Solskin

Merrimack Pharmaceuticals, Inc. (NASDAQ:MACK) is a former biotech that decided to liquidate its portfolio of candidates in exchange for milestone payments. The company was able to reduce its overheads to a minimum in order to allow the estimated time for the chance of milestone payments related to its ONIVYDE drug that was sold to Ipsen to occur.

Merrimack’s key potential milestone payments are as follows:

• $225.0 million upon approval by the U.S. Food and Drug Administration (“FDA”) of ONIVYDE® for the first-line treatment of metastatic adenocarcinoma of the pancreas, subject to certain conditions;

• $150.0 million upon approval by the FDA of ONIVYDE® for the treatment of small-cell lung cancer after failure of first-line chemotherapy; and

• $75.0 million upon approval by the FDA of ONIVYDE® for an additional indication unrelated to those described above.

Source: Merrimack Q2 2022 10-Q Filing

The risk/reward option is quite clear for shareholders that are long Merrimack. With 13.4m shares outstanding as of August 2, 2022, this represents a total potential upside to $33.58/share which if we compare that to the current share price of $4.34 would seem to offer substantial upside. This does not tell the entire picture, as clinical trials are not a done deal. According to a Pharma Intelligence survey from 2021, the following success rates are expected according to phase:

Phase 1 52% (generally focused on safety)

Phase 2 28.9% (generally the first-time proof of concept is tested on humans)

Phase 3 57.8% (most expensive and longest to conduct)

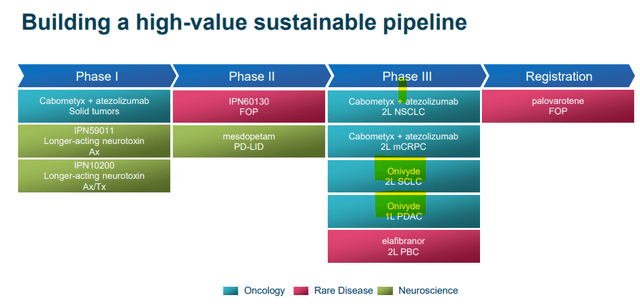

Ipsen is currently at the Phase 3 stage with its ONIVYDE studies for both of the first two milestone payments as disclosed below:

Source: Ipsen H2 2022 Results Presentation

The upside to this based on the general success rates could be argued as follows:

|

Trial |

Maximum Reward |

% Of Success |

Potential Value |

|

ONIVYDE PDAC |

$225m |

57.8% |

$130.05m |

|

ONIVYDE SCLC |

$150m |

57.8% |

$86.7m |

|

ONIVYDE Other |

$75m |

0% (not started) |

$0.00m |

|

Total |

$216.75 |

||

|

Per Share |

$16.17/share |

Source: Author Assumptions

From an expected value perspective, this gives a decent estimation of the probability of some future value from Merrimack’s options. However, the weakness of this is that it is really a go/no-go situation; either the company earns one or all of the milestones or it does not, there is no real half measure. So we have to see if there is a better indicator of success.

Unfortunately for Merrimack, Ipsen announced on August 3, 2022 that the results of the SCLC study did not show any material improvement over existing alternatives. The company will continue to review the data and the results of the PDAC trial are expected later in 2022.

The Takeaway

This result makes the risk-reward substantially less interesting now for Merrimack. It essentially makes Merrimack a one-candidate company, with the first candidate having essentially failed to meet its goals already. The market largely agreed, sent shares down 20% on the day of the announcement. With one strike already now for the product, it certainly should give investors some pause for concern on its effectiveness. Admittedly, I am not a scientist, so the second trial could be very independent on efficacy for its application than the SCLC trial was. However, with the probability of the SCLC milestone being met dropping to near zero, an investor is now relying on the PDAC trial alone.

More importantly to investors, this likely will create a negative sentiment towards shares of Merrimack until the information vacuum for the Phase 3 results of the PDAC study is resolved. MACK shares could become a great risk-reward at some point, but with the current negative sentiment towards the company, that time is likely not now, despite the potential reward even the one study offers.

Be the first to comment