5./15 WEST

Meta Platforms’ (NASDAQ:META) secret weapon is likely not metaverse, but Facebook and Instagram Reels. While the market hasn’t been too keen on the company since the beginning of this year, there’s an indication that the recovery is around the corner, as the latest earnings report showed that Meta’s Reels product is gaining more momentum and could help the business to successfully weather the current turbulent times.

Even though the digital ads market is in a cyclical decline and there’s a high chance that Meta’s business won’t grow much this year or that its metaverse initiatives would continue to be unprofitable, Reels allow the company to compete on equal footing with TikTok and potentially gain some market share from it. While I have already briefly highlighted Reels earlier this year in another article, over the months that passed since that time the product has gained additional competitive advantages, and now it could finally start helping Meta strengthen its position in the video segment of the digital ads market in years to come. As a result, now could be a good time to hold a position in Meta, as in the case of further successful performance of Reels we could see an appreciation of the company’s stock in the following quarters.

Q3 Is Around The Corner

Meta without a doubt had a disastrous start to the year. After a relatively weak performance in recent quarters, its stock has depreciated by ~60% YTD and currently trades around its 52-week lows. However, later in October, the company will report its Q3 results and there’s a possibility that we could see an improvement in some of the company’s major metrics. After all, even though Meta managed to generate only $28.82 billion in revenues in Q2, down 0.9% Y/Y and below the estimates by $130 million, its number of active users has nevertheless climbed as its DAP and MAP were 2.88 billion and 3.65 billion, up 4% Y/Y and 4% Y/Y, respectively.

At the same time, the market doesn’t expect Meta to deliver a great performance in Q3, as its quarterly guidance was lowered a few months ago to $26 billion – $28.5 billion in expected revenues during the quarter, below the street estimates of $28.94 billion, mainly due to a volatile macroeconomic environment. As a result of this, Meta has enough room to surprise everyone and beat its conservative guidance due to relatively weak expectations in the first place.

All Eyes On Reels

One product that could help Meta to improve its performance not only in Q3 but in the following quarters as well is Reels. Reels themselves are full-screen vertical videos made by content creators on Facebook and Instagram similar to the ones that creators make on TikTok. Due to their engaging way of interacting with the users, Meta is able to successfully monetize them by giving advertisers the ability to run Reels-type ads both on Facebook and Instagram. In recent months, Reels were able to gain momentum and are already on track to generate $1 billion in annual revenues for Meta.

At the same time, there are reasons to believe that the short-form video segment will continue to attract new users along with advertisers, as some reports suggest that TikTok’s parent company ByteDance (BDNCE) is about to generate $11 billion in advertising revenues this year and surpass the revenues of Snapchat (SNAP) and Twitter (TWTR) combined. In addition, by 2024 its annual revenue is forecasted to be close to $24 billion, which is ~$5 billion shy of what YouTube (GOOG)(GOOGL) earned last year.

Considering this, it’s safe to say that Reels have an opportunity to help Meta to improve its metrics and expand its presence in the continuously growing short-form video segment in the foreseeable future given the impressive rate at which its direct competitor TikTok is forecasted to grow.

On top of that, while Reels are still not as popular as TikTok at this stage, there are reasons to believe that Meta has several key advantages that should help it to compete with ByteDance on an equal footing in the short-form video segment. First of all, Meta has a greater war chest and a more solid balance sheet than ByteDance, which continues to bleed cash to finance its growth. At the same time, one of the big disadvantages of TikTok is that it doesn’t reward much its content creators, who earn significantly less revenue in comparison to other video platforms.

While ByteDance has been trying to tackle this issue by launching the TikTok Plus program under which it splits revenues with its creators by half, only a small percentage of the most popular creators are eligible for such a revenue share agreement. As a result of this, there’s always an incentive for creators to look for other platforms where they could share similar short-form video content and earn significantly more.

That’s why Meta has been actively exploiting this issue first by introducing its own revenue share agreement with a lower barrier of entry under which creators earn 55% from overlay ads in Reels, and then by adding a bonus program under which creators could earn additional revenue as well. On top of that, a few days ago, Meta announced that it would add new features to Reels in order to attract more users and advertisers.

Considering all of this, it’s safe to say that Reels could help Meta improve its performance in the following years and ease the blow caused by Apple’s (AAPL) decision to change its privacy policy, as there’s an indication that a short-form video segment would continue to gain additional momentum and attract more advertisers.

New Opportunities

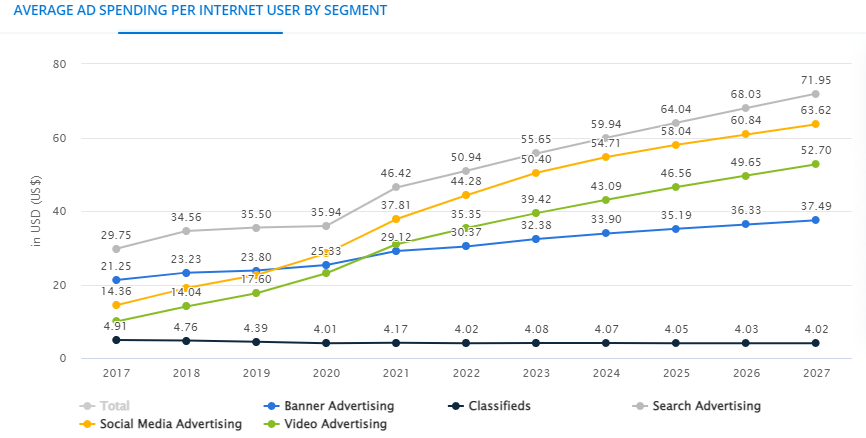

By promoting and investing in Reels, Meta is able to increase its presence within the broader video segment, which already has the highest average ad spending per user within the overall digital advertising industry in comparison to other segments. At the same time, considering how much TikTok alone is expected to generate in revenues in the following years, it’s safe to assume that Meta has solid chances of expanding the monetization opportunities of Reels and becoming one of the leaders of full-screen vertical videos segment given its latest initiatives described above. All of this is likely going to result in the creation of additional shareholder value in the following years.

Average Ad Spending Per Internet User By Segment (Statista)

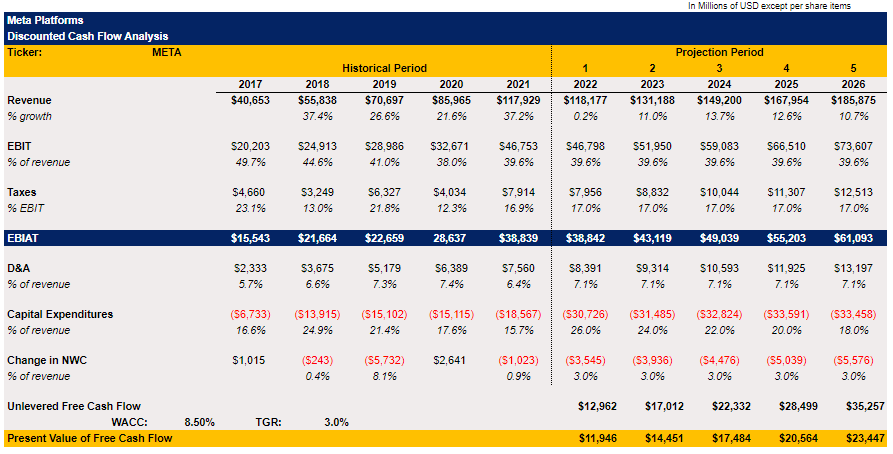

To figure out what’s Meta’s fair value and whether its stock trades at a discount, I decided to update my DCF model. The FY22 assumptions for revenues in the model are mostly in-line with the street consensus, while capital expenditures along with taxes are mirroring the management’s expectations for this year. WACC in my model is 8.5%, while the terminal growth rate is 3%.

The reason why I decreased WACC in the model in comparison to the previous time is because in August Meta decided to enter the debt market by raising $10 billion in its first-ever bond offering that added the cost of debt, which is always lower than a cost of equity, into the calculation of WACC. At the same time, the terminal growth rate was increased from 2.5% to 3% due to the fact that Meta continues to be a capital-light business with impressive margins and a dominant position in the digital ads industry, which in my opinion grants it a higher growth rate in comparison to other businesses.

Meta Platforms DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

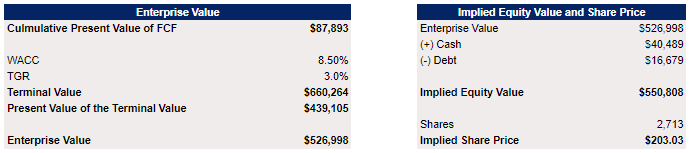

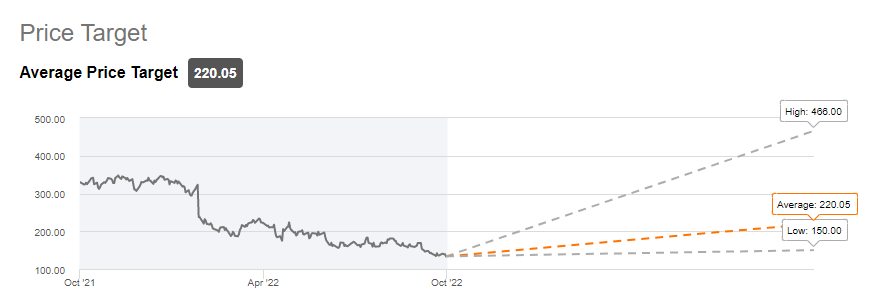

My DCF model shows that Meta’s fair value is $203.03 per share, which represents an upside of ~50% from the current market price. That price target is also slightly below the street consensus target of $220.05 per share, but significantly above the lowest rating of $150 per share, which also represents an upside from the current market price.

Meta Platforms DCF Model (Historical Data: Seeking Alpha, Assumptions: Author) Meta Platforms Street Consensus Price Target (Seeking Alpha)

Considering all of this, it’s safe to say that Meta is a solid stock to own at the current levels, as we could assume that the latest depreciation of its stock is simply a market overreaction due to the worsening macroeconomic environment.

The Downsides

The major downside of Reels is that even if it manages to generate $1 billion in revenues for the company, it’s still going to be a drop in the bucket considering that this year alone Meta is expected to generate $118 billion in revenues. As a result, while there are reasons to believe that the product would be successful in the following years, it would still take time for it to start significantly affecting the company’s financials.

In the meantime, as Meta successfully scales Reels, there’s a risk that the world would enter a prolonged global recession, which could result in further depreciation of Meta’s stock. The latest developments such as an OPEC oil production cut along with a more hawkish monetary policy by the Fed point to the fact that the macroeconomic environment could worsen even more, and as a result diminish Meta’s ability to improve its sales in the short to near-term. This is something that investors need to be aware of if they decide to pursue an investment in Meta.

The Bottom Line

Reels without a doubt are a game changer for Meta, as it’s currently one of the most successful recent products of the company that has an opportunity to continue to generate returns and attract advertisers, which is something that the firm’s metaverse products can’t do at this stage. Considering that there’s an indication that the advertising dollars would continue to flood the video segment in the long run, it makes sense for Meta to continue to develop Reels by adding new features and providing transparent revenue-sharing agreements in order to attract new content creators, which would allow the product to scale. That’s one of the main reasons, along with the fact that the company is undervalued at the moment, of why I’m bullish on Meta at this stage and hold a long position in the company.

Be the first to comment