tawatchaiprakobkit

Danaos (NYSE:DAC) is a shipping stock that was a huge beneficiary of the pandemic, as the stock is up over 20x since pandemic lows and 6x from pre-pandemic levels. Yet there may be more upside to be had here – while investors might typically shy away from such hyperbolic stock price moves, the past few years have led to a dramatic transformation in the company’s balance sheet and consequently, its capital allocation policies. The net debt position is coming close to zero, increasing shareholder hopes for large dividends and share repurchases. There however remains some uncertainty with regards to what management will choose to do moving forward which is arguably due to the structure of the management contract.

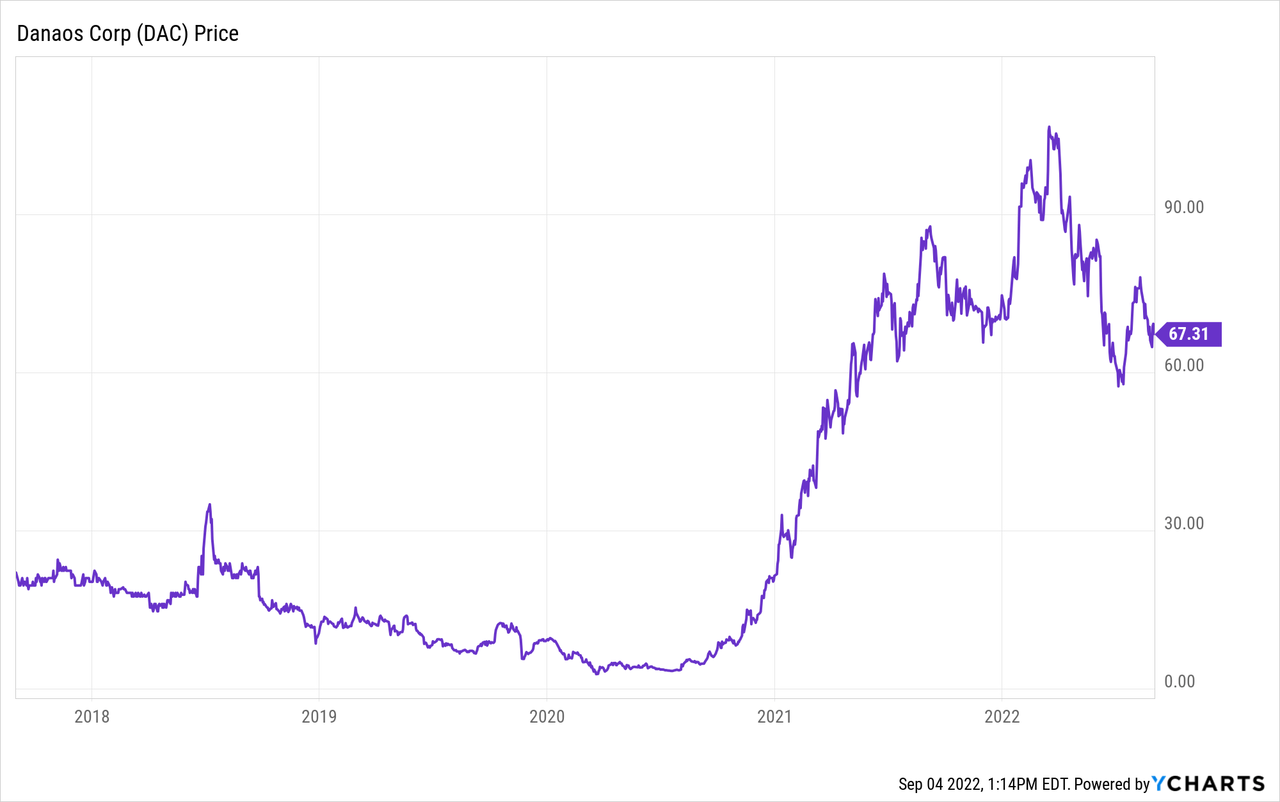

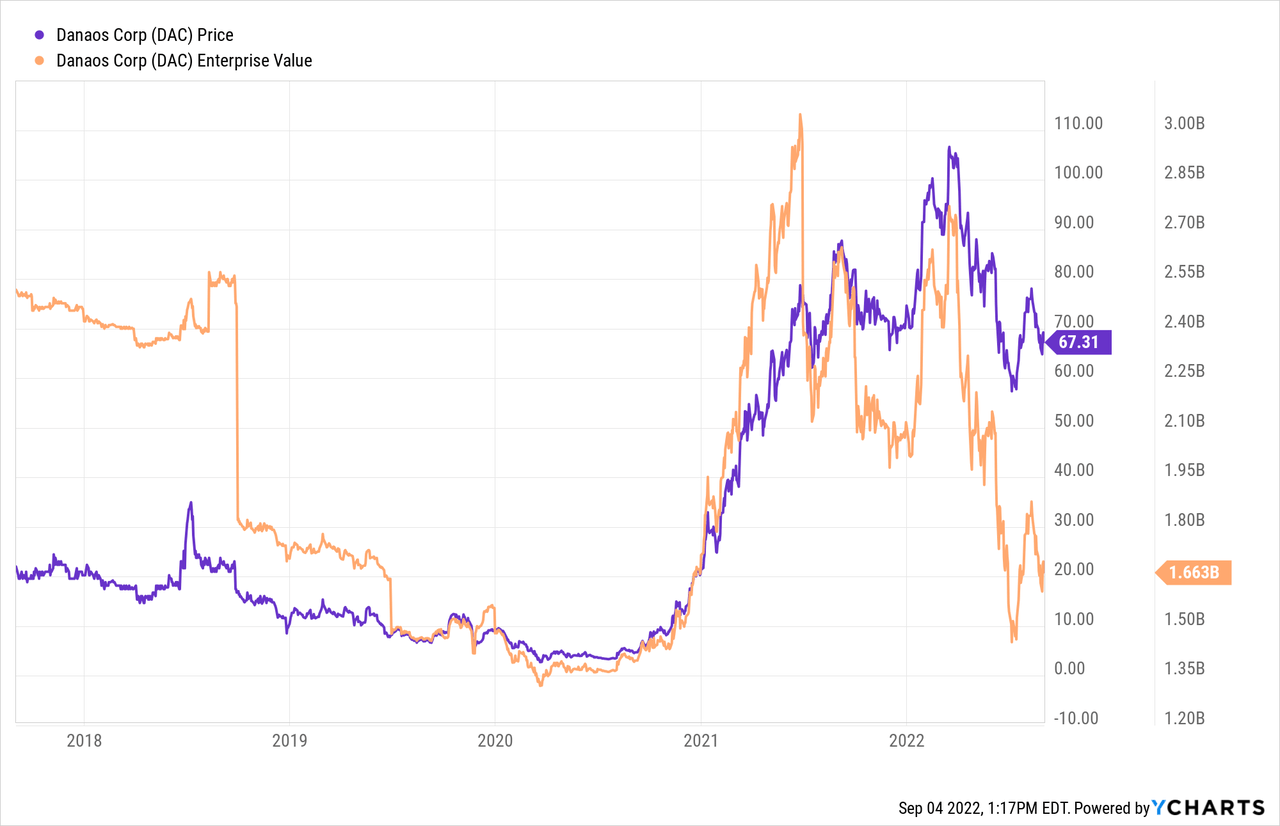

DAC Stock Price

DAC traded around $9 per share before the pandemic and crashed below $3 per share during the pandemic crash. The stock is a tad higher now.

While DAC is down 37% from highs reached earlier this year, the stock is still over 20x higher than pandemic lows. It may be uncomfortable to chase the stock after such a performance but we should focus on the fundamentals instead of the tape.

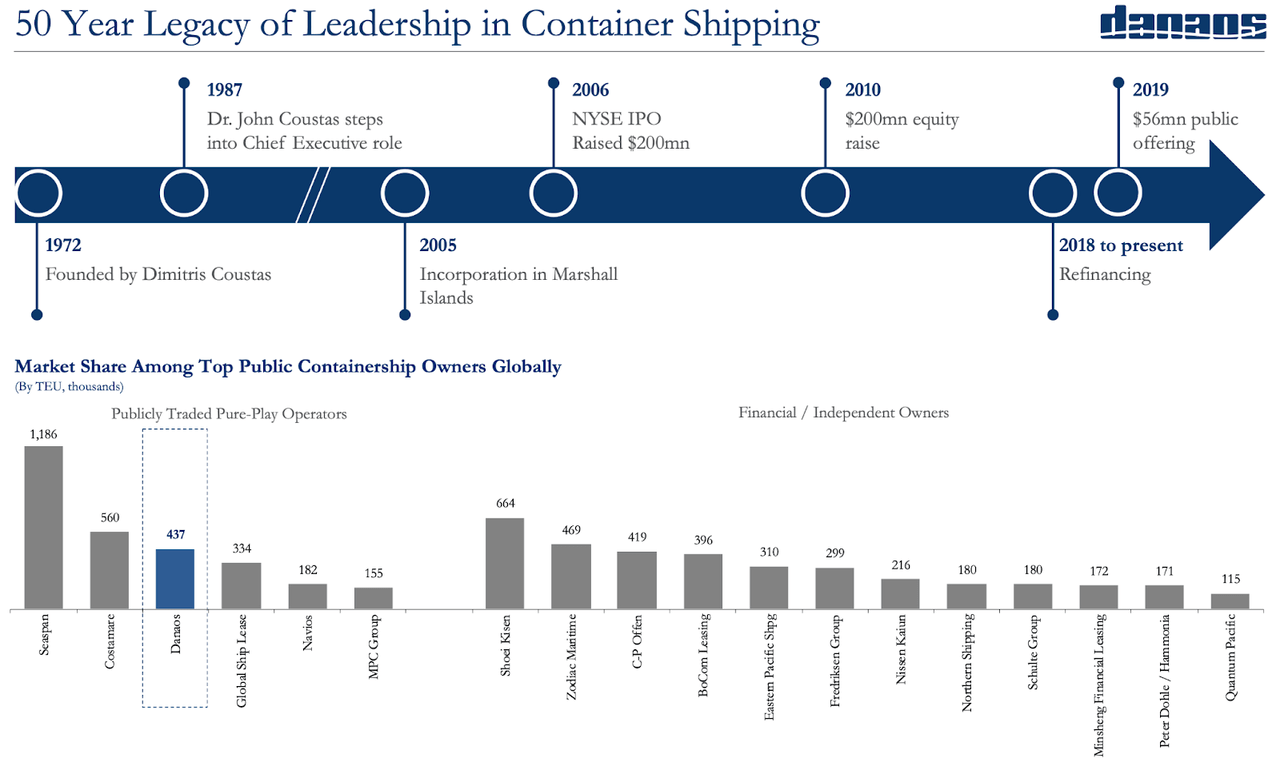

What is Danaos?

DAC has long been a leader in the container shipping industry with one of the larger fleets (by TEU) globally.

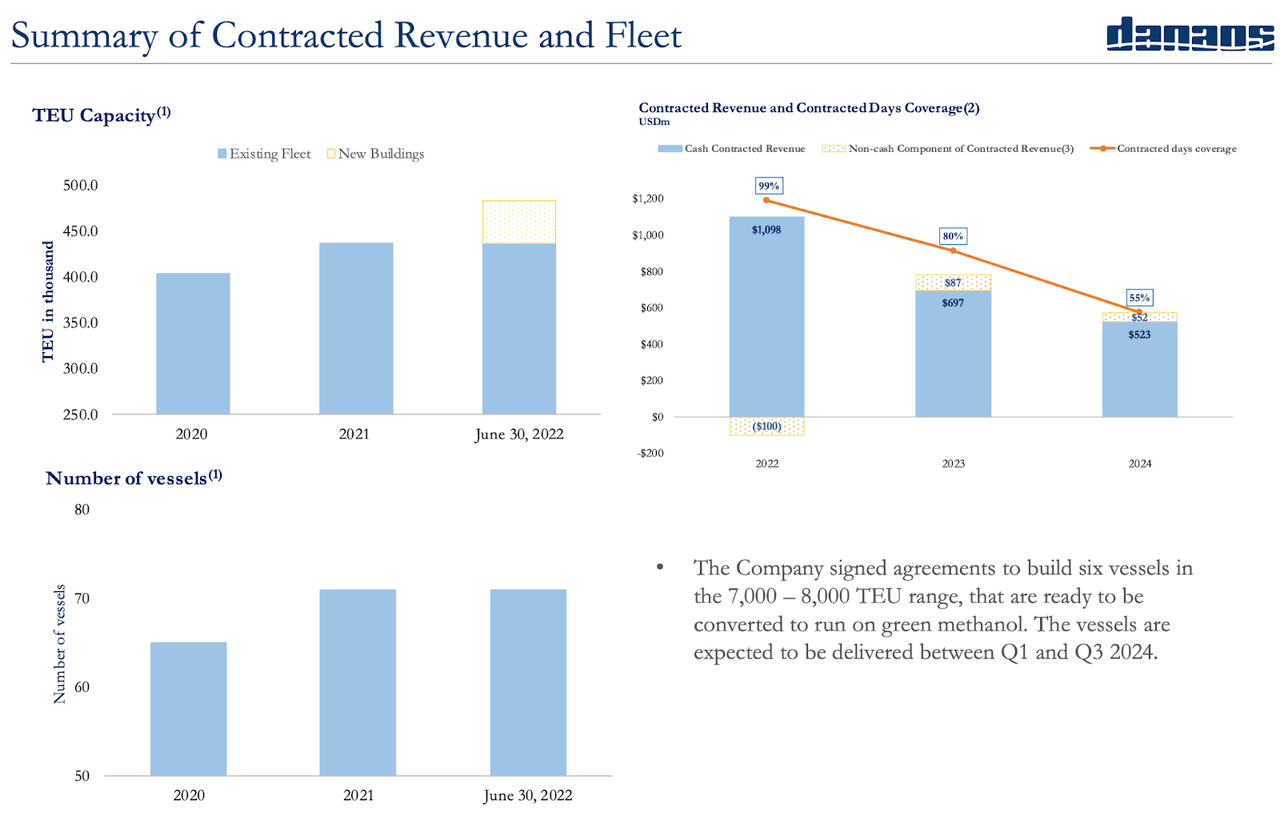

2022 Company Presentation

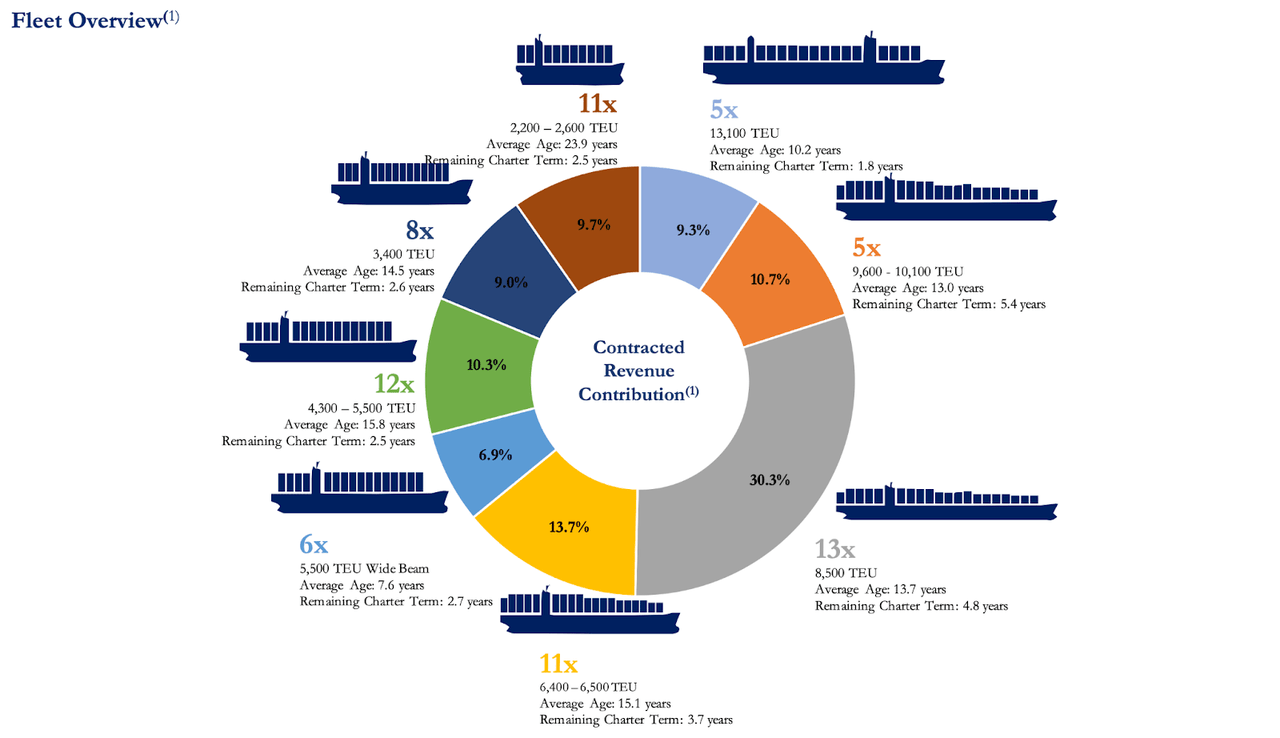

DAC had 71 containerships as of the end of the quarter spread across a variety of sizes.

2022 Company Presentation

Readers might be more familiar with ZIM Integrated (ZIM), a shipping stock which has paid nearly 200% of its IPO price in dividends since 2021. What’s the difference between ZIM and DAC? ZIM charters its containerships from DAC – this means that DAC owns the containerships and leases it out to ZIM. ZIM pays DAC contracted rates but can earn unlimited upside based on spot market prices. In return for the lower upside, DAC’s cash flows are more stable and can be somewhat compared with that of landlords. DAC is kind of like a “shipping landlord.”

That said, one must note that the comparison is not totally accurate. DAC outlines their relationships in its 20-F filing as follows:

Under our time charters, the charterer pays voyage expenses such as port, canal and fuel costs, other than brokerage and address commissions paid by us, and we pay for vessel operating expenses, which include crew costs, provisions, deck and engine stores, lubricating oil, insurance, maintenance and repairs. We are also responsible for each vessel’s intermediate and special survey costs.

That leads to substantial operating expenses for the company in the form of crew costs and maintenance costs (retail landlords do not typically pay for the employees in retail stores). Still though, the stability in its cash flows may make it a potentially less risky investment idea in the shipping universe.

DAC Stock Key Metrics

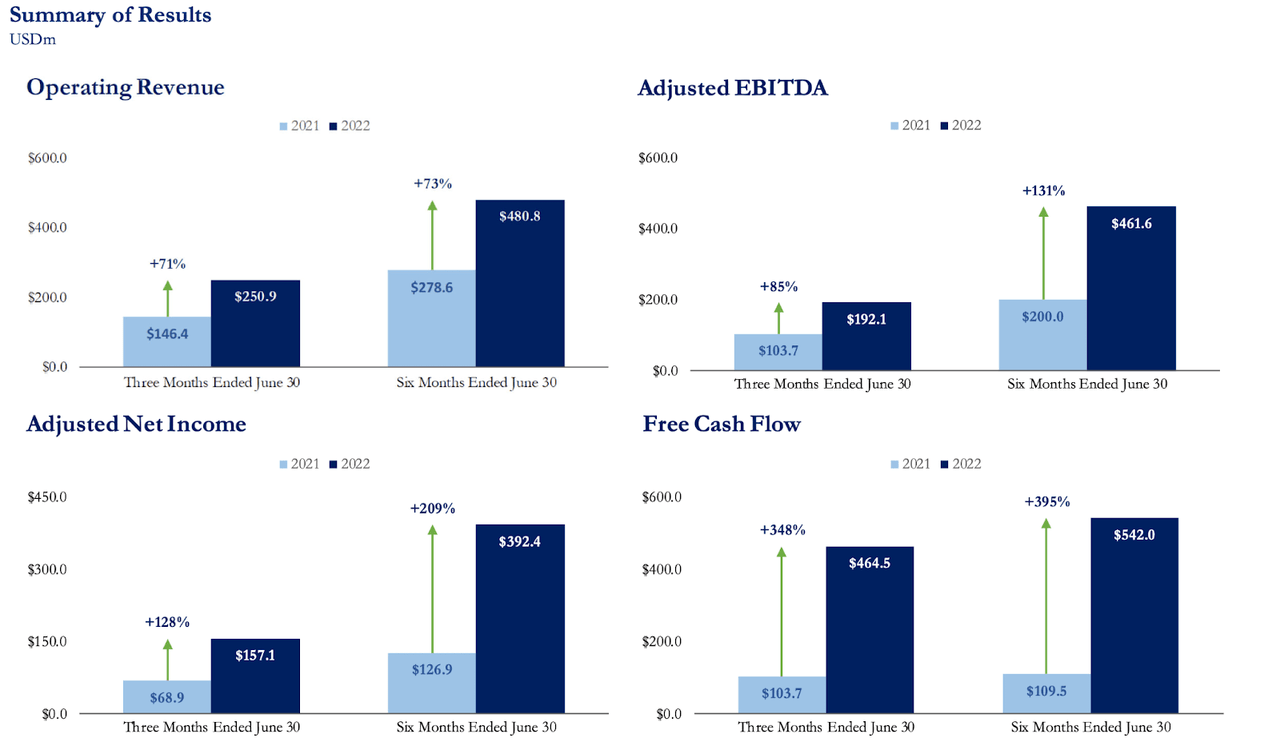

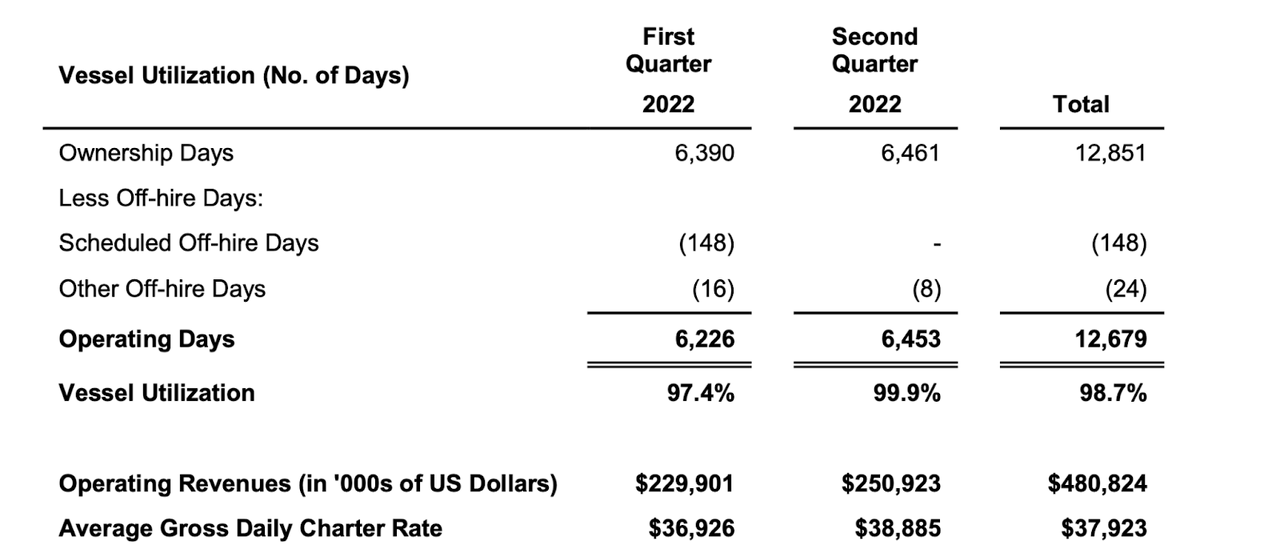

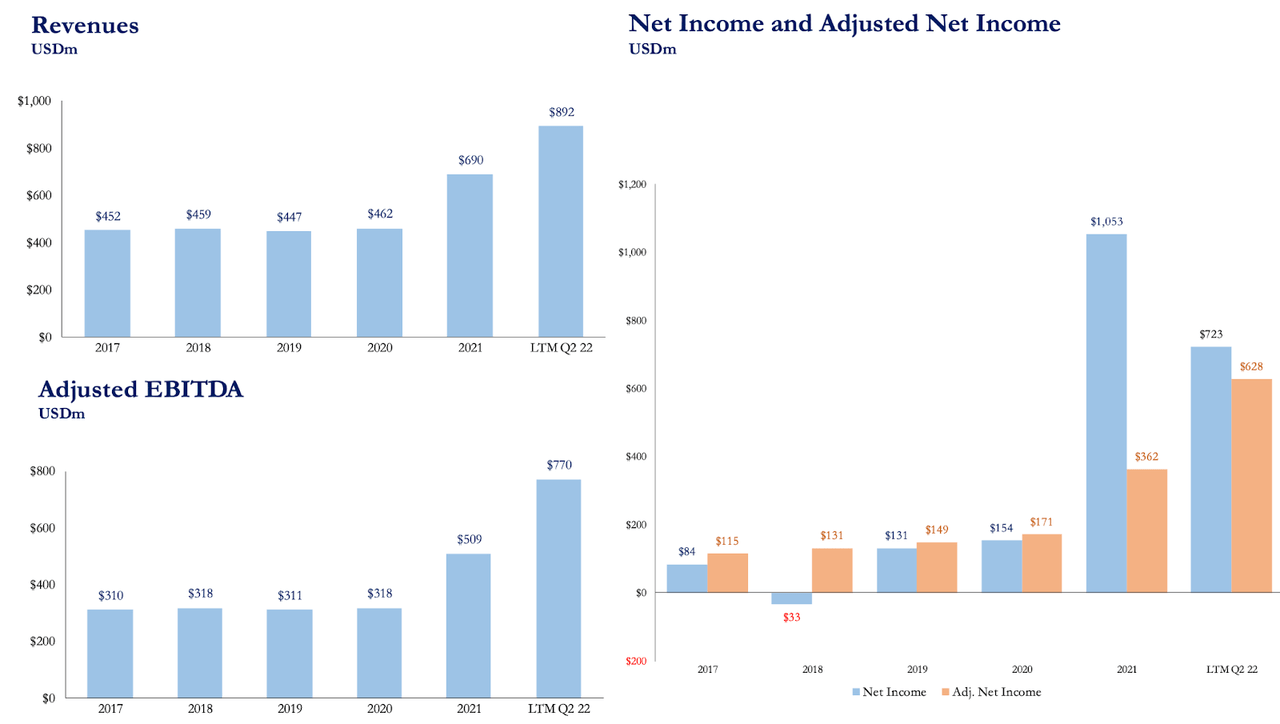

The latest quarter saw DAC show strong growth, with revenues growing 71% to $250.9 million and adjusted net income growing 128% to $157.1 million.

2022 Company Presentation

I note that equity-based compensation made up only 2% of adjusted net income with the bulk of the adjustments being related to non-cash fluctuations in its investment portfolio.

Similarly with ZIM, DAC’s financials have been greatly boosted by the tight market. DAC was able to achieve an average gross daily charter rate of $38,885 in the second quarter – higher than $27,057 in 2021, $23,175 in 2020, and $22,586 in 2019.

2022 Q2 Press Release

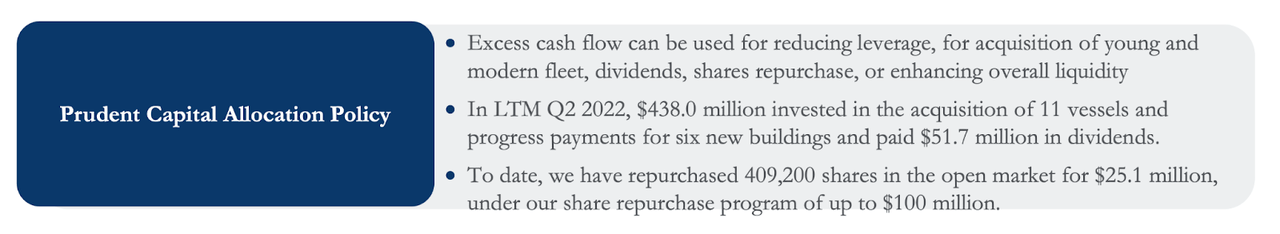

This is a company that has not traditionally rewarded shareholders with dividends or share repurchases. Yet in the latest quarter, DAC purchased $25.1 million in shares. The company also paid out $51.7 million in dividends over the past 12 months, but that pales in comparison with the $438 million spent on acquiring new vessels (more on this later).

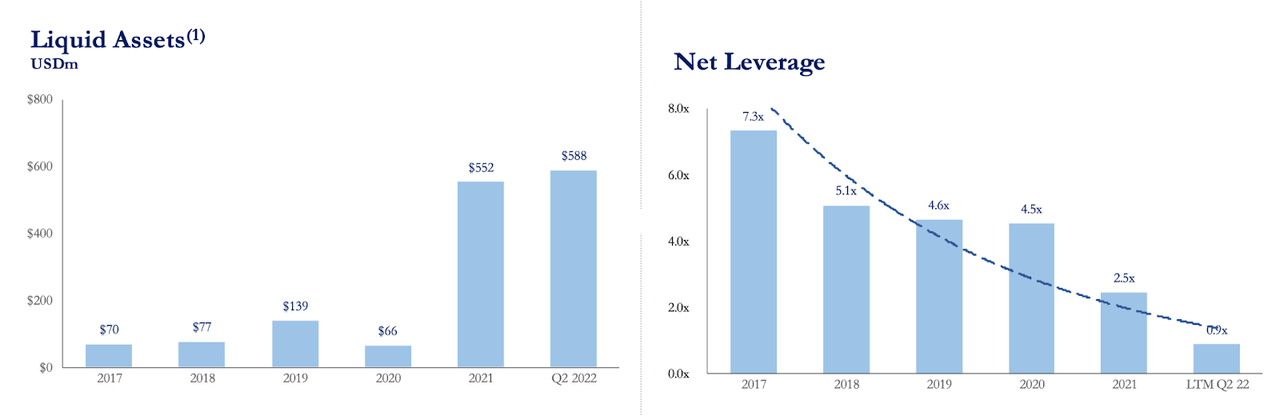

2022 Company Presentation

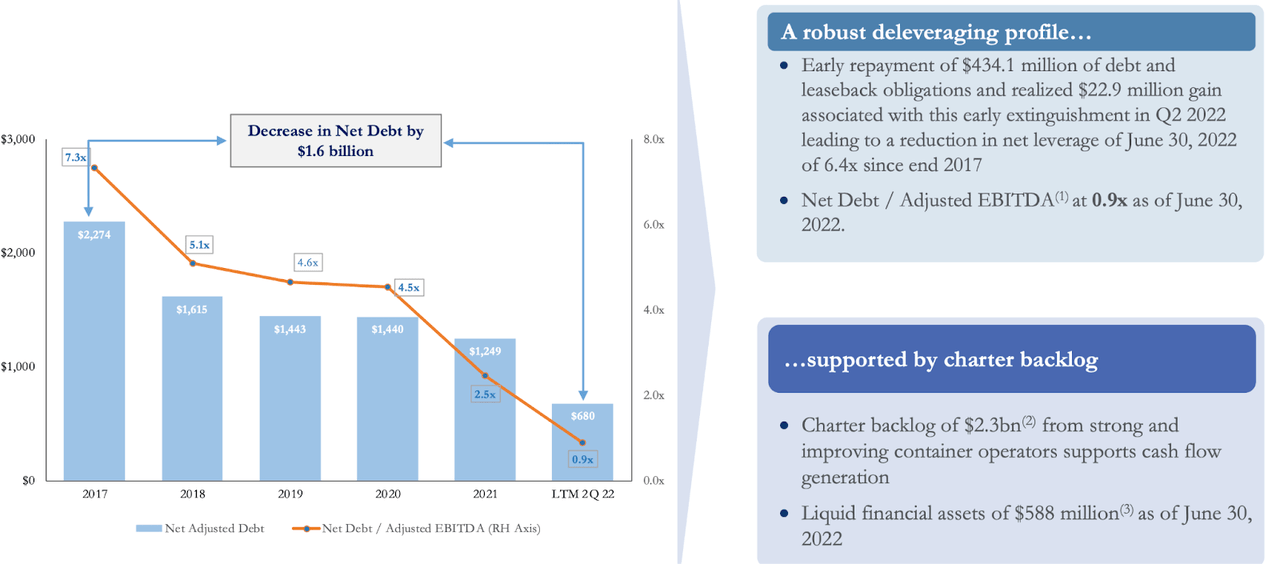

DAC has seen its leverage ratio decline dramatically over the past few years, largely due to its strong earnings profile. Leverage stood at 7.3x debt to EBITDA in 2017 but stood at only 0.9x debt to EBITDA as of the latest quarter.

2022 Company Presentation

DAC had $966.2 million of debt (inclusive of leaseback obligations) versus $332.6 million of cash and 5.69 million shares of ZIM Integrated. Based on recent prices, that equity stake in ZIM was worth around $193 million. DAC has been gradually selling off its stake in ZIM – it originally had 10.2 million shares when ZIM completed its initial public offering in 2021. Assuming it eventually liquidates its stake in ZIM to pay off debt, net debt would stand at around only $440.6 million.

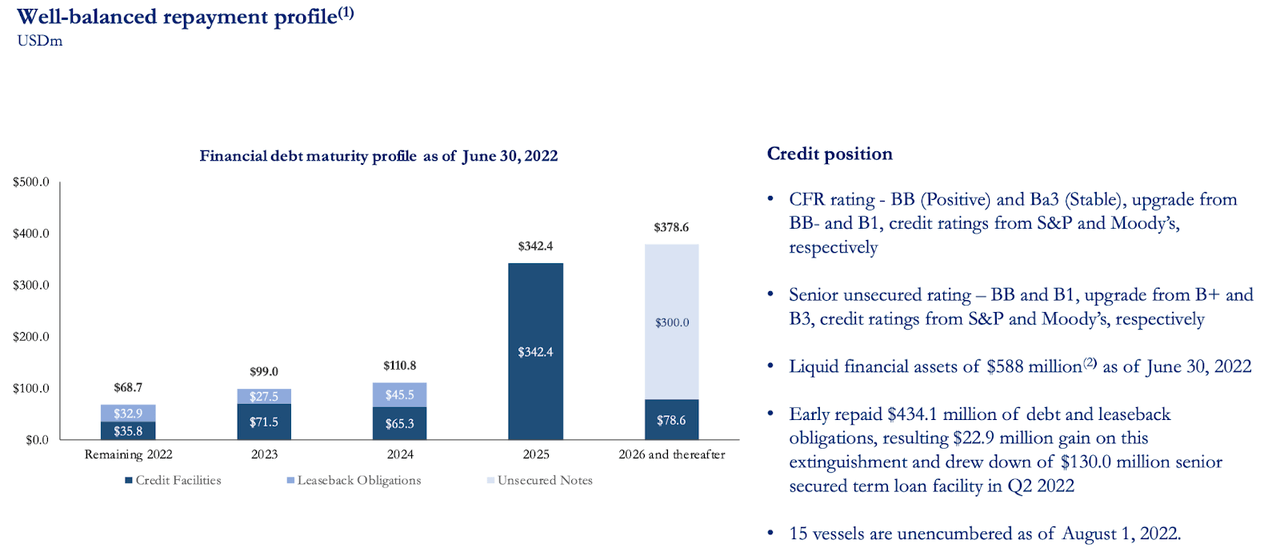

DAC’s debt outstanding has staggered maturities until 2025, when it faces its greatest maturing amount at $342.4 million.

2022 Company Presentation

Is DAC Stock A Buy, Sell, or Hold?

Why has DAC stock fallen in recent months? It likely has to do with commentary across the shipping sector implying a peak in market rates. Just check out what management had to say on the conference call:

A confluence of factors, including high energy prices, inflation, and the effects of the war in Ukraine, will likely result in slowing economic growth and negatively impact trade volumes. On the other hand, persistent inefficiencies on the shore side of the supply chain and Covid resurgence in China are keeping the vessel utilization high with increased waiting times in port. Additionally, the increase in fuel cost will likely prompt liner companies to reduce vessel sailing speeds as soon as vessels are available, however we do not expect this to happen until the 2nd quarter of 2023 and onwards. Environmental regulations, particularly the CII compliance, is leading liner companies to redesign their operating loops with lower speeds to ensure that they do not breach requirements and to also assure their customers that they are actively reducing CO2 emissions. These mitigating factors point to a weakening, rather than a collapse, of the market that we expect will result in rates much higher than pre-pandemic levels. For the time being charter rates are holding firm as the available tonnage is very scarce.

Management teams in the sector seem confident that any decline will prove gradual, but Wall Street seems less certain. That led to ZIM stock declining over 60% from all-time highs. For ZIM, that decline somewhat makes sense because collapsing freight rates could crush its earnings power. Yet for DAC, its role as a lessor may lead to more resilient fundamentals. Just check out consensus estimates – revenues are actually expected to grow mildly over the next few years.

Seeking Alpha

Earnings are also expected to remain resilient.

Seeking Alpha

Why is that the case? For starters, DAC discloses that it has already secured 80% cash contracted revenues for 2023 with many charters not expiring until 2028.

2022 Company Presentation

Another thing to consider is that DAC was profitable even before the pandemic when charter rates were much lower.

2022 Company Presentation

That brings us to an important observation. While DAC stock is up over 200% since 2019, its enterprise value is actually lower.

That is because over the same time frame, DAC has aggressively brought its net leverage position lower.

2022 Company Presentation

The fact that the enterprise value remained stable is actually surprising – with debt so high previously, it made sense for the stock to trade so low, as there was constant risk of bankruptcy. But now, with debt so low and high visibility in forward charter contracts, bankruptcy risk is a thing of the past. Investors in theory can now focus on profits instead of worrying about bankruptcy.

At recent prices, DAC is trading at 2x earnings. Even if we assume that earnings drop all the way to pre-pandemic levels, the stock still trades at just 9x earnings. I expect earnings to be somewhere in between for many years as it will take some time for new ships to become available in the market.

Given that the company’s leverage position is conservative and the stock is so cheap, why isn’t the company being more aggressive in its shareholder return policies?

On the conference call, management stated that it would not consider raising its dividend over the next 12 months.

I noted previously that the company had spent $438 million to acquire new vessels in the last 12 months while only paying out $51.7 million in dividends and buying back around $25.1 million in shares. It seems curious to see a company spend so much on external acquisition when its stock trades so cheaply.

Shipping sector expert J Mintzmyer, in his excellent interview titled, “Danaos Corp: Massive Undervaluation And Strong Returns Ahead” has asked Danaos’ CFO, Evangelos Chatzis, about the lack of aggressiveness in the share repurchase program. I was not quite convinced by the response, so I did more digging to try to understand what might be causing the hesitancy to return cash to shareholders.

In my view, it has to do with the compensation structure of management. DAC is managed by Danaos Shipping. As stated in its 20-F, DAC pays its manager as follows:

For 2021 we will pay our manager the following fees, which are fixed through the current term of the management agreement expiring on December 31, 2024: (i) a daily management fee of $850, (ii) a daily vessel management fee of $425 for vessels on bareboat charter, pro-rated for the number of calendar days we own each vessel, (iii) a daily vessel management fee of $850 for vessels on time charter, pro-rated for the number of calendar days we own each vessel, (iv) a fee of 1.25% on all freight, charter hire, ballast bonus and demurrage for each vessel, (v) a fee of 0.5% based on the contract price of any vessel bought or sold by it on our behalf, excluding newbuilding contracts, and (vi) a flat fee of $725,000 per newbuilding vessel, if any, which we capitalize, for the on premises supervision of any newbuilding contracts by selected engineers and others of its staff.

If you are familiar with externally managed REITs in the real estate sector, then the above description may sound familiar. DAC’s management team is financially incentivized to grow the size of its fleet.

DAC paid its manager $19.9 million in management fees in 2021, up from $17.7 million in 2020 and $16.8 million in 2019.

The stock is very cheap here. But as a shareholder, I must question why management continues to grow its fleet when it appears to be time to return cash to shareholders. DAC had a weighted average interest rate of 4.4% on debt as of the end of 2021. Interest rates are likely to remain stable if not go lower upon debt refinancing because of the lower leverage ratio – I see little reason to believe that the company needs to maintain such a low leverage ratio, let alone bring it lower. One can even make the argument that a debt-fueled share repurchase program is warranted. I mention that because companies often avoid repurchasing shares due to wishing to shore up their balance sheets – that is not at play here.

With the stock trading at 2x earnings and 9x pre-pandemic earnings, the stock is cheap enough to rate a buy and I own a small position. The key risk though remains the possibility that management uses its balance sheet to grow its business – increasing its management fees and potentially increasing financial risk to shareholders.

Be the first to comment