Hispanolistic

Thesis

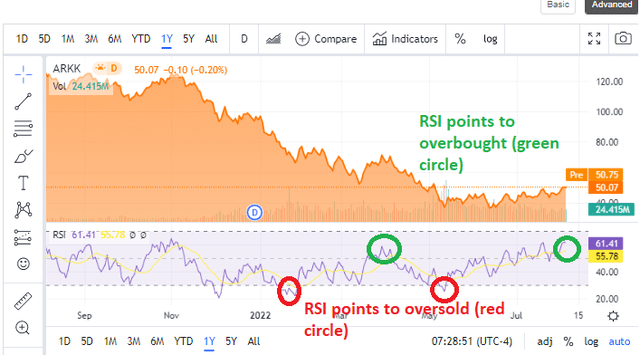

The ARK Innovation ETF (NYSEARCA:ARKK) has seen a very nice bounce off the June 2022 lows, being up almost +20% since those levels. As an expression of high P/E Tech stocks, this exchange-traded fund (“ETF”) had been pummeled to technically oversold levels and has benefited from the erroneous market pricing of a Fed pivot in rates. The ETF has moved from a low of $35.10 to the current $50 level. We believe this is a technical bounce as quantified by the RSI for the ETF and we feel the vehicle is nearing the top of its short-term range, where it is going to resume its decline. We believe we are in the midst of a bear market rally triggered by multiple factors: a) oversold technical conditions; and b) erroneous market read of a Fed rates pivot.

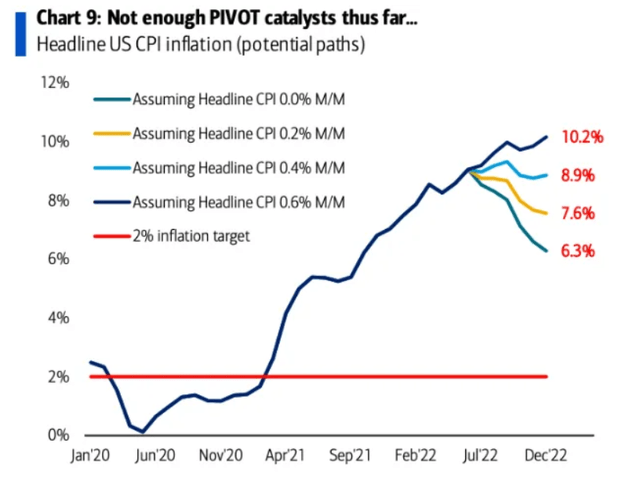

We do not believe there will be a v-shaped recovery in the Tech sector. Similarly to Credit Suisse’s Zoltan Pozsar we rather feel we are going to witness an L-shaped recession, which will provide for the best “medicine” to fight inflation. We feel inflation has reset at a permanent higher level and higher rates are here to stay. It will take a significant amount of time for inflation to come down to a more palatable level:

Courtesy of Bank of America (BAC), we can see that even if CPI goes to 0% change month on month going forward, inflation will be nowhere near the 2% threshold by the end of the year when the forward SOFR curve implies rates are going to peak:

In effect, at 0% CPI M/M we are going to need at least 1 year for numbers to go down to historic levels. Do we even expect 0% CPI month-on-month? No.

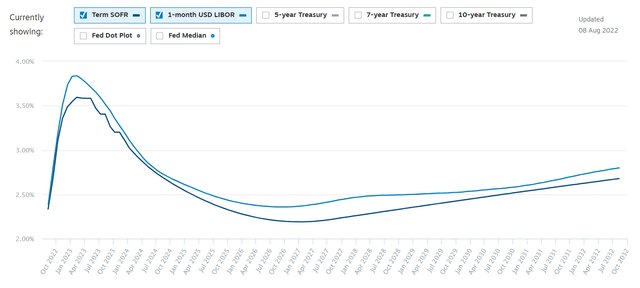

We are of the opinion that rates will stay higher for longer this time around and that the Fed is committed to seeing inflation figures come down substantially before lowering rates, even with the price of a mild recession. Technically, we are in a recession as we speak, with two quarters of contracting GDP figures. However, the labor market is strong, consumer balance sheets are in good shape, and the political apparatus is quick to point out that it is really not a recession when “Help Wanted” signs abound. This macro setup translates into higher discount rates and lower valuations for tech companies.

Given our views on rates and the technical setup, we believe that fading the ARKK bear market rally move via out-of-the money calls is a profitable trade to undertake. We propose selling October 2022 $55 strike calls that provide a 10% buffer to the current spot price and can result in annualized yields exceeding 26%. The article details the trade and potential scenarios in the “What is the Trade?” section below.

ARKK’s Performance

ARKK is down almost -50% year to date:

YTD Performance (seeking alpha)

Although it is up almost +20% since the lows seen in June:

Performance since June (Seeking Alpha)

This has been a very strong bear market rally fueled by oversold technical conditions:

RSI Graph ARKK (Seeking Alpha)

If we look at an RSI graph for ARKK, we can notice that every time the RSI recorded oversold levels (below 30) the ETF followed up with a nice technical bounce. Nothing goes down in a straight line. Similarly when overbought conditions were recorded (green circles in the above graph) they were followed by selling pressure. We believe ARKK is nearing the top of its range for 2022.

What is the Trade?

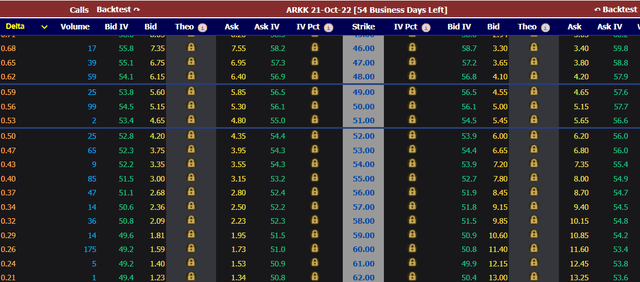

We propose selling an October 21, 2022 call with a $55 strike:

Doing this trade would give an investor a 10% buffer from current spot levels in terms of stock price appreciation before the call starts being in the money. Moreover the net breakeven price is actually $58/share, which equates to the $55 strike plus the $3 premium. The trade benefits from the high implied volatility in the front end of the curve and can generate an annualized yield upwards of 26% if not triggered.

An investor can permutate with various strike as per the below option chain, courtesy of Market Chameleon:

ARKK Option Chain (MarketChameleon)

The potential outcomes for the proposed trade are as follows:

Scenario 1: ARKK trades with a price lower than $55 on 10/21/2022

- if the stock ends up on the close of business 10/21/2022 with a price lower than $55 then the call option expires without getting triggered

- the investor ends up pocketing the $3,000 cash premium and realizes an annualized yield of 26.5%

Scenario 2: ARKK trades with a price higher than $55 but lower than $58 on 10/21/2022

- if the stock ends up on the close of business 10/21/2022 with a price higher than $55 then the call option gets triggered

- the net investor loss only starts occurring after a $58 price on the stock given the $55 strike and $3 premium received

- if the stock ends up on 10/21 with a price lower than $58 then the investor will still record a gain

- the exact gain will be dependent upon the exact stock price on 10/21 and will equal (58 – price) x 10 contracts x 100

Scenario 3: ARKK trades with a price higher than $58 on 10/21/2022

- if the stock ends up on the close of business 10/21/2022 with a price higher than $58 then the trade incurs a loss

- ideally the investor would start purchasing some ARKK shares if the price gets to $58 and above in order to delta hedge

- if no shares are purchased the call options are kept as naked positions then the loss will equal (price – 58) x 10 contracts x 100

- naked call options technically have unlimited loss potential since the stock (in theory) can go to infinity

- we do not think ARKK will go to infinity (nor beyond), nor do we think it is going to meaningfully recover this year, but this is our house view

Conclusion

ARKK is up almost +20% since its June 2022 lows. The rally has been fueled by oversold technical conditions and an erroneous market read on a potential Fed pivot on rates. We believe are approaching the top of the short term range in ARKK and the end of the bear market rally for tech stocks. Our proposed trade takes advantage of the high implied volatility for ARKK to monetize out of the money calls for the vehicle. The proposed trade leaves a 10% appreciation buffer for the ETF and provides for annualized yields exceeding 26% if the “house” view comes to fruition.

Be the first to comment