Ariel Skelley

This article was researched and written by January Mbuvi.

Investment Thesis

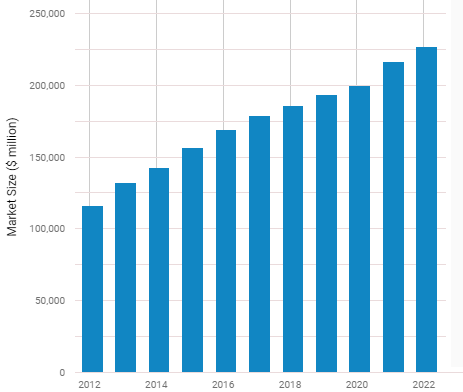

Beazer Homes USA, Inc. (NYSE:BZH) is an American company that builds and sells homes. It operates in one of the United States’ most significant and growing industries, worth about $226.8B.

IBISWORLD

BZH released its fiscal Q4 2022 results on 10 November, reflecting a solid end of its FY compared to 2021. The good results could be primarily due to the high home prices and rent resulting from rising demand for new homes and the constrained supply of homes/houses in the Covid era. Despite the company’s promising year-end performance in 2022, shares have fallen dramatically, dropping more than 42% year-to-date and currently trading at just $3.51 above its 52-week low of $9.47.

I believe the drop in share prices could be the management’s initiative as it anticipates a tough 2023. During the Q4 ’22 call, the company’s CEO admitted that they anticipate a tough 2023. This fact makes me believe the sharp decline in share prices could result from this situation, taken as a precautionary measure.

I think the company’s successful conclusion to 2022 and the cautious start to 2023 are excellent preparation for the challenges that might lie ahead in 2023. The firm has successfully deleveraged and maintains healthy liquidity levels in front of the 2023 fiscal year. These measures and others will be crucial in mitigating the risks.

A Look at the Market

The housing industry was in hyperdrive only a few months ago, with soaring home prices, historically low mortgage rates, and unwavering demand. However, recent reports have led some industry analysts to conclude that a “housing recession” has set in. Existing-home sales in July declined 5.9% from June, marking the sixth straight month of decrease and a 20% drop from a year earlier. In addition, layoffs and weaker employment growth have hit the industry, homebuilder sentiment has turned negative, and purchasers are canceling contracts as interest rates rise to 5.72 percent from 3.3% in 2022.

Considering this context, the tale differs for homeowners, purchasers, and sellers. This difference is because they provide a relaxing ambiance for the homeowners. Allow me to rephrase: they are the spectators at the play between home sellers/builders and home buyers.

Nonetheless, the effects of the recession on buyers and sellers are asymmetrical. Even if demand is falling, prices are stuck high since supply is still low. Due to rising mortgage rates and a decrease in sales to the lowest level in two years, builders have become increasingly hesitant to construct new houses, which has kept prices high.

As purchasers pulled back from the market, the number of canceled house sales increased in July to another two-year record. Roughly 63,000 house purchase contracts were canceled in July, or about 16% of all residences that went into a contract that month. That’s the largest percentage of failed deals over two years, up from June’s 15%.

As the property market declines, sellers are under increasing pressure to lower their asking prices. Economists forecast that home price growth will slow considerably in the next quarters and eventually stop rising in 2023.

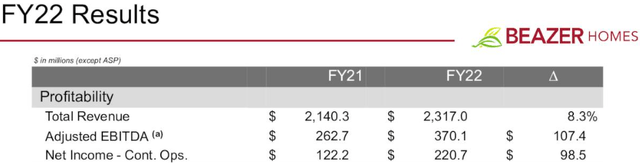

The 2022 FY Ends Strongly

When the company released its results for the last quarter of 2022, they were much better than last year’s. The good results, as earlier mentioned, were primarily due to high prices for homes and high rent due to constrained supply during the Covid era. It is my pleasure to walk investors through some of the most significant improvements and explain why I think they will be crucial in weathering the downturn.

First, BZH improved 8.3% in total revenue, registering $2,317M in 2022FY, up from $2,140.3 in 2021. Additionally, they had a $107.4M increase in adjusted EBITDA, up from $262.7 in 2021 to $370.1 in 2022, and a net income improvement of $98.5M.

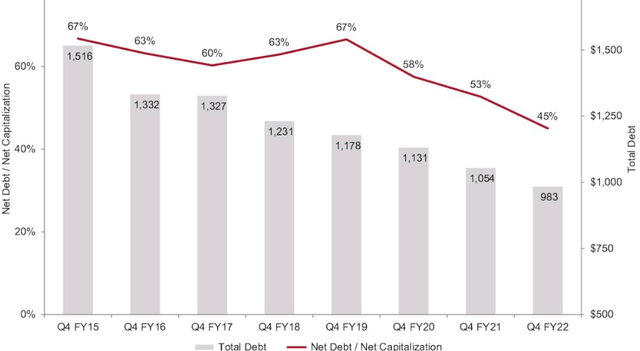

Secondly, the company made significant strides in improving its liquidity and lowering its leverage. The company has total liquidity of $460M (214.69M in cash and the rest as undrawn revolver), which is 1.7X its total operating expense TTM and a current ratio of 8.40MRQ. This liquidity is a testament that as the company enters 2023, its short-term financial health will be robust. Its liquidity can cover its operating expenses by 1.7X, and its current assets can cover its short-term liabilities by 8.40X. In my view, this gives the company a strong take-off in 2023.

Moving to financial leverage now, BZH has significantly decreased its debt as it enters the anticipated 2023 tough FY. From a total debt of $1.516B in 2015, it has consistently reduced it by more than half to its current balance of $0.983B.

At the current balance, the debt is 2.67X its market cap, which in my view, is healthy for the company’s future development as it’s adequate to fund CAPEX. The deleveraging approach will be a massive boon to the corporation as it attempts to weather the economic storm, allowing for a reduction in interest expenditures. In addition, the fact that the company has no debt maturities due until March 2025 is likely to increase interest from potential investors.

David Goldberg on the call:

“As Allan mentioned in his opening comments, we achieved our goal of bringing debt below $1 billion. We ended the fourth quarter at about $980 million of debt, and we now have no maturities due until March 2025. Our net debt to cap was 45%, and our net debt-to-EBITDA was 2.1 times, in line with our expectations.”

Given this background on the solid end of 2022, I am confident that the company has a strong land foot into 2023, which will complement their cautious entry in 2023, hence sailing through the storm very strongly.

Stepping Cautiously into 2023 FY

With a bleak forecast for the industry, which is causing house sellers to reevaluate their pricing and other strategies, the management team appears to be treading carefully in 2023 to come out on top.

David Goldberg again on the call:

“As we enter fiscal 2023, our posture is cautious. We will respond as the market develops and won’t sacrifice the progress we’ve made with our balanced growth strategy.”

The administration places a premium on making homes available at reasonable prices. To realize this goal, the corporation plans to implement price changes for their homes through cost reductions, incentive programs, and other measures. In this section, I will discuss some of those initiatives.

To begin with, it is the cost reduction initiative. The company intends to reduce both cost of materials as well as the indirect costs. With lumber prices back to pre-Covid, the company estimates saving $15,000, which will translate to an equivalent magnitude in the selling price of their houses.

Secondly is the company’s mortgage choice initiative. Advantages like Mortgage Choice are hard to come by in today’s market. Mortgage Choice was created to ensure that only reputable lenders compete for the business of BZH purchasers. This move implies that its clients can take advantage of lending programs, rate locking, and buy-downs that would be unavailable from a conventional in-house lender.

Lastly is the energy-efficient houses. Homes built by BZH meet or exceed today’s stringent energy codes for new construction and are decades ahead of the used home market in terms of efficiency. That means they can save money on utility bills, and their homes are more likely to hold their value in the face of the inevitable rise in the construction of more environmentally friendly homes.

Allan Merrill on the call:

“With a monthly cost of ownership and resale value at the center of most buyer conversations, our commitment to energy efficiency is a big advantage.”

Despite the challenges in 2023, I have every confidence in Beazer Homes USA, Inc.’s ability to survive and thrive by capitalizing on its unique competitive advantages. I think the business will come out on top!

Conclusion

The U.S. home industry prognosis is bleak, with contract cancellations and mortgage rates rising. Analysts say the problem has caused a recession. The company’s management seems well-prepared for 2023 through strategic efforts. BZH’s excellent 2022 FY finish gives them a strong landing foot in 2023, and I believe they will prevail. I recommend the company to any housing investor because of this. Beazer Homes USA, Inc. will most likely survive the recession; thus, it’s worth investing in.

Be the first to comment