Thank you for your assistant

Humans and the activities engaged in by them are not always exactly the cleanest. It stands to reason then that the modern era would be in part defined by a significant need for the handling of waste management. And one of the companies that operate in the space that is on the smaller side of the spectrum in terms of overall market presence is Heritage-Crystal Clean (NASDAQ:HCCI). Operationally speaking, the firm provides environmental services like full-service parts cleaning, containerized waste management, anti-freeze services, and more. It also engages in bulk used oil collection services that result in much of the oil collected being re-refined into lubricating base oil and sold to relevant clients. So far this year, the company has been performing quite well from a fundamental perspective. In response to this, shares have risen nicely. But even with that increase, the stock looks to be trading on the cheap. So despite the company already climbing materially over the past few months, I do believe that it still warrants a ‘buy’ rating as of this moment.

Cleaning up nicely

Back in late June of this year, I wrote my first article discussing the investment worthiness of Heritage-Crystal Clean. In that article, I acknowledged the company’s mixed operating history over the prior few years. Even with that mixed performance though, I talked about how the most recent data provided by the company was encouraging. I did warn in that article that the favorable trend the company was benefiting from might not last forever. But even if that were the case and if financial performance were to weaken, the company was cheap enough to still make for a favorable risk/reward prospect. This led me to rate the enterprise a ‘buy’, reflecting my belief at the time that shares should outperform the broader market moving forward. So far, the company has exceeded my own expectations. While the S&P 500 is up by 3.2%, shares of Heritage-Crystal Clean have jumped by 26.9%.

This surge in price came about as a result of strong fundamental performance. To see what I mean, we need only look at financial data covering the third quarter of the company’s 2022 fiscal year. During that quarter, sales came in at $172.2 million that’s 39.8% above the $123.2 million the company generated the same time last year. Although the company benefited from growth across the board, the greatest expansion came from its services activities. Revenue there jumped from $59.7 million to $90.1 million. Its overall revenue increase, management said, was driven largely by higher base oil selling prices, increased demand, and higher selling prices for its environmental services products. Some of the growth also came from acquisitions. But this was a fairly minor portion of the increase compared to the other factors mentioned.

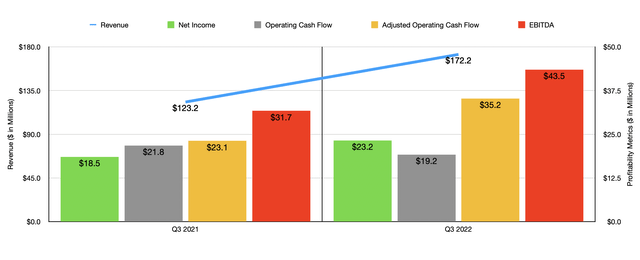

With this rise in revenue came improved profitability. Net income jumped from $18.5 million in the third quarter of 2021 to $23.2 million the same time this year. Yes, operating cash flow did come in worse year over year, declining from $21.8 million to $19.2 million, but if we adjust for changes in working capital, it would have risen from $23.1 million to $35.2 million. And over that same window of time, we also saw an improvement in EBITDA, with that metric jumping from $31.7 million to $43.5 million.

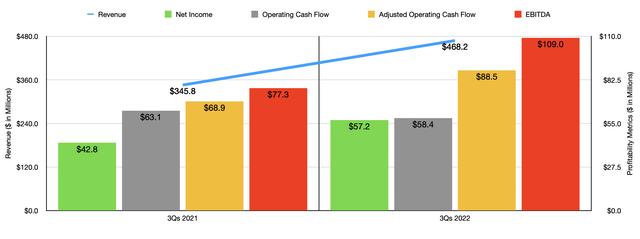

The third quarter was not the only time in which the company fared well. Rather, it was a time when financial results aided significantly in helping the company’s overall performance for 2022 so far. For the first nine months of the 2022 fiscal year as a whole, revenue came in at $468.2 million. That’s 35.4% higher than the $345.8 million the company generated the same time one year earlier. Just as was the case when it came to the third quarter alone, profits for the first nine months of the year are also up nicely. Net income grew from $42.8 million to $57.2 million. Once again, operating cash flow took a hit, declining from $63.1 million to $58.4 million. But unsurprisingly, when we adjust for changes in working capital, it would have risen from $68.9 million to $88.5 million, while EBITDA expanded from $77.3 million to $109 million.

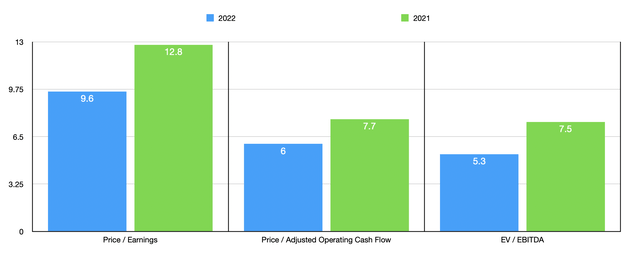

Although I maintain that there is no guarantee that the favorable oil price environment will remain in place forever, the company is showing no signs of weakening. If we simply annualize results experienced so far for the year, we should anticipate net income of $81.4 million, adjusted operating cash flow of $130.6 million, and EBITDA of $160.2 million. Based on these figures, the company is still trading at rather cheap levels. The forward price to earnings multiple, for instance, should be 9.6. That’s down from the 12.8 reading that we get using data from 2021. The forward price to adjusted operating cash flow multiple is 6.0, which represents a decline from the 7.7 reading that we get using data from last year. And finally, the EV to EBITDA multiple should come in at 5.3. That stacks up favorably against the 7.5 reading that we get using data from last year.

Just as I do with other companies in most cases, I decided to compare Heritage-Crystal Clean to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 15 to a high of 1,581. Of the four companies with positive results, Heritage-Crystal Clean was the cheapest. Using the price to operating cash flow approach, the range was from 3.2 to 42.9. In this scenario, two of the five companies were cheaper than our target. And finally, using the EV to EBITDA approach, the range was from 9 to 38.5. And in this scenario, our target was once again the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Heritage-Crystal Clean | 9.6 | 6.0 | 5.3 |

| Harsco (HSC) | 93.7 | 3.2 | 15.3 |

| SP Plus (SP) | 15.0 | 7.5 | 9.5 |

| Montrose Environmental Group (MEG) | N/A | 42.9 | 38.5 |

| Aris Water Solutions (ARIS) | 1,581.0 | 4.5 | 10.1 |

| BrightView Holdings (BV) | 43.7 | 6.7 | 9.0 |

Takeaway

In recent months, economic conditions have caused me to become more cautious about some of the opportunities out there. Uncertain times can lead to uncertain performance. You would think that a company that has risen as much as Heritage-Crystal Clean would warrant a downward revision in my book by this point. But in that case, you would be wrong. Given how strong the company still seems to be and how cheap shares are, both on an absolute basis and using data from 2021, I do think that there is still some upside potential on the table from here. As such, I am still rating the company a ‘buy’ for now.

Be the first to comment