Olemedia

Investment Thesis

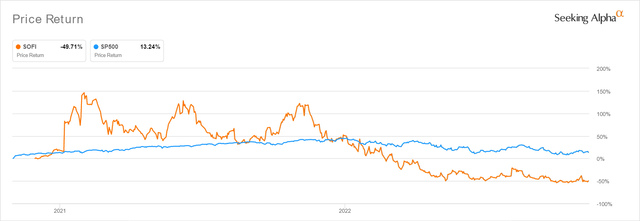

SOFI 2Y Stock Price

SoFi Technologies, Inc. (NASDAQ:SOFI) has been thoroughly decimated with a -79.78% plunge from its peak level of $24.64 in February 2021. The recessionary fears have also worsened, with the S&P 500 Index similarly reporting a -19.14% fall YTD.

However, as witnessed in its latest earnings call, SOFI continues to record impressive growth across the board despite the tougher YoY comparison. Due to the improved operating efficiency and lower cost funding, the company may finally report positive Free Cash Flow (FCF) generation by FY2023 and GAAP net income profitability by FY2024. In addition, the raised forward guidance for FY2022 was exemplary, though unfortunately not enough to lift the stock out of its current rut.

Nonetheless, we are also looking at an interesting pattern, in which the SOFI stock has been trading at sustainable support levels of ~$5 over the past six months. Though the stock may seem over-valued due to its inflated P/E valuations of -49.65x and temporal lack of profitability, we remain convinced that the premium is warranted, due to the strength of its product and membership adds thus far. Once the moratorium ends by the end of 2022 and if student loan origination rises to pre-pandemic levels of over $2B, we may see the company record tremendous adoption and growth by H1’23. This could be impressive, given the tailwind effects of the elevated interest rates.

SOFI would likely ride an enormous wave of optimism as the Feds pivot, speculatively by the December meeting. 80.6% of analysts are already predicting a more moderate 50 points basis hike, similar to the Bank of Canada’s recent easing. All of these positive catalysts may just trigger a long-term stock recovery for the next decade’s portfolio growth and investing, significantly made sweeter by its current rock-bottom levels.

What Does The Moratorium & Federal Block Mean To SoFi?

Naturally, with the ongoing student loan moratorium since 2020, many did not feel the need to refinance their loans. However, all of that will end over the next two months, depending on the result of the legal battle between Biden and the Federal Court. Current interest rates are also elevated, thanks to the raging inflation and the Fed’s delivery of its fourth consecutive 75 basis points hike in November. However, with SOFI’s highly attractive fixed-rate 3.74% APR against the average minimum of 4.59% or 4.99% from other banks, it is easy to see why the former’s offering would be more popular by the start of 2023. Therefore, we concur with SOFI’s management that student loan refinancing will likely double by H1’23.

Even with Biden’s $10K forgiveness plan, SOFI’s average student loan balance is still elevated at $47K by FQ3’22, with a weighted average income of $170K and a FICO score of 773. As a result, we do not expect to see much impact on its core business since it only applies to those below $125K of annual income. However, with the plan thrown in disarray with the Federal Court’s block, SOFI may have to contend with another short-term moratorium through Q1’23. On the other hand, we are slightly more optimistic and expect things to be swiftly resolved by the end of 2022, given the ongoing mid-term election. Either way, these loans will need to be repaid eventually and, most likely, refinanced as American households enter a challenging winter accompanied by rising inflationary pressures.

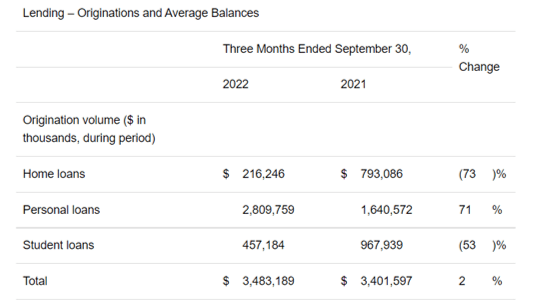

SOFI Lending Segment By FQ3’22

Seeking Alpha

These refinancing volumes will return by early 2023 and massively enrich SOFI’s lending segment. By FQ3’22, the company reported only $457M in student loan origination, representing a minimal 13.1% of its total lending volume. While the segment has previously made up 36.39% of its volume back in FQ3’20 at $1.03B, it is evident that SOFI has strategically expanded its product offerings by now, thanks to its robust R&D efforts thus far. Adding $2B in student loan origination speculatively by H1’23 would push SOFI’s lending volume to beyond $4B, further improving its profitability due to the segment’s impressive 60.8% contribution margin.

In the meantime, SOFI’s bank deposits continue to grow aggressively to $5B, with an excellent $2.3B or 86% increase reported in FQ3’22. The segment alone reports an impressive GAAP net income of $28M with an 11% of profit margin. Membership continues to grow remarkably to 4.7M by 61% YoY, while new products rose to nearly 7.2M by 69% YoY. It is apparent that SOFI’s highly competent management has delivered stellar results from its strategic diversification plan. Thereby, further fortifying its relevance and liquidity ahead no matter the impact of the macroeconomics and political issues. Profitability should come soon enough. Patience for now.

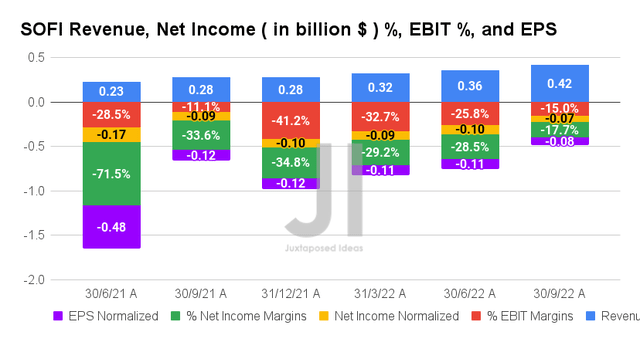

SOFI’s Forward Execution Remains Beautifully Intact

By FQ3’22, SOFI continues to report excellent revenues of $0.42B, indicating an increase of 16.66% QoQ and 150% YoY. Its profit margins also expanded tremendously over the past few quarters, to EBIT margins of -15% and net income margins of -17.7% against FQ4’21 levels of -41.2% and -34.8%. Thereby, explaining the improvement of its adj. EPS to -$0.08 by the latest quarter, compared to -$0.11 in FQ2’22 and -$0.12 in FQ3’21.

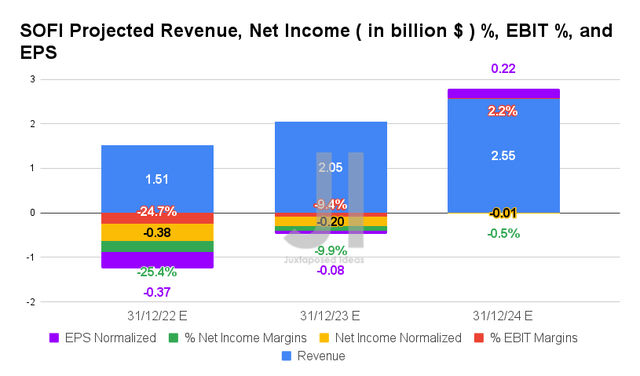

Despite the -66.96% YTD destruction in stock prices, it is evident that Mr. Market is still cautiously confident about SOFI’s forward execution. This optimism is visible in the nominal top-line downgrades of -4.2% for FY2023 revenues, since our first analysis in April 2022. Otherwise, only by -1.34% since August’s analysis, despite the impending recession and the Fed’s aggressive rate hikes through 2023.

In addition, SOFI’s revenue growth remains excellent through FY2024, at a CAGR of 36.1% against hyper-pandemic levels of 48.59%. The company is expected to report profitability from FY2024 onwards as well, with projected GAAP EPS of $0.02 or adj. EPS of $0.22.

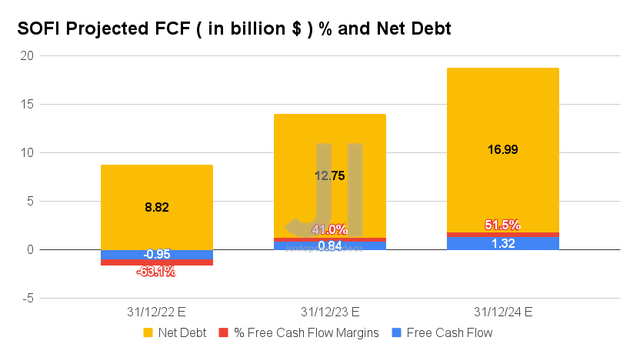

Furthermore, SOFI may achieve positive cash flow over the next few quarters, generating $0.84B of FCF by FY2023 and $1.32B by FY2024. The improvement in its profitability is astounding too, from EBIT/ net income/ FCF margins of -45.1%/-34.6%/-138.8% in FY2021 to 2.2%/-0.5%/51.5% by FY2024. Though the utilization of debts is also expected to expand at the same time, we are not overly concerned, since most of it will be attributed to its Credit Facilities. Thereby, further emphasizing the growth of SOFI’s product adds and memberships over the next three years. Impressive, despite the perceived destruction of demand due to the temporal student moratorium through 2022 and recession through 2023.

We’d like to encourage you to read our last article on SOFI, which would help you better understand its position and market opportunities.

- SoFi: Doubling Down On Our Bullish Buy Rating – Proving The Bears Wrong

- SoFi: The Perfect Storm For Speculative Portfolios

So, Is SOFI Stock A Buy, Sell, or Hold?

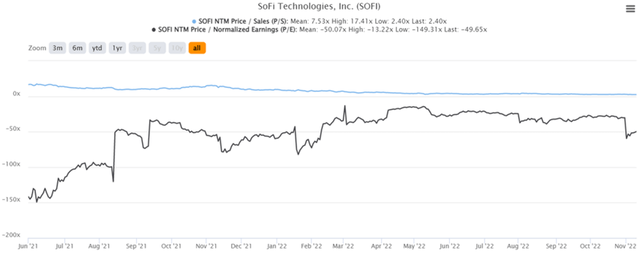

SOFI 2Y EV/Revenue and P/E Valuations

SOFI is currently trading at an EV/NTM Revenue of 2.40x and NTM P/E of -49.65x, lower than its 2Y EV/Revenue mean of 7.53x though similarly inflated with its 2Y P/E mean of -50.07x. The stock is also trading at $4.98, down -79.79% from its 52 weeks high of $24.65, nearing its 52 weeks low of $4.77. Nonetheless, consensus estimates remain bullish about SOFI’s prospects, due to their price target of $7.50 and a 44.79% upside from current prices.

In the meantime, depending on Mr. Market’s reaction to the upbeat October CPI reports, we may see another round of short-term volatility ahead. However, we are a little more optimistic, since any headwind would be temporary at best. Hold on to this gem through the roughest of storms ahead, since no pain will likely last forever.

Be the first to comment