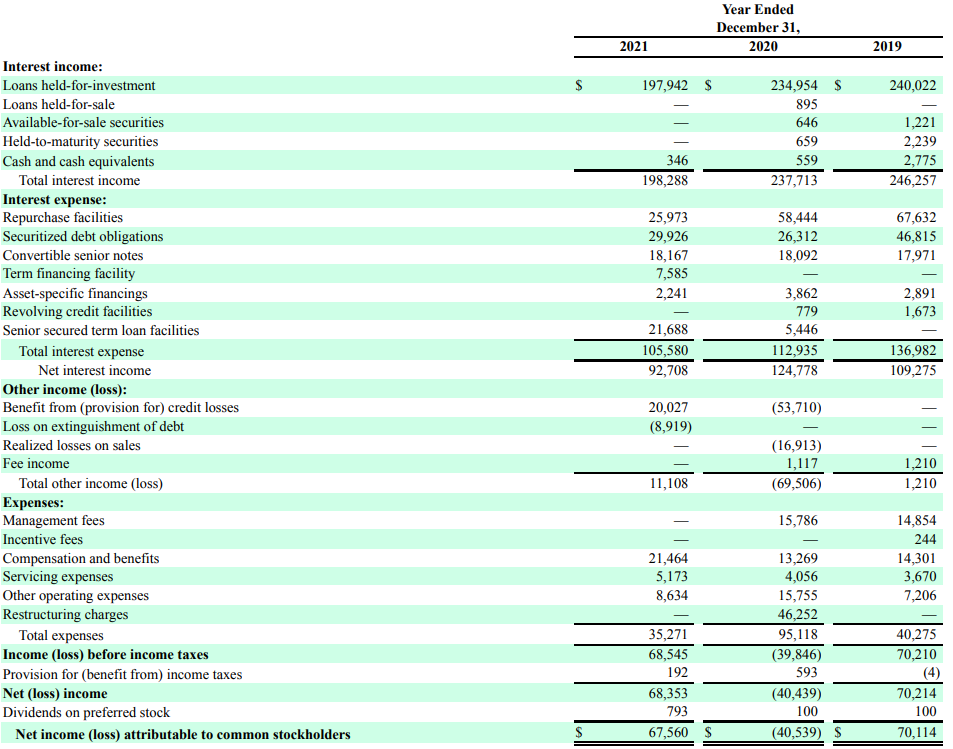

During 2021, Granite Point’s balance sheet was reduced which weighed on the company’s interest income and net interest income. Looking at the FY 2021 results, GPMT reported a net interest income of just under $93M. Despite this lower result, it was able to boost its pre-tax result thanks to the lack of non-recurring expenses. In fact, whereas Granite Point recorded almost $75M in credit loss provisions and realized losses on the sale of investments as well as almost $50M in restructuring charges, it was relatively smooth sailing in 2021.

GPMT Investor Relations

That being said, the company’s net income of $68.4M was boosted by approximately $11M in non-recurring gains. You also see the preferred stock dividend was just $0.8M but that is obviously caused by the fact the preferred shares were only issued late in the year. There were approximately 4.6M preferred shares outstanding as of the end of 2021, but the company issued an additional 3.63M preferred shares in January resulting in a current share count of just over 8.2M preferred shares. These securities have a pro forma value of $205M (based on the $25 par value per preferred share) and as the preferred dividend is $1.75 per preferred share per year, the normalized amount in preferred dividends payable in any given year is just over $14M.

Granite Point Mortgage used the proceeds of these preferred shares to repay a portion of the 8% senior secured loan. This is a good move as the company used equity with a 7% cost of capital to repay debt with a cost of capital that is higher. Although only $50M was repaid (and a $3M repayment penalty was due), this is a good move as it will save Granite Point hundreds of thousands of dollars per year: It will reduce its interest expenses by $4M while $50M in preferred equity will cost just $3.5M.

Although the REIT has a good history of managing its risks, sometimes it does have to incur a loss. In the first quarter of 2022, one of the loans related to an office property which was already recorded as a non-accrual loan, was settled resulting in a $10M loss to Granite Point. A provision of $8M had already been recorded so there will be an additional impact of approximately $2M.

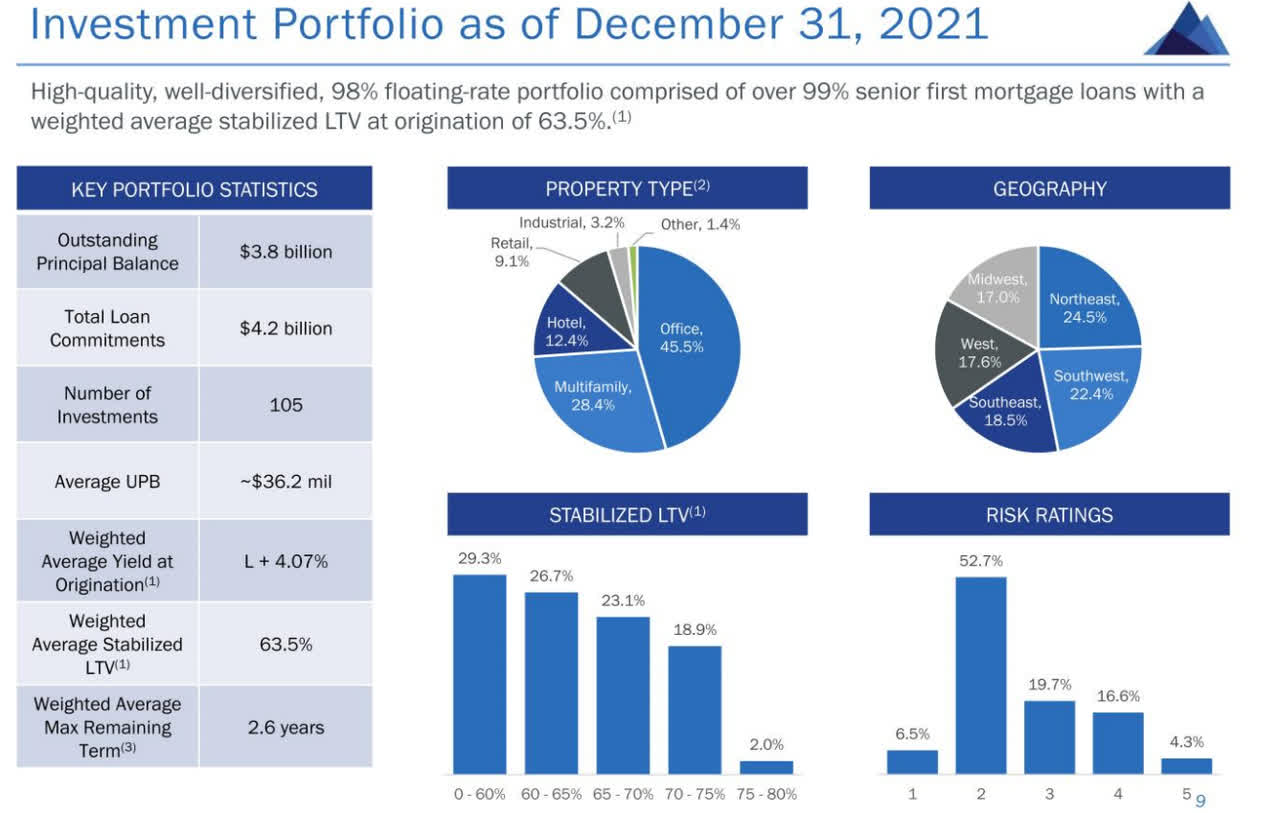

While a $10M loss on a $54M senior loan isn’t great, it does show that even when a loan goes sour, the senior creditors are usually able to keep the damage limited. As of the end of 2021, the portfolio consisted for about 99% of senior first mortgage loans with an average LTV ratio of 63.5%. The breakdown of the LTV ratios in the image below shows that approximately 80% of the portfolio has an LTV ratio of less than 70% with just 2% of the loans having an LTV ratio exceeding 75%. This doesn’t mean Granite Point is immune to defaults, but it does indicate it should be able to keep loan losses relatively limited.

GPMT Investor Relations

Another important feature of the loan portfolio is the floating rate as about 98% of the loans are floating rate with an average markup of just over 4% on the LIBOR rate.

The Series A preferred shares are attractive

As explained in my previous article: the new preferred shares were priced on Nov. 22 and the preferred dividend was fixed at $1.75 per year for a preferred dividend yield of 7%.

The preferred dividend will be fixed for about five years (until Jan. 15, 2027) where after it will become a floating dividend with a three-monthly reset based on the Secured Overnight Funding Rate (‘SOFR’) plus a 5.83% spread. With the SOFR at 0.3%, this implies the preferred dividend would be reset at 6.13% of the $25 par value, or $1.5325 per share per year. Of course, it’s still a long way until the effective reset date in January 2027 but this example helps to set the expectations.

The preferred share came out of the gate rather strong and within a month after the issue date, it was trading at a 4% premium to par, at $26/share. But as the interest rates started to increase, Granite Point’s preferred shares started to go down in value to adjust to the net interest rate environment. On Wednesday, the preferred shares closed at $23.30 for a yield of 7.51% based on the $1.75 annual preferred dividend until January 2027.

I think the preferred dividends enjoy a good coverage ratio as we saw that even after filtering out the one-time elements, the income would likely exceed $55M. Which means the annual preferred dividend cost of just over $14M is still very nicely covered.

GPMT Investor Relations

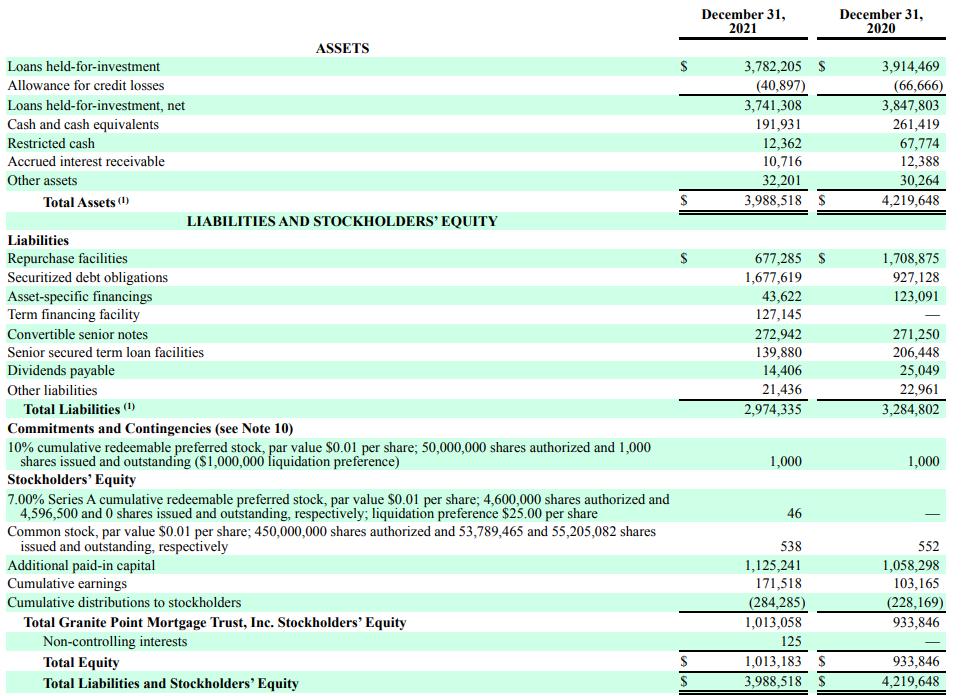

Moving over to the balance sheet, we see Granite Point reduced the leverage as its equity ratio (equity versus total book value) increased from 22.67% to 25.4% mainly under the impulse of a smaller balance sheet and the issue of the preferred shares.

As of the end of 2021, the total value of the preferred shares was $116M ($1M in 10% preferred shares which can be called from June 2022 on) and $115M of the recently issued preferred shares Series A) which represented just over 11% of the equity. If we would include the recent issue of 3.6M additional preferred shares, we can assume the total value of the preferred shares is $206M on an equity value of $1.1B for a ratio of around 18%.

Investment thesis

I’m comfortable with both the coverage ratio of the preferred dividends as well as the asset coverage level but I’m not convinced the current preferred dividend of 7.51% is the best I can do in the current market as for instance the New York Mortgage preferred shares are yielding in excess of 8% while the preferred shares from non-mortgage REITs like Global Net Lease and Necessity Retail REIT are yielding around 7.1%-7.7% as well.

While this preferred issue from Granite Point Mortgage Trust definitely is interesting, I don’t think it is a “must buy now” as the current sell-off on the preferred share market will create other opportunities.

Be the first to comment