Nordroden

By Alex Rosen

Summary

By focusing on natural resource companies, iShares North American Natural Resources ETF (BATS:IGE) seeks to capture the growth in the energy market in the U.S. Specifically, it invests in American oil companies in an attempt to capture the upside of the American carbon energy boom.

Strategy

IGE focuses on producers of oil, gas and consumable fuels, providers of energy equipment and services, metals and mining companies, manufacturers of paper and forest products, and producers of construction materials, containers and packaging. The fund is rebalanced twice a year and has a 10% cap on any one holding. Overall, the fund has 127 holdings, though the majority of it is concentrated in the top ten holdings, and 20% in Chevron (CVX) and Exxon (XOM) alone. Additionally, while IGE is officially a broad based natural resources ETF, it really is just an energy and energy infrastructure fund, as those two sectors constitute 80% of the holdings.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Industries

-

Sub-Segment: Natural resources

-

Correlation (vs. S&P 500): Medium

-

Expected Volatility (vs. S&P 500): Medium

Holding Analysis

82% of IGE’s assets are held in Energy and Energy Infrastructure sectors, with the majority in large cap blue chip stocks. All of its holdings are in either the U.S. or Canada leaving zero exposure to emerging markets and Europe. The remaining assets are spread across multiple sectors including mining, and timber, but it’s really like putting a sprig of parsley on a steak and calling it a salad.

Strengths

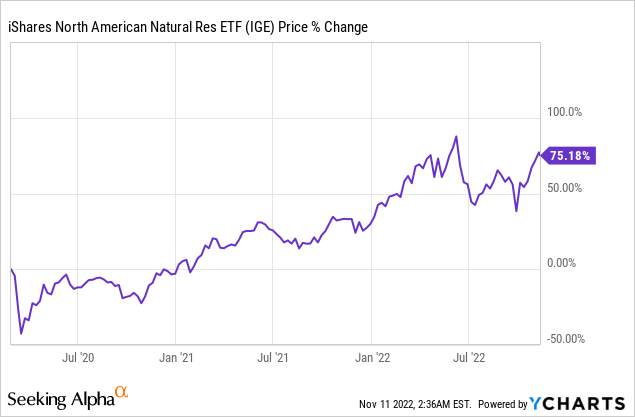

The North American energy sector is booming. Changes in legislation combined with technological advances turned the U.S. into a net exporter of oil. This was prior to the Russian invasion of Ukraine and the global economic downturn. During the height of the COVID pandemic, as people stopped driving and the oil market collapsed, IGE saw a predictable down turn, but those days are over. Thanks to vaccines, and Mr. Putin’s follies, the U.S. energy sector is back in business.

Weaknesses

IGE is heavily concentrated in a notoriously fickle sector. IGE has no exposure to markets outside of North America, and it is heavily weighted towards a few large cap stocks. All it would take is for one giant oil spill in the gulf to sink the fund. Despite the fact that IGE holds 127 unique stocks, the lack of diversity at the top is really a potential blind spot for the fund.

Opportunities

IGE is finding itself in a perfect storm of opportunity. The pandemic is mostly over, people are back to consuming and traveling, and one of the major rival producers, Russia, has decided it no longer wants to participate, and prefers attempted territorial gains over economic success. For the time being, this really makes IGE an attractive option. It is hard to say how long this perfect storm will last, but for now, the going is good, and you know what they say to do when that happens.

Threats

IGE’s overweighting toward one region and one sector leaves it vulnerable to any changes in that sector and region. Tomorrow, legislation restricting extraction and pipeline construction could be enacted and the whole industry could suffer. Long term, this is also not a great investment, because it is a bet against the future of mankind. There is only so much we can extract from the earth and burn, before we get burned ourselves.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

IGE is misrepresenting itself as a natural resources fund. The logic behind its holdings is sound in that it focuses on the most profitable portions of natural resources. As a North American Energy ETF, IGE is doing an excellent job of capturing the upside. However, it is in theory not supposed to be that, so it’s up to investors to decide what they want to do with it.

ETF Investment Opinion

Regardless of whether IGE is a natural resources fund or an energy fund, the bottom line is it’s a profitable fund in the short term. This is why we rate it a Buy. Investors looking for total return will be happy with IGE. If you really want a natural resources fund though, perhaps this is not the fund to invest in.

Be the first to comment