franckreporter/E+ via Getty Images

In 2020, I published a series of utility articles covering what I considered to be the best utilities for long-term investors. Included in the five companies was a review of mid-cap Alliant Energy (NASDAQ:LNT), with the caveat that the preferred shares of subsidiary Interstate Power & Light, Series D [IPLDP] looked a bit more attractive. Series D was called at par in Dec. 2021. I continue to believe LNT remains one of the best utility investments and is very worthy of inclusion in an income portfolio when the market finds its bottom.

Alliant Energy has outperformed the S&P Utility ETF (XLU) for annual total returns, dividends reinvested, over the 10-yr (11.4% for LNT vs. 9.1% for XLU) and 7-yr (11.1% vs. 9.5%) timeframes, according to dividendchannel.com. However, LNT has generated less than or equal to sector average total returns over 2-yr (-0.7% vs. 3.9%), 3-yr (1.4% vs. 3.5%), and 5-yr (7.4% vs. 7.3%) periods. Can LNT reclaim its long-term outperformance? I believe it can.

Alliant Energy is the regulated electric and natural gas utility serving large swaths of Wisconsin and Iowa and provides 1.4 million customer hookups, just under 1.0 million for electric and 420K for natural gas. LNT operates as Interstate Power & Light [IPL] in Iowa and Wisconsin Power and Light [WPL] in Wisconsin. As of 12/21, 85% of IPL revenues were from its electric business and 13% were from its natural gas segment (2% other). For WPL, the split was 87% of revenues were from electric and 13% were natural gas. From a customer count basis, the two states are about evenly matched with about 500K electric and 210K natural gas in each state. Alliant also owns a 16% interest in American Transmission Co. Of the electricity it sells, 32% is generated from coal, 32% from natural gas, 16% from wind, and LNT purchases an additional 19% from third parties.

There are multiple reasons Alliant Energy could be poised to regain its outperformance. The most important reason is the geography it covers and the regulatory environment of its service territory. 99% of LNT’s business is in the states of Wisconsin and Iowa, with 1% in Minnesota. Regulatory Research Associates [RRA], a service of S&P Global (SPGI), ranks states by support of the utilities under their respective utility commissions and regulations. As the utility sector is mostly regulated by state public utility commissions and each state offer different financial profiles, S&P believes the financial support of regulators is an important component of a specific utility’s credit ratings. As the ultimate gatekeepers to long-term utility profits, I personally rate RRA ratings quite high on my utility sector due diligence criteria. Alliant Energy’s regulatory overseers are some of the best in the country with RRA ratings of Above Average for the regulatory environment in both Wisconsin and Iowa. RRA considers merely nine states as having Above Average regulatory ratings. LNT is the only multi-state utility with 100% of its service territory overseen by Above Average regulators and an investment in LNT offers a unique regulatory profile.

This fact does not go unnoticed by credit agencies and stock analysts. For example, the latest Morningstar review offers this opinion:

Alliant benefits from operating in what we consider two of the most constructive regulatory jurisdictions. To maintain earned returns near allowed returns during this period of high investment, management has worked to reduced regulatory lag, received above-average allowed returns across its subsidiaries, and aims continue to reduce operating costs for the near term. We believe Alliant has healthy relationships with the regulators in its two states, Iowa and Wisconsin, as exemplified by mechanisms that allow the firm to more closely earn its allowed return on equity.

The impact of being part of the “most constructive regulatory jurisdiction” can be seen in two important financial areas: allowed return on equity ROE and cost riders. According to the Edison Electric Institute, the average regulated quarterly approved allowed ROE across the sector during the 2nd qtr. 2022 was 9.45%. The lowest allowed ROE in the nation is Maine Public Utilities Commission 2020 ruling which reduced Central Maine Power (AGR) allowed ROE to 8.25%, compared to LNT’s 10.00% allowed ROE. No big deal, you say? LNT has announced an $8 billion capital investment schedule from 2022 to 2026. The difference between LNT’s approved ROE and the national average represents an additional $48 million a year in allowed ROE, and could be as much as $120 million a year over Central Maine Powers allowed profit, for the same dollar investment. In addition, Wisconsin regulators allow LNT to recover upwards of 50% of operating cost increases by “riders”. Riders imply these cost increases will be automatically approved and included in its rate base. The inclusion of “riders” removes the uncertainty and the time lag of filing for rate increases to offset higher operating costs. In the current environment of higher operating costs and higher costs of capital, investors should not ignore these benefits.

Alliant has an outstanding 10-yr history of earnings and dividend growth, according to the SPGMI rating offered by CFRA analysts. Formerly known as the S&P Capital IQ Earnings & Dividend Ranking or S&P Equity Quality Ranking, the methodology dates to the 1950s and evaluates earnings and dividend growth over the previous 10 years. Ratings range from “A+” (highest) to “B+” (average) to “C” (below average). The 10-yr timeframe is chosen as it usually will include at least one economic downturn. Of the 132 electric, gas, and multi-utilities tracked by Schwab’s stock screener, no utility has earned an “A+” rating while only 14 utility management teams have earned an “A” rating. Alliant Energy is included in these higher “A” ratings.

Alliant Energy could be considered a compelling clean energy investment opportunity. As their power generation profile moves away from an overreliance on coal, LNT is investing heavily in solar and additional wind power. After adding 1,200 MW of added wind from 2018 to 2020, Alliant has become the third largest owner-operator of regulated wind power in the U.S. LNT is taking advantage of both the government funded subsidies for renewable energy and the interesting fact that its Iowa service territory is well suited for wind generation. Management recently announced a 12+ project investment to generate over 1,500 MW of new utility-sized solar power generation and storage – 400 MW in Iowa and 1,100 MW in Wisconsin. In response to warnings of potential power shortages in summer 2023 from MISO, management has delayed the closure of two coal plants. Interestingly, Alliant said it’s still seeking to recover roughly $500 million each in the Columbia and Edgewater coal plants that were mostly tied to installing more than $1 billion in pollution controls as part of a 2013 regulatory settlement.

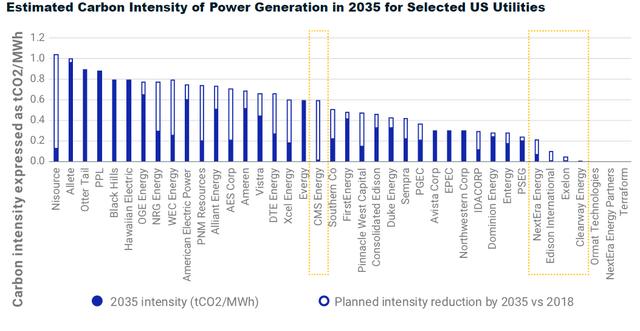

I am not a fan of ESG as an investment criterion, however, I know some investors are. According to msci.com, Alliant Energy has earned a “Leader” rating and was upgraded from “Average” in Sept 2020. LNT is one of only nine utilities with an AA rating by MSCI. LNT is not a “Laggard” on any of the key issues MSCI evaluates for utilities, is a “Leader” in Human Capital Development and “Average” on all other issues. Interestingly, MSCI also offered on its blog the following graphic of the estimated carbon intensity in 2035 by selected utility. For all the accolades LNT receives for its “green power” footprint, MSCI estimates LNT will remain in the top 25% for 2035 carbon intensity of the 40 utilities reviewed.

Estimated Carbon Intensity 2035 (msci.com blog)

In Feb 2021, I offered a review of 60 utility companies’ ESG ratings with NextEra Energy (NEE) the clear winner as the only utility with a “AAA” MSCI ESG rating.

Alliant Energy is offering a current dividend yield of 3.40% or $1.71 per share annually, with a stellar track record of increasing its dividends for 18 consecutive years. Over the past 10 yrs, dividends have increased by an average of 6.5% annually. Most analysts expect LNT long-term earnings to continue to grow by 5% to 7% annually with ongoing distribution raises squarely in the middle at 6%. Earnings are expected to grow to $3.09 in 2024, supporting a 2024 expected dividend of $1.93. With the passage of the IRA spending bill, many analysts believe the $1+ billion additional investments LNT is making in “green power” could allow LNT earnings to surpass estimated earnings during the next few years. Most price targets are in the $58 to $60 range with a few outliers calling for $70 targets. Even the lower target equates to a ~20% gain from today’s price.

I would rate Alliant Energy as a “Buy” except for the currently uncontrolled headwind of higher interest rates and escalating operating costs. I believe the relative benefits of servicing RRA’s highly rated regulators will soon be mightily tested and the competitive financial advantages over lower-rated utilities will be more apparent to investors. However, prudence dictates waiting for positive signs of a market bottom. These signs include a decline in the 2-yr Treasury Note (10/21 close 4.50%) to below its 50-day moving average (currently 3.90%) along with the same for the U.S. Dollar Index Continuous Contract IFUS (10/21 close 111.8) to below its 50-day moving average (currently 110.0).

When there is clear signs the market has bottomed, Alliant Energy should be added to most mid-cap utility portfolios. Until then, prudence powers me to rate Alliant Energy as a “Hold”. Regrettably, LNT does not currently offer any preferred stock for income investors. Personally, I anticipate adding Alliant Energy to my utility portfolio as one of my “market bottom” buys, when it is appropriate.

Be the first to comment