EUR/USD Rate Talking Points

EUR/USD struggles to retain the rebound from the monthly low (1.2104) as the European Central Bank (ECB) retains the current course for monetary policy, and the exchange rate may threaten the opening range for June as it initiates a series of lower highs and lows.

EUR/USD June Open Range Vulnerable as ECB Sticks to Higher PEPP

EUR/USD appears to have reversed ahead of the June high (1.2254) even though the ECB upgrades its economic outlook for the Euro Area as the “Governing Council expects net purchases under the PEPP (pandemic emergency purchase programme) over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year.”

The ECB appears reluctant to switch gears as European lawmakers have yet to deploy the Next Generation EU Recovery package, and it seems as though President Christine Lagarde and Co. will continue to support the monetary union over the coming months as “an ample degree of monetary accommodation is necessary to support economic activity and the robust convergence of inflation to levels that are below, but close to, 2 per cent over the medium term.”

In turn, the Governing Council may continue to endorse a dovish forward guidance as President Lagarde and Co. “stand ready to adjust all of our instruments, as appropriate, to ensure that inflation moves towards our aim in a sustained manner,” and the Euro may face headwinds ahead of the next ECB interest rate decision on July 22 as the Euro Area recovers from a technical recession.

Nevertheless, the tilt in retail sentiment looks poised to persist as traders have been net-short EUR/USD since April, with the IG Client Sentiment report showing only 35.47% of traders net-long the pair as the ratio of traders short to long stands at 1.82 to 1.

The number of traders net-long is 3.91% lower than yesterday and 23.46% lower from last week, while the number of traders net-short is 8.20% lower than yesterday and 14.91% higher from last week. The sharp decline in net-long position comes as EUR/USD struggles to retain the rebound from the monthly low (1.2104), while the rise in net-short interest has fueled the crowding behavior as 38.50% of traders were net-long ahead of the ECB rate decision.

With that said, it remains to be seen if the decline from the January high (1.2350) will turn out to be a correction in the broader trend rather than a change in EUR/USD behavior as the crowding behavior from 2020 resurfaces, but the exchange rate may threaten the opening range for June as it struggles to retain the rebound from the monthly low (1.2104).

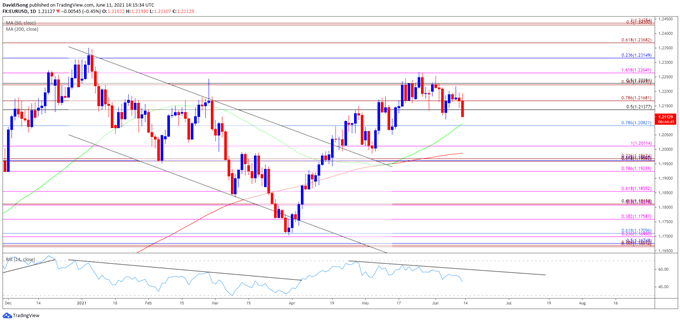

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, EUR/USD established a descending channel following the failed attempt to test the April 2018 high (1.2414), but the decline from the January high (1.2350) may turn out to be a correction in the broader trend rather than a change in market behavior as the exchange rate trades back above the 50-Day SMA (1.2088) to break out of the bearish trend.

- The Relative Strength Index (RSI) showed a similar dynamic as the oscillator reversed ahead of oversold territory to break out of a downward trend, but the string of failed attempts to push above 70 suggests the bullish momentum will continue to abate as the indicator reverses ahead of overbought territory.

- As a result, EUR/USD may threaten the opening range for June, with a break of the monthly low (1.2104) opening up the 1.2080 (78.6% retracement) region, which largely lines up with the 50-Day SMA (1.2088).

- Next area of interest comes in around 1.2010 (100% expansion), with a break of the May low (1.1986) bringing the Fibonacci overlap around 1.1920 (78.6% expansion) to 1.1970 (23.6% expansion) on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment