9parusnikov/iStock via Getty Images

Investment Thesis

Microsoft (NASDAQ:MSFT) is one of the best companies in the world. One bad quarter is not a reason to sell.

Here are the three aspects that weighed Microsoft down.

- Revenue guidance for Q2 2023 of approximately 5% y/y.

- Also, the mix of the outperformance seen in Q1 2023 did not come from Azure. The bulk of the outperformance in the quarter came from Productivity and Business Processes. More specifically, Office 365 Commercial and LinkedIn.

- Operating margins compressed y/y by approximately 170 basis points.

In the analysis that follows, I offer my own perspective on what’s at play, what’s good and bad in the quarter.

Microsoft’s Prospects

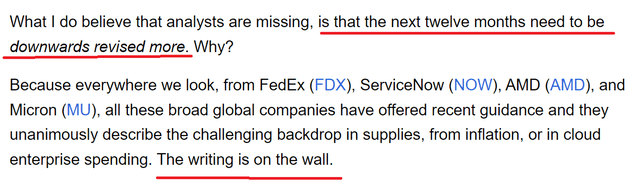

Two weeks ago, I wrote a bullish article on Microsoft here I said:

Author’s work, Oct 12

I then went on to say,

Author’s work, Oct 12

Ultimately, the story is very much intact, Microsoft is still benefiting from companies embarking on their digital journeys. That has not changed. The only thing that’s happened is that analysts seem either lazy or unwilling or incapable of seeing that Microsoft’s growth ahead was going to get hit hard in the coming twelve months.

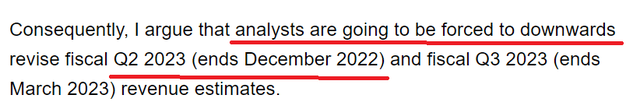

Revenue Growth Rates Slow Down

Author’s work

Before going further, keep in mind that the graphic above uses as-reported figures, rather than currency adjusted.

Here’s the reality of the situation, Microsoft’s near-term growth rates are decelerating. This is an unavoidable reality.

I don’t believe that analysts will be too brutal with downwards revising Microsoft’s revenue estimates, after all, who would want to lead on that? Too much career risk!

It’s much better from a career perspective to wait for someone else to get thrown under the bus, and follow some other analysts’ downwards revision.

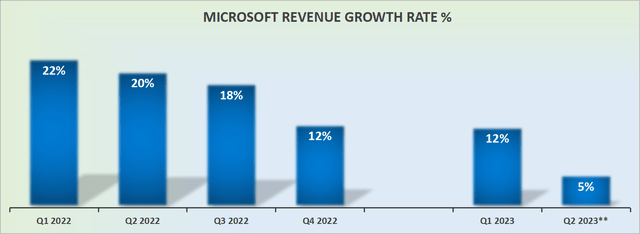

MSFT revenue estimates

And that’s why Microsoft’s revenue estimates are still now expected to move up and to the right.

Very few analysts want to start to see the writing on the wall, that Microsoft’s revenue growth rates are not going to be reporting mid-10s% CAGR any time soon.

Profitability Profile in Focus

The other aspect that weighed down Microsoft is that its operating margin last year was 44.7%, while this time around it compressed by 177 basis points to 42.9%.

During the earnings call, Microsoft’s CFO Amy Hood

At the total company level, we continue to expect double-digit revenue and operating income growth on a constant currency basis.

So again, the issue here is that Microsoft is a global company. That means, the topic of the day, namely FX, will continue to plague Microsoft by around 500 basis points!

That means that if Microsoft guides for at least 11% to 12% FX-adjusted CAGR for the full year, knowing that it already has 1 quarter on its books at 16% fx-adjusted CAGR, that implies that the later parts of this fiscal year will be moving down. On a GAAP basis, Microsoft will be reporting sub 10% CAGR.

And that’s going to impact margins and overall EPS growth rates too.

MSFT Stock Valuation — Reasons to be Bullish

If we assume that Microsoft’s EPS figures throughout the remainder of fiscal 2023 get downward revised slightly, a realistic EPS figure for the fiscal year is around $9.80 to $10.00.

Given the after-hours sell-off, I suspect that Microsoft is now getting priced around 23x to 25x forward EPS.

Realistically, given the stickiness of Microsoft’s operations throughout enterprises and the quality of the management team, I don’t suspect there’s much likelihood that Microsoft’s EPS multiple contracts below 20x forward EPS.

That means that the bulk of the EPS contraction is largely already priced in.

That means that for an investor now looking at the stock assuming not a lot more multiple contraction, investors will probably get around ~15% upside returns, including dividends and share repurchases.

I know that for a lot of investors 15% returns are something to sneer at, particularly when we all become accustomed to YOLO memes. But nearly all of those YOLO investors have already been decimated.

Once expectations become more reasonable, I believe that investors will come back to the market to accept a 15% return as something that’s very palatable.

The Bottom Line

There’s a change in the narrative at hand. What was previously the unequivocal growth driver of Microsoft’s narrative, Azure, is now expected to slow down sequentially by up to 5% fx-adjusted. That means that going forward, rather than expecting Azure to come in a save the quarter each time with its +40% CAGR, Azure’s near-term growth rates are moderating ever-so-slightly.

That means that shareholders that were previously latching on to one story will slowly have to latch on to a different story. One that is focused on EPS growth rates, rather than one that is squarely focused on digital transformation.

Personally, despite writing a very nuanced analysis of the quarter, I remain bullish on MSFT. Good luck to everyone.

Be the first to comment