Zoran Zeremski/iStock via Getty Images

The shares of agriculture giant Archer-Daniels-Midland (NYSE:ADM) have risen to levels not seen since the beginning of this year, when the company reached an intraday all-time high of $98.88. Does this recent surge in share price mean that the company has become too expensive, or is it still an attractive pick? In this article I try to use graphs and data to answer this question.

Share price surge

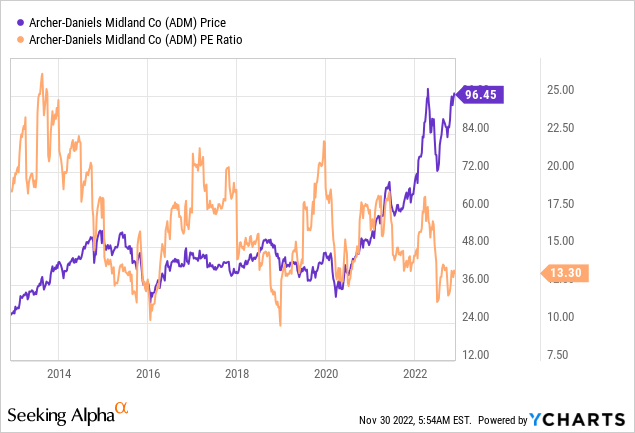

Ever since the stock experienced a major dip during the Covid crisis in the beginning of the year 2020, ADM shares have rallied. At the moment, they have almost tripled since the low of 2020. This giant surge in share prices could mean that shares have become overvalued, but let us look at the profit-to-earnings ratio to be able to make a rough estimate of whether potential overvaluation is likely:

Graph 1: ADM share price and P/E ratio during the last 10 years (source: YCharts)

It is interesting that, while share price has gone up dramatically during the during the last 3 years, the profit-to-earnings ratio of ADM has gone the opposite direction and has trended down. If we look at the 10 year graph, the P/E ratio has fluctuated, but it looks as if a level of around 15 seems reasonable, which is more than what the shares are trading for at this moment.

Still, the P/E ratio is only a strong metric if earnings are very predictable, and the nature of the agriculture business in which ADM operates means that earnings can be fluctuating heavily, just take a look at the quarterly earnings of ADM over the last couple of years to confirm this.

While ADM stills seems to be relatively cheap on a P/E basis, the company needs to continue its strong recent earnings streak to be able to ‘confirm’ its valuation.

Taking a brief look at ADM’s peers in the food trading industry, ADM is the A of the four big ABCD companies (or five, if you count Chinese Cofco (private)). The other ones being Bunge (BG), Cargill (private) and Louis Dreyfus (private). Just so you get a grip on where these companies stand compared to one another: Cargill is the largest of these companies with a 2021 revenue of about $134B, ADM had $85B of revenue during this year, and the others followed with Bunge at $59B, Cofco at $48B and Dreyfus at $37B. It is difficult to assess the valuation of ADM by looking at these peers, since three of the five are private enterprises which are not publicly traded. The only other public company, Bunge, also looks relatively affordable at the moment but did not experience the huge recent surge in share prices which ADM did.

Dividend and payout

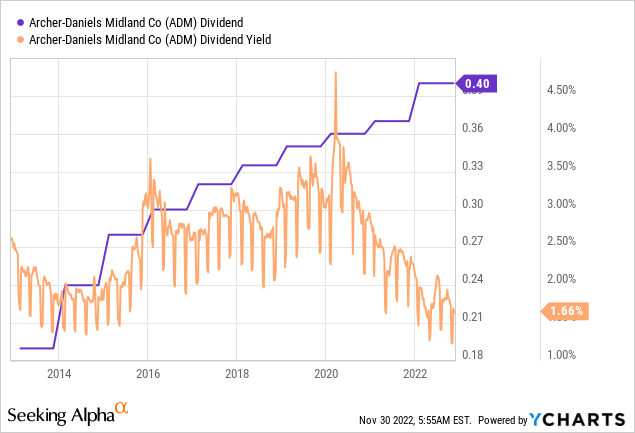

Next to the appreciating share price, dividends are another reason for investors to invest in Archer-Daniels-Midland. Let us take a look at the dividend of the company during the last 10 years:

Graph 2: ADM quarterly dividend and dividend yield during the last 10 years (source: YCharts)

As we can see, dividend has doubled since 10 years while the yield has only gone down slightly in this time period. With a value of 1.66%, current yield is relatively low, but let us take a look at the payout ratio and see whether ADM has room to increase their dividend in the next few years:

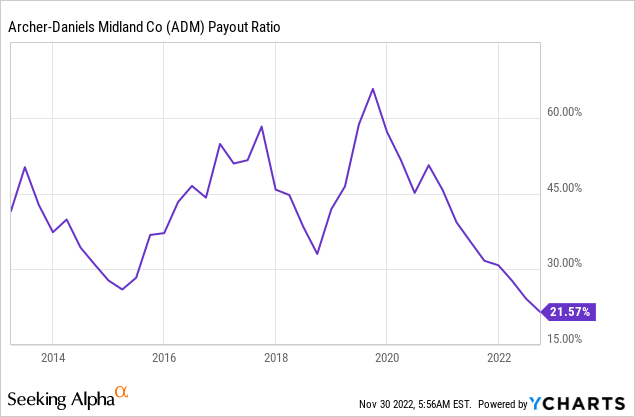

Graph 3: ADM dividend payout ratio during the last 10 years (source: YCharts)

As we can see in the graph, payout ratio is very low at the moment with a value of only 21.6 percent. This would mean that, provided they can keep their earnings at the high level at which they are at currently, I would expect some nice dividend increases during the coming years. Even if ADM would only slowly increase its dividend to a payout ratio of 30%, I would not be surprised to see multiple years with 10%+ dividend increases. Mind you, a payout ratio of 30% is still very conservative, even for a cyclical business. If ADM would be able to increase their earnings over the next years, this would even improve the picture. As far as I can see, there is ample room for some large dividend increases at ADM the next couple of years.

Let us consider the following situation, which I intentionally designed in a relatively conservative way:

- ADM earnings stay the same for the next 5 years

- Dividend is increased step by step to a payout ratio of 40%

| Quarterly dividend | Annual increase | |

| 2022 | $0.40 | |

| 2023 | $0.468 | 17.1% |

| 2024 | $0.536 | 14.6% |

| 2025 | $0.605 | 12.7% |

| 2026 | $0.673 | 11.3% |

| 2027 | $0.741 | 10.2% |

Even with stagnant earnings, dividend increases during the next 5 years would exceed 10% every single year if ADM would simply raise their payout ratio to 40%. Of course, not increasing their earnings would likely impact their share prices and as a result drive up their dividend yield, so if this situation were to happen, it does not directly mean that buying ADM’s shares now is a good idea. The only thing I am saying is that when looking at these data, I believe that large dividend increases are likely for ADM during the coming years.

Profits and margins

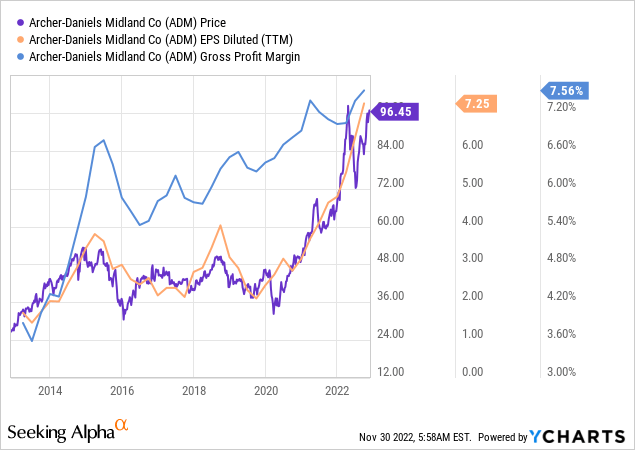

As a cross-check it is always a good idea to look at other financial metrics to see if price (and dividend) increases are matched by earnings and margins. At ADM, some of these metrics can be found in the graph below:

Graph 4: ADM share price, earnings per share and gross profit margin during the last 10 years (source: YCharts)

As you can see, earnings have basically grown alongside share price appreciation, and (gross) margins have improved during the last couple of years. These are all good signs of a healthy business and confirmation that the company likely deserved its recent share price appreciation and can afford its dividend increases.

There is one interesting thing about ADM and its earnings that I would like to point out. Since 2010, there were a couple of years (2011-2014) when earnings of ADM were relatively high compared with the years after this, which can be seen in the following graph:

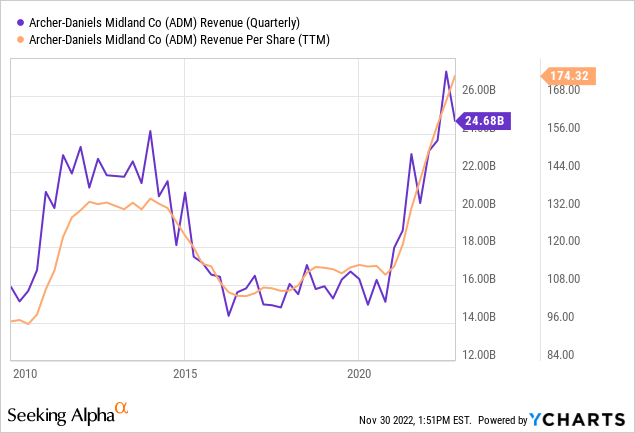

Graph 5: ADM quarterly revenue and revenue per share since 2010 (source: YCharts)

As you can also see in graph 5, current revenue is higher than during the years in the 2010, but not that much higher. If you look closely, we can see however that the revenue per share has increased by a larger percentage than the revenue itself (note that the graph’s y-axis does not start at 0). This can only be true if the total number of shares of ADM decreased, so let us take a look at this:

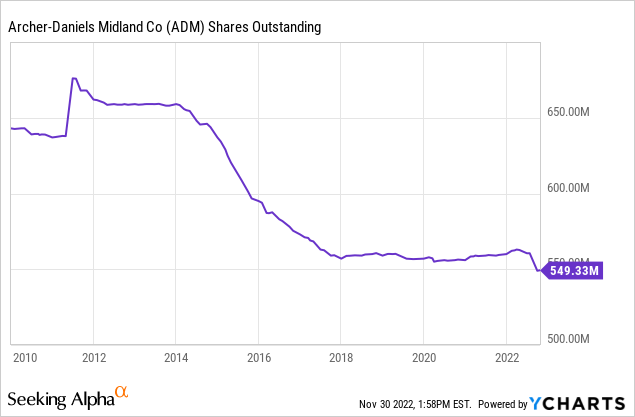

Graph 6: ADM number of shares outstanding since 2010 (source: YCharts)

The graph confirms this; the number of outstanding ADM shares decreased from a high of about 684M to about 549M today, a decrease of almost 20%. This explains the much higher per share revenue today compared to 2011-2014. ADM authorized an extensive repurchase program between 2015 and 2019 in which it originally aimed to buy back 100M of its own shares. This program has been extended by five years (so until January 2024) and buyback of another 100M shares has been authorized. We can see in the graph that ADM already bought back more than 100M shares, but it is unlikely that they will succeed in buying back the additional 100M of shares before 2024 if they continue at their current pace. Nevertheless, I find it positive that the company actively tries to reward shareholders not only by issuing a dividend, but also by share buybacks.

Cyclicality and conclusion

Though ADM is a well-diversified company, agriculture remains a cyclical business, which also impacts ADM’s share prices to a great extent, as we saw in the past:

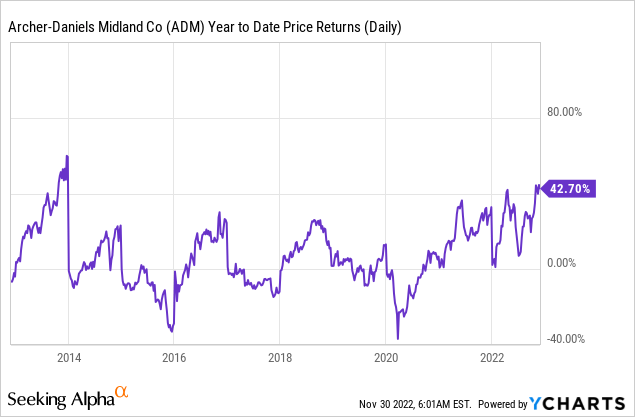

Graph 7: ADM year-to-date price returns during the last 10 years (source: YCharts)

As can be seen in the graph of the year-to-date returns of ADM, returns can fluctuate heavily. Just before the year 2014, ADM returned almost 60% in a single year, and there were multiple occasions (2016 and the beginning of 2020, during the Covid crisis) that the year-to-date returns were almost 40% in the negative.

There is no reason not to assume that this trend will continue: being active in a relatively cyclical business will also impact the volatility of stock prices. For traders, this makes companies like ADM an interesting target. Long-term investors though will just need to grin and bear the sometimes heavily fluctuating short-term returns. I have been an investor in ADM myself since the year 2016 and have experienced some strong volatility since. But the buy-and-hold nature of my investment style kept me from selling any of my shares when times got rough. Though I consider ADM to be a very solid business, long-term investors in this company sometimes need a strong stomach and a focus on the long term.

ADM is a solid business and does not appear to be overvalued even though its share price has surged since 2020. Its dividend looks very safe and is likely to be strongly increased the coming years, if earnings stay at their current levels or increase. The company has also actively bought back shares in the past, which shows their commitment to reward shareholders. For dividend growth investors, I would give ADM a cautious buy rating, even at these high share price levels.

Be the first to comment