tumsasedgars

Investment Thesis

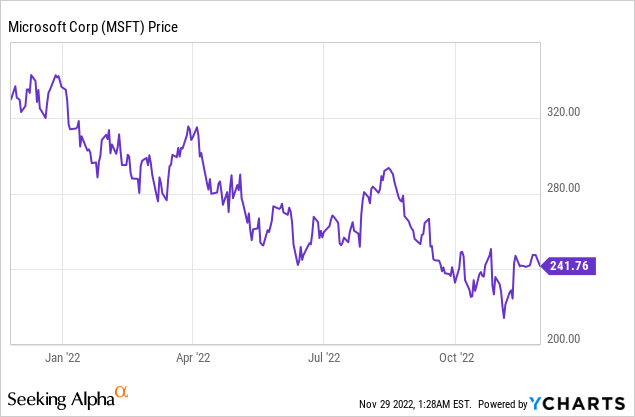

Microsoft (NASDAQ:MSFT) is one of the biggest companies in the world. It is not just big but has several great qualities that are sustainable in the long term. In addition, despite its enormous scale, it can seize attractive growth opportunities that can continue to create value in the cloud computing and gaming industry.

Uncertainty surrounding a company often presents good investment opportunities. The Company’s acquisition of Activision Blizzard (ATVI) implies two possibilities. Either by saving a ton of cash or by Microsoft taking another quantum jump and becoming a stronger company in the market it is focusing on. In the end, the winner, with or without an acquisition, will be Microsoft, and I think investing in the stock is very promising at its current level.

Qualities and Growth

MSFT is a fitting example of a high-quality business that can compound its value over the long term. A quick review of its scale, growth, and profitability is presented below.

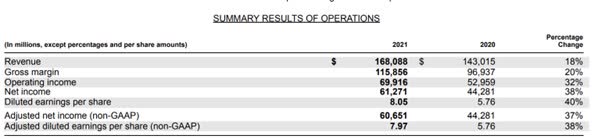

Total revenue in 2021 is about $168 billion, and operating income is about $70 billion, increasing 18% and 32% from the last year, respectively.

Summary Results of Operations (MSFT 2021 10-K)

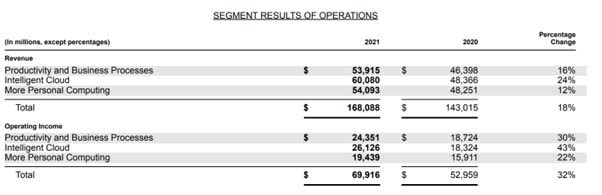

The company is the sum of three businesses. First, Productivity and Business Processes provide Office 365 applications such as Word, Excel, etc. Its products and services have become digital necessities in daily life and work and, as a result, generate stable cash flows. Second, Intelligent Cloud provides public cloud services and is responsible for the future growth of the company. Last, More Personal Computing operates Windows, and Xbox. It also has a great ability to generate cash flows due to its great market share in the PC OS market and potential for future growth in the gaming industry. I think what is great about the company is that these three businesses are not separate businesses; they’re all closely interrelated and connected.

Segment Results of Operations (MSFT 10-K 2021)

The company’s management has shown a particularly good ability to add value as well. ROIC over the past five years has consistently maintained a high level that far exceeds the cost of capital. These achievements resulted from the strategic movement by Satya Nadella, the CEO of the company. He managed to focus on the company’s resources into the public cloud market. Since then, the company’s market share of the cloud business has grown rapidly. Currently, it is estimated to have a global market share of 20-30%.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| ROIC before tax | 134% | 120% | 128% | 123% | 122% |

| ROIC, adjusted | 30% | 34% | 37% | 40% | 44% |

*Capitalized R&D and Marketing Expenses

The king of network effects

The reason the company generates so much value over the past years is that it is in a unique position to take advantage of network effects, where the value of the product for customers on one side depends on the volume of the users either on the same side or on the other side.

As the definition of network effects clearly elaborates, the company’s services and products are the prime examples. Everyone uses office programs, and as a result, work can be done more efficiently.

Not only at work, but also when playing games, network effects become powerful. Game publishers are more likely to develop content for a platform with a significant user base and, in turn, a strong content library attracts more users to a platform. Most PC games are developed with Windows-operating PCs in mind, not other operating systems such as Mac. Considering this point, the proportion of Windows in the OS market is said to be about 70-80%, but it is estimated to be more than 95% for gaming according to the CMA’s assessment.

And strengthening the network effect in the console game market would be the reason why it is trying to acquire ATVI. If it owns ATVI, it can take a stronger position in the console game market with ATVI’s games through Xbox and make its competitive advantages sustainable for decades ahead like Windows.

Growth

Even without Microsoft’s acquisition of Activision, the company has the potential to continue its tremendous growth in the cloud market going forward. Sustaining double-digit growth is not an easy task for a company of this size. But the cloud market is so large that it allows the company to sustain high growth.

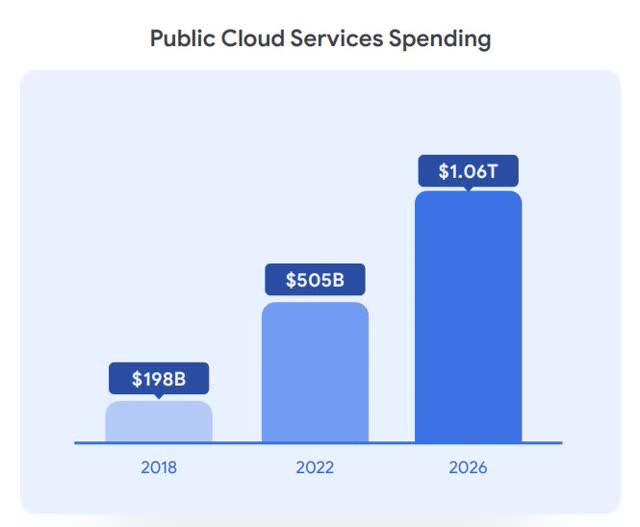

Public Cloud Services Spending (Alphabet (GOOGL) Investor Presentation)

According to Google (GOOG) (GOOGL) investor presentation, the size of the public cloud market in 2022 is about $505 billion. And it is expected to increase further. Businesses and organizations are moving to the cloud and its adoption accelerated since COVID-19. According to McKinsey, Cost savings are commonly seen as the primary reason for the cloud. Considering corporate IT spending is about $2.4 trillion and the top three companies’ combined sales are only between $100 billion and $200 billion, the cloud is expected to continue to be a great growth source.

I believe only big tech companies like Microsoft will be able to remain competitive in this market. The big issue with cloud services is the latency problem; large-scale servers must be installed in many places to solve this problem. It is difficult for local players to make large-scale global investments, and eventually the global market will flow in the form of an oligopoly dominated by top players capable of such large-scale investments.

Second growth source will be from the gaming sector. Gaming is the fastest growing part of the media and entertainment sector. It became larger than pay-TV, home video including streaming, cinema, music, books, or newspapers & magazines.

Nowadays, there are two important trends in the gaming industry. The first one is that the gaming industry is shifting toward cloud gaming services. The emergence of cloud gaming provides additional benefits such as no need to download games and wider access to various games. In other words, gamers can play more technologically complex games on less powerful devices thanks to cloud gaming.

The second one is a shift from buy-to-play towards multi-game subscription services. Gamers traditionally pay a one-time upfront fee for each individual game, but now with multi-game subscription services, they can access a curated catalogue of games. MSFT is already in an advantageous position to take advantage of these structural shifts and will be able to significantly reinforce the company’s competitive advantages with the acquisition of ATVI.

Risks: the uncertainty about the acquisition

There seems to be considerable uncertainty in the market right now about Microsoft’s acquisition of Activision Blizzard. MSFT offered $95 per share, but the stock currently sits in the low $70s, which is about 30% discount value. In contrast, a famous investor, Warren Buffett, still holds his positions. He sees the merger will be complete.

If the transaction is going to complete, it will become a dominant player in the gaming sector.

The major players in the console market are Microsoft, Sony (SONY) and Nintendo (OTCPK:NTDOY). The company’s main rival is Sony’s PlayStation, as Nintendo focuses on other genres, such as fitness, rather than games. It’s true that the PlayStation is doing better than the Xbox right now. However, acquiring ATVI could increase the competitiveness of the Xbox platform through priority access to the world’s most popular game franchise, Call of Duty, which is one of the successful game franchises globally. MSFT’s competitor admitted that ATVI’s games constitute a significant share of overall spend and gameplay time on its platform. And CMA referred a survey report by YouGove (linked above) which suggested that almost 50% of Xbox gamers would consider signing up for it if it included ATVI’s games. As the competitor and survey results show, the acquisition will bring more users to the Xbox platform. Strong contents and more users will strengthen the network effect it already has, further strengthening its competitive advantage for the long term.

If the transaction failed, it will save a lot of cash and be proven to be a unique player in the industry.

If the company fails to acquire, it is because the competition regulator believes that the acquisition seriously undermines competition. According to the U.K. competition regulator CMA, the concern is that Xbox may monopolize or advantageously provide ATVI’s contents in the de facto duopoly console game market and the transition to the cloud gaming, which is rapidly emerging, will fortify Microsoft’s competitiveness in cloud gaming. MSFT already has a strong position in that market; therefore, it will become too powerful with the acquisition.

However, the first concern is not that fundamentally relevant. Even if the deal is not going well, there is no major obstacle to using ATVI’s contents. This is because Microsoft still has the upper hand in the relationship with ATVI, one of the many game publishers. If MSFT can’t use ATVI to its advantage, it means that SONY, its only competitor, can’t do that either, so the balance will be maintained, and competition will be made in other fields.

As for the second concern, I do not believe the situation can be prevented by disapproving the takeover in the short term. MSFT has a strong gaming ecosystem. First, Xbox is one of the three major consoles alongside Sony PlayStation and Nintendo Switch. Second, the company offers a multi-game subscription service called Xbox Game Pass. Third, it is also a game publisher and owns 24 game development studios. Fourth, it provides a leading cloud platform, Azure, and PC operating system, Windows. These products and services together will strengthen the network effect and raise the barrier to entry, giving it an unparalleled competitive edge in the future. I think it is just a matter of time.

Valuation

Whatever the way the future unfolds, Microsoft’s prospects look bright. I conducted the valuation using forward earnings yield and compared it to treasury yield, because Microsoft’s business generates as strong cash flows as treasury bonds, evidenced by its credit rating of AAA.

Case 1: The deal fails

Earnings yield is calculated with forecasted operating income and enterprise value. Current enterprise Value, after accounting for savings of future cash outflow is:

(Unit: $ million)

| Current Equity Value | 1,772,700 |

| (-) Cash & Cash Equivalents | (104,757) |

| (-) Equity Investments | – |

| (-) Non-Core Assets | – |

| (+) Total Debt | 78,400 |

| (+) Pensions | – |

| (+) Preferred Stock | – |

| (+) Non-Controlling Interests | – |

| (-) Savings of future cash outflows (ATVI) | (69,000) |

| Current Enterprise Value | 1,677,343 |

Next, I assumed that the company’s total revenue growth over the next five years will grow to 12-13%. It is assumed that the Productivity and Business Process division, which operates Office 365, will grow by 10% on average, the Cloud division by 20%, and the division operating Windows and Xbox by 5%. Operating margin is 39-40% over the next 5 years.

Finally, I adjusted forecasted EBIT by capitalizing R&D and marketing expenses. This is because R&D and marketing expenses of tech companies are long-term investments, not one-time expenses, like investing in factories by manufacturing companies.

| (Unit: Million, %) | LTM | 2023 | 2024 | 2025 | 2026 | 2027 |

| EBIT | 83,383 | 80,505 | 90,689 | 102,487 | 116,189 | 132,139 |

| (+) Selling & Marketing | 21,825 | 30,795 | 34,691 | 39,204 | 44,445 | 50,546 |

| (+) Research & Development | 24,512 | 29,097 | 32,778 | 37,042 | 41,994 | 47,759 |

| (-) Selling & Marketing Amortization | (18,396) | (19,539) | (23,291) | (27,091) | (31,129) | (35,567) |

| (-) R&D Amortization | (14,937) | (16,852) | (19,301) | (21,996) | (25,006) | (28,403) |

| EBIT, adjusted | 96,386 | 104,006 | 115,564 | 129,644 | 146,494 | 166,474 |

| Current Enterprise Value | 1,677,343 | |||||

| Forward Earnings Yield | 6.20% | 6.89% | 7.73% | 8.73% | 9.92% | |

| 5-Year Treasury Rate | 3.85% | 3.85% | 3.85% | 3.85% | 3.85% |

Given its ability to generate cash flows, strong balance sheets, and growth opportunities, the earnings yield over 6.0% to 9.0% is attractive for a long-term investor.

Case2: The deal is complete

If the deal is complete, cash outflows will be realized, which affects the current enterprise value.

| Current Equity Value | 1,772,700 |

| (-) Cash & Cash Equivalents | (104,757) |

| (-) Equity Investments | – |

| (-) Non-Core Assets | – |

| (+) Total Debt | 78,400 |

| (+) Pensions | – |

| (+) Preferred Stock | – |

| (+) Non-Controlling Interests | – |

| (+) Future cash outflows (ATVI) | 69,000 |

| Current Enterprise Value | 1,815,343 |

If the deal is complete, cash outflows will be realized, which affects the current enterprise value. I estimated ATVI’s future operating profits to calculate Microsoft’s future operating profits after the acquisition. ATVI’s sales are assumed to grow at 10% per year, and the OP margin is assumed at 28%. Its operating profits are also adjusted by capitalizing marketing and R&D expenses.

| (Unit: Million, %) | LTM | 2023 | 2024 | 2025 | 2026 | 2027 |

| EBIT | 83,383 | 80,505 | 90,689 | 102,487 | 116,189 | 132,139 |

| (+) Selling & Marketing | 21,825 | 30,795 | 34,691 | 39,204 | 44,445 | 50,546 |

| (+) Research & Development | 24,512 | 29,097 | 32,778 | 37,042 | 41,994 | 47,759 |

| (-) Selling & Marketing Amortization | (18,396) | (19,539) | (23,291) | (27,091) | (31,129) | (35,567) |

| (-) R&D Amortization | (14,937) | (16,852) | (19,301) | (21,996) | (25,006) | (28,403) |

| EBIT, adjusted | 96,386 | 104,006 | 115,564 | 129,644 | 146,494 | 166,474 |

| (+) ATVI EBIT, adjusted | 4,239 | 4,701 | 5,294 | 5,915 | 6,574 | 7,282 |

| Total EBIT | 100,625 | 108,707 | 120,859 | 135,559 | 153,067 | 173,756 |

| Current Enterprise Value | 1,815,343 | |||||

| Forward Earnings Yield | 5.99% | 6.66% | 7.47% | 8.43% | 9.57% | |

| 5-Year Treasury Rate | 3.85% | 3.85% | 3.85% | 3.85% | 3.85% |

Valuation results indicate that attractive earnings yields are still expected after the acquisition. Moreover, since my estimate does not take into account business synergies from the acquisition, there are huge potentials for better performance.

In conclusion

Microsoft has great business qualities, strong balance sheet, and long-term sustainable growth opportunities. Despite the uncertainties surrounding the acquisition of ATVI, current valuation and its qualities make the idea of buying MSFT stock compelling for long-term investors.

Be the first to comment