galinast/iStock via Getty Images

Severe Geopolitical and Macroeconomic Issues Are Paving the Way for Hard Times for Copper and its Producers

Despite the US Federal Reserve’s aggressive hawkish monetary policy stance, annual inflation remains at record highs, which means that interest rates will need to be raised further in the future.

The maneuver is very risky as it could plunge the economy into a recession that some economists — usually described as non-hawkish — believe will be more difficult than widely expected with the outbreak sometime in the second half of 2023.

A recession will reflect a slowdown in demand for several commodities as consumption and investment are hampered by the looming tough economic climate.

The resulting headwinds will also impact the share price of US-listed stocks, and some of the hardest-hit companies could include companies that produce copper. Mainly due to the above factors coupled with a slowdown in manufacturing activity in China [the largest consumer of copper globally], analysts are forecasting that demand for the base metal will be under strong downward pressure in the coming months and this could be the case for copper miners footing the bill.

With this in mind, investors should consider the possibility of reducing some US-listed copper mining company stocks from their portfolios, and First Quantum Minerals Ltd. (OTCPK:FQVLF) (TSX:FM:CA) could be one of those stocks.

First Quantum Minerals Ltd. and Its Mineral Copper Operations

First Quantum Minerals Ltd. is primarily engaged in the exploration and production of copper mineral properties, while gold and nickel are more secondary activities in terms of revenue generated.

The company is targeting copper production of between 790,000 tons and 855,000 tons this year, averaging just 0.74% above the 816,435 tons mined in 2021.

First Quantum Minerals Ltd. is also targeting gold production between an expected minimum volume of 285,000 ounces and a maximum of 310,000 ounces and nickel production between 25,000 tons and 30,000 tons. However, the gold business will account for no more than 7% of total sales. While nickel is on the order of small percentages.

Currently, all copper and secondary gold and nickel productions come from the Cobre, Panama mine, two mines in the Northwest Province of Zambia, namely the Kansanshi mine and the Sentinel mine, and the Ravensthorpe mine in Western Australia.

The Country Risk: Moderate to Low

The three countries are aiming to be mining-friendly jurisdictions.

Central America and Australia are, but African countries are usually viewed with some skepticism by investors due to political instability and social tensions in some of them.

From this perspective, Zambia now appears to offer democratic solidity as peaceful elections were reported in 2021, resulting in Hakainde Hichilema being the seventh President of this country of southern Africa since last year.

Zambia is also attracting massive foreign investment, particularly from European multinationals interested in exploiting the copper mineral resources of the prolific Copperbelt District.

The disbursement of a roughly $1.3 billion plan by the International Monetary Fund [IMF] will allow the government to at least partially solve the age-old debt problem that is plaguing the domestic economy.

Word to The Mines: Current Situation and Possible Developments Amid Strong Global Headwinds

Cobre, Panama, which accounts for 40-42% of total copper production, has recently seen the continued arrival at the plant of material characterized by good metal concentrations in the mineral, which has resulted in significant cost savings to date.

A measure of this is provided by the second quarter 2022 earnings report which showed a cash cost billed to Panamanian production of $1.54 per pound [lb.] compared to a higher cash cost of $1.74/lb. for total copper production made by First Quantum Minerals Ltd. in the period.

The result was possible by increased truck availability and improved plant performance, while an increased focus was placed on projects aimed at making better use of the processing stages of the mined material.

However, employing more inputs and services to increase production entails additional costs for Cobre, Panama which, together with inflation and higher energy and other commodity prices, are undermining the mine’s profitability profile.

Using ad hoc hedging strategies to mitigate the risk of short-term commodity price shocks may be less effective in the future and some adverse balance sheet effects due to higher costs may be unavoidable.

Kansanshi, which accounts for approximately 20-22% of total copper production, is facing an issue of low base metal concentration in the ore, which is severely impacting production levels.

Comparing expected copper production for this year, which is in the range of 175,000 tons to 195,000 tons, to 202,159 tons in 2021 and 221,487 tons in 2020 clearly shows an ongoing negative trend at the Kansanshi mine.

The ongoing production slowdown has a geological cause that the company is investigating, but it will take time to develop a new mining strategy that can be implemented to optimize Kansanshi’s production.

Meanwhile, Kansanshi will face severe headwinds from a macro environment characterized by continued high inflation and lower demand for copper due to the looming global economic recession. They will put further upward pressure on costs.

Currently, these show an unwelcome trend as evidenced by the $1.83/lb. cash cost that was borne by the mine in Q2 2022 versus cash costs of $1.74/lb. for the total copper production First Quantum Minerals Ltd. managed to mine during the same period.

Sentinel, which accounts for about 30-32% of total copper production, is off-the-grid for certain parameters related to the waste-to-strip ratio, which measures how much waste material is mined per a given volume of mineral.

The company is trying to improve mining operations, but the burden of input costs, which will increase due to persistent inflation and rising raw material prices, will make the task more difficult for the Sentinel mine.

As expected, Q2 costs were above the company average: cash costs were $1.88/lb. for Sentinel versus $1.74/lb. for the entire asset portfolio.

The next quarters should not differ from Q2 due to strong and entrenched factors leading to higher prices for goods, services and energy.

Additionally, due to geopolitical issues, including the war in Ukraine, higher energy and commodity prices are likely to continue to impact Ravensthorpe‘s salable nickel production and operating costs.

The Balance Sheet Looks Good but Deleveraging It to Avoid Higher Borrowing Costs Won’t Be Easy

As of June 30, 2022, the company’s balance sheet appears in good shape to support the activities highlighted above, which the company is seeking to improve copper production performance.

Trying to narrow the gap between total cash of $1.82 billion, which is less than 4.5 times the total debt, and total debt of $8.44 billion is no easy feat.

However, the mismatch between cash and total debt just mentioned should not be a cause for concern, for the following two reasons.

The first is that the following comparison of operating income [$2.72 billion for 12 months through Q2 202] with interest expense [$670 million for 12 months through Q2 202] indicates that the financial burden can be borne without any problem as the financial costs are fully covered.

Second, metal mining is a capital-intensive industry, so for First Quantum Minerals Ltd. and other mining companies, it goes without saying that they incur significant debt to fund mineral projects.

Although it would be good to further reduce debt exposure in anticipation of a future of rising borrowing costs due to the US Federal Reserve’s restrictive monetary policies.

That won’t be an easy task, as several copper operations will barely become efficient without the ability to leverage financial resources along the way, so the company may struggle to further reduce debt.

The context is compounded by the well-known geopolitical and macroeconomic issues plaguing economies worldwide.

For the above reasons, and with copper prices expected to fall in the coming months, First Quantum Minerals Ltd. might endure the resulting blow quite hard. The copper price is expected to fall 10% in 52 weeks from the current level of $3.52 a pound.

Operational Issues, Higher Costs, and Disappointing Commodity Could Drive the Stock Price Lower

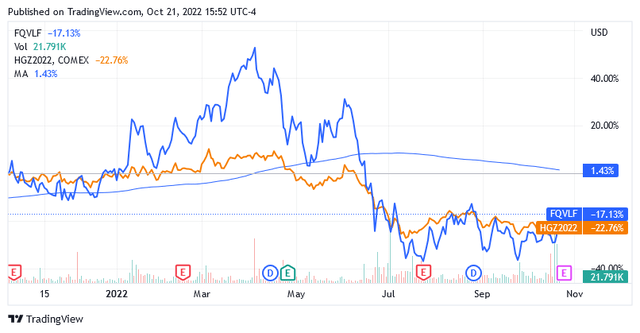

The stock was trading at $19.54 per share as of this writing for a market cap of $12.06 billion and a 52-week range of $14.48 to $37.76.

seekingalpha/symbol/FQVLF

The share price is trading below the middle point of $26.12 of the 52-week range and significantly below the long-term trend of the 200-day simple moving average of $23.94.

On the Toronto Stock Exchange, First Quantum Minerals Ltd. was trading at Canadian Dollars [CA$] of 26.73 per share for a market capitalization of CA$16.46 billion. Here the stock had a 52-week range of CA$18.80 to CA$45.38. The stock price is trading below the long-term trend of the 200-day simple moving average of CA$30.83.

The stock has a 14-day relative strength indicator of 51.01, suggesting shares are not yet oversold despite the significant drop of more than 17% over the past year.

Given the pressure from faltering mineral operations and continued strong headwinds in the copper markets, there is scope for the stock price to be even lower than current levels.

Conclusion – Shares Are Probably on the Way Down

Copper prices aren’t doing well right now, and the future isn’t looking bright either, as the recession that economists expect to hit in 2023 will weigh on demand for the metal.

Many public copper miners will follow the metal’s downtrend, with more volatile companies likely to perform worst. First Quantum Minerals Ltd. could be one as its stock seems to suffer from a copper bear market remarkably, while 50% of mining operations don’t fare well.

Be the first to comment