Olemedia

Investment Summary

With macroeconomic indicators leading med-tech equities on a turbulent journey this YTD, we’ve been pleased at the performance of some of our healthcare longs. Despite this, within the broad healthcare basket, there are several names within our medtech coverage universe that have left us a little underwhelmed in the back end of FY22. One that comes to mind is Nevro Corp. (NYSE:NVRO). Since our last NVRO publication the stock has held firm and traded in sideways territory, backing and filling in a narrow range around the $45 mark. After the company’s Q3 numbers, we’re back with you again to report our latest suppositions in the NVRO investment debate. Net-net we revise our position to a speculative buy seeking an initial price objective of $50 before re-evaluating the available data. By the way, you can check out our previous NVRO publication by clicking here.

NVRO Recent Developments

Last time, we commented on NVRO’s progress around its HFX Therapy for painful diabetic neuropathy (“PDN”). The therapy [from hereon in, “PDN”] and were pleased to note of its success since launch.

In particular, we noted several structural tailwinds for the segment, in that United Healthcare is to provide coverage for the 10kHz, therapy, whereas “several coverage updates among BCBS insurers were made to cover PDN explicitly – securing an additional ~23mm commercially-insured covered lives”. Note, United Health has since revised its coverage to treating complex regional pain syndrome (“CRPS”) and PDN, and failed back surgery syndrome for SCS.

It’s therefore equally as satisfying for us to see the FDA’s approval of NVRO’s Senza HFX iQ spinal cord stimulation (“Senza SCS”) system in October.

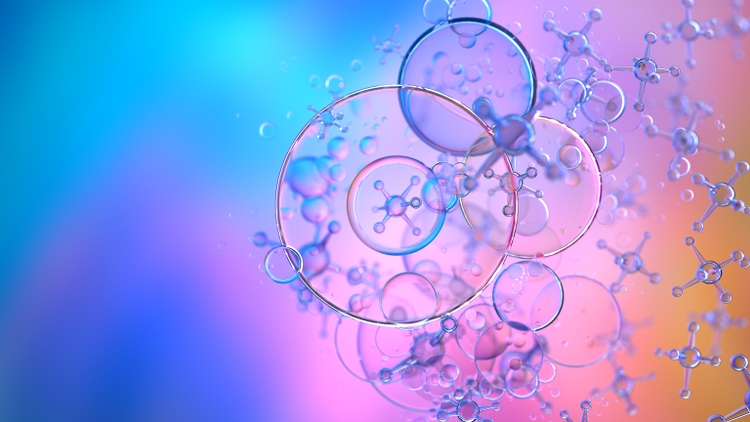

As a quick reminder, the Senza SCS system is the first and only artificial intelligence based SCS system that uses algorithms to “optimize” pain relief based on a patient’s individual factors [mobility, lifestyle, level of physical activity, etc.]. The use of AI means the Senza SCS is supposedly adaptable to a person’s individual pain characteristics, which could be a key differentiator within the space in our opinion.

The company says that it will launch a trial run of the device in Q4 in the USA, so we’ll be patiently waiting for the results of this pilot launch.

Exhibit 1. Senza HFX iQ spinal cord stimulation System

Data: NVRO Q3 investor presentation, pp. 9

Meanwhile, Boston Scientific, NVRO’s main competitor in the SCS domain, reported it faced reimbursement issues in its neuromodulation segment last quarter and that it’s US SCS sales “were impacted by preauthorization denials”, thus hurting turnover. To this point, NVRO CEO, Keith Grossman said on the call:

“One of our competitors made a recent comment about prior authorization pressures from payers becoming a much more significant headwind for SCS in the third quarter. This is not something we saw. Medicare and commercial payers reimburse almost universally for SCS therapy. And the payment amounts themselves for both facilities and physicians have remained reasonably stable and appropriate over time…

…In fact, about 1/3 of all of our patients come through our access team, and that number is growing. For those patients, we have an 80% to 85% prior auth approval rate for all trial patients and well over a 90% approval rate for perm patients following a successful trial”.

Consequently it does not foresee any meaningful challenges in this regard looking down the line.

Finally, PDN clinical trials in the USA increased 22% from Q2 FY22’ and represented ~18% of the company’s USA trial volume, an improvement of 4 percentage points from last year.

Q3 results: PDN growth curve stretching higher

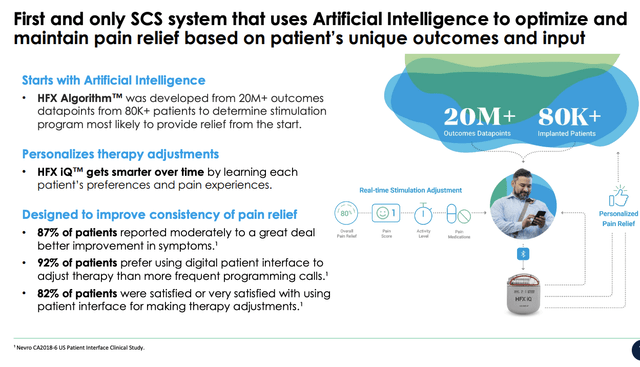

Switching to the quarter, we noted similar strengths in the company’s PDN growth numbers. Revenue growth was reported at 8% YoY and lifted to $100.5mm on adjusted EBITDA of negative $3.8mm. Management noted that PDN signified 13% of global permanent implant procedures and contributed $13.4mm to the top line.

Geographically we saw that US revenue came in 10% higher YoY at $86mm, with growth underscored by a 16% uplift in USA permanent implants.

It’s worth noting that OpEx was flat YoY at $92mm, but when including the $105mm in litigation credits, netted $12.8mm. Moreover, NVRO obtained FDA clearance for a new global manufacturing plant in Costa Rica. Management hope to see a more efficient cost base this way, nonetheless, this will certainly impact OpEx downstream in our opinion.

As such, it pulled these results vertically down to net earnings of $2.22 per share, an enormous surprise to the upside of $2.32. This has not been recognized by the market in our estimation and therefore we opine there’s post earnings drift yet to be priced into the NVRO share price from this upside. A more extensive history of NVRO’s operational results is seen in Exhibit 2.

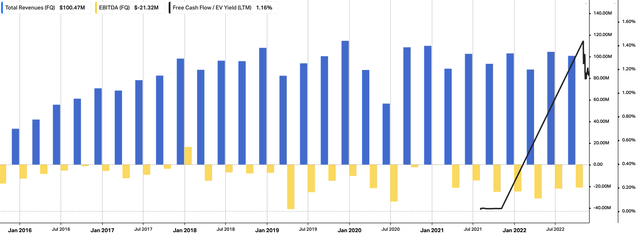

Finally, with improvements in its cost structure and the additional litigation credits, we noted that NVRO realized a substantial free cash inflow last period that we believe will serve well for capital deployment in future periods, especially given the historical, cyclical relationship between NVRO’s FCF flows and its return on capital investment [Exhibit 3].

Exhibit 2. NVRO operational walk-thru, FY16–date

Note: With free cash inflows only realized within the last few quarters we have opted to withhold all negative FCF yields from the chart. FCF yield is calculated as [FCF TTM / rolling enterprise value]. (Data: HBI, Refinitiv Eikon, Koyfin)

Exhibit 3. NVRO cyclical relationship with FCF and return on capital.

Data: HBI, Refinitiv Eikon, Koyfin

Technicals pointing to potential breakout

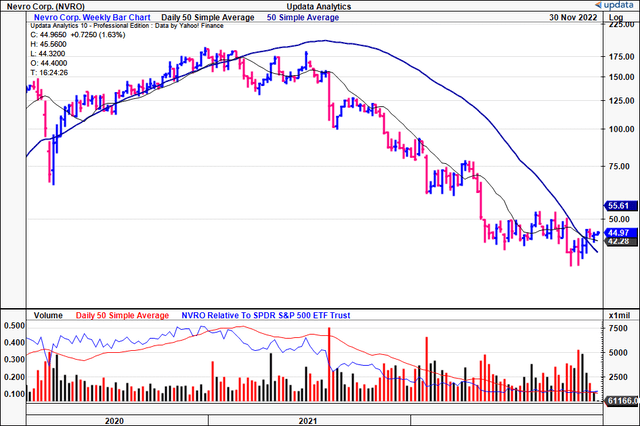

We acknowledge it’s been a difficult time for NVRO longs these past 12-18 months. Just look at the chart below; the descending base from mid-2021 extended until midway this year, from which the stock has been trading sideways.

However, a few notable takeaways from the chart studies. First, whilst the stock has been backing and filling in this sideways channel, the volume trend has been increasing substantially.

The combination of flat price action with ascending volume is heavy support in our opinion.

In addition, we see the stock has climbed above the 50DMA and 200DMA who themselves have also crossed to the upside.

We like this chart setup, especially the large accumulation of shares since the stock started forming a base in June this year.

Exhibit 4. NVRO 2-year price evolution [weekly, log scale].

Data: Updata

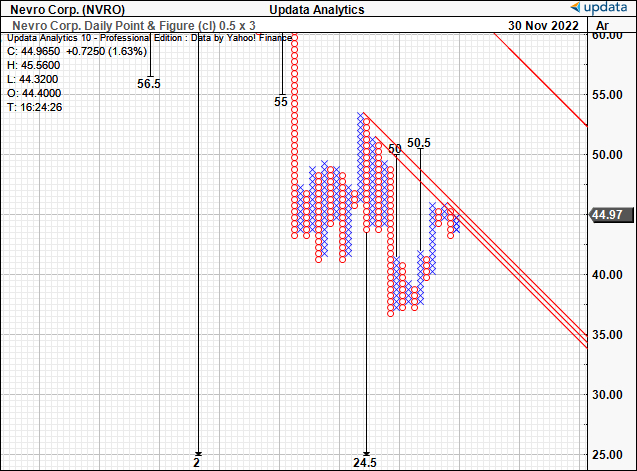

Consequently we now have good confluence around a price objective of $50, as seen in our point and figure analysis below. The stock is also testing the inner resistance lines shown in red.

Exhibit 5. Upside targets to $50

Data: Updata

Valuation and conclusion

Consequent to our findings above, we now have upside mobility priced into our investment thesis on NVRO.

Last time we valued the stock at $42, or the market consensus’ forward sales multiple of 3.7x our FY22 sales estimates. We note the industry multiple is 4.4x, which we feel is appropriate. Rolling our FY22 sales estimates of $405mm forward [see: previous analysis] to this multiple derives a price target of $50. In addition, we commented last time of Seeking Alpha’s quant ratings on the company. You see the current snapshot below, which we opine fits our thesis.

Exhibit 6. Seeking Alpha Factor grades, NVRO

Data: Seeking Alpha Quant Rankings, NVRO

This aligns with technical objectives listed above and therefore there’s good confidence around this estimated price target. We therefore set our first objective to $50 and look forward to additional market data, company growth percentages, to re-evaluate these objectives a little further down the line. For now, we revise our position to a speculative buy, hoping to capture an earnings surprise to the upside from the company’s latest updates.

Be the first to comment