DZIANIS BARYSAU /iStock via Getty Images

Introduction

The last decade was volatile and more often than not, a tough time for the natural gas industry in the United States, much to the discomfort of compression equipment suppliers, such as the large industry player, Archrock (NYSE:AROC). Thankfully, after years of receiving the same quarterly dividends, it now seems that a new era of dividend growth is afoot heading into 2023, which could be further turbocharged by the bullish outlook for natural gas production in the United States.

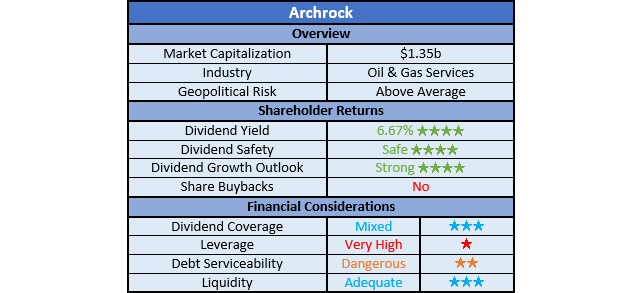

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

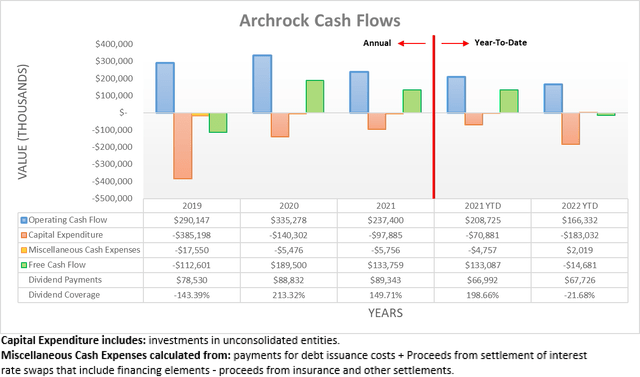

Even though the severe downturn of 2020 is now a fair way back in the rearview mirror, due to the inherent lag between natural gas prices, production growth and thus demand for their compression equipment, they were still feeling the aftermath during 2021 and 2022. As a result, their operating cash flow of $166.3m during the first nine months 2022 was down around 20% year-on-year versus their previous result of $208.7m during the first nine months of 2021. Similar to how their operating cash flow of $335.3m during 2020 was actually a sizeable increase year-on-year versus their previous result of $290.1m during 2019, as there was a lag before the weaker operating conditions took their toll.

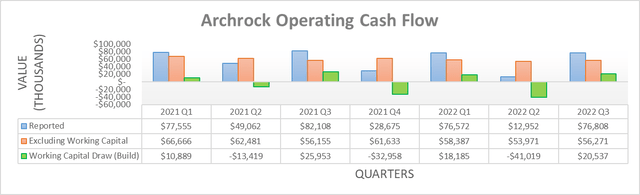

When viewing their operating cash flow on a quarterly basis, it shows their working capital movements have a sizeable influence quarter-to-quarter as draws and builds either boost or hinder their results respectively. A prime example is the second quarter of 2022, whereby their reported operating cash flow was only a mere $13m but was accompanied by a very large $41m working capital build. Even if these are removed from their results, both during 2021 and 2022, the latter still sees its underlying operating cash flow down year-on-year to $168.6m during the first nine months versus their previous equivalent result of $185.3m during the first nine months of 2021.

If circling back to their cash flow performance for the first nine months of 2022, they significantly increased their capital expenditure year-on-year to $183m versus only $70.9m during the first nine months of 2021, as they ramped up their growth investments. As a result, their free cash flow obviously suffered in the short-term, thereby falling down to negative $14.7m during the first nine months of 2022. Obviously, this was incapable of covering their accompanying dividend payments of $67.7m, unlike during full-year 2020 and 2021 whereby their coverage was a very strong 213.32% and a strong 149.71% respectively. Even though they have not released their guidance for 2023, it nevertheless appears their capital expenditure is not poised to slow down due to their expectation for stronger demand, as per the commentary from management included below.

“2023 demand is shaping up to be robust across our customer base, and we’re beginning the annual work with our Board of Directors to solidify a capital budget for next year. We have the opportunity to redeploy asset sell proceeds into an undersupplied market at attractive long-term returns and based on our customer engagements today, we expect the level of 2023 CapEx required to meet demands with core strategic accounts will be higher than in 2022.”

– Archrock Q3 2022 Conference Call.

This implies another year of low to zero free cash flow is likely ahead, as they appear to signally further growth investments as demand increases from their customers. Normally, their lack of free cash flow would simply equal very weak dividend coverage, although in this instance, it is seemingly a temporary situation as they pursue growth, thereby creating mixed coverage. Furthermore, their dividend payments of $67.7m during the first nine months of 2022 remain well below their accompanying operating cash flow of $166.3m. Despite not being a perfect measurement, as a secondary measurement, this indicates their dividend payments do not impose too great of a burden upon their company and thus, they are safe whilst they undertake these growth investments, despite the lack of free cash flow. Excitingly, it seems that a new era of dividend growth is afoot heading into 2023, as per the commentary from management included below.

“As we reinvest in our business, our quarterly dividend will remain a fundamental pillar of our 2022 capital allocation, reflecting our confidence in Archrock’s strong cash generation capacity. And as Brad discussed earlier, as the path to leverage below 4x becomes clearer next year, this will provide opportunity to revisit our capital allocation, including the potential for additional returns to shareholders.”

– Archrock Q3 2022 Conference Call (previously linked).

It remains to be seen how much their dividends will be increased, although the prospects of any dividend growth is a very welcome change after seeing their current quarterly dividend of $0.145 per share remaining unchanged since the middle of 2019. Apart from the prospects of stronger financial performance on the back of their growth investments, there are more reasons to expect better years ahead. Most notably, natural gas production in the United States is very likely to continue growing in the coming years and thus potentially turbocharging their dividend growth, as Europe moves to source their vast supply outside of Russia following its invasion of Ukraine.

Initially, this massive decision was more so driven by a desire to punish Russia economically whereas now, it is increasingly becoming a matter of necessity as Russia reduces their own exports in retaliation for other sanctions levied by Europe. Plus, the apparent sabotage of the Nord Stream pipelines a couple of months ago further lifts the stakes in this pivotal geopolitical moment in history and makes it more difficult for either side to reverse course. This is obviously a momentous task, which will take many years to complete but the United States is well positioned to help meet this demand via LNG exports given their vast resources and business-friendly environment.

Whilst it may take time for this to work its way down the production chain to benefit their financial performance, suffice to say, a rising tide lifts all boats. This does not mean natural gas prices can only go higher, rather, it should enhance long-term demand and thus reduce both the severity and length of any future downturns, which in turn creates a bullish future backdrop for production. When this is combined with the only relatively modest size of their dividend payments, it creates a strong dividend growth outlook.

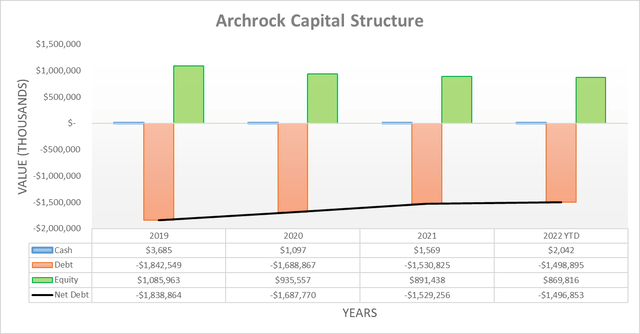

Despite their capital expenditure far outstripping their operating cash flow during the first nine months of 2022, their net debt still decreased to $1.497b versus where it ended 2021 at $1.529b, as a result from their combined $113.1m of non-core assets divestitures. The extent these detract from their growth investments remains uncertain, although even in the worst realistic case whereby they completely offset their growth investments, the relatively modest size of their dividend payments versus their operating cash flow still leaves ample scope for dividend growth.

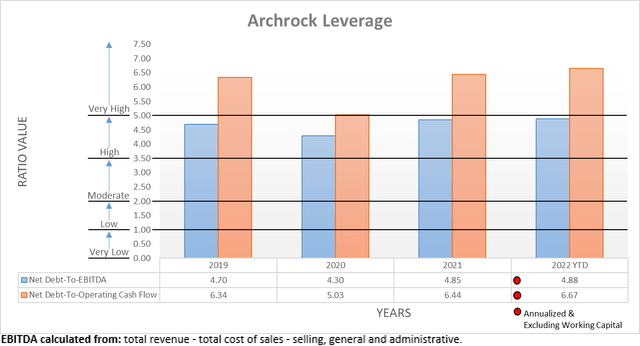

Whilst the analysis thus far carried a positive tone, unfortunately, this cannot necessarily continue into their leverage with their net debt-to-operating cash flow sitting at 6.67 and thus well above the threshold of 5.01 for the very high territory. Admittedly, their net debt-to-EBITDA is below this point at 4.88, although I nevertheless prefer utilizing cash-based metrics, as I feel they provide a superior and cleaner test, similar to how they provide a superior test for dividend sustainability and growth, at least in my eyes. Also, their very high leverage is not a new factor, as their net debt-to-operating cash flow was also above 5.01 at the ends of 2019, 2020 and 2021 with results of 6.34, 5.03 and 6.44 respectively.

Thankfully, this situation is not beyond help as their financial performance hopefully increases on the back of increasing natural gas production, it should push their leverage lower. Alternatively, if not forthcoming, they would very likely scale their capital expenditure lower once again, which should see free cash flow retained for deleveraging. In turn, this should facilitate deleveraging across a number of years, whilst simultaneously growing their dividends, albeit to a lesser extent than is possible if natural gas production increases.

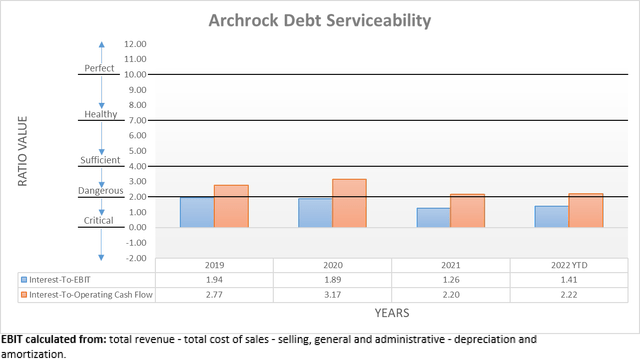

Unsurprisingly, their very high leverage is mirrored by dangerous debt serviceability, as observed when comparing their interest expense against their accrual-based EBIT that produces an interest coverage of only 1.41. Whilst the comparison against their cash-based operating cash flow sees a better result of 2.22 that is sufficient, I prefer to judge on the worse side, thereby allowing for a margin of safety.

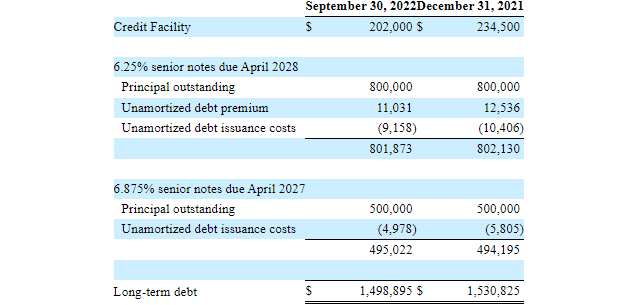

Even though this sounds quite deterring in this age of rapidly tightening monetary policy, the only portion of their debt that carries variable interest rates relates to their credit facility, which in turn only amounts to $202m of their $1.499b of total debt. Plus, in the short-term, they have this covered via interest rate swaps, thereby providing time to deleverage and thus concurrently improve their debt serviceability before facing the full effects of higher interest rates.

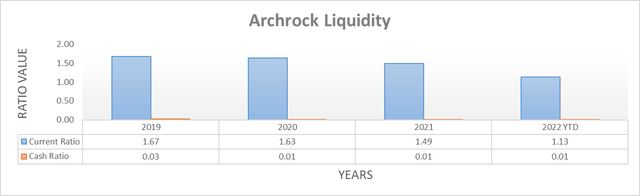

Even though their very high leverage can sound scary and is obviously less than ideal, their liquidity is also important and provides a clearer view of their financial position. At least on this front, there are no problems, firstly with their current ratio of 1.13 that is adequate, although it would have been preferable to see a cash ratio greater than a mere 0.01. Nevertheless, thankfully their credit facility still retains $486.4m of availability and does not mature until November 2024, which elevates this issue. Secondarily, the remainder of their debt relates to their 6.875% and 6.25% senior notes that do not mature until April 2027 and April 2028 respectively, which provides ample time to increase dividends before repayment or refinancing even becomes a topic for discussion.

Archrock Q3 2022 10-Q

Conclusion

Even if the bullish outlook for natural gas production in the United States turns into nothing more than hot air, they still have a strong dividend growth outlook as they deleverage thanks to the relatively modest size of their dividend payments versus their operating cash flow. Considering they already offer a safe high 6%+ dividend yield, I believe that a buy rating is appropriate since it seems a new era of dividend growth is afoot.

Notes: Unless specified otherwise, all figures in this article were taken from Archrock’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment