Justin Sullivan

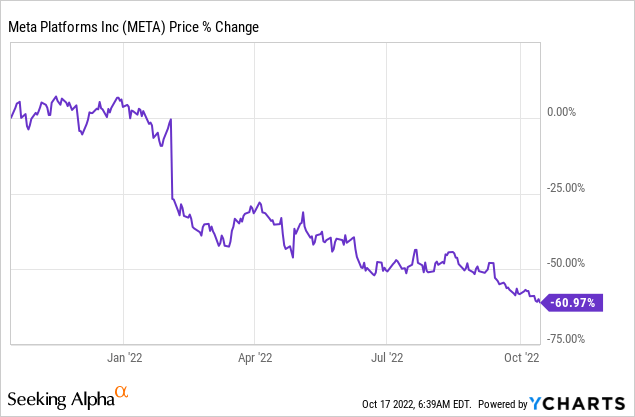

The third-quarter earnings sheet of Meta Platforms (NASDAQ:META) is due on October 26, 2022 and the social media company is likely going to update investors about the slowdown in the digital advertising business. Meta Platforms’ shares also just made a new 1-year low which indicates that investors continue to see headwinds in the digital advertising market and fear TikTok as a formidable challenger. I believe that Meta Platforms’ shares represent deep value here and that, given the low valuation based off of earnings, it will be almost impossible to not make any money on an investment in the social media company in the long run!

Meta Platforms: Low Q3’22 EPS expectations

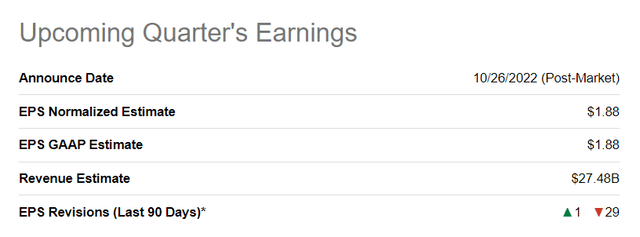

Expectations for Meta Platforms are very, very low heading into the Q3’22 earnings report period and I believe it will work to the benefit of investors that may want to take a chance on the social media company. Meta Platforms will submit its Q3 earnings card in 10 days and earnings expectations are seriously depressed. Low expectations are driven in part by a continual advertising slowdown — due to Apple’s iOS update last year and weaker ad spending in a high-inflation world — which have pushed Meta Platforms’ shares to a new 1-year low last week.

The consensus is for Meta Platforms to report Q3’22 revenues of $27.5B and EPS of $1.88, showing declines of 5% and 42% compared to the year-earlier period. Meta Platforms projected that its third-quarter revenues will fall into a range of $26.0B to 28.5B… which means revenues could drop as much as 10% quarter over quarter. The estimate trend is very negative, too: analysts have down-graded Meta’s Q3’22 EPS estimates 29 times so far.

Seeking Alpha: Meta Platforms’ Q3’22 Estimates

What I am looking for in Meta Platforms’ Q3’22

I believe two metrics will stand out when Meta Platforms reports Q3’22 earnings later this month: (1) Daily active users, and (2) free cash flow.

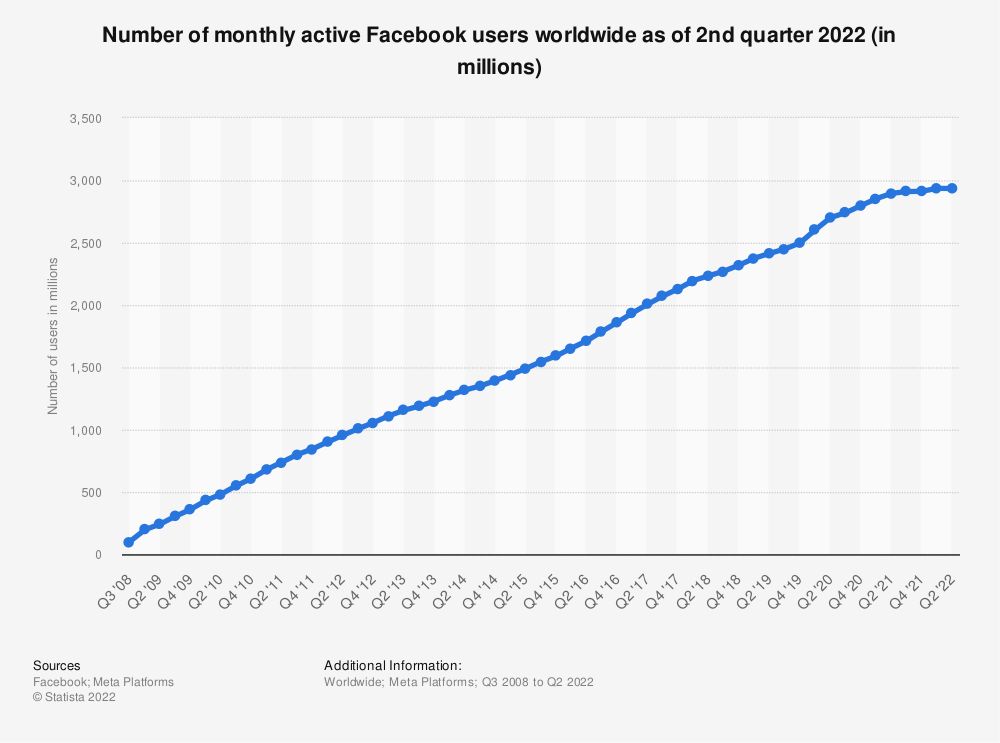

The first factor, daily active users, will attest to the company’s general platform and engagement trends. Meta Platforms had 1,968 million daily active users at the end of second-quarter, showing 3% year over year growth. User growth is slowing, however, as companies like TikTok have been quite successful in luring younger users away from other social media companies. Facebook has launched new products, like Facebook Reels, which try to appeal to a younger demographic. If Meta Platforms sees negative DAU growth in Q3’22 and the growth curve flattens more, shares may revalue further to the down-side.

Source: Statista

The second biggest revelation in Meta’s Q3 earnings sheet will come in the form of free cash flow. Despite the firm’s challenges resulting from a cyclical, post-pandemic down-turn in the digital advertising market and from Apple’s iOS change that dealt a blow to advertisers’ tracking abilities last year, Meta Platforms remains a highly profitable company regarding free cash flow.

Meta Platforms generated $4.5B in free cash flow in Q2’22 which calculates to a free cash flow margin of 15.4%. The average free cash flow margin over the last four quarters, however, was much higher at 29%.

|

in mil $ |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Y/Y Growth |

|

Revenues |

$29,077 |

$29,010 |

$33,671 |

$27,908 |

$28,822 |

-0.9% |

|

Operating Cash Flow |

$13,246 |

$14,091 |

$18,104 |

$14,076 |

$12,197 |

-7.9% |

|

Purchases of Property/Equipment |

($4,612) |

($4,313) |

($5,370) |

($5,315) |

($7,528) |

63.2% |

|

Payments on Finance Leases |

($123) |

($231) |

($172) |

($233) |

($219) |

78.0% |

|

Free Cash Flow |

$8,511 |

$9,547 |

$12,562 |

$8,528 |

$4,450 |

-47.7% |

|

Free Cash Flow Margin |

29.3% |

32.9% |

37.3% |

30.6% |

15.4% |

-47.3% |

(Source: Author)

Meta Platforms has guided for Q3’22 revenues of $26.0B to 28.5B, so a free cash flow margin of 29% would translate to $7.5B to $8.3B in free cash flow. This, of course, may be a bit optimistic since Meta Platforms’ free cash flow margin came under pressure from weak spending in the core advertising business in the last quarter. Assuming that Meta Platforms’ generated a 20% free cash flow margin, which is a much more realistic figure, the social media company and investors could be looking at potential free cash flow of at least $5.2B and up to $5.7B.

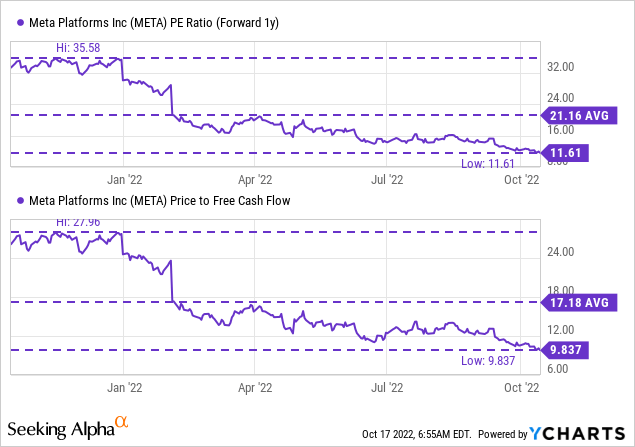

Meta Platforms is a real bargain

Based off of earnings and free cash flow, Meta Platforms’ shares are a tremendous bargain right now. The social media company has a P-E ratio of 11.6 X — assuming $10.91 per-share in earnings in FY 2023 — and a P-FCF ratio of 9.8 X. Both valuation factors are materially below the 1-year average ratios…

Risks with Meta Platforms

The biggest risk for Meta Platforms is the daily active user trend. If Facebook and Instagram users, especially of the younger demographic, abandon Meta Platforms’ social media apps and migrate over TikTok then engagement and monetization are set to suffer… with potentially more serious consequences for revenues, free cash flow and the firm’s valuation factor. What would change my mind about Meta Platforms’ is if the company reported a material drop in free cash flow and margins.

Final thoughts

I believe Meta Platforms’ is a buy heading into earnings: the stock just dropped to its lowest price in a year, the valuation multiple is very attractive (P-FCF ratio below 10 X) and expectations regarding EPS and revenues are depressed, indicating that Meta Platforms’ bar for Q3 is extremely low. A slight EPS beat and a better outlook for Q4 could lead to an upwards revaluation of Meta’s shares. Considering how much free cash flow Meta Platforms’ generates from its various social media platforms and apps, I believe Meta Platforms is so attractively valued that it will be almost impossible for investors to not make money on the stock in the long run!

Be the first to comment