onlyyouqj/iStock via Getty Images

Investment thesis

Schnitzer Steel Industries (NASDAQ:SCHN) is a company with more than 100 years of experience behind it. After a decade characterized by weakening sales due to the need of deleveraging the balance sheet, the management has returned to the fray with two major acquisitions and a huge increase in CapEX in order to achieve technological improvements in its facilities and thus improve the profitability of operations.

Currently, the price of ferrous and nonferrous metals seems to have already peaked and has started to show signs of a trend change downwards as fears of an economic cycle change emerge worldwide. Still, the company has managed to generate strong cash from operations in the last decade and cover its dividend and interest expenses very comfortably. Moreover, last quarter’s profit margins were high compared to recent quarters and years, and sales have increased very significantly since the start of the pandemic thanks to the acquisitions carried out recently. Therefore, I believe that the current cash from operations of almost $200 million per year is enough to absorb the potential headwinds that could emerge from the cycle change as interest expenses represent only ~5% of the total cash generated while margins have remained positive almost consistently for a decade.

A brief overview of the company

Schnitzer Steel Industries is one of the largest North American recyclers of ferrous and nonferrous metal, including end-of-life vehicles, and a manufacturer of finished steel products. The company’s operations network includes 50 retail self-service auto parts stores, over 50 metals recycling facilities, and an electric arc furnace steel mill. In this sense, the company buys, processes, and recycles used rail cars, home appliances, industrial machinery, manufacturing scrap, and construction and demolition scrap through its facilities and sells ferrous and nonferrous metals globally to steel mills, foundries, refineries, smelters, wholesalers, and other recycled metal processors. As for finished parts, the company sells its products to service centers, construction industry subcontractors, steel fabricators, wire drawers, and major farm and wood products suppliers.

It also owns Pick-n-Pull, a retail self-service auto parts retailer for used but serviceable auto parts, located in the United States and Western Canada. The company was founded in 1906, and its market cap currently stands at ~$780 million, employing over 3,000 workers.

Schnitzer Steel Industries (Schnitzer Steel)

Schnitzer Steel exports its products to different countries located in Asia, the Mediterranean region, and the whole of America. For long-term investors, a strong incentive for holding Schnitzer Steel shares is that it is a company that operates in an industry that favors efforts of global warming and resource depletion mitigation, which is a trend that is poised to become more important over the years. But on the other hand, it is very important to keep in mind that the price is very susceptible to changes because it is a company of a very cyclical nature, and therefore, the risk of the investment will increase as the price of shares increases.

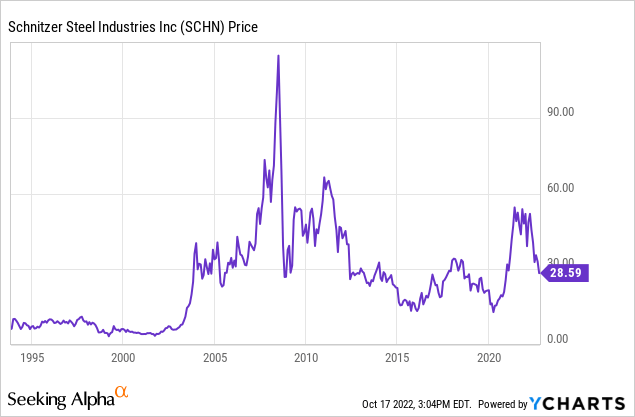

Currently, shares are trading at $28.59, which represents a 58.49% decline from the highs of $68.87 reached in 2010 and a 52.11% decline from the highest 52-week price of $59.70 reached in April 2022. Still, the stock traded in the $11 range at the beginning of 2016 and during the worst days of the coronavirus pandemic crisis back in March 2020, which means that the current pessimism reflected in the share price has been higher twice during the last decade. Therefore, I believe that a very careful approach is needed when investing in Schnitzer Steel by buying in stages in order to buy more shares as the price continues to fall.

Recent acquisitions will boost future sales and introduced the company into a new deleveraging phase

After a decade of reducing its debt load, the company expanded its operations again in 2021 and 2022 in order to return to the growth path as revenue needed a new boost after a decade of declines.

In August 2021, the company acquired eight operating facilities located across several states in the southeast, including Mississippi, Tennessee, and Kentucky, from Columbus Recycling, for ~$107 million.

One year later, in May 2022, the company acquired the operating assets of Encore Recycling LLC in the greater Atlanta Metro area, which is composed of two full-service recycling facilities, a metal shredding operation, and a recycled auto-parts center, for ~$63 million. This represents the first metal shredding operation in the southeast for Schnitzer Steel, which broadens the scope of its operations. The Encore facilities recycle around 90,000 ferrous tons, 14 million non-ferrous pounds, and 20,000 end-of-life vehicles per year.

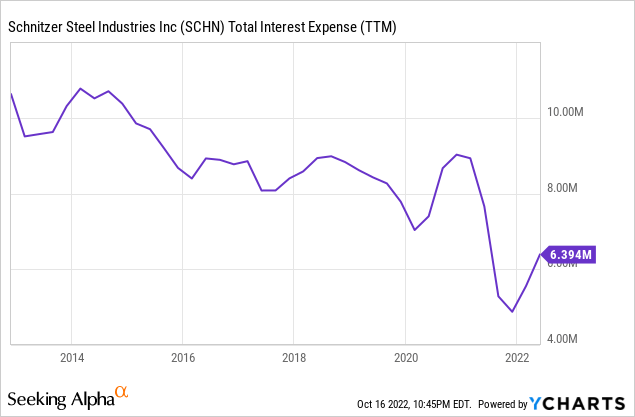

As a consequence of both acquisitions, the company has increased its debt load. This means that despite the expansion that these represent for the company’s operations, it will be necessary to reduce the debt level with the company’s profits in the coming years in order to absorb the potential of said expansions. Nevertheless, the company still has room for more acquisitions as interest expenses are still very low compared to cash from operations.

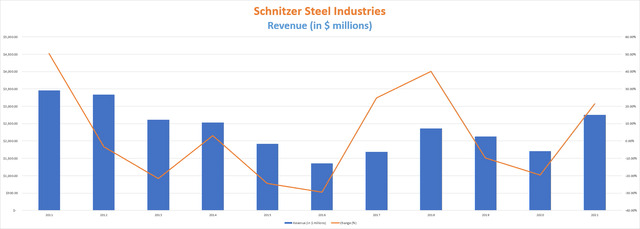

Net sales have returned to the growing path

After a few years of declining sales, they finally increased by 61.10% in fiscal 2021 to $2.76 billion. Since then, the company posted an increase of 62.18% year over year during the first quarter of fiscal 2022, 30.51% during the second quarter, and 23.07% during the third quarter. All these increases were boosted by the acquisition of the eight manufacturing facilities from Columbus Recycling apart from volume increases, and the acquisition of Encore Recycling will be reflected in the coming quarters. This has boosted the current trailing twelve months’ revenue to $3.44 billion, and estimates for the full fiscal 2022 stand at $3.40 billion. For fiscal 2023, however, revenue is expected to fall by 14% compared to fiscal 2022 to $2.93 billion as metal prices are not expected to remain at the same levels, but it is still significantly higher than the $2.76 billion reached in fiscal 2021.

Schnitzer Steel Industries net sales (10-K filings)

During the third quarter of fiscal 2022, volumes increased by 37% on non-ferrous products and 27% on finished steel products, sequentially. Demand for long products keeps rising and their price is at record highs as construction spending is showing strength. As for ferrous and non-ferrous pricing, prices reached $650 per ton at the beginning of the third quarter, which represents historically high levels, but the quarter ended with lower prices at $450 to $500 per ton due to lockdowns in China, lower demand in Turkey, low-cost Russian billets, and high scrap flows. Furthermore, recessionary fears could have a significant impact on prices in the short to medium term. Nevertheless, copper and aluminum scrap prices started the fourth quarter at high levels.

Apart from economic growth, the main drivers of growth in the industry are increasing environmental policies in order to preserve the environment and lower greenhouse gas emission goals. These two factors should contribute to promoting recycled metals over mining them from natural resources. That’s why the scrap metal recycling market is expected to grow at a CAGR of 5.4% in the United States from 2022 to 2033, and by 5.5% globally by 2031.

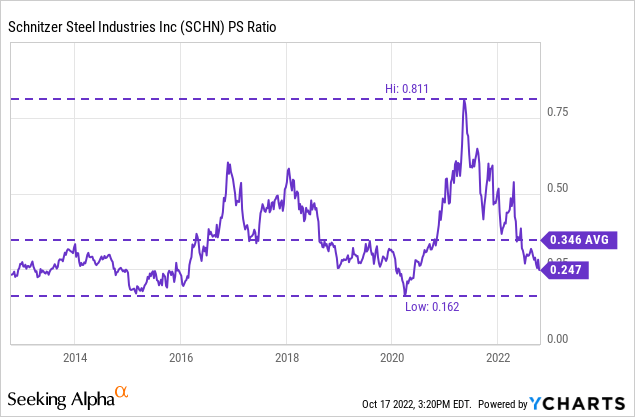

The current price decline despite revenue growth has caused a steep decline in the price-to-sales ratio, which currently stands at 0.247. This means that the company generates $4.05 of revenue for each dollar held in shares by investors, annually. This ratio is significantly lower than the average of 0.346 for the past decade, which means investors are less willing to pay for the company’s sales, but pessimism reached worse levels in the pandemic when the PS ratio reached 0.162, and we must take into account that sales are expected to fall in the coming quarters.

The company exports over 60% of its ferrous product volumes to countries located in Asia, the Mediterranean, and America (north, central, and south), and also over 60% of nonferrous metals, mostly (69% of revenues from nonferrous exports) to India, Malaysia, and China. Finally, finished steel products are mostly sold to locations in the Western United States and Western Canada.

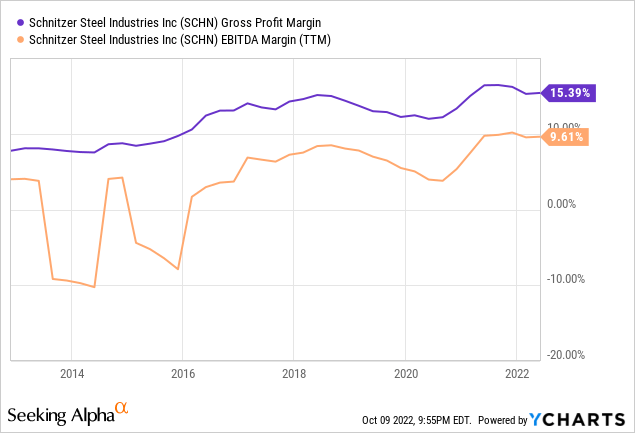

Margins are very acceptable and the company is profitable

The company has achieved positive gross profit and EBITDA margins for almost the entire last decade, and currently, these are at an acceptable level with a trailing twelve months’ gross profit margin of 15.39% and EBITDA margin of 9.61%. Nevertheless, the gross profit margin increased to 17.40% during the last quarter and the EBITDA margin to 11.54% due to stronger market conditions, increased volumes, and the acquisition of Columbus Recycling. That is despite headwinds related to increased labor, energy, logistics, and waste disposal costs.

The company achieved earnings per share of $2.59 during the past quarter, which represents a 17.73% increase year over year and an 87.68% increase compared to the prior quarter. In part, this has been possible thanks to an increase in demand for recycled metals due to the increase in the price of ferrous, non-ferrous, and finished steel products.

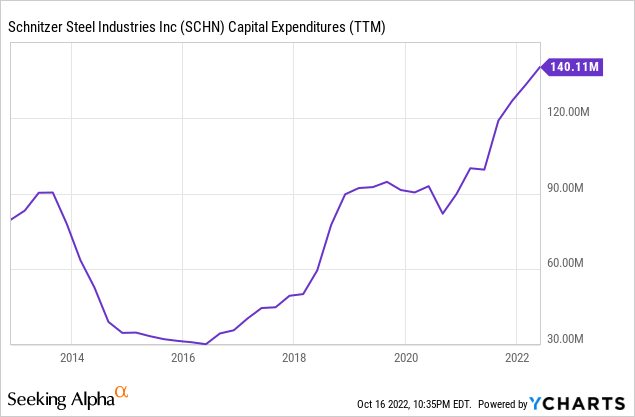

The company has two main plans to keep margins healthy in the long term. First, it is in the process of making technology investments to improve current metal recovery systems in order to extract more nonferrous metals, including copper and aluminum, from shredding activities, and some of these technological projects are near complete. And second, the company plans to keep looking for efficiencies in processing, procurement, and pricing in order to reduce inflationary uncertainties. Nevertheless, these improvements will require around $5 million in capital expenditures in the fourth quarter of fiscal 2022 and $50 million more in 2023, as stated in the third quarter’s earnings call of fiscal 2022.

A new deleveraging phase begins

The company has successfully reduced its debt load over the last decade thanks to a very low cash payout ratio, which demonstrates its ability to generate profitability through its operations. In this sense, the management prefers to pay down the debt pile instead of increasing the dividend.

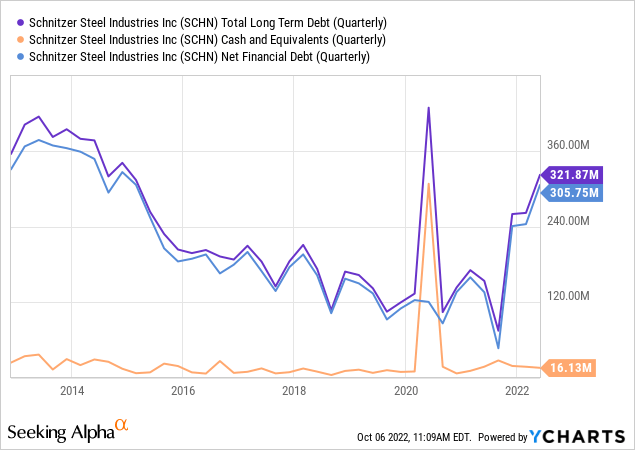

In the last decade, long-term debt declined from $373 million in fiscal 2013 to $71 million in fiscal 2021, before increasing again to over $300 million in the last quarter as the company acquired made new acquisitions. Also, the company has aggressively increased capital expenditures to $140 million in the past 12 months in order to carry out technological improvement projects and make investments in spot volume growth. Post-acquisition activities are also producing a significant increase in the current capital expenditures.

In short, we can say that the company is currently spending huge amounts of cash to grow, although these aggressive investments should decrease over time once the technological improvement projects are completed and the investments related to the recent acquisitions are no longer needed. This will be necessary if the company wants to pay off its debt relatively quickly since the cash balance is very tight after dealing with CAPEX, dividends, and interest expenses.

And in relation to the interest expenses, the company managed to cut them by half during the last decade, although these are rising again due to the new debt contracted. Currently, the trailing twelve months’ interest expense stands at $6.39 million, but considering the last quarter’s interest expenses were $2.22 million, we can expect an expense of ~$9 million per year from now on.

The dividend is very safe as the cash payout ratio is very low

The company has paid dividends for 113 consecutive quarters, but the dividend is frozen at $0.75 per year since 2013 as the management prefers to use the resources to pay down debt and expand operations.

Below is a table with the dividend cash payout ratio. To calculate it, I have used the cash from operations as a base and I have calculated what percentage of said cash has been used each year for the payment of the dividend and the coverage of the interest on the debt. In this way, we can see the company’s ability to cover the dividend through actual operations.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $39.29 | $141.25 | $144.63 | $99.24 | $100.37 | $159.68 | $144.74 | $124.60 | $190.06 |

| Dividends paid (in millions) | $20.01 | $20.13 | $20.34 | $20.44 | $20.40 | $20.74 | $20.62 | $20.88 | $21.26 |

| Interest expenses (in millions) | $9.62 | $10.60 | $9.19 | $8.89 | $8.08 | $8.98 | $8.27 | $8.67 | $5.29 |

| Cash payout ratio | 75.42% | 21.75% | 20.42% | 29.56% | 28.37% | 18.61% | 19.95% | 23.72% | 13.97% |

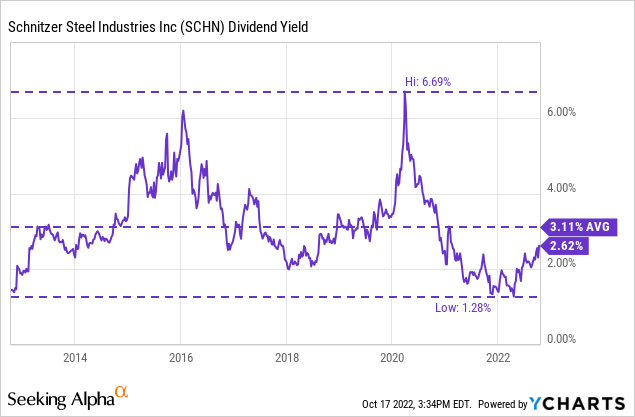

The conclusion is that the company uses cash from operations very conservatively since the cash payout ratio is very low. This enables the preservation of good health in the company’s balance sheet through lower debt and high capital expenditures. Such a low cash payout ratio does not mean that the dividend is too low as the company currently pays 2.62% per year due to the current share price decline while it was below 2% during the first half of 2022.

But if we compare the current dividend yield with the average of the past decade, it is actually ~16% lower, and ~61% lower than the all-time high of 6.69% reached in March 2020 and the ~6% reached at the beginning of 2016.

The difference is that the company’s ability to increase the dividend has increased compared to recent years as the company’s trailing twelve months’ cash from operations increased to $197.5 million during the past quarter, boosted by the recent acquisitions. For this reason, I believe the current dividend yield of 2.62% is very generous. After all, the cash payout ratio is enormously low as the company only needs slightly over 10% of cash from operations to cover it, and slightly over 15% to cover both the dividend payment and interest expenses. Therefore, in my opinion, 2.62% seems to be a reasonable dividend yield on cost despite the headwinds expected in the short and medium term.

Risks worth mentioning

One of the biggest risks that I think is important to consider before investing in Schnitzer Steel is the cyclical nature of the company since it represents a permanent risk in operations. It is important to be aware that Schnitzer Steel is a company with a highly cyclical nature, which makes it very susceptible to periods of high volatility over the years. Therefore, once we believe that the share price is attractive, it is important to consider keeping one or more bullets in case the price continues to fall because in this way will be able to acquire more shares at even more attractive prices, thus partially reducing potential risks related to price volatility.

It is also important to bear in mind that we are facing a time of great economic uncertainty. There are many voices suggesting that a sizeable recession could be just around the corner in the world’s economy, and metal feedstock prices are showing a declining trend that still has a wide margin to continue, for which the share price has fallen in anticipation of weaker operations. Fortunately, Schnitzer Steel has a robust enough balance sheet to mitigate a very significant impact on its operations, but the truth is that if the current global economic and industry landscape worsens more than expected, the share price could eventually continue to fall.

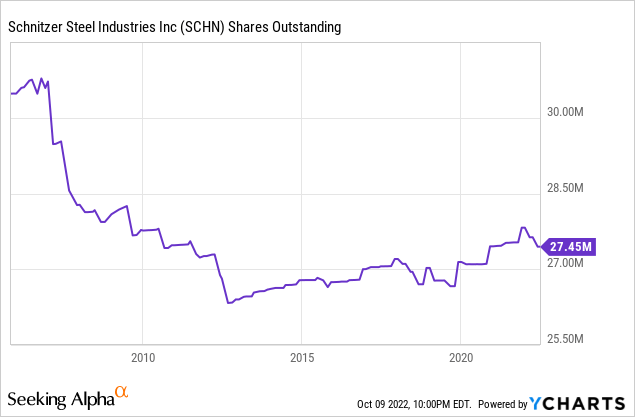

Also, one risk that should be continuously monitored by investors is share dilution. In this sense, the number of shares outstanding increased by 4.2% since fiscal 2012 to 27.45 million after a period of strong share repurchases.

In this sense, the company has historically been a stock buybacker, but high capital investments and strong efforts to deleverage the balance sheet have prevented further reductions in the number of outstanding shares in the past few years. Nevertheless, the company repurchased almost 1% of the number of shares outstanding during the last quarter. From now on, higher revenues and cash from operations should allow for further share repurchases in the future, but the management could again prioritize paying off debt as it did in the past, letting thus share dilution continue.

Conclusion

Schnitzer Steel’s situation is not as bad as it might seem when considering that the share price has fallen by ~52% from the recent highs reached in April 2022. In reality, the current price drop seems to be due to the fact that the drop in the prices of ferrous and nonferrous metals will follow a downward trend in the short and medium term. Although this is in my opinion very likely, the company has a strong balance sheet that is ready to take the hit.

We must not forget that Schnitzer Steel systematically enjoys good profit margins, generates large amounts of cash from operations, and its cash payout ratio is very low despite a ~2.6% dividend yield on cost. Of course, despite the fact that the dividend payment is not a high expense, do not expect increases in the dividend as they have been frozen since 2013 and the management has always preferred to reduce the debt rather than increase the dividend. Nevertheless, the current debt level is not a problem as interest expenses can be paid very easily. For this reason, I think now is a good time to add Schnitzer Steel to your radar and consider buying shares as the price declines.

Be the first to comment