semenovp/iStock via Getty Images

It is only natural to wonder “what if”?

Think about how many times you’ve wondered what the impact on your life would have been if you had done this or that. Similarly, have you ever wondered what the impact on your investment portfolio would have been if you had made one decision rather than the other? Opportunity cost helps us measure the impact of forgoing one investment choice for another.

For example, investors who waited on the sidelines as stocks soared during most of the pandemic would have suffered a massive opportunity cost as the major averages exceeded their pre-pandemic highs in a meaningful way. Similarly, during the Fed’s long-term experiment with ZIRP and QE, investors who kept their fixed-income allocations in money markets or short-term notes gave up a lot of total return compared to those who ventured further out on the yield curve.

Imagine if you collected 4.25% annually from a bond for 10 straight years, while someone else, constantly waiting for the Fed to normalize rates, sat in short-term instruments averaging 1.25% over that time. Your 30 percentage points of outperformance would make it very difficult for the person who chose shorter-term instruments to ever overcome the opportunity cost.

We are living through a period of time in which the Federal Reserve has for months kept the fed funds rate below 1% while inflation was simultaneously soaring, reaching a level above 7%. Actions speak louder than words. From an inflation-fighting-credibility perspective, something is clearly missing at the Fed.

With that in mind, does anybody really think the Federal Reserve’s upcoming rate-hike cycle will take Fed funds above last cycle’s high of 2.25% to 2.50%? I will believe that when I see it.

In the meantime, rather than sitting in money markets earning close to zero, or short-term CDs under 1%, I continue to look for opportunities in the corporate- and municipal-bond space, capturing yields that will outperform short-term, fixed-income instruments over time. I have written about some of those opportunities here. In this commentary, I would like to discuss opportunities in the bonds of two beer titans – Anheuser-Busch InBev (BUD) and Molson Coors (TAP).

Anheuser-Busch InBev – The King of Beers

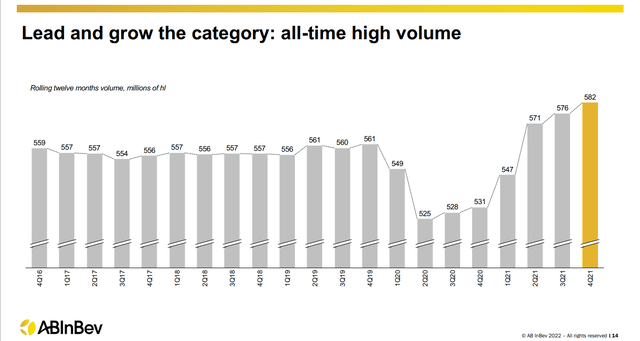

Anheuser-Busch, the largest beer company in the world, is selling a lot of beer. In the fourth quarter of 2021, the company recorded its all-time high volume, measured in hectoliters. It appears people are drinking heavily coming out of the pandemic. How much volume are we talking about? Have a look:

Anheuser-Busch InBev Q4 2021 Results Presentation

The 582 million hectoliters sold in Q4 2021 equal 58.2 billion liters or 1.968 trillion fluid ounces!

Anheuser-Busch’s brands include the number one selling beer in the United States, Bud Light, as well as Budweiser, Michelob Ultra, Stella Artois, Busch Beer, Natural Light, Hoegaarden, Shock Top, and more.

Some of its key financial figures from 2021 included $54.3 billion of revenue and $19.2 billion of EBIDTA, representing 11.8% EBITDA growth.

Before discussing Anheuser-Busch bonds, I’d like to point out a few items from its recent earnings presentation and its recently released 2021 Annual Report that should inspire confidence among owners of the company’s notes.

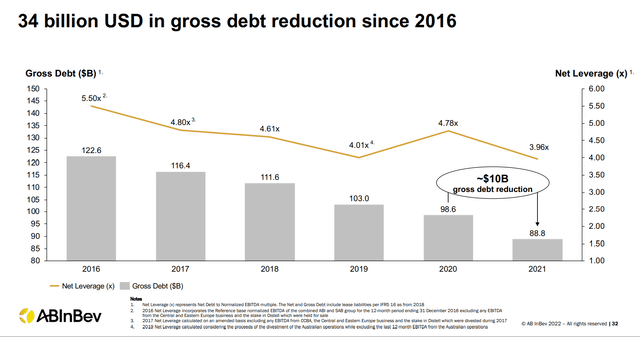

First, Anheuser-Busch appears very focused on reducing debt, with a 28% reduction in gross debt since 2016. This is obviously a positive from a credit perspective.

Anheuser-Busch InBev Q4 2021 Results Presentation

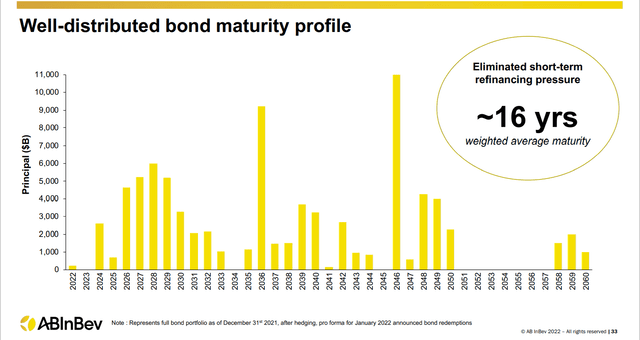

Second, the company has no significant near-term bond maturities, which should help it weather the 2022 dual storms of inflation and war in Europe. Additionally, Anheuser-Busch ended 2021 with $22.2 billion of liquidity, including $12.1 billion of cash and $10.1 billion available under its “Sustainability-Linked Loan Revolving Credit Facility” (source: slide 37 of previously linked 2021 Annual Report).

Anheuser-Busch InBev Q4 2021 Results Presentation

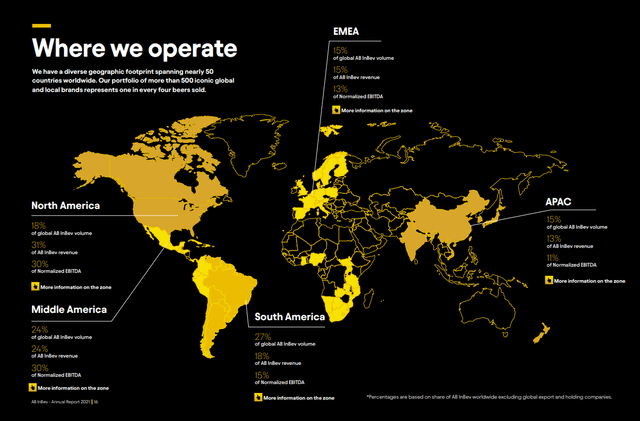

Third, Anheuser-Busch is truly a global company, with operations in nearly 50 countries. Under normal conditions, this would be a positive, and hopefully, over a multi-decade holding period, normalcy will reign supreme. In 2022, however, we are living under the prospect of World War III. Therefore, even though a global reach typically would inspire confidence, for the time being, Anheuser-Busch’s exposure to Europe, and, I would argue, even China should give a bit of pause.

Anheuser-Busch InBev 2021 Annual Report

Anheuser-Busch InBev Bonds

The January 17, 2043 maturing notes, CUSIP 035242AB2, are rated Baa1/BBB+ by Moody’s and S&P, respectively. At the time of this writing, the 2043 notes have a yield-to-maturity of 4.224% and a current yield of 4.13%.

The February 1, 2044 maturing notes, CUSIP 03524BAF3, are rated Baa1/BBB+ by Moody’s and S&P, respectively. At the time of this writing, the 2044 notes have a yield-to-maturity of 4.353% and a current yield of 4.46%.

The February 1, 2046 maturing notes, CUSIP 035242AN6, are rated Baa1/BBB+ by Moody’s and S&P, respectively. At the time of this writing, the 2046 maturing notes have a yield-to-maturity of 4.44% and a current yield of 4.59%.

From an opportunity cost perspective, the Fed would have to hike short-term rates really high, really fast to overtake the Anheuser-Busch bonds yielding in the low-to-mid 4%s.

From a timing perspective, it is certainly understandable if investors want to wait to see what the Fed’s upcoming meeting holds, as it may give us a window into the FOMC’s desire or hesitancy to hike aggressively this year. Moreover, given Anheuser-Busch’s global reach, including exposure to Europe and China, investors concerned about the prospect of World War III may want to wait a bit until we have a better grasp of how the war in Europe will play out.

Molson Coors Beverage Company

I like to think of Molson Coors as the little cousin to Anheuser-Busch. Its product portfolio is extensive, including two of the top three top selling beer brands in the United States – Coors Light and Miller Lite, both of which are growing.

Molson Coors – Fourth Quarter and Fiscal Year 2021 Presentation

The company’s extremely long list of brands can be found here.

Before discussing Molson Coors bonds, I’d like to point out a few items from its recent earnings presentation that should inspire confidence among owners of the company’s debt.

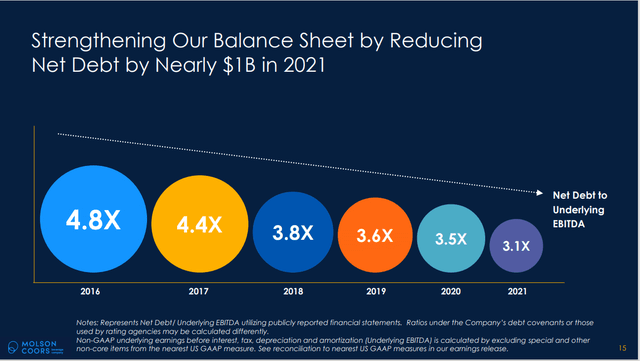

First, Molson Coors has reduced net debt to EBITDA for five straight years. This demonstrates the Baa3/BBB- rated company is focused on maintaining an investment-grade credit rating.

Molson Coors – Fourth Quarter and Fiscal Year 2021 Presentation

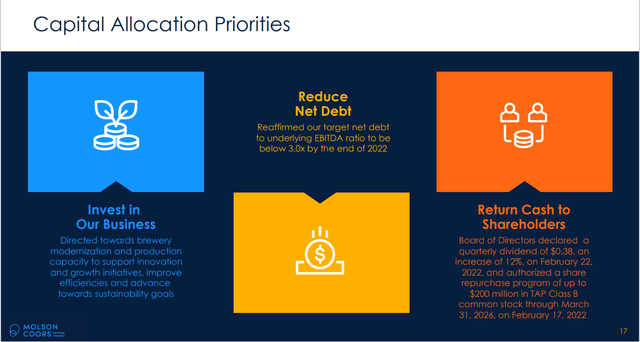

Second, in one of its earnings presentation slides, Molson Coors specifically mentions reducing net debt as a capital allocation priority for 2022. This again demonstrates a focus on balance-sheet health and is music to a bond investor’s ears.

Molson Coors – Fourth Quarter and Fiscal Year 2021 Presentation

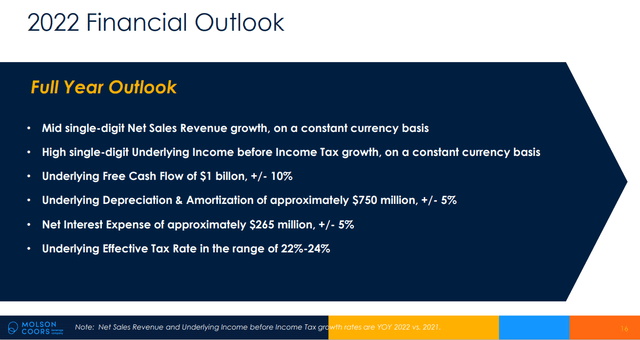

Third, the company is projecting mid-single-digit net sales revenue growth for the current fiscal year. In 2021, Molson Coors had net sales of $10.279 billion, with approximately 82.5% coming from the Americas. At the start of the year, Moody’s 2022 EBIT/interest expense projection for Molson Coors was 4.5x. Growing revenue and manageable interest expense both inspire confidence for bond investors.

Molson Coors – Fourth Quarter and Fiscal Year 2021 Presentation

Molson Coors Bonds

The May 1, 2042 maturing notes, CUSIP 60871RAD2, are rated Baa3/BBB- by Moody’s and S&P, respectively. At the time of this writing, the 2042 notes have a yield-to-maturity of 4.637% and a current yield of 4.78%.

The July 15, 2046 maturing notes, CUSIP 60871RAH3, are rated Baa3/BBB- by Moody’s and S&P, respectively. At the time of this writing, the 2046 notes have a yield-to-maturity of 4.528% and a current yield of 4.41%.

For investors wanting to stay on the front end of the yield curve, the July 15, 2026 maturing notes, CUSIP 60871RAG5, may be more suitable. They are also rated Baa3/BBB- by Moody’s and S&P, respectively, have a yield-to-maturity of 3.047% and a current yield of 3.01%.

Just as with Anheuser-Busch’s bonds, from an opportunity cost perspective, the Fed would have to hike short-term rates really high, really fast to overtake the Molson Coors bonds yielding in the mid-4%s.

From a timing perspective, it is certainly understandable if investors want to wait to see what the Fed’s upcoming meeting holds, as it may give us a window into the FOMC’s desire or hesitancy to hike aggressively this year.

Conclusion

There is ample evidence supporting the fact that the modern Federal Reserve is quick to cut rates and slow to raise rates. This fact has perhaps never been more evident than in recent months, as real interest rates reach negative levels last seen in the mid-to-late 1940s. If I have a choice between investing my portfolio’s bond allocation in short-term securities earnings 0% to 2% or longer-term instruments yielding multiples more, I will choose the longer-term instruments all day long.

Both Anheuser-Busch InBev and Molson Coors bonds have a home in my portfolio, accruing interest each and every day and crushing my cash allocation that, thanks to the Fed, has been earning one basis point for far too long. How long will it be before money markets yield over 4%, bringing cash allocations closer in yield to most of the bonds mentioned in this commentary? I am worried that might never happen again. The longer it takes, the higher the opportunity cost for money left in cash, and the higher money-market yields would have to go to make up the difference.

Keep in mind that bond investors are buying income streams. The price of a bond may rise or fall in the interim, but absent a default, the price always returns to 100 cents-on-the-dollar. Therefore, my focus is on income streams rather than trying to time the top in yields.

Finally, for those investors concerned about market timing and the possibility that an upcoming recession or rate-hike cycle sends yields higher in the near term, there is always the option to do with your bonds what equity investors regularly do with their stocks – average into positions by buying the dip.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment