Derick Hudson

To truly experience a fall from glory, one should have experienced glory in its fullest. Not many individuals and companies can lay claim to have reached serious glory, but Meta Platforms, Inc. (NASDAQ:META) and Mark Zuckerberg certainly can. Hence, the phrase “fall from grace” fits Meta and its founder to a T as 2022 draws to a close.

This article reviews Meta’s 2022 and offers a few positives and negatives for the company as we welcome 2023 in a few weeks.

2022 – Annus Horribilis

Many things changed at Meta in the last year or so:

- The stock ticker changed from FB to Meta.

- Sheryl Sandberg officially moved on from the company.

- Zuckerberg expanded (a little) on his Metaverse vision.

- And the company had its first-ever decline in advertising revenue.

Except #1, the other 3 points fundamentally contributed to the company’s horrible year to varying degrees. If you think about it, even #1 may have contributed to the downfall as the company was clearly signaling it wanted to distance itself from the controversies created by its bread-and-butter product, Facebook. Undoubtedly, the company, and in turn, the stock had their worst year ever so far. This could change a little in the remaining few weeks, but as things stand now, Meta is almost dead last, as shown below.

S&P Performance (slickcharts.com)

Meta investors will be glad to see the back of 2022. Let’s evaluate how the company is setting up for 2023 and beyond.

Short-Term Technical Indicators – Recovering But Shaky

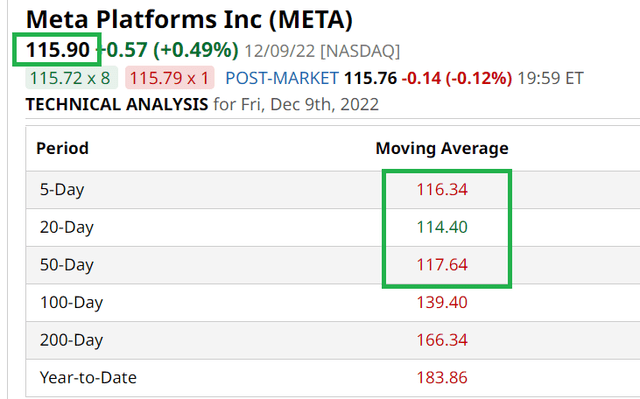

From a technical standpoint, Meta, like many other stocks in the recent market run-up, raced past its 5-, 20-, and 50-Day moving averages but has fallen back down in last week’s selloff, as shown below. The 200-Day moving average is a good 45% away from here, and that shows the base has shifted clearly, not just metaphorically. But the fact that the stock has either taken out or is extremely close to its 5-, 20-, and 50-Day moving averages indicates that the bottom may well have been in the $80s that the stock saw in November.

Meta Moving Average (Barchart.com)

Relative Undervaluation

Obviously, Apple (AAPL), Google (GOOG), and Microsoft (MSFT) are fundamentally stronger companies than Meta at this point. They perhaps deserve a bit of premium, but the following points provide the context as to how negative Meta is currently viewed by the market.

- Analyst estimates are so negative right now that the expectation is for Meta to have an annual negative growth rate of 17% for the next five years. That is 60 months of negative growth. The average recession has lasted 17 months, dating back to 1854.

- Microsoft’s forward multiple is twice that of Meta’s. Again, Microsoft is fundamentally stronger with a better ecosystem. But twice the multiple? With nearly 40% of the World’s population as monthly active users, Meta’s advertising reach does not deserve this undervaluation forever.

- Speaking of the world’s population and active users, WhatsApp is still out there with the potential to monetize heavily on the Business side. The undervaluation may extend into the company’s overall potential as well and not just the stock. As admitted by the company, WhatsApp is in its infancy when it comes to monetization. To understand how WhatsApp makes money for Meta, read this nice educational article on Seeking Alpha.

Rumors of Ad Death are Greatly Exaggerated

Okay, apologies to Mark Twain, but I couldn’t resist using that powerful quote. Make no mistake about it, there are still just a few basic ways an advertisement can reach consumers. Seeing it, reading it, or hearing it.

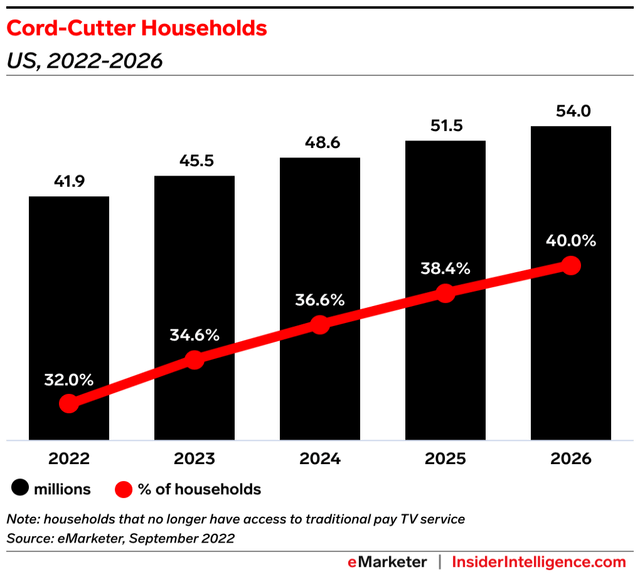

With cord-cutting still being a trend and expected to keep raising, where will the marketing revenue go? Facebook remains and will remain one of the top three ways to sell online ads.

Cord Cutting Trend (www.insiderintelligence.com)

Risk Factors – 2023 and Beyond

There are clearly risks associated with Meta as we head into 2023. I am listing the top three below.

- Spending Spree: As of now, it appears like Zuckerberg has finally caught up with the real world, despite his enormous goals for the virtual and augmented ones. But there is no saying when he will relapse into the “growth at any cost” mode. The problem is just not the focus on growth, the market loves growth stories. The problem has been the lack of convincing vision from the visionary. With no Sheryl Sandberg in the room to play the role of an adult, it is not hard to see Zuckerberg get too carried away with his dreams.

- Economic Woes: As mentioned above, many things changed at Meta this year. But one thing that hasn’t changed is the company’s reliance on advertising revenue. Despite attempts to monetize other products and services, advertisements still contribute nearly 98% of the company’s revenues. That is not an enviable position to be in when the economy is staring at a major slowdown, if not a full-blown recession. After eliminating redundant positions, cutting down on marketing and sales expenses is the natural extension in most businesses. 30% of advertisers are already cutting their 2023 budgets. However, as covered in the section above, this is more likely to be a short to medium-term problem than a long-term issue.

- Metaverse: The problem with Metaverse is not just about what it represents or means. Technology trends are fickle and most don’t stay long enough but the rare ones that do tend to make a boatload of money. If you thought terms like Augmented Reality and Virtual Reality were making you dizzy, hold onto something. “Immersive Reality” is already here and Meta may benefit from it if its Metaverse bet pays off but the flip side is that this is likely to harm traditional digital advertising as noted on this Seeking Alpha news item. So far, Meta has incurred billions of dollars in expenses (losses) but user engagement is not off to the best possible start.

Conclusion

As we saw in 2022, when macro conditions and a company’s fundamentals worsen at the same time, it leads to a double whammy. However, when things improve, growth names accelerate your returns. When the growth name in question is coming off a terrible year where it lost 65% and is now trading at a forward multiple of 12, the returns can be turbocharged. No wonder, Meta is an early candidate being recommended for 2023, as seen here on Seeking Alpha and elsewhere.

Do I expect Meta Platforms to double in 2023? Unlikely. But do I believe the risk-reward is in favor of the longs from here, especially with a 3- to 5-year horizon? Absolutely. You may not nail the absolute bottom, but the risk-reward for Meta Platforms, Inc. appears in favor of longs here.

Be the first to comment