Andrew Burton

A couple of weeks ago, SEC added Alibaba (NYSE:BABA, OTCPK:BABAF) to the list of companies facing delisting from the American exchanges for failure to comply with the Holding Foreign Companies Accountable Act (HFCAA). Back in October, I wrote an article titled Alibaba: Prepare For The Possible Delisting in which I explained why there’s a real possibility that Alibaba’s stock could be delisted in the foreseeable future. Back then, there was a lot of skepticism from various investors regarding the possible delisting, as it would make no sense for Alibaba to not follow the rules and miss on the opportunity to continue to raise funds from the most liquid capital market in the world.

However, Alibaba appears to be powerless in this situation since, without the blessing from Beijing, it can’t allow international auditors to audit its books. At the same time, while the talks between the U.S. and Chinese regulators have been ongoing since late 2021, no major progress has been made to date. As a result, SEC Chairman Gary Gensler is hesitant to send auditors to China and Hong Kong before a deal that gives full access to the books of Chinese companies is reached.

Considering that Sino-American relations are at historical lows after U.S. House Speaker Nancy Pelosi visited Taiwan, the opportunities to reach an audit deal appear to be dim at this stage, which makes it more possible for Alibaba to be delisted in the foreseeable future. At the same time, unless a deal is reached, Alibaba’s stock is likely to continue to trade at distressed levels, especially if we consider the fact that in addition to external risks the company is also facing internal pressure back at home due to the weak results that it has recently reported. For those reasons, it makes it hard to justify owning Alibaba even at the current prices.

Delisting Is A Real Concern

One of the main reasons why the SEC has added Alibaba to the list of companies facing delisting is because the PCAOB wasn’t able to fully audit the company’s fiscal year results for the year ending in March 2022. Even though the Chinese and Hong Kong branches of PwC annually audit Alibaba’s reports, the company has been constantly added to the list of firms located where authorities deny access to conduct inspections. In the past, the SEC even started administrative proceedings against PwC’s Chinese branch for the failure to provide documents, while PCAOB stated the following about the failure to conduct full inspections in the country:

The PCAOB spent significant time and resources negotiating a Memorandum of Understanding (MOU) with the Chinese authorities for enforcement cooperation. Unfortunately, since signing the MOU in 2013, Chinese cooperation has not been sufficient for the PCAOB to obtain timely access to relevant documents and testimony necessary to carry out our mission consistent with the core principles identified above, nor have consultations undertaken through the MOU resulted in improvements.

With the passage of HFCAA nearly two years ago, Chinese firms have up to three years to give auditors full access to their books after the first warning is issued or face delisting from the American exchanges. However, there have been efforts to shorten that timeframe, so there’s always the risk that Alibaba could be delisted even sooner than a lot of investors expect if the legislators change the law. Even though the company is eager to stay on the American exchanges and earlier this month issued a statement that it will comply with any applicable law, in reality, it won’t be able to do so until an audit deal between the American and Chinese regulators is reached.

The problem is that the regulators from both sides of the Pacific have been in talks since late 2021, and failed to reach any deal to this day. While throughout spring Chinese officials were hinting that the deal is on the horizon, SEC Chairman Gary Gensler last month cast doubt that any deal will be reached soon. At the same time, he also stated that the American side wouldn’t accept a deal that includes any sort of restrictions, and he won’t send inspectors before the regulators agree on how to move forward.

On top of that, PCAOB’s Chair Erica Williams in an interview earlier this month mirrored Gary Gensler’s statement by saying that the organization will need to have complete access to the books of Chinese firms in order to conduct a thorough inspection. At the same time, she reiterated that it’s important for the deal to be reached soon, as lots of other steps will need to take place before the inspectors could start auditing the Chinese books and reach a conclusion.

Another SEC director YJ Fischer agrees that timing is of the essence since the agreement is just the first step to resolve the delisting concerns. Earlier in May, he stated that an audit deal needs to be reached soon so that the PCAOB can do all the necessary investigations by early November in order to draft a determination and vote for it to fulfill Congress’s mandate. Here’s his direct quote:

Even if an agreement is signed between the PCAOB and Chinese authorities, it will only be a first step. The PCAOB must be able to obtain sufficient cooperation and agreement from Chinese authorities so that the PCAOB Board can make a determination that it can inspect and investigate completely in China and Hong Kong.

In 2021, PCAOB has already issued a report on its determinations where it concluded that it can’t access the books of Chinese firms even though HFCAA has been active for a year already. It’ll likely say the same thing in its 2022 report since it appears that an audit deal is nowhere near in sight.

The main problem at this stage is whether Beijing is ready to give complete access that could include any sensitive information since the American side won’t be able to agree on a deal that includes any restrictions. Considering that after Nancy Pelosi visited Taiwan, Beijing cut contacts with Washington on vital issues and agreed on military drills with Russia, it appears that the SEC Chairman is correct when he casts doubt that any deal will be reached in the foreseeable future.

As a result of this, Alibaba investors are likely going to continue to suffer, as one of the main risks will remain with the stock for a while until either a deal is reached or the stock is delisted. While Alibaba decided to minimize the downside by making a primary listing in Hong Kong, which should be completed by the end of 2022 and give additional options for Chinese mainland investors to invest in the company, it still won’t solve the fundamental issues, which will continue to pressure its shares. At the same time, the exodus of international investors continues with Bridgewater becoming one of the latest major funds that closed its position in Alibaba.

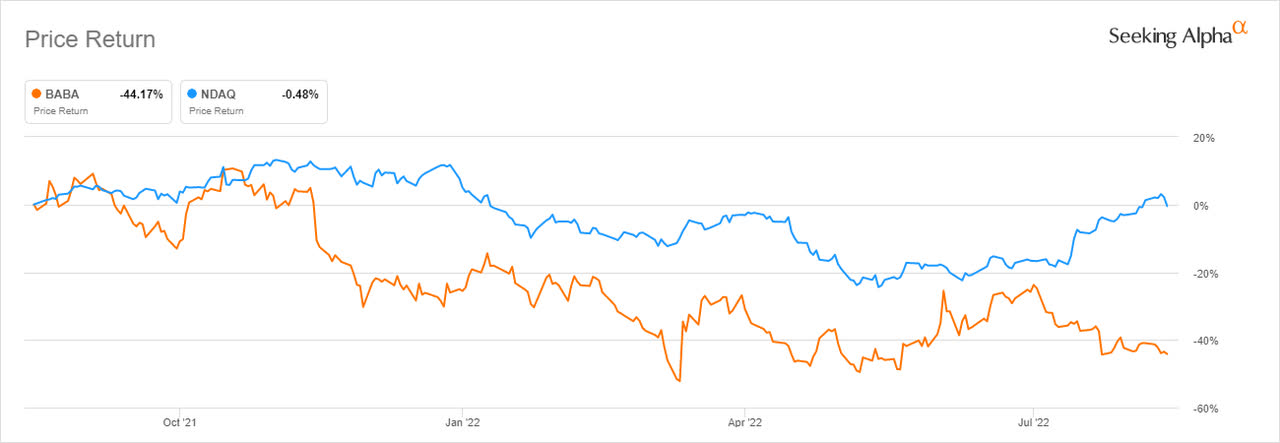

What’s also important to note is that it’s wrong to blame the weak performance of Alibaba’s stock on the overall market selloff. The internal and external issues that the company is currently facing are the main reasons why its stock trades at distressed levels and lost ~44% of its value in the last 12 months, while the NASDAQ Index is nearly flat for the same period. It’s unlikely that without the deal Alibaba’s stock will be able to move significantly higher and beat the index in the foreseeable future.

Alibaba’s 12-Months Price Return Against NASDAQ (Seeking Alpha)

Risks To The Thesis

It’s obvious that an audit deal could change the whole situation, neutralize the delisting fears and push Alibaba’s stock higher. This article highlighted the latest developments, which point to the fact that it’s unlikely that we’ll see regulators will reach a deal anytime soon, but there’s always the risk that the situation would change in an instant and any investor should be aware of this.

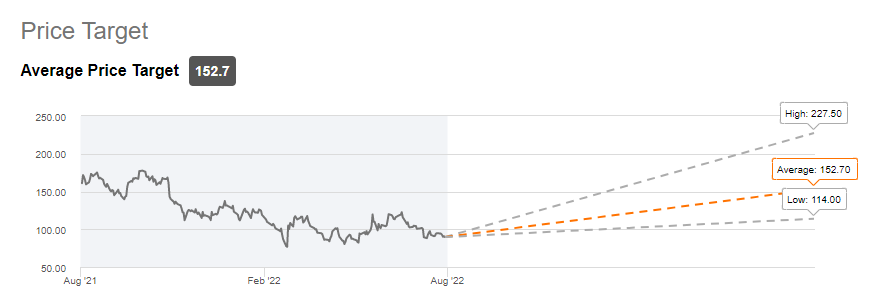

On top of that, Alibaba’s stock is a buy solely on the fundamentals. My DCF model a couple of months ago showed that the company’s fair value is $152.34 per share, while the current consensus price target is $152.7 per share. As a result, Alibaba’s stock has an upside of around 70% from the current levels based on fundamentals alone. The problem is that the company has been trading below its fundamental fair value since late 2020 after Beijing started its crackdown against the firm. As a result, Alibaba could continue to trade cheaply for a long time due to the constant internal and external risks that make it hard to justify a long position even at the current levels.

Alibaba’s Consensus Price Target (Seeking Alpha)

The Bottom Line

Most of the geopolitical developments of 2022 so far indicate that an audit deal is unlikely to be reached anytime soon, as the talks between the regulators have been ongoing since late 2021 without any major progress. On top of that, there’s also a risk that American legislators will shorten the time under which the SEC enforces the delisting of shares from American exchanges, making it possible for Alibaba to lose access to the most liquid capital market in the world sooner than a lot of investors think. Therefore, I continue to believe that it’s hard to justify a long position in the company even at the current price until the external regulatory risks are neutralized.

Be the first to comment