Jerod Harris/Getty Images Entertainment

Introduction

Sonos, Inc. (NASDAQ:SONO) products are highly regarded for both the quality of materials and sound and their design. The speakers have become a piece of furniture and almost a must. With the various streaming services the consumption of digital media has increased significantly and the excellent results obtained by Sonos and other companies show that there is attention to these products, as the sound quality improves the experience of when you watch a movie or play music.

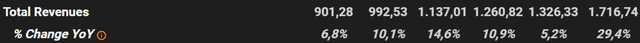

The last quarter was very disappointing. Analysts and management expected much better results for the quarter and for the full fiscal year. The outlook for FY2022 predicted growth between 14% and 16% compared to 2021 bringing the company’s revenue to $ 2 billion at best, after the third quarter results management expects to achieve revenue between $ 1,730 and $ 1,755 billion, a completely different scenario than the previous one since we are talking about growth between 1% and 2% (4% -5% on a constant currency basis). The only comment I feel I can make is that the management expected too much, probably after an extraordinary year like FY2021 where the revenues recorded a growth of 29.4%, they are under the illusion of being able to achieve excellent results even in 2022 without consider the changing economic scenario and consumer demand for this category of products.

As I mentioned before, speakers are almost considered furniture products given their aesthetic component and the fact that they must be positioned in plain sight. It is therefore in my opinion reasonable to think that the demand for these products is comparable to that of furniture. When a management decides to issue guidance I always prefer it to remain conservative even at the cost of disappointing analysts, rather than thrilling investment banks with forecasts above expectations and then backtracking once they come to terms with reality.

Regardless of the latest quarterly report, I believe that Sonos is an interesting company to analyze and with this article I want to try to understand if after the collapse of 25% of the shares and with the new growth prospects it is also a possible purchase. I have already expressed my doubts regarding the latest results and I do not want to dwell on them any longer because I believe that there is not much more to comment than the numbers released by the company, I will focus more on the business model and on the strengths and weaknesses that characterize Sonos and then try to evaluate it.

Business

In October 2021, SONOS devices worldwide were 37.1 million registered in about 12.6 million homes after 1.7 million were added in the course of 2021. Sonos produces various kinds of speakers, starting from soundbars to up to portable speakers, but the feature that unites these different devices is the software and therefore the ease with which they interconnect with each other and communicate. On average there is 3 Sonos devices per household, in fact once the decision to buy the first speaker has been made the choice to buy the next ones will most likely fall among the models of the same brand thanks to the fact that they are compatible with each other and it would become uncomfortable have devices from different brands.

Sonos brand is internationally recognized for the sound quality and design of its products. It is positioned in different segments of the market both for the price of its products and for the type. In fact, in the catalog we find portable wireless speakers, home theater products, amplifiers and also products made in collaboration with Sonance called “Sonos Architectural” which concern ceiling, wall or outdoor speakers, as well as products in partnership with other brands like IKEA or Audi.

2021 revenue is 48.1% generated outside the U.S., and customers who had previously purchased a Sonos product accounted for approximately 46% of the new products registered. These are excellent data, they mean that the quality of the products is appreciated and that a link is created between consumers and the brand that pushes them to buy company products again. They have created an ecosystem around physical products that can keep people inside and are timidly trying to do the same with digital services like Sonos Radio or Sonos Radio HD, undoubtedly marginal business parts at the moment.

Let’s now analyze some numbers and evaluate if Sonos is also interesting in terms of the financial aspect. From 2015 to 2021, Sonos’ revenue doubled from around $ 843 million to $ 1,717 billion, gross margin hasn’t changed much over the years, we’ve seen a 2021 high of 47.2% and a low of 41.8 % in 2019, the long-term goal of management is a margin that is between 45% and 47%. As far as the operating margin is concerned, we find a completely different scenario, in fact it can be said that the company operated in balance from 2018 to 2020 (slight loss), on the other hand, a clear improvement was seen in 2021, where the operating margin was 9,8%, above all thanks to the significant growth in revenues. Previously, in fact, the gross profit was enough to repay the expenses of R&D and SG&A. Cash from Operations has always been positive and has had a strong improvement in 2019, going from $ 30.57 million to $ 120.64 million, in 2021 it was outstanding hitting $ 253 million. Since 2015, Capex have decreased taking the FCF from negative to positive by $ 207 million in 2021 with a FCF margin of 12.1% (7.7% in 2019, 9.7% in 2020).

As far as the Balance Sheet is concerned, we are facing an excellent situation, the company has in fact Total Liabilities for $ 600 million and $ 400 million in Cash. From the data I have provided you can immediately see that the company’s profitability history is very recent and it may therefore be difficult to get an idea of the results it can achieve in the future. However, I believe that Sonos has now reached a critical dimension that will allow it to maintain profitability, as previously mentioned the customer base is solid and loyal to the brand and I therefore see a collapse of sales in the near future very unlikely.

The management expects to be able to reach an Adjusted EBITDA margin of 15% -18% after 2024, in 2021 stock-based compensation represented about 3.6% of revenue, we can therefore say that approximately the EBITDA margin can be around between 11.5% and 14.5% and the Operating margin between 9.5% and 12.5%. Take these estimates with caution, the weight of stock-based compensation could vary in ways that I can hardly predict, what interests me is not so much to find the precise margin but to get an idea of what they could be, assuming a wide range in order to evaluate the business.

Market

The market in which Sonos operates is very competitive and fragmented. We find very important brands such as Bang & Olufsen, Bose, Samsung, Sony and in recent years Amazon can also be considered competitors with its Alexa, Apple and Google devices. The products of the last three companies that I have mentioned are normally of lower quality than those of Sonos or those of other important players but they have had a wide diffusion also thanks to the low price, given the fact that they have the function of letting the user in the ecosystems of their respective companies which can therefore afford not to be profitable on the sale of these products.

Although Sonos has shown over time that it can acquire new households even while increasing the prices of its products, I do not see a clear and solid competitive advantage over other competitors such as Bose or Samsung that offer products of excellent quality and at similar prices. So while I don’t have many doubts about the fact that Sonos once acquired a customer can keep them in its ecosystem, I have a few more concerns about acquiring new users.

Valuation

Evaluating Sonos isn’t as simple as you might think. In addition to being uncertain about margins, I have doubts about what future growth could be. Management’s old goal of reaching $ 2.5 billion in revenue by 2024 seemed ambitious to me even before they presented their third quarter results, now they have said they will reach that goal after 2024 without giving a specific deadline. Growth rates have been mixed in previous years, as might be expected given the nature of the products sold.

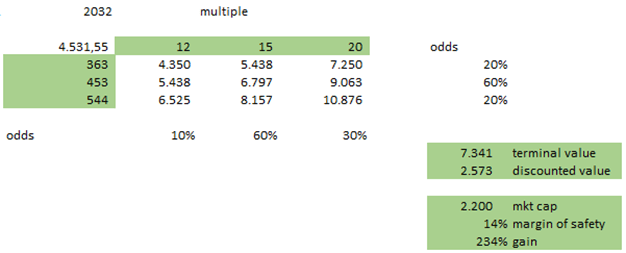

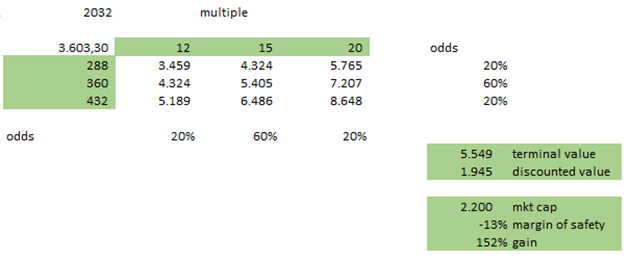

As regards the growth in turnover, I will consider two scenarios, the best of which reflects the expectations of management:

- Growth best case: CAGR 12% until 2027 and 8% until 2032

- Growth base case: CAGR 9% until 2027 and 6% until 2032

For the margins I will use three different net income margin hypotheses:

- Best case: 12%, P/E 20

- Base case: 10%, P/E 15

- Worst case: 8%, P/E 12

Using a 10% discount rate these are the results I get:

Growth Best case:

Author’s estimate

Author’s estimate

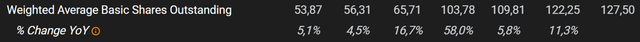

As you can see at the moment, Sonos seems to be well priced in the best growth case I’ve considered, slightly overrated in the second case. Am I too conservative in my estimates? Maybe, but I don’t feel confident considering a possible investment in Sonos considering higher rates. Based on my assumptions, we could say that by buying Sonos at current prices we could get a 10% return for the next 10 years, not bad but I have not considered the dilution of the shares.

Even if a share repurchase plan is in place, this is not enough to bring down or keep the number of shares constant. Assuming that the shares over the next 10 years will increase on average by an annual 3.5%, we will arrive in 2032 with 179.85 million shares in circulation (the weighted diluted shares outstanding would be even more). In the first case, the market cap we get is $7.3 billion in the second $ 5.5 billion, taking into account the dilution we would have $ 40.60 per share or $ 30.60, this would lead to much more modest returns.

Risks

I have already pointed out my main doubts about the Sonos’ business, but to sum it all up more clearly, I will talk about what is currently preventing me from adding Sonos to my portfolio. The first and main doubt is the fact that the company only became profitable a few years ago, also from the point of view of the FCF which became relevant only 3 years ago. This makes it difficult for me to imagine what the long-term margins will be, not least because 2021 has been an extraordinary year that is extremely favorable for the products sold by Sonos. I believe Sonos can keep its customer base close, the brand is strong, and the products are great, but I find it hard to find a clear and strong competitive advantage over competitors like Bose. For this reason, I don’t know how much it will be able to grow in the coming years in terms of new households.

Conclusion

From the last paragraph it may seem that the main risk of an investment in Sonos is uncertainty. Well, as Mohnish Pabrai’s estimator, I believe that uncertainty is a real risk only in some cases. In determining whether uncertainty is a risk or not, you must pay attention to the price of the asset in which you want to invest. If the price is low enough to price the worst possible case, then uncertainty is a factor to our advantage. We buy the asset at a very low price and fair for the terrible scenario that is considered the most likely, but if this scenario does not occur, we could get really high returns running the risk of losing little capital.

Sonos is currently rated for a normal scenario, and in this case, the level of uncertainty I perceive can hurt me in several cases. With the same fundamentals to make a first entry into Sonos I would prefer to wait for $14 per share if not less. At the end, Sonos for me is a “hold,” it is a business that interests me and I realize that the doubts I have may be personal and that someone else might think differently.

Be the first to comment