Igor Kutyaev

MercadoLibre (NASDAQ:MELI) delivered another excellent quarter for Q2 of 2022, powered by accelerating growth in fintech. In spite of the challenging economic landscape, MercadoLibre is proving to have an exceptional ability to execute well under all kinds of conditions.

Going forward, expansion into the credit business is a double-edged sword that could have big implications on both sides.

On the risk side, providing credit to small merchants and consumers in Latin America is obviously very risky, especially because macro conditions in the region tend to be unstable. Even if MercadoLibre keeps executing at a high level in this market, it is not unreasonable to say that the market could have some reservations – at least in the short term – about this accelerating expansion into credit.

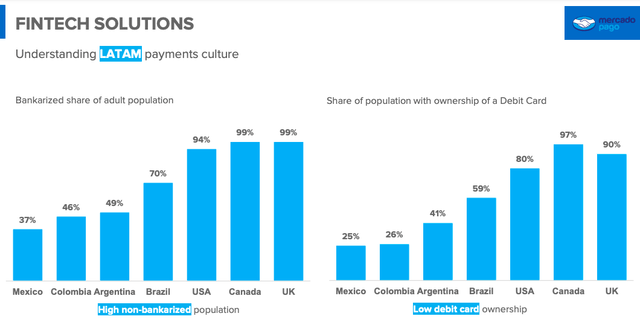

But it is also true that MercadoLibre has a massive opportunity ahead of itself in this market. According to 2020 data from The World Bank, an average of only 55% of Latin American adults have an account at a financial institution.

In many big countries, less than half of the population has access to bank services or even debit cards.

Many of these consumers and small businesses serving them are having their first access to financial services via MELI’s solutions. This can build an impenetrable moat around the company’s ecosystem over years to come.

MELI is managing the risk exposure to credit very well so far, but this is arguably the biggest factor to monitor in the investment thesis.

That aside, MercadoLibre is proving to be arguably the best tech company in Latin America, with the most seasoned management team and impeccable execution in challenging times.

The Commerce Business

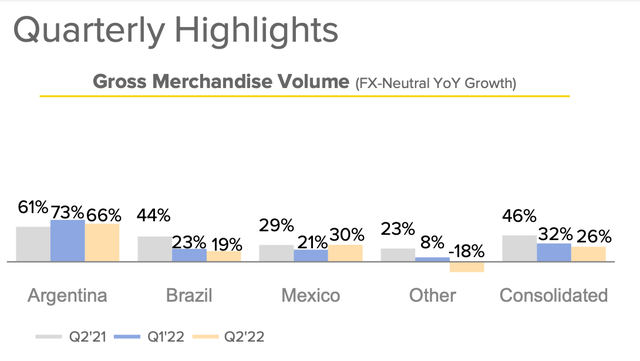

Management observed signs of a slowdown in online retail both locally and globally. However, growth rates remain comparatively elevated, close to pre-pandemic levels, but growing at this speed from a much higher rate, which is remarkable.

From the conference call:

We are seeing local and worldwide signs of online retail slowdown due to the normalization of mobility triggering shifts and constraints in consumer spending. However, our commerce platform is showing resilience.

Total gross merchandise volume (GMV) reached an all-time high, with over $8.5 billion dollars, growing almost 22% in U.S. dollars and over 26% on an FX-neutral basis. The company reached 40.8 million unique buyers in the second quarter.

MELI has aggressively focused on building a wide assortment of products on the platform, covering key categories such as auto parts and accessories, home decorations, consumer electronics, apparel and beauty, toys and entertainment, and groceries, among others. Fast, cheap, and reliable shipping makes a big difference for consumers.

Management does not disclose too much information about the advertising business, but this is increasingly looking like a big opportunity for MELI. The company said that they had “a significant increase in the number of total daily advertisers” in all geographies, combined with a consistent increase in the number of total ad clicks, which grew over 50% year-over-year on aggregate.

MercadoLibre has said multiple times that the advertising business is enormously profitable, with EBIT margins in the high 70s to low 80s.

The bullets below summarize revenue growth in advertising for different US players in this market. It is clear that Amazon (AMZN) is leveraging its data and strategic position to outperform traditional advertising players, and e-commerce companies are particularly well positioned in that regard.

MercadoLibre is probably making a similar move, and MELI is a solidly dominant player in Latin America.

- Amazon – 18%

- Snapchat (SNAP) – 13%

- Google (GOOG) (GOOGL) – 12%

- Pinterest (PINS) – 9%

- Twitter (TWTR) – 2%

- Facebook (META) – (1.5%)

In shipping, the company is focused on improving delivery times and driving cost efficiencies, especially in times of rising fuel prices. MELI is making improvements by creating faster connections between nodes of the network. For example, MELI Air is a partnership with aircraft carriers so that it can have dedicated planes for Mercado Envios, allowing MELI to deliver within two days in most large cities and capitals in the north and northeast regions of Brazil.

Similarly, the MELI Places network for package pick-up and drop-off is currently present in five countries and leverages a total of 6500 activated stores, more than 5000 of which are now enabled to accept returns.

Powerful Fintech Growth

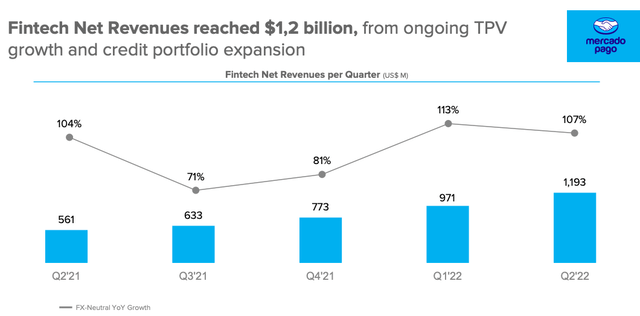

The fintech business is firing on all cylinders and even accelerating versus prior quarters.

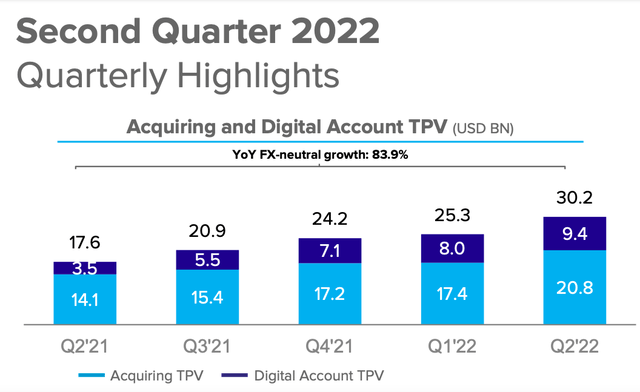

The payments processing and acquiring business delivered a total payment volume of over $30 billion dollars, growing 72% on a USD basis and 84% on an FX-neutral basis. Digital account TPV reached $9.4 billion dollars in the second quarter, growing 167% on a USD basis and 189% on an FX-neutral basis.

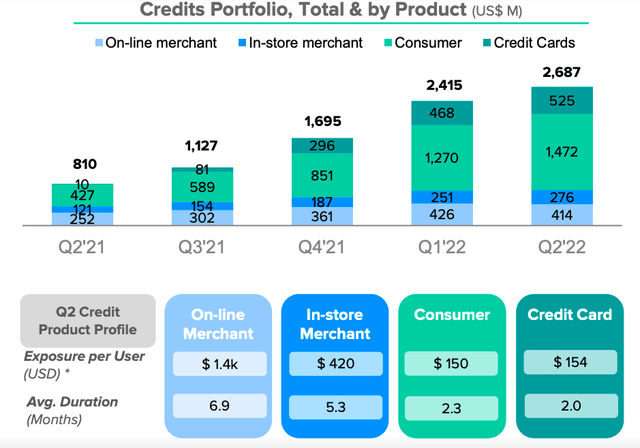

The credit business is a particularly relevant driver to watch. The business closed the second quarter with a portfolio of $2.7 billion, of which about 55% were consumer loans and 20% is the credit card book.

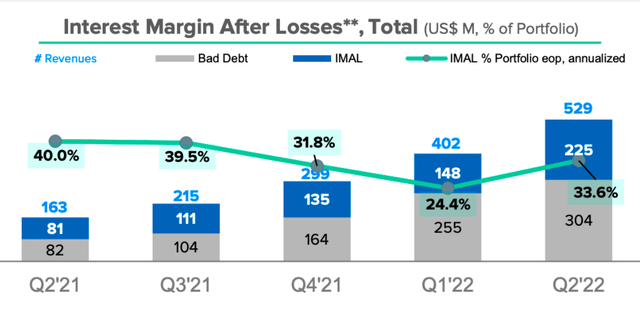

MercadoLibre’s credit business has historically operated with annualized interest margins after provision for doubtful accounts (IMALs) of over 30%, reaching almost 34% in the second quarter.

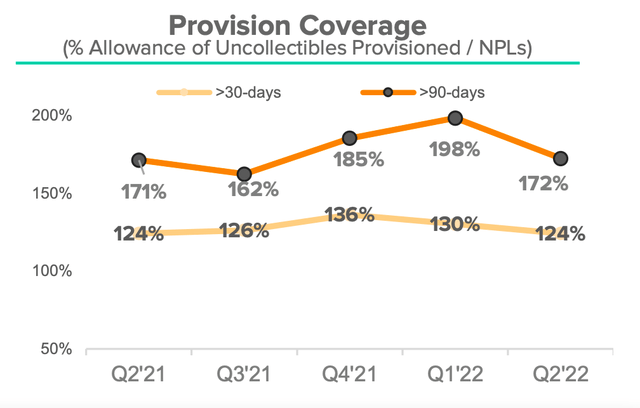

The non-performing loan ratio reached 31.4% this quarter, growing mainly in the over 90-day cohorts, while the 1-90 day NPLs remain at 13.2%, similar to previous quarters. This is a big number, but not unexpected for this kind of business in Latin America.

More importantly, these levels of nonperforming loans are well provisioned and reflected in the consistently high and profitable IMAL spreads. The allowance for doubtful accounts coverage ratios was over 170% in the second quarter for loans over 90 days past due, which is above the industry average.

In very simple terms, non-performing loans are very high, but the company is still making big profits after loan losses, and bad loans are adequately contemplated on provisions. It is critical for MELI to keep managing this risk well.

Credit is a big piece of the ecosystem, providing more opportunities for merchants and buyers, facilitating transactions, and deepening MELI’s relationship with users in commerce and fintech.

Management provided some insights to explain why they think that they can continue growing in credit while also adequately managing risk.

First, the business model is highly atomized – on the consumer side, we are offering consumer credit to nearly 10 million users with an average exposure of $150 dollars per individual. Second, the loans are short in duration, which means we can constantly adjust our risk assessment and user scoring models to determine the price and risk appetite of the next loan based on recent user behavior, which we can gauge quickly through data collected on our platform’s several touchpoints.

Finally, the credit books are managed on granular sub-segments to observe risk and default trends for similar groups, and these models are constantly retrained to reflect past learnings of default triggers. In the current context, our models, and our team’s experience inform our decision to keep growing the credit book, albeit at a slower pace to mitigate potential macroeconomic risk while sustaining our average margin ratios.

It is very important to emphasize that offering credit to low-quality borrowers in Latin America is exceptionally risky, and even more in this environment. However, MercadoLibre is doing it very well so far. The company is in a unique position to do so, and the reward could be massive over the long term.

It is positive that the company disclosed more information about the credit business this quarter, as this could provide more transparency and dissipate some concerns among the analysts following the stock.

Profit Margins

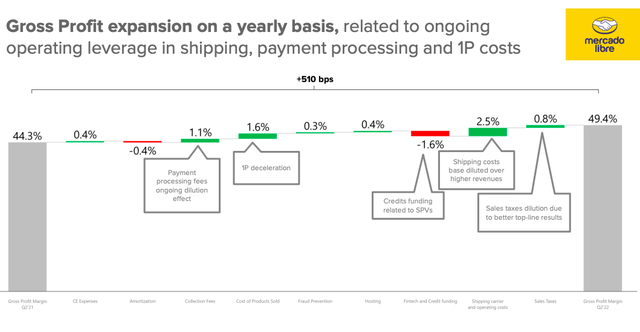

Gross profit margins expanded from 44.3% to 49.4%, this is due to multiple factors, a growing business scale allows MELI to dilute costs for shipping, payment processing fees, first-party product costs, customer service operations, and fraud prevention investments.

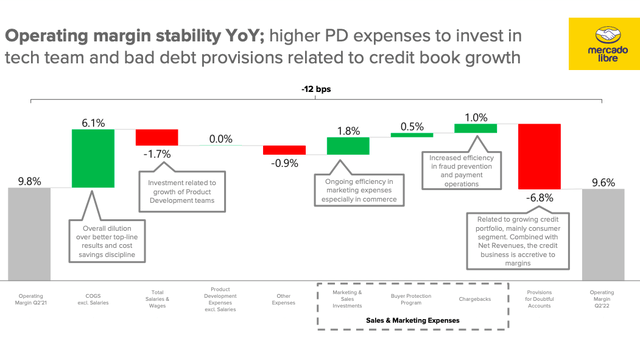

The operating margin remained stable year over year at 9.6%. There was an increase in product development costs, and the provision for credit losses had a negative impact on expenses, even if the credit business is accretive to margins when considering the revenue effect.

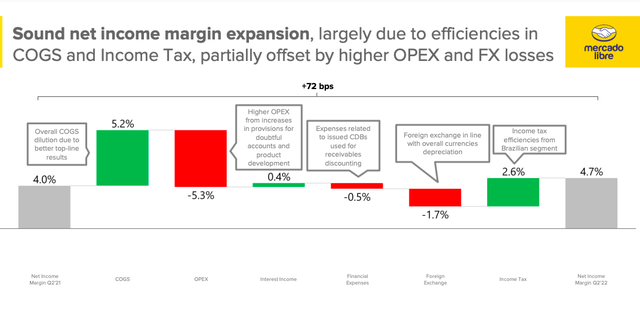

MercadoLibre delivered a modest net profit margin of 4.7%. This is a nice balance in my perspective, clearly in the green with positive earnings and cash flows, but also investing actively for growth in logistics and product development.

Compelling Valuation

MercadoLibre is attractively valued for a growth leader with a dominant market position in its main markets and a profitable business model executing at a high level.

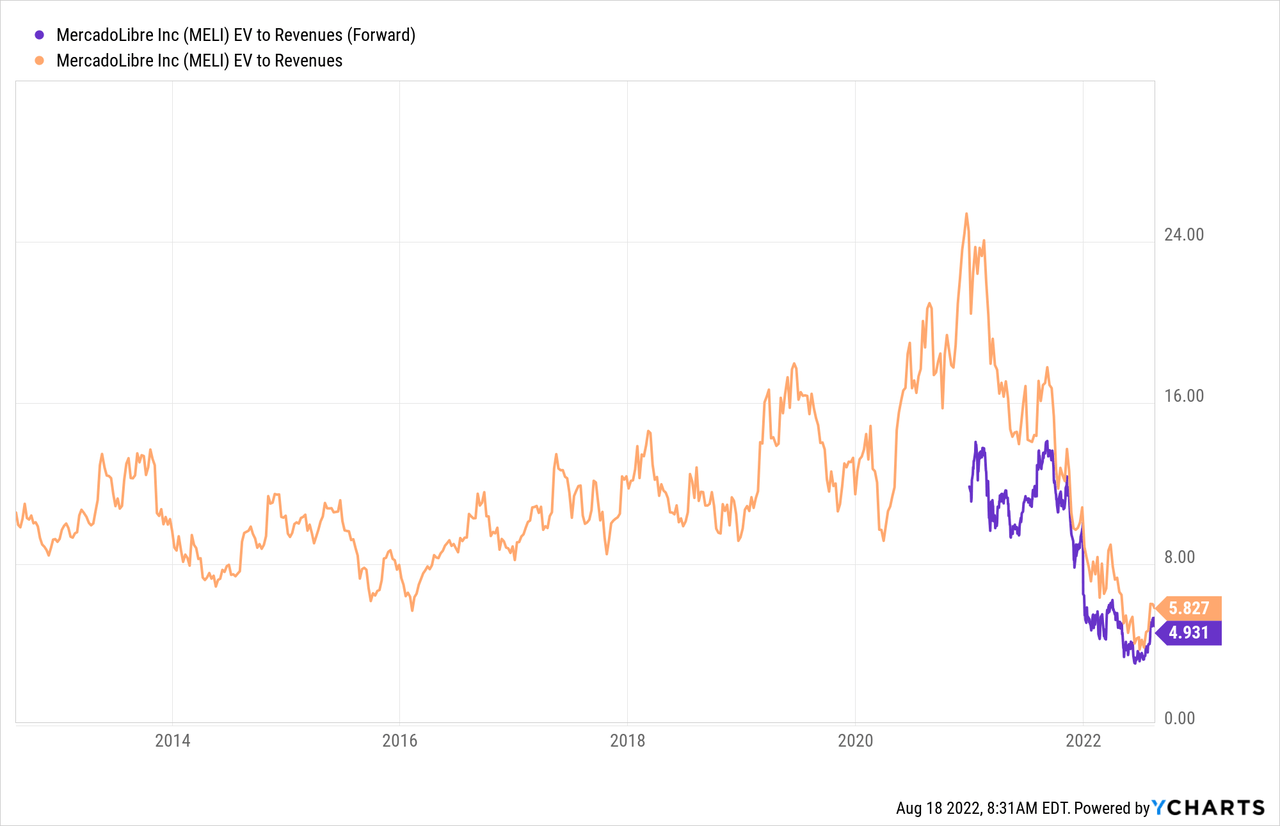

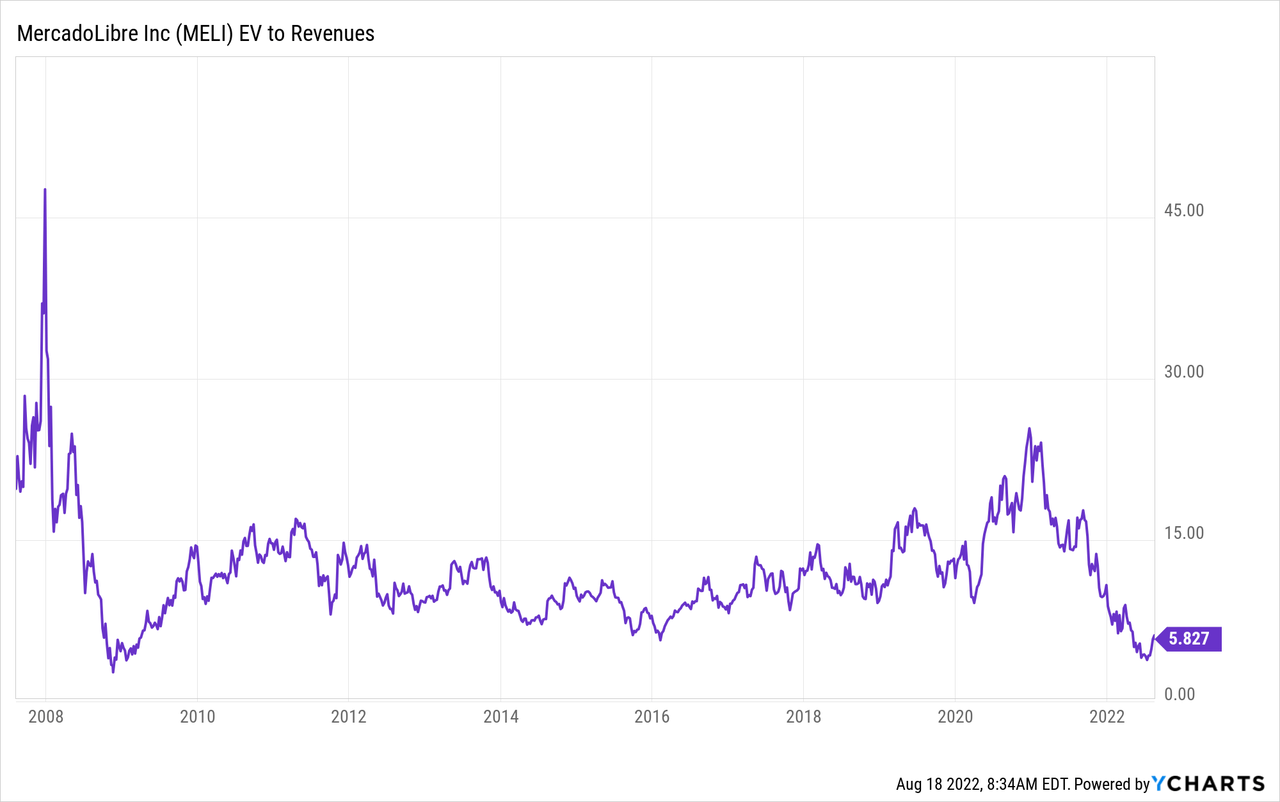

The forward EV to Revenue ratio is currently around 5, while it has been around 9/10 on average over the long term.

We need to compare valuations versus those of the Financial Crisis in 2009 to see MELI trading at such cheap levels. At that time, the global financial system was collapsing and MELI was a recent IPO from Latin America, with a much smaller and fragile business model.

Going Forward

Brazil has presidential elections in October of this year, and Argentina is going through another economic crisis. MercadoLibre is doing spectacularly well considering the circumstances, but the macro risk affecting the company is very real. Now that MELI has reported excellent numbers in spite of macro headwinds, investors could be disappointed if they see any macro-related weakness in the months ahead.

The expansion into credit has enormous strategic value, but it also exacerbates macroeconomic risk in a convoluted economy.

That said, MercadoLibre is executing exceptionally well. Revenue growth is outstanding in spite of challenging comparisons and economic headwinds. The company is solidly profitable and it is building rock-solid economic moats via the network effect, technology, logistics, and credit.

All this comes for a cheap valuation, MercadoLibre is not too far away from historical lows when considering valuation ratios based on revenue.

The long-term upside potential in MercadoLibre should more than compensate for the risks over the years ahead.

Be the first to comment