Dominic Jeanmaire/iStock via Getty Images

Look out below! Stocks are cratering, and continuing to face pressure. You would think that in this horrific market environment, where there is uncertainty on how strong businesses and consumers will be in the coming months, that companies working to assist other companies in maximizing their supply chain efficiency should be doing well. A few months ago, we highlighted a supply chain solution company that had been absolutely crushed. The company in question is E2open Parent Holdings (NYSE:ETWO).

In that column, we laid out a play for entry and building a position. This week, the stock hit the final entry point. So we now expect those who followed our recommendation now have their position. Things could really move now, because the company just reported earnings. Here is the deal. The company will continue to lose money this year. The company is killing it, in terms of expanding operations, and bringing in new customers. We still think the company will swing to a profit next year overall, but this macro environment is horrible. The NASDAQ is still getting crushed, and setting new lows as we write. However, if you have a medium-term to longer-term horizon, we really like this company, and think an investment will pay off. Right now it is tough. Really tough. But we are sticking with it into 2023.

Discussion

Look this market stinks. Stocks are being crushed. Little is being spared. But, eventually, the market will start to look past the Federal Reserve’s actions to reduce inflation, and will look toward better days, and a return to growth. E2 is growing though. The company offers 100% cloud-based, supply chain management software. Cloud stocks have been absolutely hammered the last month, including E2. Now remember, this company has four pieces to its network, including Demand, Supply, Logistics, and Global Trade. Each one generates revenue from either certain software subscriptions and/or specialized professional services.

We love that the company is a rare combination of value and growth. The value has only gotten better as share prices have retraced. The metrics are attractive for a tech investment, and Seeking Alpha gives a grade of “A-” for valuation, and for growth, it assigns an “A” rating. You just do not see this combination much, especially in innovative tech.

The thing we like here is the real potential for strong future earnings. Companies are not going to stop trying to grow just because rates are up and the market is scared. We think positive earnings are coming. With all of the issues we saw with supply being unable to meet demand, and transport issues galore last year, supply chain management technology providers like E2open are in demand. Big demand. Let us discuss.

Top line growth still explosive

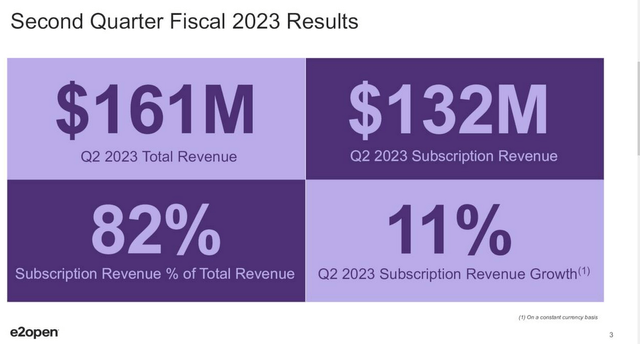

Despite a horrific operating environment for many businesses, in the just-reported quarter, revenue continued to explode higher. However, the revenues were slightly below consensus estimates. Subscription revenue grew 113% from the year-ago comparable period to $131.6 million or 81.9% of total revenue. So revenues more than doubled on the subscription side of things. And you are telling us the stock deserves to be down so dramatically? We do not think so. Organic subscription revenue growth was 10.7% on a constant currency basis.

E2 Q2 report

We really love the growing subscription revenue. Seeing this revenue rise so much is great because it is recurring revenue, not one time revenue. This is a key reason why a lot of companies have moved away from one-time sales to promoting subscriptions. Overall revenue in Q2 rose 105.8% from last year to $160.7 million. Folks, this was slightly beneath consensus by $1.87 million. Where we did see some bearish activity was in profit potential.

Margins are under (slight) pressure

Companies like this which offer software as a service usually have some pretty strong gross margins. We first liked the company because it was expanding margins. With revenue up so much, we once again saw a big increase in gross profit. In fact gross profit more than doubled, widening 101.0% from the year-ago period to $77.4 million.

However, adjusted gross profit grew just 2.6% on a constant currency basis to $106.9 million. It is important to note that this included $2 million of strategic investments that were not present a year ago, but as you can see, margins faced some growth pressure. Overall, the company saw 48.2% gross margins compared to 49.3% last year, while adjusted gross margin was about flat at 66.5%. So, while the top line grew, margins were slightly crimped compared to a year ago (and compared to the sequential quarter). This weighed on earnings power to a degree, but the earnings power overall was still solid.

Earnings power solid, but under pressure

So revenues were up mightily, and gross profit expanded despite margins being crimped. That said, part of the reason the market was justified in selling this stock off in the last 6 months or so was that adjusted EBITDA in Q2 declined.

E2 Q2 Report

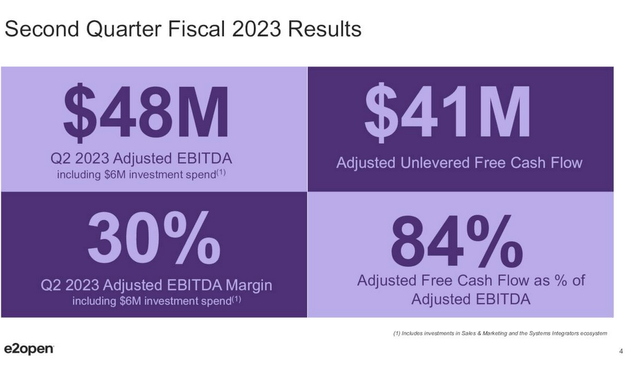

In Q2 here, adjusted EBITDA was down 4% to $48.3 million. Positive adjusted EBITDA is great for a tech company, even if there was some pressure. Adjusted EBITDA margin, perhaps not surprisingly was down a well. It came in at 29.0% versus 33.5% last year. With heavy expenses, the company is still losing money, but real profits are on the way this year, and not just on an EBITDA basis. We suspect the company is consistently earnings positive next calendar year, and should be this fiscal year, despite losing money in H1.

We saw net losses on a GAAP basis, but on an adjusted basis, earnings per share was a positive $0.05. So, we are seeing positive earnings now, even if they are small here. We expect the earnings to continue to be stronger and positive as we moved forward quarter after quarter.

And with earnings becoming positive, this puts a floor under the stock, so long as the stay there. On top of that, the balance sheet is strong.

Balance sheet remains strong

Cash flow from operations was $2.2 million in the quarter, but this included some huge merger and acquisition expenses. This is lower than the $41.5 million last year but was inclusive of those huge merger expenses. However, free cash flow for the second quarter, adjusted for acquisition costs was a very strong $40.6 million, which represents 84.1% of adjusted EBITDA. Folks this is quite strong. Honesty, even in this bad operating environment, they are delivering.

We also love the massive cash position even after the merger expenses. E2 has a massive $98 million in cash on hand as well. Further, the company also has been buying back stock over the last few quarters, though did not deploy any cash this quarter it appears.

Looking ahead

Here is where we get excited about this company and the stock. The macro situation stinks. It is horrible. But the company, while seeing a slight reduction in amazing performance, is still delivering and growing like crazy. Despite the growing inflationary pressures, the Federal Reserve raising rates, pressuring consumers and businesses, E2 is still forecasting growth. Now to be fair, they slightly reduced their annual outlook, but maintained their adjusted EBITDA outlook for the entire year. Folks, this is a big positive sign. We stand by the stock here.

There is so much to like here. The subscription revenue continues to grow. Ongoing profits are on the way. The company is forecasting subscription revenue for the year to be in the range of $535 million to $543 million versus prior guidance of $538 million to $546 million, due to an approximate $3 million negative impact from foreign exchange rate fluctuations. Total revenue will be $668 million to $676 million also being revised due to constant currency issues. Adjusted gross profit margin will still be 68% to 70%. This is still very strong, while the adjusted EBITDA was reaffirmed to be $217 million to $223 million. On a per share basis, for the year, we think there could be a loss of $0.20 up to a gain of $0.05, depending on where EBITDA and margins land.

Overall, we rate the stock a buy, with a medium- to long-term outlook. At $5, with positive EBITDA and earnings, solid grade ratings for growth and value, it’s flying under the radar. Scoop it up.

Be the first to comment