Victor Fraile/Getty Images Entertainment

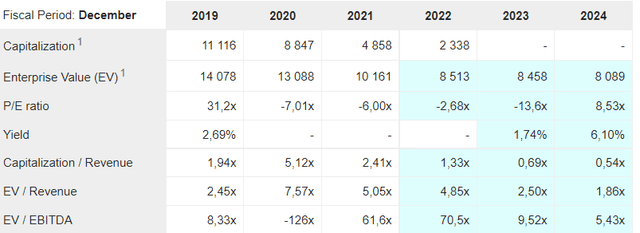

Looking through the industry-wide gross gaming revenue (GGR) weakness in recent quarters, I continue to see the long-term value in Melco’s (NASDAQ:MLCO) leadership in the lucrative Macau premium mass segment. Plus, the company retains a collection of high-quality assets that ensure ample room for future upside as it capitalizes on an eventual GGR recovery in the coming years. In the meantime, MLCO has done a great job on cost-cutting and given some of these cuts are structural, expect the EBITDA margin improvement to sustain over the long run as well. At the current valuation of ~5x FY24 EV/EBITDA, the stock trades at a wide discount to historical levels, presenting compelling re-rating potential from here. The key near-term catalyst remains the US-listed depositary receipt (ADR) delisting issue – with MLCO actively exploring mitigating measures such as an auditor change and a Hong Kong listing, positive progress on addressing the delisting risk could drive a re-rate.

MarketScreener

COVID Restrictions Weigh on Q2 2022 Results

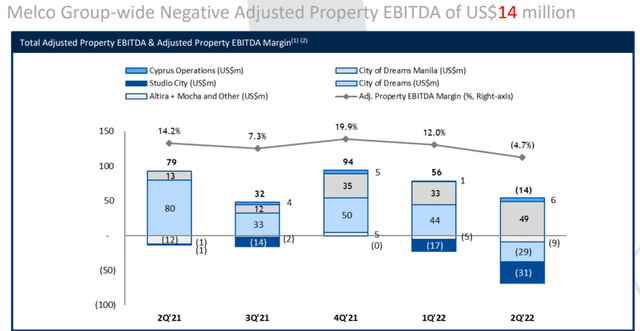

It came as no major surprise that MLCO’s Q2 2022 results was below par, with a – $13.8m EBITDA loss (vs. +$56m EBITDA in Q1 2022) headlining the print. Adjusted for luck factor (i.e., the casino’s take per dollar of rolling chip volume), the EBITDA loss would have been wider at -$16mn (vs. a $48m EBITDA in Q1 2022), as Macau activity suffered from the impact of travel restrictions amid the Omicron outbreak across China. Of note, Macau mass table GGR stands at only 14% of the pre-COVID base (or down ~60% QoQ), while the VIP rolling chip was even lower at ~4% (or down 76% QoQ). All things considered, the hold-adjusted EBITDA loss of ~$27m (including a ~$2m hold benefit) at City of Dreams Macau was a decent result. The good news, though, is that MLCO has further reduced its daily opex to $1.7m (down from ~$1.8m in Q1 2022 and ~$1.9m in Q4 2021), highlighting its flexibility on the cost side.

Melco

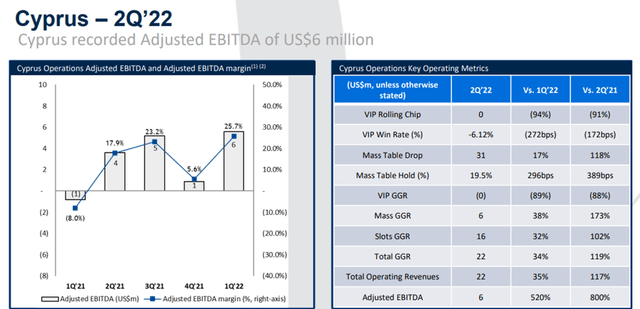

Results in the Philippines operation was better, as City of Dreams Manila saw a continued GGR recovery at >60% of pre-COVID levels (vs. ~54% in Q1 2022), matching key peer Bloomberry’s (OTC:BLBRF) quarterly performance. Key drivers include a solid increase in VIP volume and mass GGR, as the property continues to operate at full capacity. Benefiting from the government reducing the COVID alert to its lowest level, the revenue growth is flowing through the P&L as well, with EBITDA up ~31% QoQ to $46m. Similarly, the Cyprus operations reported EBITDA expansion to ~S$6m (vs. ~$1m in Q1 2022) on a GGR recovery back to pre-pandemic levels following the loosened travel restrictions since mid-April.

Melco

Cautious Guidance Maintained Amid Macau Uncertainty

Understandably, MLCO’s commentary was cautious on the call. Thus far, the post-COVID lockdown recovery has been slower than expected in the last two weeks (though Macau’s GGR did improve over the period). While Q3 could be difficult, there are seasonal tailwinds in Q4, including the October Golden Week, which could add some cheer on a potential demand recovery. Still, management has lowered expectations, guiding that the process will still be slow and dependent on the outcome of the upcoming National Party Congress Meeting.

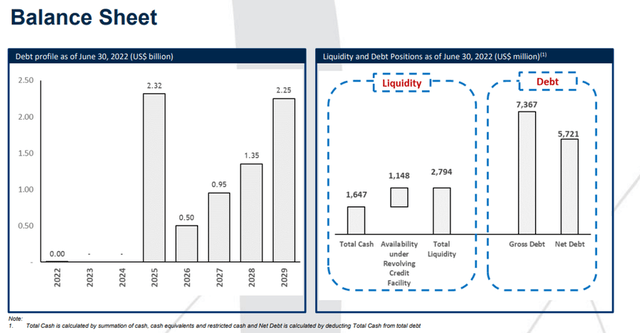

Given the low visibility into a future demand recovery, the company is continuing to control what it can – this means an emphasis on cost control, with daily opex set to be even lower than the ~$1.7m run rate in Q2. Post-repurchase (~10m shares and ~25m ADRs), MLCO’s balance sheet is also as strong as ever, with a total liquidity of ~ $2.8bn (comprising ~ $1.65bn of cash and ~ $1.15bn from available facilities) as of quarter-end. The solid liquidity position and burn rate bodes well for the MLCO runway, while the normalization of City of Dreams Manila and Cyprus should offer additional support. Finally, the reduction of the overall budget of the Studio City Phase 2 project over the course of a smooth construction phase significantly alleviates the capex outlook, with only ~ $250m left to be incurred this year.

Melco

Auditor Change to Address the ADR Delisting Overhang

On another positive note, MLCO management is actively working to address any potential delisting of its US-listed ADR, most recently changing the auditor to EY Singapore (from EY HK). The change is a positive step, in my view, reflecting not only a broader diversification effort to minimize business risk, but also a multi-step process to address the SEC’s concerns (note Singapore isn’t named in the SEC’s ‘Holding Foreign Companies Accountable Act’ (HFCAA) regarding audit requirements). Plus, the move should placate the Public Company Accounting Oversight Board (PCAOB) by removing any access hurdles to accessing audit records. For MLCO, Singapore also offers good connectivity to its Philippines operations, along with its Hong Kong office and Macau operations. Coupled with a potential secondary listing in Hong Kong (still in the works), I see a clear path to MLCO addressing the ADR delisting overhang going forward.

Fundamentals Remain Solid Through the Headwinds

While MLCO is in an EBITDA loss-making position, signs of stabilization in its overseas operations and a Q2 2022 revenue recovery to ~60% of pre-COVID levels bode well for the outlook. A meaningful recovery of Macau gaming demand is still far from certain anytime soon, though, as travel sentiment has yet to recover following the recent travel restrictions in the Greater China region. Yet, MLCO’s balance sheet is as strong as ever – the available liquidity position stands at a solid $2.8bn as of Q2 relative to the current opex run-rate of $1.7m per day, implying an over two-year runway in a near zero revenue environment. In the meantime, the timing for a resolution of the de-listing overhang is key to a near-term re-rating, along with a business recovery outside of Macau. At the current discounted valuation of ~5x fwd EV/EBITDA, though, investors get a wide safety margin on this turnaround play.

Be the first to comment