Justin Sullivan

Thesis

Meta Platforms (NASDAQ:META) stock is trading – in my opinion – at a ridiculously cheap valuation. And despite a successful Developer Connect Event, that highlighted outstanding R&D capabilities in VR/AR, investor sentiment remains depressed.

All eyes are now on Meta’s Q3 results, which are expected on October 26 (post-market). Buy-side expectations are very low, given a presumably sharp drop in digital advertising spending. I feel investors are now pricing as much as a 20% revenue contraction for 2022 versus 2021 (ahead of sell-side consensus). But is the environment really that bad? In this article, you should get the information you need to know.

For reference, Meta stock has underperformed the S&P 500 (SPX) year to date, being down 61.6% versus 22.7% respectively.

Earnings Preview

According to data compiled by Seeking Alpha, as of October 20th, 37 analysts have submitted their estimates for Meta’s Q3 results. Total sales are expected to be between $25.48 billion and $28.49 billion, with the average estimate being $27.48 billion (versus Meta’s guidance range of $26-28.5 billion). If an investor would assume the average as the anchor, Meta’s Q3 sales are estimated to contract by about 5.3% as compared to the same quarter in 2021. EPS estimates are between $1.22 and $2.41. The average is $1.88, which would imply a year-over-year growth of negative 41.77%.

Three Key Observations

I would like to highlight three key observations:

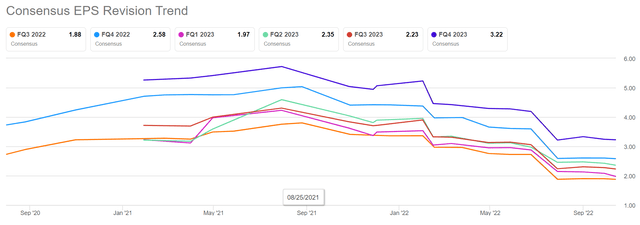

First, there is a significant dispersion in both revenue and EPS expectations for Meta’s Q3 quarter. Revenues could fall between a $3 billion range, and EPS between a range of $1.19/share respectively. The takeaway: uncertainty is very high.

Second, earnings expectations for Meta’s Q3 have slumped since late 2021. In fact, less than a year ago, analysts believed that Meta would generate close to $4/share in Q3. Now the same analysts believe that less than $2/share is more reasonable.

Third, analysts now discount a material year over year EPS contraction for Q3 (-41.77%).

Are Expectations Reasonable?

Although I acknowledge that Meta’s outlook has been clouded by increasing competition, paired with a cooling digital advertising market, I simply cannot believe that Meta’s business environment has deteriorated as sharply as analysts expect. And given the excess negativity, I argue it should not take much positivity to deliver upside surprise.

Investors should consider that in Q2 2022, Meta’s advertising revenue was still growing by about 3% quarter over quarter – and the June quarter was already pressured by a slowing global economy as well as FX headwinds.

Moreover, I would like to highlight the unreasonably low EPS expectations. In Q2 2022, Meta delivered earnings of $2.47/share. What will cause a drop to $1.88/share as estimated by consensus? I struggle to make an argument for it. In fact, I believe Meta has focused on stronger operating discipline in Q3 versus in Q2 – as indicated by the hiring freeze, restructuring, and various budget cuts for non-high-value projects. Moreover, given an asset-light business model with little exposure to raw-material cost inflation, I do not see that Meta’s profitability has been pressured excessively by inflationary trends at this point in time (wage inflation usually lags other cost inflation trends).

So, the question if Meta’s earnings dropped sharply in Q3 will be dependent on the topline — or in other words, the global market for digital advertising.

Is Digital Advertising Really That Bad?

Already in Q2, we have learned that the market for digital advertising is slowing. But still, in the same quarter, META delivered a 3% quarter over quarter topline expansion. Google delivered a similar quarter-over-quarter growth.

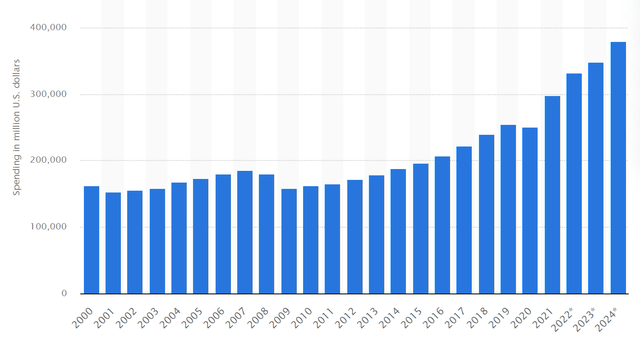

Moreover, investors should consider that a slowing macro-environment for digital advertising is actually much less severe than the media buzz implies. If, for reference, investors would like to consider a 2008/2009 type recession, then the 41.7% year over year EPS contraction for should be nothing but ridiculous. In 2008/2009 ad spending in the US ‘only’ decreased by about 10%. And in early 2000, after the dot-com bubble broke, the market contracted by less than 7%.

I would also like to point out that Meta will – in my opinion – be less affected by digital ad budget cuts than, for example, news outlets, and low-ROI ad platforms such as Twitter (TWTR), Snapchat (SNAP) and Pinterest (PINS).

Other (Upside) Considerations

Besides revenue and EPS considerations, Meta Platforms may have other opportunities to positively surprise the market. I see two major potential surprises: Better than expected consumer traction with regard to Reality Labs, and/or the announcement of even more aggressive share buybacks.

Reality Labs

On October 11th, Meta celebrated its annual Developer Connect event, which delivered exciting updates with regard to the company’s metaverse ambition. Amongst others, Zuckerberg presented the new Oculus Quest Pro, which costs about $1,500 and is already live for pre-order. Analysts will be interested to know how sales for the Quest Pro progress. If Meta says that pre-orders exceed expectations, META stock will likely rally (because investors start to think that Zuckerberg’s Reality Labs ambition could have value after all).

More Buybacks

In my opinion, more buybacks from Meta could be reasonable. As of June 30th, Meta still had $23.8 billion of net cash on the balance sheet, with quarterly cash from operations equal to $12.2 billion.

If Meta would like to be really aggressive, and take advantage of the depressed stock price, the company could easily aim for a 10% – 15% annual buyback yield.

For reference, during Q2 2022, Meta repurchased $6.2 billion of stock, which implies an annualized yield of about 7%.

Risks To Q3 Earnings

Betting on earnings is risky — even for the FAANGS. Remember the 30% sell-off for Netflix (NFLX), twice and the 30% sell-off for Meta Platforms. No matter how well-researched a company’s quarterly performance is, there always remains some uncertainty. And this uncertainty is risk. Note, for example, how analysts estimate disperse, from $25.48 billion and $28.49 billion.

That said, investors should also consider that the risk may not be in the past Q3 quarter, but in the upcoming Q4 2022 and Q1 2023 quarters, which could preliminarily disappoint due to a weak guidance.

Conclusion

I simply love the risk/reward of owning Meta stock going into Q3 earnings, as I believe the market has excessively discounted any potential earnings headwinds — and EPS expectations are just ridiculously bearish in my opinion. Moreover, Meta stock is trading at a valuation level that is simply too attractive to ignore.

Concluding, I believe Meta Platforms will beat expectations by a wide margin (my personal opinion). And given the excessively bearish sentiment, I believe the stock could experience a rapid share price appreciation.

All that said, going into earnings, I am increasing my exposure to META stock and buying time-sensitive call options as a short-term play. Investors may want to look at the 105/115 %-moneyness call spreads with November 4 expiration. If Meta stock would close at the 115 %-moneyness strike ($150/share), traders may enjoy a more than 4:1 payoff.

Be the first to comment