JHVEPhoto/iStock Editorial via Getty Images

Intel (NASDAQ:INTC) is going to submit its earnings sheet for the third-quarter very soon — the release date is scheduled for October 27, 2022 — and the chip maker could be headed, I believe, for another disaster earnings report. This is because the PC market weakened considerably during the third-quarter, potentially requiring Intel to once again lower its guidance for FY 2022. Since consulting firm Gartner reported a steep drop in PC shipments in the third-quarter and AMD issued a profit warning as well, operating conditions for Intel’s Client Computing Group clearly deteriorated in Q3’22 which sets Intel up for disastrous earnings release later this month!

Gartner PC shipment report and AMD’s pre-release are red flags

Intel is not having a good time right now: the chip maker drastically lowered its revenue and EPS outlook for FY 2022 due to a slowdown in the company’s Client Computing Group which is the most important business segment for Intel. In Q2’22, Intel down-graded its revenue forecast for FY 2022 by a massive $8-11B due chiefly to a decelerating PC market and weaker product demand. Based off of Intel’s last guidance in Q2’22, the company expects FY 2022 revenues of $65-68B, but given most recent shipment data for the PC market, I believe Intel may be forced to further cut its top line outlook for the current fiscal year.

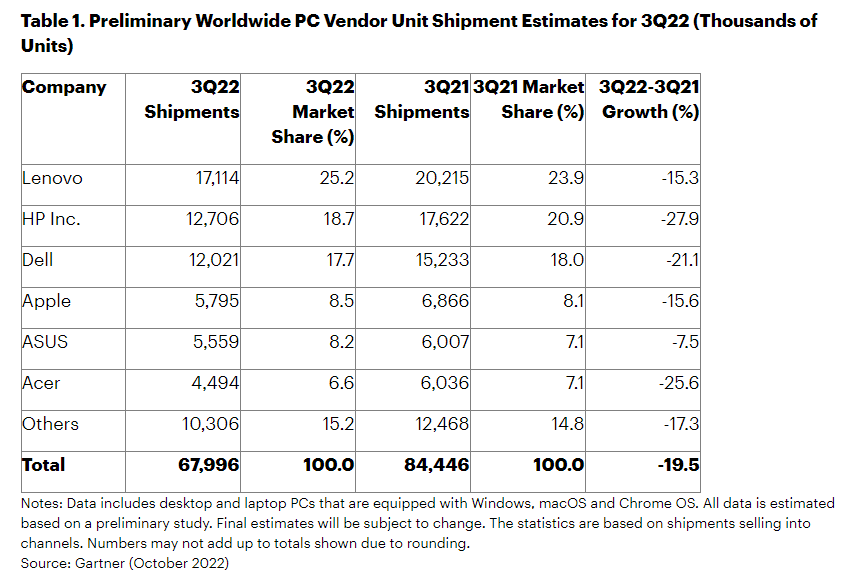

Gartner, a consulting firm, recently reported a 19.5% decline in third-quarter worldwide PC shipments, with all major vendors seeing a significant drop in shipments. Gartner’s research revealed the steepest drop in PC shipment volume since the 1990s which is when the company began tracking such data. The deceleration of growth in the PC market indicates big trouble for Intel’s Client Computing Group which sells the chip maker’s processors and other PC components. The Client Computing Group generates about half of the company’s revenues. In the second-quarter, also according to Gartner, worldwide PC shipments declined 12.6% year over year, so the decline in the PC market actually gained significant momentum in the third-quarter.

Gartner: Q3’22 Global PC Shipments

Related to the massive decline in PC shipments in the third-quarter, AMD also issued a profit warning that showed a sharp down-turn in its Client business. AMD’s Client segment generates revenues from the sale of Ryzen desktop and laptop processors.

Intel may not be able to meet low EPS expectations

Intel and AMD are both dependent on the number of PC and laptop shipments, so the accelerating down-turn in the third-quarter is set to be a big problem for Intel… especially because Intel’s CEO said in Q2’22 that the third-quarter would be the “bottom”. Since the market’s down-turn accelerated in Q3’22, I am not sure Intel’s CEO will still be able to defend this statement later this month.

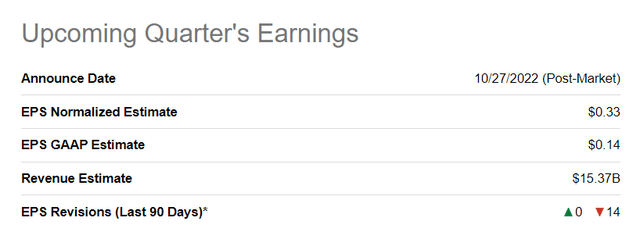

As a result, I believe Intel’s third-quarter performance could even under-perform low EPS expectations. For Q3’22, expectations are for Intel to report revenue of $15.37B and EPS of $0.14, indicating year over year declines of 15% and 92%.

Seeking Alpha: Intel Q3’22 Estimates

EPS risks and Intel’s valuation

The consensus already is that the third-quarter wasn’t a good one for Intel. In the last 90 days, Intel’s revenue and EPS estimates for FY 2022 have dropped significantly, with EPS down-ward revisions outnumbering up-ward revisions by 34:0. Intel has guided for FY 2022 EPS of $2.30 and cut its forecast by 36% in Q2’22.

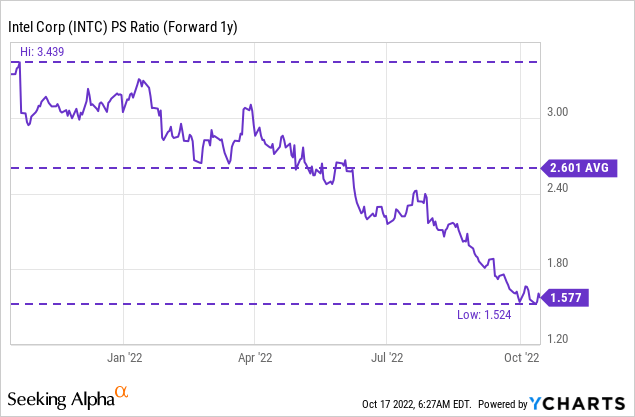

Intel’s valuation factor has declined materially this year as evidence of a broader PC market decline emerged in the second-quarter. Currently, shares of Intel trade at a P-S ratio of 1.6 X. Although the P-S ratio is much lower than at the start of the year and about 40% below the 1-year average, I believe the risks are still very high heading into the Q3 earnings report.

Risks with Intel

The biggest risk for Intel is a continual slowdown in the CCG business and, related to this, a sequential cut to the company’s FY 2022 guidance. Besides these two big risk factors, investors must brace themselves for a decline in gross margins in the third-quarter as well as weaker volume shipments likely affected product pricing in a big (and negative) way.

Final thoughts

Given the developments in the PC market, Intel’s Q3’22 earnings sheet could be yet another catalyst for a downward revaluation. Intel’s share price plunged after the company cut its full-year guidance last quarter and with the newest Gartner report indicating that the down-turn in the PC market accelerated in Q3’22, the chip maker’s shares are very vulnerable. Although expectations are already very low, Intel’s upcoming earnings report on October 27, 2022 is likely going to be a disaster for investors. For those reasons, I believe the risk profile remains heavily skewed to the down-side, especially if Intel were to cut its outlook for FY 2022 a second time!

Be the first to comment