JHVEPhoto

Medtronic (NYSE:MDT) is one of the world’s largest medical device makers. It has a wide range of products spanning various clinical conditions. Unlike some smaller rivals, it isn’t overly tied to any one specific product, device, or type of treatment.

Like most of its peers, Medtronic stock has been ailing since the novel coronavirus pandemic began. At first, this was because of hospitals choosing to delay elective surgeries in order to reserve beds for Covid-19 patients. On top of that, many patients understandably chose to avoid hospitals in order to avoid any potential exposure to the virus.

While mainstream media attention toward the pandemic has diminished since the rise of widespread vaccination, numerous strains and variants of the coronavirus have continued to spread in 2022 in various parts of the world. Certainly much of the elective surgery landscape has returned toward normal, but there is still a meaningful drag on results.

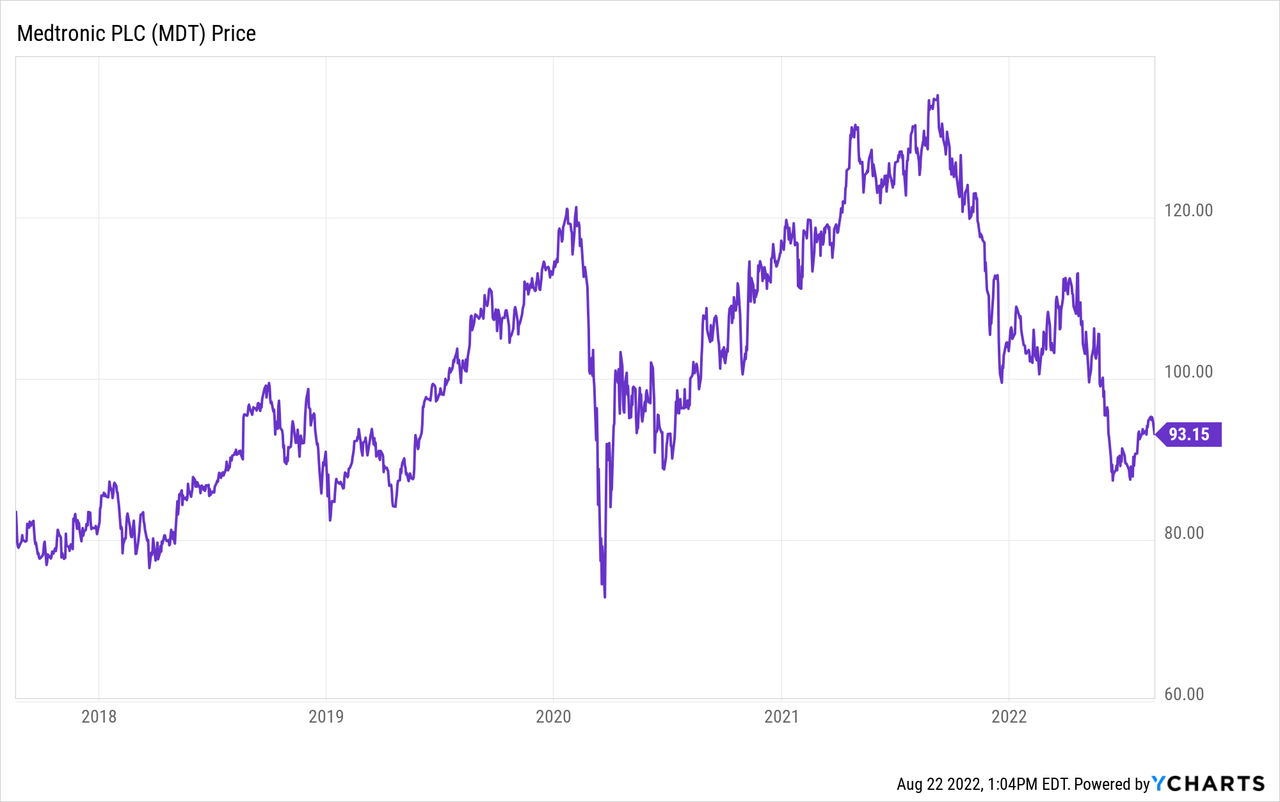

All this has resulted in MDT stock lingering in the lower end of its five-year trading range:

Shares traded around $80 in 2018 and briefly hit that level during the start of the Covid-19 pandemic. MDT stock almost fell back to that point this summer and is still stuck below $100 now, even with the recent rally in the overall stock market.

Why Is Medtronic’s Stock Down So Much?

If the underlying business is doing alright, why are Medtronic shares failing to gain much traction?

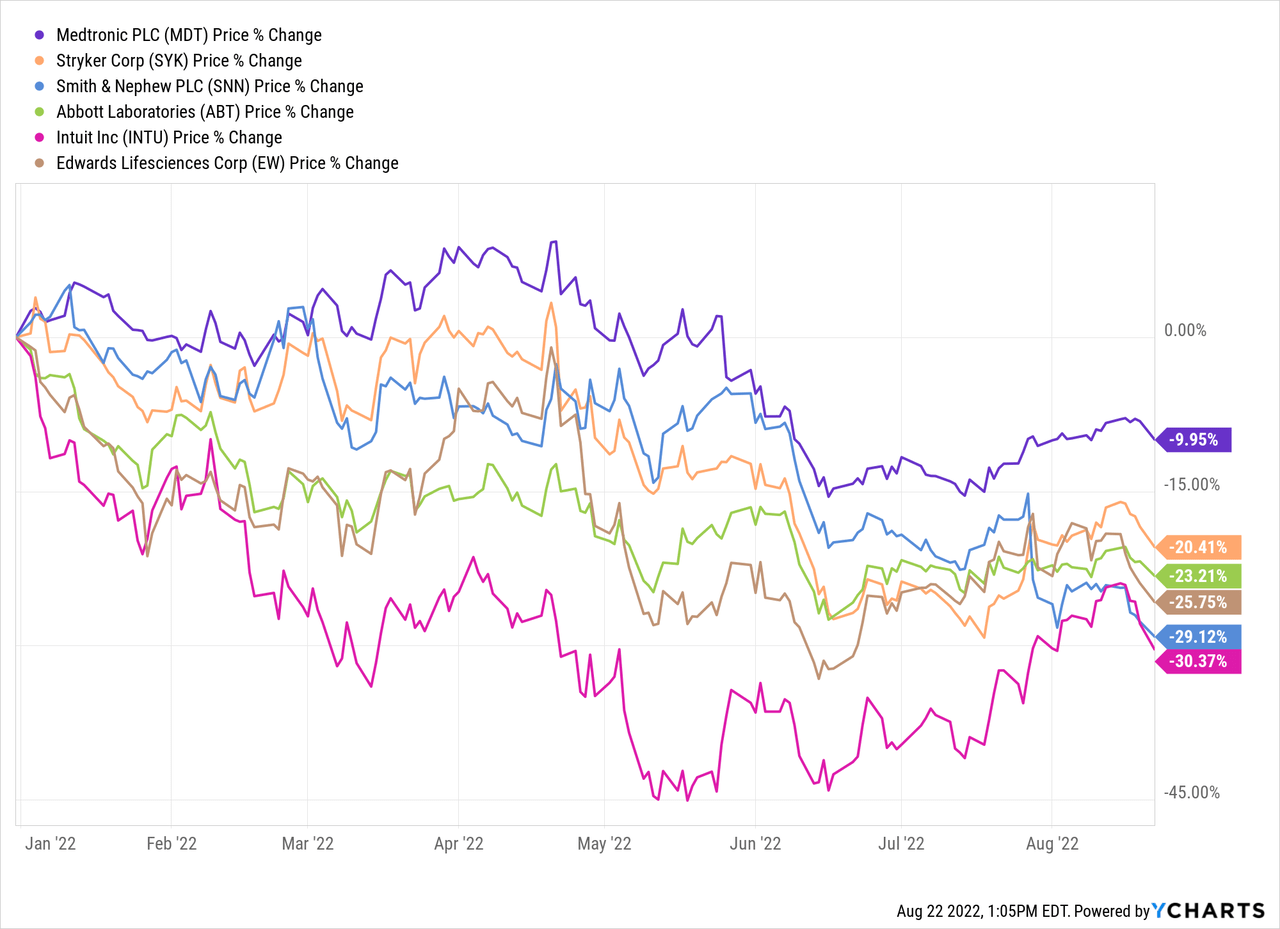

There are several factors seemingly at work. For one, the whole sector has been under a great deal of pressure:

As the above chart shows, Medtronic has actually been the best performer of these six major industry players so far year-to-date. Down 10% is hardly great — and Medtronic was down substantially in 2021 as well — however other medical device makers are also having a rough 2022. Much of the apathy toward Medtronic stock is part of a broader aversion to its industry. In fact, the median medical device stock is down more than 20% year-to-date.

The company has run into problems of its own within the broader challenging landscape. CEO Geoff Martha explained this in a recent industry conference:

“Starting in probably the middle of Q4, these [supply chain issues] started to present themselves in a much more acute way. I mean going into Q4, a lot of our safety stock was depleted because of the ongoing chip issue and resins. But in Q4, like midway through, things got much more acute, especially for our Surgical Innovations business. Because of this packaging issue that we had in our supply chain, there was an explosion at one of the — our suppliers that shut them down for a couple of months and that really impacted our SI business. And then you had China shut down in the month of April and into May.”

Martha explained that these issues will continue at a high level for some time to come. More broadly, the company has acquired a lot of other firms in recent years and thus picked up a lot of plants and facilities in those deals. Martha said the company had previously centralized supply chains and logistics across these new acquisitions to gain operating scale, but is now decentralizing some operations to avoid the sorts of headaches we’ve seen over the past 12 months.

Given this wider business realignment, investors should view Medtronic as a 2023 recovery story rather than something that will turn around next quarter. Perhaps this is part of what is weighing on the stock so considerably.

Zooming further out, there is some perception that Medtronic may not be a top-tier player in the industry. In recent years, for example, Medtronic’s organic growth has significantly lagged more successful rivals such as Stryker (SYK).

There’s been a good deal of debate about whether this is an inherent flaw in Medtronic’s process specifically, or just a combination of pipeline, new products, competition, and so on. And, some folks would argue, perhaps rivals like Stryker have outperformed due to aggressive management tactics that are in danger of backfiring sooner or later. That is outside the scope of this article though, and I’d note I own Stryker stock as well.

Leaving that aside, you can argue that Medtronic’s product mix is generally less attractive than some other rivals. The pacemaker business, for example, risks being fairly commoditized and thus lower-margin compared to some of the more cutting-edge stuff at peer firms.

Competition could hit higher-growth areas of the company as well. Medtronic’s diabetes business, for example, has shown double-digit annualized growth in the past, but could be at meaningful risk now as various innovative new products and treatment techniques are currently in the pipeline which could disrupt existing players.

Valuation Is Appealing

Medical device companies have strong moats due to patents, doctor familiarity and training with individual devices, and large R&D efficiencies among others. Profit margins tend to be high and demand is steady to increasing over the longer-term. It’s a good industry that deserves to trade at a premium to the S&P 500 as a whole.

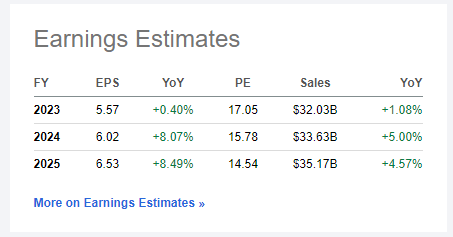

Medtronic, however, is selling at just 17x current and forward earnings:

MDT earnings estimates (Seeking Alpha)

I get all the concerns around supply chains and Covid hangovers and whatnot, but 17x earnings is not the right price for a company of this caliber absent the whole market being at a low multiple. As things stand today, the S&P 500 is at 23x earnings. MDT stock merely selling at that same multiple as the market would put the stock at $128/share versus the current $93.

Over the longer-term, Medtronic’s management aims to deliver 8% earnings growth and 5% revenue growth compounded annually. The company also has been highly successful in generating free cash flow out of earnings, meaning that the current starting 6% earnings yield can largely be used for dividend increases and share buybacks. Delivering the company’s long-term average growth rates off the current starting valuation should lead to total returns which dramatically outpace the S&P 500.

I’m not the only one seeing considerable value in MDT stock at current prices. Morningstar’s analyst Debbie Wang values shares at $129, which puts MDT stock at a 30% discount to fair value today. In May, Wang wrote:

We’re holding steady on our fair value estimate of $129 per share, which includes our expectations for the resumption of prepandemic procedure volume in fiscal 2023, hospital labor constraints that will prevent significant expansion of capacity through the midterm, and the anticipated launch of renal denervation by early 2024. We continue to hold fairly optimistic expectations for innovation in the structural heart, diabetes, and neurovascular units, as well as gradual margin expansion to account for efficiency programs and higher-margin new products.

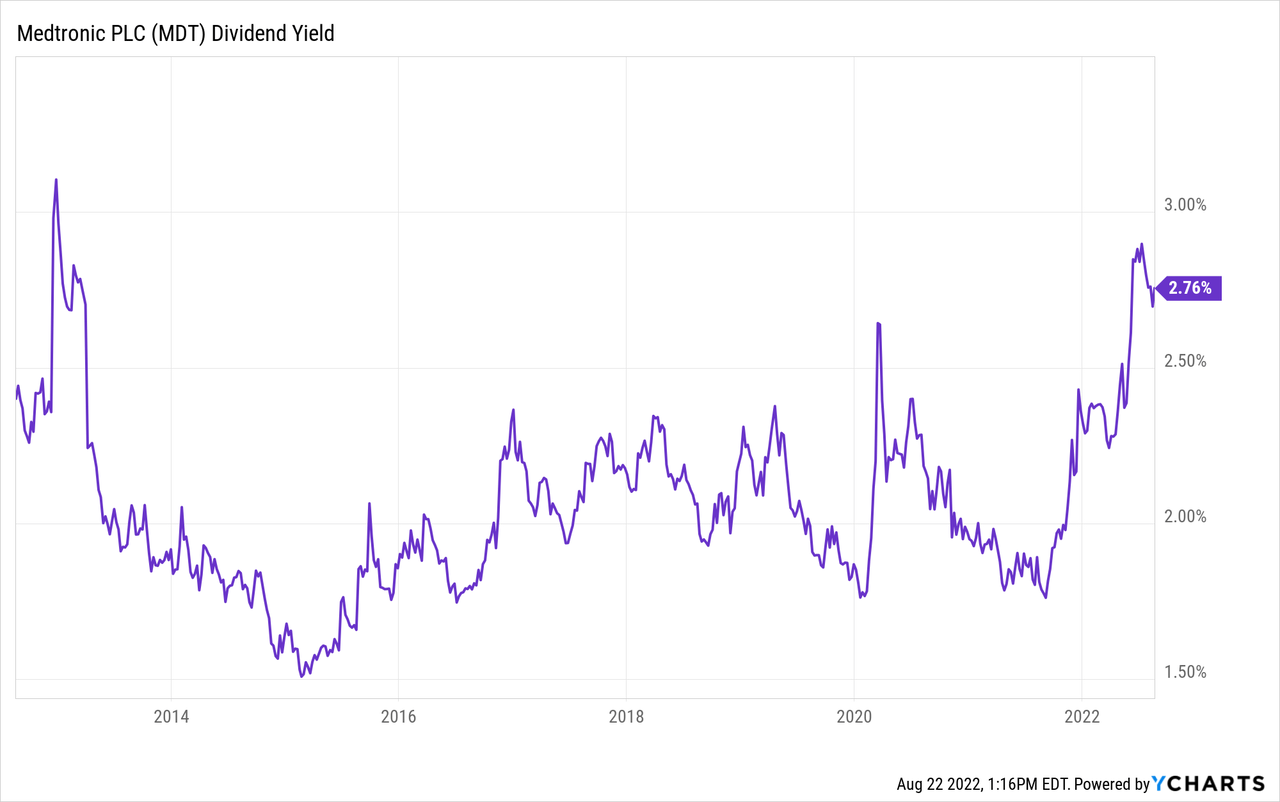

Finally, Medtronic is a Dividend Aristocrat. Shares are currently near their highest dividend yield, with the 2.8% yield being far above its historical median around 2.0%:

For a Dividend Aristocrat with high single digit growth in a better-than-average industry, a starting 2.8% dividend yield is a pretty strong offer.

Additionally, Medtronic has grown said dividend at an 8%, 8%, and 10% compounded rate over the past three, five, and ten years, respectively. That combined with an attractive starting valuation makes Medtronic a suitable growth and income holding in the healthcare industry today.

Be the first to comment