MoMo Productions

Fiserv (NASDAQ:FISV) reported better-than-expected growth in the second quarter with solid results. Overall YoY growth organic growth jumped to 12%, well over expectations.

I still believe the shares of Fiserv remain undervalued, with much of the market underestimating Fiserv’s long-term growth prospects.

Fiserv’s recent (2019) acquisition of FirstData, including the Clover and Carat platforms, continue to offer great growth opportunities. Along with many other irons in the fire, payments-wise, including Zelle.

Business Overview

For those unfamiliar with Fiserv, they are a legacy fintech player with strength in the core banking ecosystem, exciting stuff, I know.

But with the recent addition of platforms like Clover and Carat, they started gaining a leading position in payment acceptance and processing.

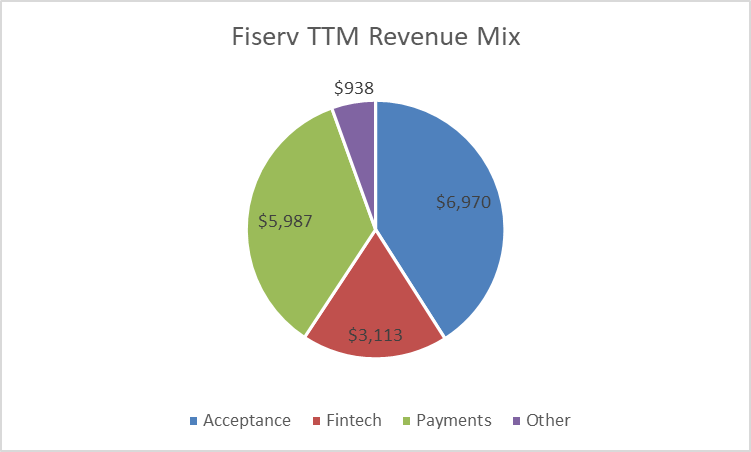

Fiserv operates through three segments:

- Acceptance

- Fintech

- Payments

Fiserv’s legacy business operates around the core banking offerings, which occupy a space in the fintech segment. Core banking is plumbing for banks, enabling items such as maintaining deposits, loan accounts, and posting daily transactions.

Fiserv remains the market leader in the space, among competitors Jack Henry (JKHY) and Fidelity National Service (FIS), second and third, respectively.

The legacy core banking systems remain quite sticky; it’s difficult for customers to switch banks, imagine the process for banks.

Fiserv’s legacy core offerings allow for wider margins, with the cost advantages and ability to scale newer services when added.

After the FirstData merger, Fiserv added a new segment, merchant acquiring, focusing on the Clover system. The new segment now occupies 41% of Fiserv’s total revenues, growing 14.1% year over year.

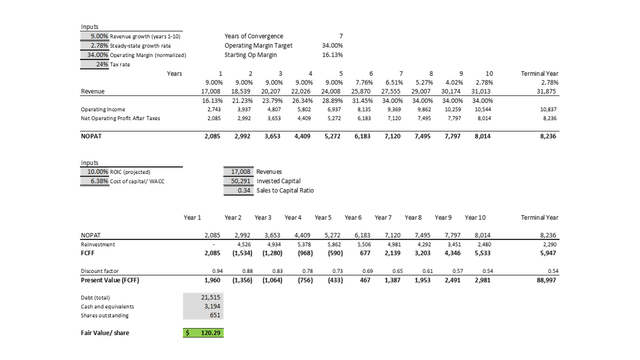

Chart courtesy of author (Author excel spreadsheet)

The fintech and payments segments also experienced growth at a slower pace, 6.5% and 6.8%, respectively.

Revenues

Fiserv saw organic revenue growth of 12% for the second quarter, along with adjusted earnings growth of 14%, at $1.56 per share and an adjusted operating margin of 33.5%.

The company also exceeded expectations on merger revenue synergies of $600 million two years early.

Acceptance Segment

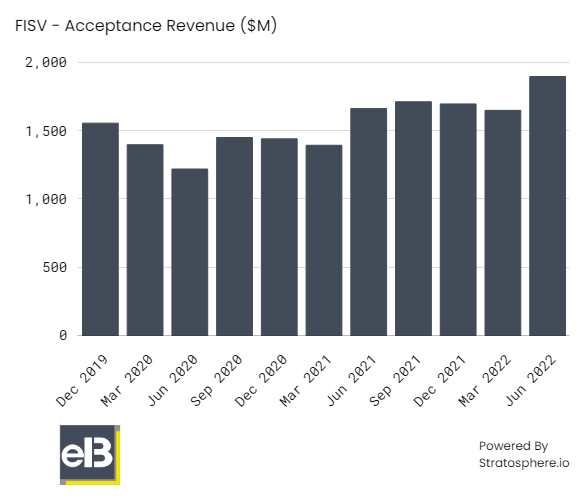

The acceptance segment leads the way for Fiserv, with Clover becoming the number one path to growth. The merchant segment saw organic growth of 17% for the second quarter and 18% year-to-date.

Fiserv Acceptance Revenues (stratosphere.io)

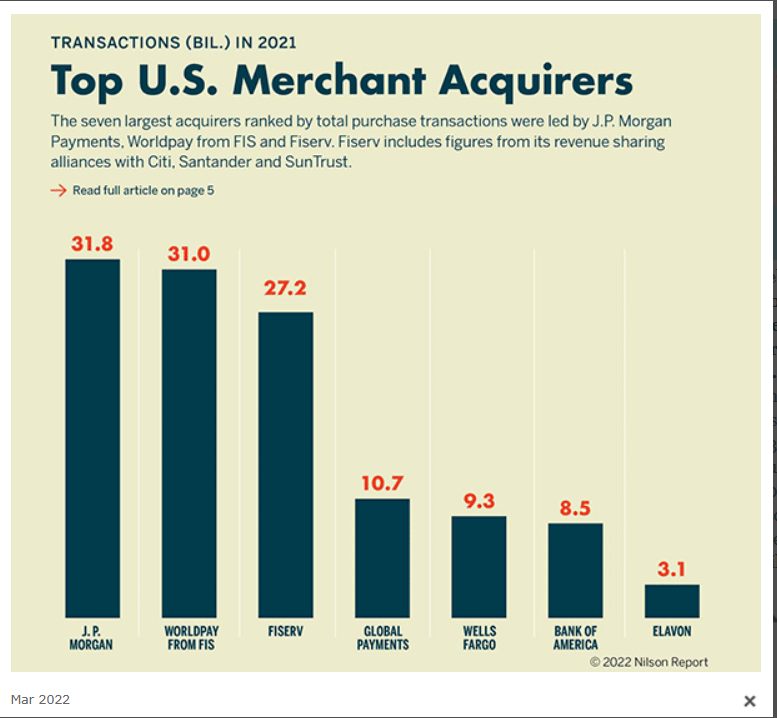

Fiserv’s merchant segment remains the number three US-based acquirer, with $27.2 billion in annual transactions for around 6 million merchants. Two-thirds of the revenue comes from SMBs (small to medium businesses), another 20% from mid-to-enterprise merchants, and the final 15% from wholesale processing.

Chart (Nilsonreport.com)

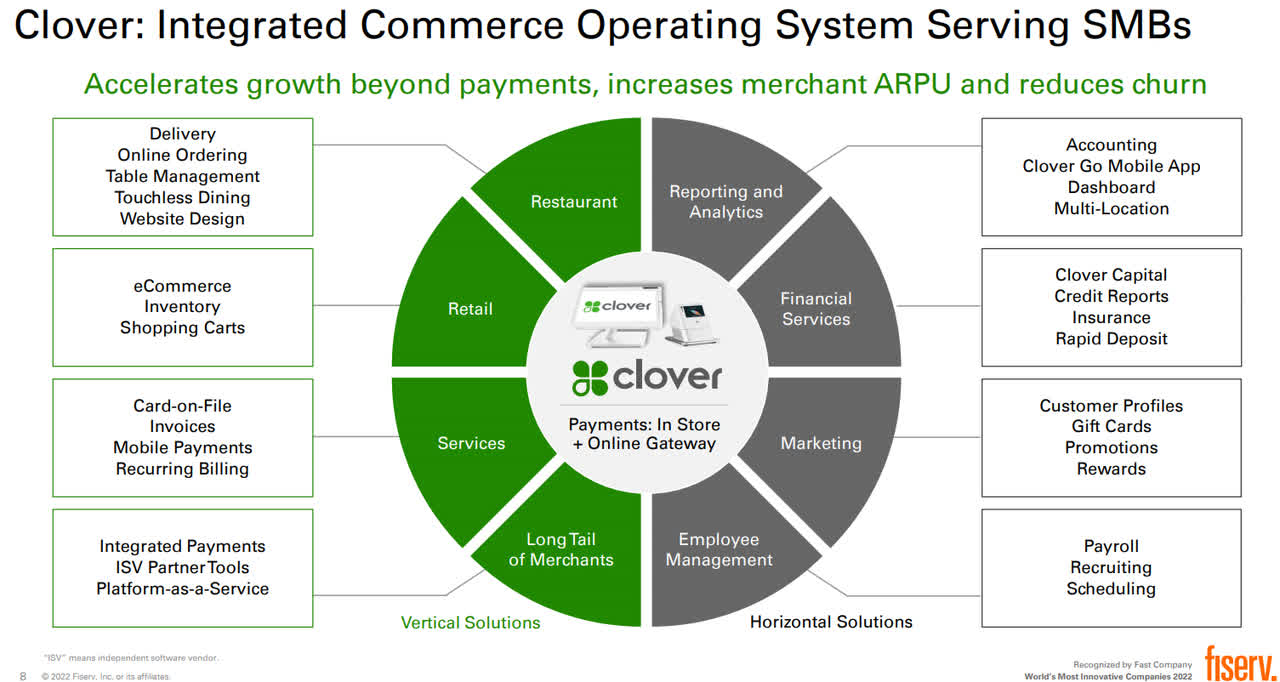

The key to growth for the merchant acceptance segment and Fiserv continues to be Clover.

Acquiring Clover in the First Data merger allowed Fiserv to move up the payments food chain by focusing on the SMB business segment.

Clover is a horizontal acceptance platform with modules for specific verticals, such as restaurants. Clover competes with a large group of players in different niches. For example, Toast (TOST) in the restaurant space, Shopify (SHOP) in e-commerce, and Block (SQ) and PayPal (PYPL) in SMBs.

Clover Integrations (Fiserv Investor Briefing March 8, 2022)

Fiserv Investor Briefing on Merchant Acceptance, Mar 8, 2022

Clover grew revenues by 24% in the quarter and 30% year to date, driven by volume growth of 27% of over $233 billion in annualized GPV (gross payment volume).

The Clover solution offers a combination of:

- Software and services

- Payments

- Hardware

The recent BentoBox acquisition is now contributing to Clover’s restaurant growth. With the integration, the company reports a 3x increase in average revenue per user than standalone Clover in restaurants. The company’s ISV (independent software vendors) through Clover Connect grew 39% YoY and 44% year-to-date. They also signed 45 ISVs during the quarter, giving them 89 in total.

The company has five strategic initiatives it is putting forward to spur growth in Clover:

- Software and services penetration

- Vertical specialization

- Omnichannel

- Distribution

- International expansion

We can see these initiatives working based on the growing volume and revenues. Clover has grown from $0.8 billion in 2019 to $1.3 billion in 2021, a 27% CAGR. Based on rough math, Clover grew 39% in Q1 from a $1.3 billion base, giving them $930 million in revenues year-to-date and a run rate of $1.86 billion if the growth remains steady.

The current run rate for Clover will give it an approximately 10% share of company revenues, up from $0 only two years ago. Impressive, very impressive.

In the interest of being brief, Clover is the growth engine for Fiserv and has performed quite well to date.

Carat is the other side of the coin of growth for Fiserv, with 22% revenue growth for the quarter. Carat offers Omni/e-commerce solutions for merchants and physical POS systems.

Carat generated $450 million in annual revenues for 2021 and has seen a 12% CAGR since 2019.

Revenue growth for Fiserv of 9-11%, based on the growth driven by the Merchant Segment, particularly Clover and Carat, remains likely, with analysts predicting revenue growth of 6-7% over the next few years.

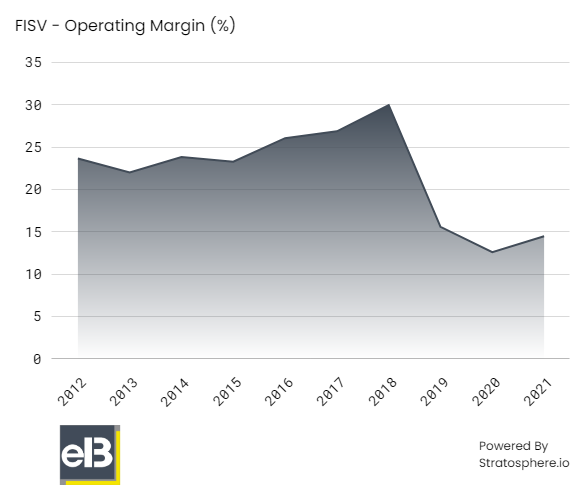

Operating Margins

Fiserv’s margins pre-First Data merger were in the high 20s to low 30s, but since the merger, they have hovered around:

- 2019 – 15.65%

- 2020 – 12.66%

- 2021 – 14.54%

Much of Fiserv’s margin compression stems from the merger-related acquisition costs, which the company expects to pay off in the next five years.

Chart courtesy of stratosphere.io (stratosphere.io)

Among other impacts are cost inflation from both labor and material costs for Clover, along with investments made related to Bentobox and Finxact and reinvestments.

But if we dig deeper, we see the individual segments performing well and growing margins. For example, the merchant segment averages 30.9% adjusted margins compared to 2021’s adjusted margins of 29.7%.

Adjusted margin averages for the last five quarters for each segment look like this:

- Merchant Acceptance – 30.9%

- Payments and Network – 44.2% compared to 2021’s of 43%

- Financial Tech – 35.9% compared to 34.9%

As the company moves away from the First Data acquisition and the impact of the acquisition-related cost diminishes, I believe Fiserv will achieve higher margins based on the growing revenue mix of Clover and Carat at around 34%.

Capital Allocation

Fiserv continues to put capital to work, as evidenced by recent acquisitions of Ondot, Bentobox, and Finxact, a leading developer of cloud-native banking solutions.

Fiserv also continues to return capital via buybacks, with over $2.6 billion spent on 23.3 million shares in FY21, repurchasing almost $1 billion in H1’22, and spending an additional $400 million in July alone, and $500 million on 5.1 million shares in the second quarter.

They are on track to reduce shares by almost 3% by year’s end, thus helping grow earnings, which is all part of Fiserv’s strategy.

The nice part of the buybacks, particularly this year, was many were bought during the market pullback, lowering the prices paid for those shares and increasing the returns for shareholders.

The one area I would love to see Fiserv work down remains the long-term debt, which sits higher than I would like at $20.9 billion. The company’s current debt to adjusted EBITDA sits at 0.3x, in line with Fiserv’s target leverage.

Risks

Ongoing risks Fiserv faces continue to be the economy overall. As a payment processor, they run the risk of a deteriorating economy driving down consumers’ buying stuff, which could threaten the continued growth of Clover.

If the economy worsens in the second half, it could strain organic growth, impacting free cash flow and margins growth. There is also the impact of Fed actions on the strengthening dollar, which puts a strain on international revenues, which saw a 2% negative impact on revenues in the first half.

Any slowdown in the banking sector could threaten the growth of core banking expansion and the slowdown of the Finxact acquisition.

And finally, there remains the threat of disruption. The payments industry continues to evolve. Currently, Fiserv holds a good position in acquiring, but further disruption from companies such as Block or Adyen (OTCPK:ADYEY) could impact future returns or erode the profitability of any moat Fiserv is building with Clover and Carat.

Valuation

Okay, the rubber meets the road time, what is Fiserv worth?

Below is my DCF model using the free cash flow to the firm, based on the following inputs:

Cost of equity = 6.38% ROIC = 10% projected Sales to capital = 0.34

Revenue growth of 9% based on Fiserv’s low-end of guidance for the balance of 2022, before falling to the current 10-year Treasury rate of 2.78%, as of writing this article.

Margins will grow from 16.13%, projected for next year to 34% by year seven based on the reduction of merger-acquisition costs, the increasing mix of Clover revenues and margins, and continued growth in core banking, a higher margin business.

After all the inputs, the model gives us a fair value of $120.29, above the current market price of $109.48. All of this gives us a small margin of safety if I am wrong in my assumptions.

The model also doesn’t account for the ongoing reduction in share count, which will also help boost fair value. Furthermore, the market is currently pricing in revenue growth of around 9.5%-10%, which is in line with projections.

Final Thoughts

Bottom line, I think Fiserv is a well-run company in the core banking and payments segments with a long runway ahead with Clover and Carat.

The merchant acquiring segment from the First Data merger is still coming online. Still, Clover’s growth, partly from the platform’s abilities and the years of relationships Fiserv has built in the banking and retail sector, gives the company a long runway of growth.

Fiserv has done well in the competition between Clover and Square Sellers, with Clover passing Square in recent years. But they face stiff competition from Adyen on the enterprise front, along with Square and PayPal.

I am long Fiserv, and with a cost basis of $95, I am comfortable with the steady improvements the company continues to see. I think a fair value between $115 to $130 is reasonable given today’s conditions, and I recommend the company at any price below those prices.

Be the first to comment