jetcityimage/iStock Editorial via Getty Images

Introduction

It’s time to discuss a dividend stock that I believe makes sense to own on a long-term basis. The Indiana-based engine producer Cummins Inc. (NYSE:CMI) is one of the world’s leading industrial companies with a terrific dividend growth history. In this article, we’re going to assess its business and the markets it serves in light of ongoing developments, its qualities as a dividend (growth) stock, analyst ratings, its earnings, and its valuation.

I believe that Cummins is a tremendous dividend stock. Yet, given my view on the macro situation, I believe investors might get better entry prices, making the dividend a bit more juicy (more bang for your buck).

In this article, I will give you all the details!

The Cyclical Cummins Business Model

Cummins is one of the companies that is rather well-known in the United States, unlike on the other side of the pond. Even if people aren’t *that* familiar with the company, the Cummins-powered trucks on America’s roads are hard to miss.

With a market cap of $35.3 billion, the company is one of the largest producers of engines and related products and services.

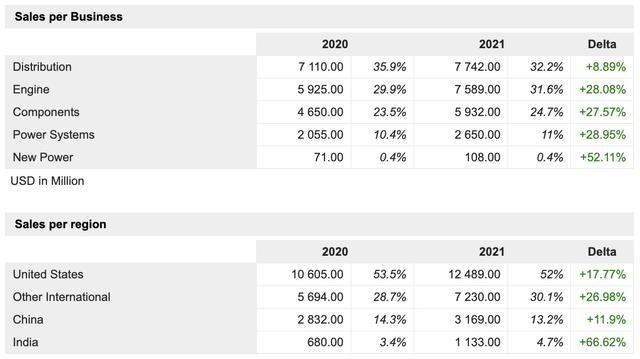

As the overview below shows, the company operates five segments. The largest two are distribution and engine, which account for roughly 32% of total sales each. The components segment accounted for a quarter of 2021 sales.

MarketScreener

Essentially, the distribution segment supports the company’s engine segment through the sales and support of a wide range of products and services, including power generation systems, high-horsepower engines, and heavy-duty and medium-duty engines for both on- and off-highway use.

In its engine segment, the company manufactures and sells a wide range of diesel and natural gas-powered engines under its Cummins brand name, as well as customer brand names. This includes trucks, buses, recreational vehicles, light-duty cars, construction, mining, marine, rail, defense, and tractors.

The company’s largest customer in 2021 was PACCAR (PCAR), which produces heavy-duty trucks and related equipment. This customer accounted for 15% of total sales, indicating that CMI’s customer base is well-diversified.

Moreover, when looking at its sales breakdown, the company has emerging market exposure. This is achieved through several joint ventures with companies like Dongfeng and Chongqing, two major Chinese industrial players. Moreover, the company has distribution JVs with Komatsu in Chile.

In other words, Cummins’ business model is driven by global economic growth developments as almost every single customer is operating in a cyclical environment.

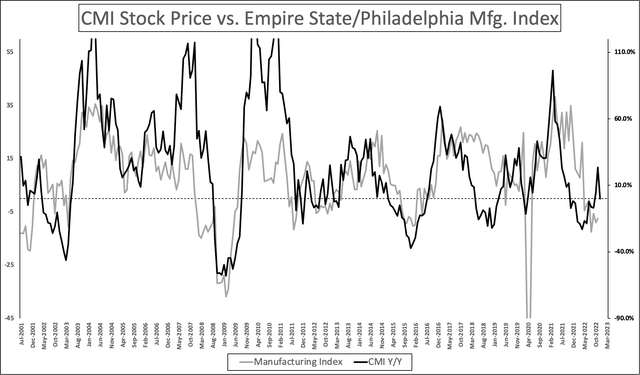

Hence, it’s no surprise that the CMI stock price is highly correlated to (leading) economic indicators like the Empire State and Philadelphia Fed manufacturing surveys.

Author

Note that the CMI stock price usually leads to economic growth. In the 2015/2016 manufacturing recession, the stock weakened before manufacturing surveys started to contract. The same happened last year when CMI peaked before market participants saw growth indicators come down.

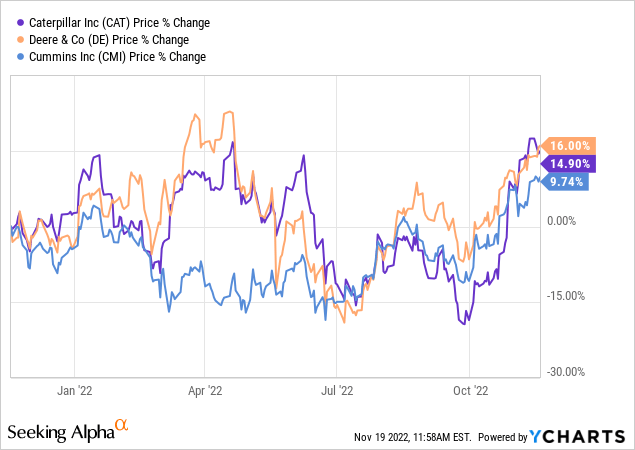

Moreover, despite the economic slowdown, CMI shares are UP 15% year-to-date. Shares are down just 1.5% from their all-time high.

The same goes for its peers Deere & Company (DE) and Caterpillar (CAT).

In this case, I believe that Deere and Caterpillar are outperforming as both benefit from secular tailwinds. Deere benefits from strong agricultural growth, while Caterpillar sees strong tailwinds in resources. Cummins also benefits from these tailwinds, yet its exposure in these industries is a bit smaller.

What You Should Know About 3Q22 Earnings

In light of our dividend discussion, it’s important to take a quick detour, given that the recently released earnings tell us a lot about the current business environment – and why the stock is doing so well this year.

As reported by Seeking Alpha on November 3, Cummins generated $7.3 billion in sales in its third quarter. That’s 22.3% higher compared to the prior-year quarter and $170 million higher than expected.

In August, Cummins acquired Michigan-based industrial company Meritor. Meritor is…

[…] a leading global supplier of drivetrain, mobility, braking, aftermarket, and electric powertrain solutions for commercial vehicle and industrial markets.

The integration of Meritor’s people, products and capabilities in axle and brake technology will position Cummins as a leading provider of integrated powertrain solutions across internal combustion and electric power applications.

The company used cash, commercial paper, and debt to execute the $3.7 billion transaction, including net debt.

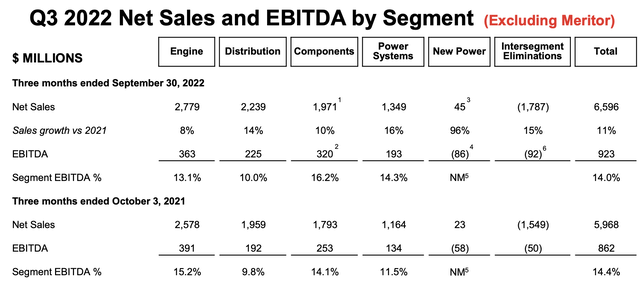

What’s interesting is that the company did tremendously well in its third quarter (excluding the Meritor deal). The company grew its sales in every single segment with EBITDA margin improvements in all segments except for its engine segment.

Cummins Inc.

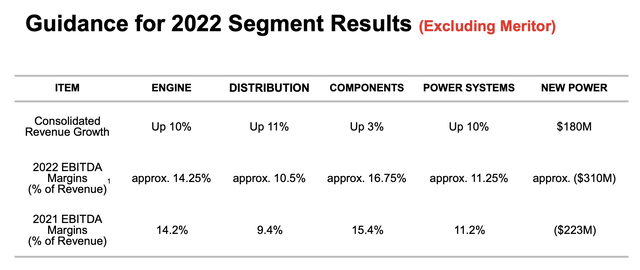

However, on a full-year basis, the company expects positive revenue growth in all segments and higher margins in every single one of its segments.

Cummins Inc.

This is fueled by high truck demand in North America, where the company sees up to 15% unit growth in heavy-duty trucks and between 5% and 10% growth in medium-duty truck demand. This same segment in China is expected to see a 55% contraction.

Not only is the company handling supply chain issues quite well (supported by higher volumes and pricing), but it is also seeing future strength based on demand growth in mining, oil and gas, and power generation markets.

This guidance reflects stronger performance in North America and a continued weak market outlook in China, as well as the indefinite suspension of our operations in Russia. We are forecasting higher demand in global mining, oil and gas, and power generation markets, and expect aftermarket revenues to increase compared with 2021.

What we’re seeing here for the first time in decades is a recession with secular growth in cyclical markets. Oil and gas markets benefit from strong prices (due to supply issues), mining demand remains high due to net-zero investments (also supply shortages), and aftermarket revenues are up due to the age of existing equipment and the ongoing replacement cycle.

Now, with all of this in mind, let’s dive into the next key question – the reason you’re reading this article.

Is Cummings A Good Dividend Stock?

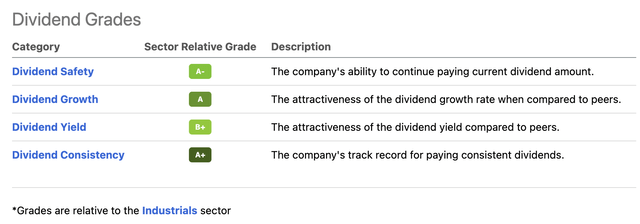

To answer this question, we can use our findings from the first half of this article and the dividend scorecard below. The company scores very high on dividend consistency and dividend growth. Dividend safety and dividend yield both score high as well.

Seeking Alpha

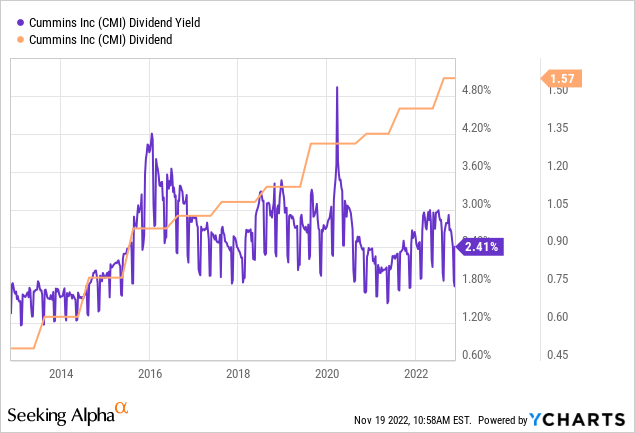

Cummins investors currently receive a $1.57 per share per quarter dividend. That’s $6.28 per year or 2.5% of the company’s current stock price. It’s an OK yield given its 10-year history and relatively high compared to the industrial sector.

A 2.5% yield is OK, it’s definitely a yield that I would be interested in buying. However, some investors may find this yield too low.

That can be solved by waiting for a better entry (more on that later in this article) and the company’s dividend growth rate.

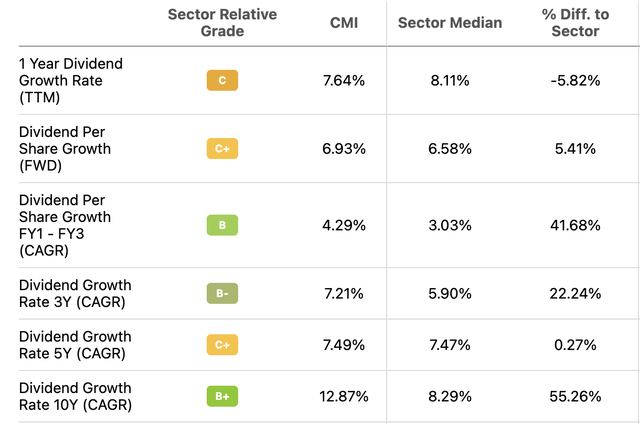

Hence, it’s great news that Cummins is growing its dividend by 12.9% per year. That’s the average annual dividend growth rate of the past 10 years.

With that said, the dividend growth rates are slowing, as the Seeking Alpha table below shows.

Seeking Alpha

These are the most “recent” hikes:

- July 2022: +8.3%

- July 2021: +7.4%

- October 2020: +3.0%

- July 2019: +15.0%

What the data tells us, so far, is that the company is more aggressive when economic growth is strong. That makes sense. However, even during the pandemic and in the two years after the first lockdowns, dividend growth was anything but weak.

With that in mind, there’s more to unpack. Dividend growth is one thing, the payout ratio is another thing. After all, that tells us how much room the company has to maintain strong dividend growth.

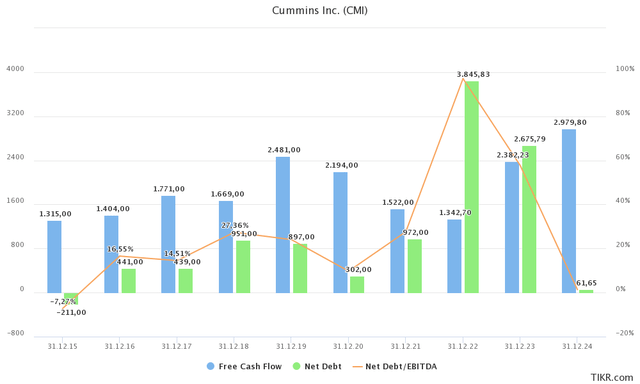

When it comes to the payout ratio, I always prefer free cash flow over earnings. After all, free cash flow is earnings after non-cash operating items and capital expenditures. It’s cash a company can spend on whatever it wants. Note that this only makes sense if the company is financially healthy. In this case, even the Meritor transaction was not able to push net debt to more than 1x EBITDA.

TIKR.com

Looking at the graph above, the company is expected to do $2.4 billion in FCF next year. That will change based on economic conditions. Yet, based on current conditions, that’s 6.8% of its market cap. That’s a very decent yield that will allow the company to quickly reduce net debt, maintain high dividend growth, and engage in buybacks.

Based on these numbers, bear in mind that Cummins has the goal to return roughly 50% of its operating cash flow to shareholders. This target has allowed the company to maintain excellent financial health throughout the past few economic cycles.

Hence, Cummins has an A2/A+ credit rating, which is fantastic news for its borrowing activities and its shareholders.

Additionally, buybacks have resulted in a steady decline in the number of shares outstanding. Between 2017 and 2021, the company repurchased close to 22 million shares, lowering its share count by 13.2%.

CMI Stock Valuation

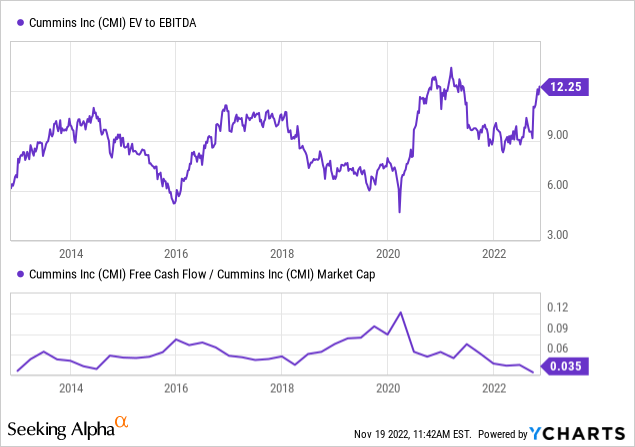

Cummins is trading at 8.7x 2023E EBITDA ($4.6 billion). This is based on its $39.9 billion enterprise value, consisting of its $35.3 billion market cap, $2.7 billion in 2023E net debt, $680 million in pension-related liabilities, and $1.2 billion in minority interest.

This valuation uses future EBITDA and it incorporates a debt reduction due to high free cash flow. Yet, it’s a rather attractive valuation given that the company usually trades at 9x EBITDA (mid-cycle).

The same goes for the implied FCF yield of almost 7%. It’s above the longer-term median.

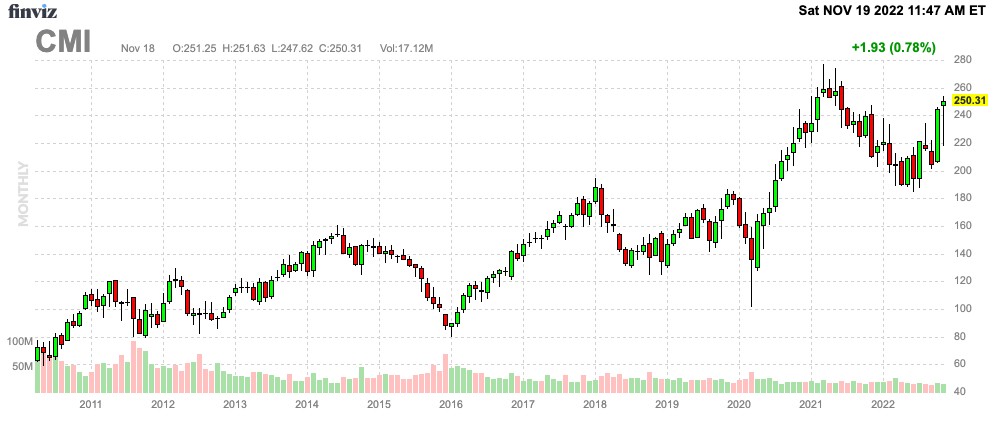

The current average analyst target is $253. Meaning CMI is at fair value as its stock price is at $250.

FINVIZ

I would agree that CMI is at fair value. However, that’s based on current estimates. Economic risks are building. While CMI is doing a tremendous job growing despite weaker economic growth, it doesn’t do the valuation any favors.

On a longer-term basis, I believe that CMI remains significantly undervalued.

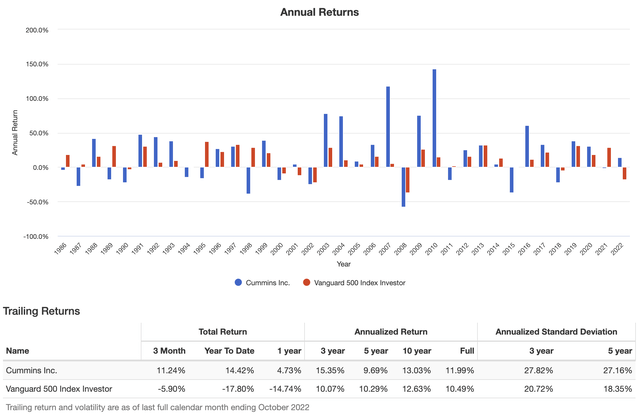

With that said, the company is doing a tremendous job creating wealth besides paying a steadily growing dividend. Going back to 1986, the stock has returned 12.0% per year. That beats the S&P 500 by 150 basis points per year. The company’s returns have remained impressive over the past 3, 5, and 10 years. Moreover, the standard deviation has been consistently below 28%. That’s still somewhat high, but we’re dealing with a cyclical industrial stock.

Portfolio Visualizer

Needless to say, steady buybacks have contributed to this very satisfying valuation.

Is CMI Stock A Buy, Sell, Or Hold?

Cummins is a tremendous dividend stock. It offers a decent yield, backed by a rock-solid business model capable of consistent and high growth. Moreover, this yield benefits from consistent, above-average, dividend growth.

Cummins has high free cash flow growth, allowing the company to distribute up to 50% of its operating cash flow while maintaining a very healthy balance sheet.

The stock is doing quite well this year, despite slowing economic indicators as secular tailwinds persist.

On a long-term basis, I remain bullish. However, for the time being, I rate CMI stock a hold. Given macroeconomic uncertainties, I believe that it makes more sense to wait until CMI offers a better opportunity. Macro developments are by far the company’s biggest risk. I do not believe that chasing the CMI chart at current prices offers a good risk/reward.

However, that’s fine. If investors get CMI stock 10-20% cheaper, they are buying a fantastic asset allowing them to build wealth on a long-term basis.

(Dis)agree? Let me know in the comments!

Be the first to comment