marchmeena29

Main Thesis & Background

The purpose of this article is to evaluate the BlackRock Floating Rate Income Trust (NYSE:BGT) as an investment option at its current market price. The fund’s objective is to “provide a high level of current income”, and it does this by investing primarily in senior secured floating rate loans made to corporate and other business entities.

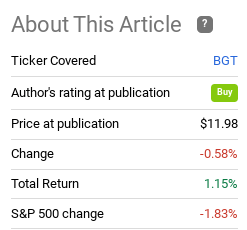

This is a fund I often consider for floating rate exposure, and have owned for a while. But I haven’t reviewed it since April, at which time I put a “buy” rating on the fund. Looking back, this turned out to be a reasonably good call:

Fund Performance (Seeking Alpha)

While these gains are relatively modest, we should consider the difficult market environment over the past quarter. With that in mind, a small gain seems more impressive. But what is most important is that I believe the macro-forces at work that allowed BGT to rise modestly are still in place. Therefore, a “buy” rating remains appropriate going forward in my view, and I will explain why in more detail below.

Investors Mostly Worried About Interest Rate Risk

To start the review I want to focus on a key reason why I think floating rate debt could be a decent equity hedge in the coming months. This has to do with the risks facing the market – with a focus on the perceived risks in the minds of investors. What I mean is, what are investors worried about right now, and how can we profit off that worry?

Not surprisingly, a key fear at the moment is rising interest rates. This has rattled debt and equity markets alike in 2022. While this story has been well known for a while, it remains an important theme because the Fed is expected to keep on hiking their benchmark rate. So while some market risks tend to dissipate over time, interest rate worries is one such risk that is not going away this year.

This is especially true in debt markets. In fact, in a recent survey of asset managers, investors, analysts, and executives, interest rates rising trumped credit concerns in terms of short-term risks in the market right now.

Biggest risk facing the corporate debt market (MLIV Pulse Survey)

What this means is, market participants are more worried about the impact of rising rates on their investments than they are about potential credit risk (defaults and delinquencies). This is striking given how the sentiment is felt across the board.

So, how does this impact BGT? In my view, it means that we should be buying into the areas that are protected against rising rates. This extends to BGT, and other floating rate funds by extension. Simply, BGT begins to earn more in income as interest rates rise, since the underlying debt re-sets at prevailing (higher) interest rates with time. So these debt products function differently than the fixed-rate realm whose prices decline when rates rise. With investors worried about higher interest rates impacting their portfolios, it is logical to expect them to rotate to the assets that would perform well in that type of environment. Therefore, I see buying BGT (and similar funds) as a way to front-run market forces as they re-adjust to account for primary concerns.

Valuation Still Attractive

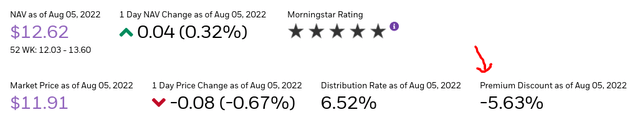

Digging into BGT specifically, valuation is a key component on why I would consider this particular fund for floating rate exposure. At current market prices, investors can buy into the fund for almost 6% less than what the underlying securities are worth at fair value. This presents a pretty nice risk-reward proposition in my opinion:

Of course, we should recognize that BGT often trades at a discount to NAV. So I am not suggesting the fund is going to just shoot higher from here and produce double-digit returns. But I am suggesting that this is a reasonable entry point, and only slightly more expensive than the 9% discount the fund had back in April. With the total return being positive since then, it stands to reason the discount would have narrowed a bit. Yet, I still see value here and expect this CEF to continue to be a reasonable way to play this space going forward.

Looking Elsewhere For Yield Has Risks

As my readers are aware, I have been lukewarm on fixed-rate debt for the majority of the past year. I hold almost no exposure in that realm, except for municipal bonds which I primarily bought for tax advantages. In the corporate space, I have seen little value in IG bonds, and that thesis remains intact today. Focusing on corporate bonds specifically, I would either buy high yield or floating rate assets (such as through BGT, which I own).

However, there are other ways to obtain yield. Investors can look overseas, for example, buying up developed or emerging market debt that produces stronger yields than domestic assets. Those have unique risks, but one benefit is diversification. On that front, I certainly would not discourage readers to at least take a look at what’s out there.

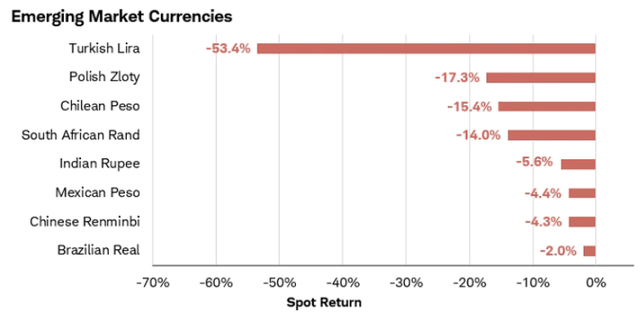

In fairness, I have as well, but the problem is after taking a look, I do not like what I see. One reason is that the value of the U.S. dollar continues to surge, driven by stronger than average growth here at home, as well as a more aggressive Federal Reserve. This has a profound impact on foreign markets, especially emerging market currencies and debt. The impacts are mostly negative, and for this reason, I would continue to avoid looking for yield internationally, on average.

To understand why, let us consider that the rise in the U.S. dollar is not an occurrence that happens in a bubble. When the dollar rises, that often makes other currencies less valuable. This is a theme that has been pretty consistent in 2022 across the globe:

Select Foreign Currencies Devaluation Against The U.S. Dollar (8/21 – 8/22) (Charles Schwab)

The implication here is that it is becoming more difficult for EM countries, and the corporations within them, to service their debt obligations. When their currency loses value, it means they need more of that currency to make good on their interest payments. This puts pressure on the fiscal standing of those issuers and challenges the forward outlook. Without a compelling catalyst to reverse the trend, I have to have a fairly negative outlook on this type of debt.

To reiterate, this is not what BGT holds. I am saying I like the idea of moving down the credit quality ladder domestically through funds like BGT because of the relative value. Rather than looking for yield overseas, the strength of the U.S. dollar has me looking closer to home. BGT is one such CEF that I am taking advantage of this trend with.

Do Not Ignore The Risks

Through this review, I have been fairly bullish. BGT has indeed been holding up reasonably well over the past few months and I see that trend continuing through the rest of 2022. However, I want to add my own word of caution here. Do I think this is a reasonable fund and do I have a positive outlook? Yes. But am I suggesting this is a “sure thing” and investors should take on a big position? No.

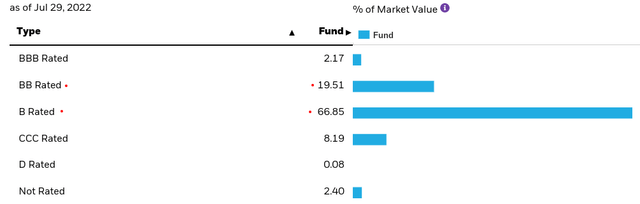

This is not meant to be contradictory, but rather cautionary. I see value here, but we cannot remain blind to the risks. BGT is useful in a rising rate environment, and the Fed is expected to keep that story intact over the next few months (at least). But readers should also remember BGT holds debt that is mostly below IG quality. This increases the credit risk of the fund and the potential for delinquencies and credit-related losses:

BGT’s Credit Quality (BlackRock)

As you can see, very little debt within BGT’s portfolio is rated investment-grade. This is not inherently “bad”, and it is the reason for BGT’s high income stream. But it does mean investors are taking on more risk to get this exposure, so we have to manage our expectations on what this means for the fund. With GDP growth registered negative the past two quarters, the U.S. could be facing a prolonged recession if conditions continue to deteriorate. This is not what I am expecting, but it is a risk. If that happens, leveraged debt of below-average quality is going to suffer. That could be trouble for BGT.

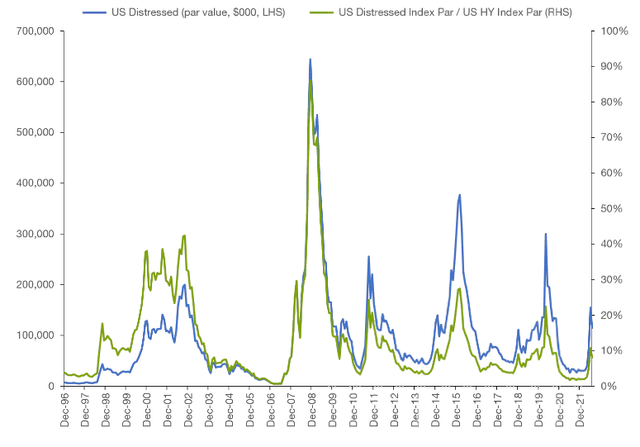

On this front, there are already some signs of weakening conditions in credit markets. The amount of distressed debt has risen, in terms of total volume and as a percentage of total debt outstanding:

Distressed Debt (High Yield Sector) (Lord Abbett)

The issue here is there are signs of deterioration in the credit space. More distressed debt means more interest payments are either being missed, debt is falling into default, or the expectation is a debt issuer is going to start missing payments. It is a combination of both worsening current conditions and/or a weakening forward outlook.

This does not mean there isn’t value in the high yield space. The U.S. economy in particular has shown how resilient it can be. That means there is value to buying in now if conditions improve (you are picking up debt for cheaper prices and then those prices will theoretically rebound). But it also signals to stay within a comfort zone. This means readers considering BGT should probably have an exit game-plan, or perhaps be buying selectively, or both. Given where we are in the economic cycle, now is not the time to be blind to risks.

Income Metrics Not Great, But Could Improve

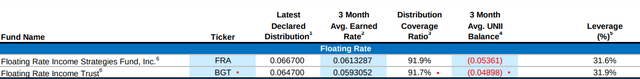

Expanding on that point above, the worsening high yield credit environment likely explains why BGT is having some difficulty covering its distribution rate. Given that we are in a rising rate environment, one would expect BGT to be earning more income and therefore be over-earning its current distribution level. Yet, the most recent UNII metrics show that BGT is struggling in this regard. It has a negative UNII balance and a coverage ratio near 92%:

This is also not meant to be alarmist. The coverage ratio is not terrible and while the negative UNII balance is a bit too large for my comfort, there is a chance BGT can make this income up going forward.

The reason is that the Fed has signaled it will continue hiking interest rates in the coming months, especially on the backdrop of a strong labor report from July. In fact, just over this past week, Fed Governor Michelle Bowman was direct in the opinion the Fed will need to keep on raising rates to contain inflation. As reported by CNBC, she was quoted:

“My view is that similarly sized increases (.75 basis points) should be on the table until we see inflation declining in a consistent, meaningful, and lasting way.”

What this means for BGT investors is that the underlying debt is likely to see their interest rates move higher still to wrap up the year. While income metrics are currently a bit weak, likely due to some underlying delinquencies, the rise in interest rates in the month ahead could counter-balance that. The most recent UNII report is strong enough that even a minor improvement in income collection will go a long way. With this backdrop, I am comfortable owning this exposure.

Bottom Line

BGT has provided my portfolio with a decent hedge against equities in 2022. This is a story I expect to continue for the remainder of the year. The performance has not been spectacular, but strong enough that it continues to look compelling against alternatives that have struggled in this macro-environment. With a discount to NAV and an income stream that could improve in the months ahead, I like BGT as an option to counter one of the biggest market fears right now – rising interest rates. With this mindset, I see no reason to alter my “buy” rating on this fund and suggest readers give BGT some consideration at this time.

Be the first to comment