ferrantraite/E+ via Getty Images

Introduction

Old Republic International Corporation (NYSE:ORI) showed a mixed performance as general insurance net premiums and fees increased 9%, but title insurance revenue declined 7% year-over-year over the previous quarter. No growth in premiums and fees was recorded on a consolidated basis.

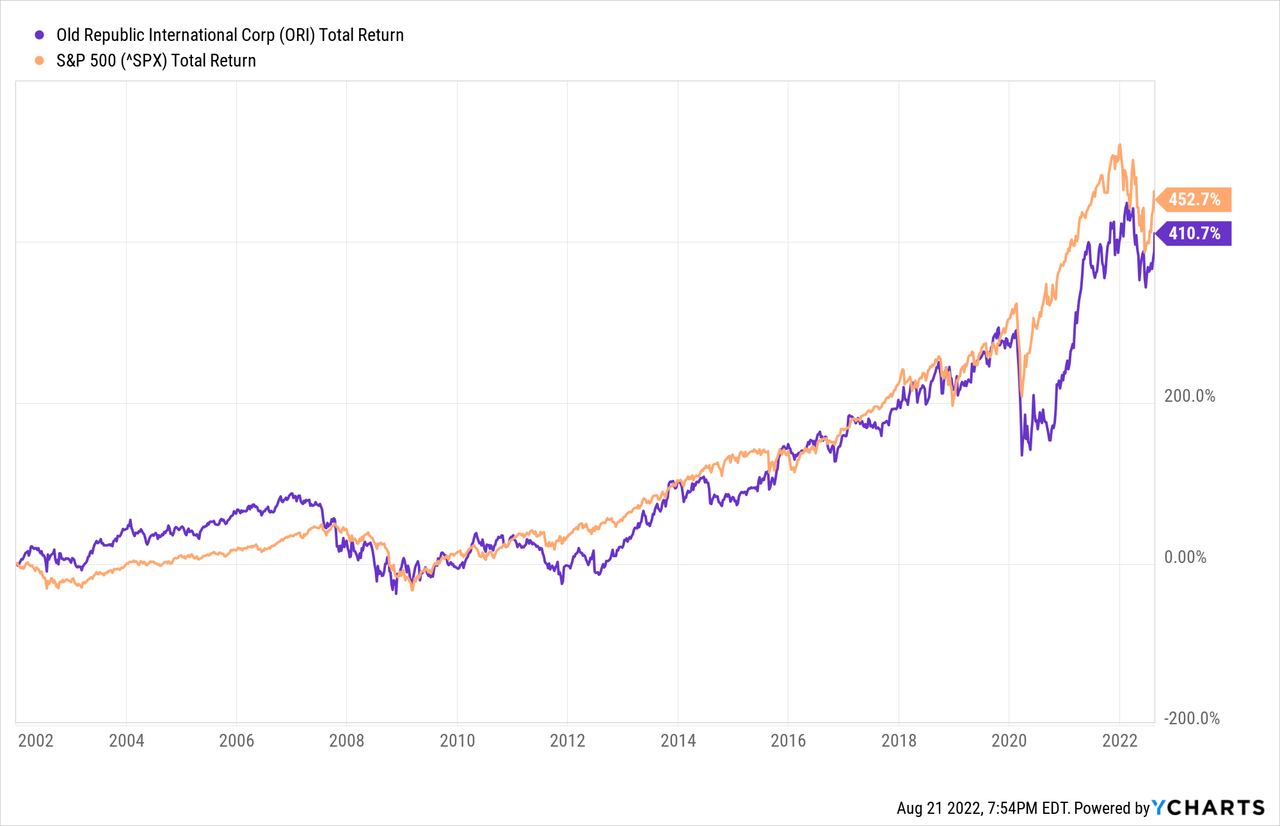

The stock has performed well over the past 20 years. But, the stock has shown more volatility than the S&P500 and now lags somewhat behind the 20-year total return of the S&P500.

With high inflation rates and rising interest rates, the insurance industry should be doing well. In times of high inflation, investors prefer real assets because they tend to increase in value. But with recent articles citing home sales crashing faster than the bursting of the 2005 housing bubble, things wouldn’t look rosy for the title segment.

The general insurance segment should do well in the coming years, but the title insurance segment will decline. Because this mix makes it unclear what earnings per share will be in the coming years, ORI stock is a hold.

About the Company

Old Republic International underwrites insurance in the United States and Canada under three segments: General Insurance, Title Insurance, and the Republic Financial Indemnity Group Run-off Business. The company is originated from 1923, and based in Chicago, Illinois.

The General Insurance offers products such as automobile extended warranty insurance, aviation, commercial automobile insurance, inland marine, travel accident, workers’ compensation, financial indemnity, et cetera. General Insurance segment compromises approximately 48% of the consolidated net premiums and fees received.

The Title Insurance business offers policies to real estate purchasers and investors. In addition to title insurance, the company provides escrow closing and construction disbursement services, but also real estate information products, national default management services and other services related to real estate transfers and loan transactions. Title Insurance represents approximately 52% of the consolidated net premiums and fees received.

The Republic Financial Indemnity Group Run-off Business provides mortgage insurance coverage. The coverage protects mortgage lenders and investors from default related losses on residential mortgage loans. This segment contributes to a small portion of consolidated revenue.

The Housing Market Is In A Bubble

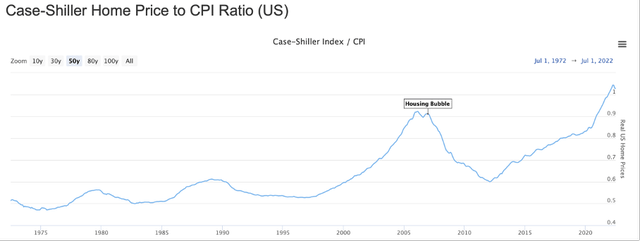

The housing market is in a bubble. The ratio between average house prices and the consumer price index has never been higher. This is seen in the Case-Shiller Home Price to CPI Ratio below.

Case-Shiller Home Price to CPI Ratio (longtermtrends.net)

The 2008 housing crisis is marked at a ratio of 0.9, which is lower than the current quote of 1.03. This indicates that house prices are expensive compared to the price of the package of everyday goods and services. I expect both house prices and CPI to be corrected. Inflation will remain high and house prices will fall. The sharp rise in interest rates will contribute to this.

Chris Puplava’s recent article described the following:

Existing home sales continued their historic plunge in July to reach the lowest level in 7 years outside of COVID, down roughly 1.7 million home sales in just the last six months.

If demand falls and interest rates rise, house prices will soon fall. This is very detrimental to the title insurance segment.

Revenue and Earnings Per Share Will Fall

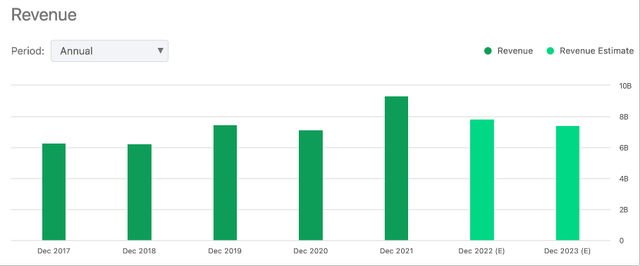

The second quarter showed strong results for the general insurance segment. Net premiums written grew 8.8% year over year. On the other hand, the title insurance segment revenue was down 7.1%. This is a harbinger of what is to come. Consolidated revenue was the same as last year. The general insurance segment is thriving amid rising interest rates, while the title segment is experiencing difficulties due to the expected decline in refinancing volumes. A possible fall in house prices will further deteriorate earnings for the title segment. Overall, analysts expect revenue to fall -16% in FY22 and -6% in FY23.

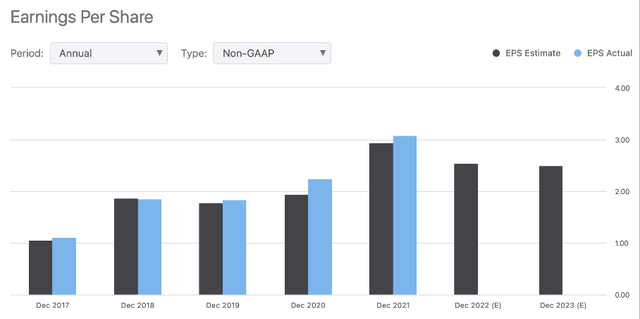

Net written premiums and fees are invested in a bond portfolio that provides a stable income stream. The value of bonds usually falls when interest rates rise, but that’s not a problem for Old Republic because they’re held until maturity. Non-GAAP EPS is expected to decline -17% in FY22 and -2% in FY23.

The mix between general and title insurance is well suited to offset potential declines in the title insurance segment. But this offers no value in times of falling house prices and falling home sales. The stock has already risen from its low in May. What about its valuation?

Stock Valuation

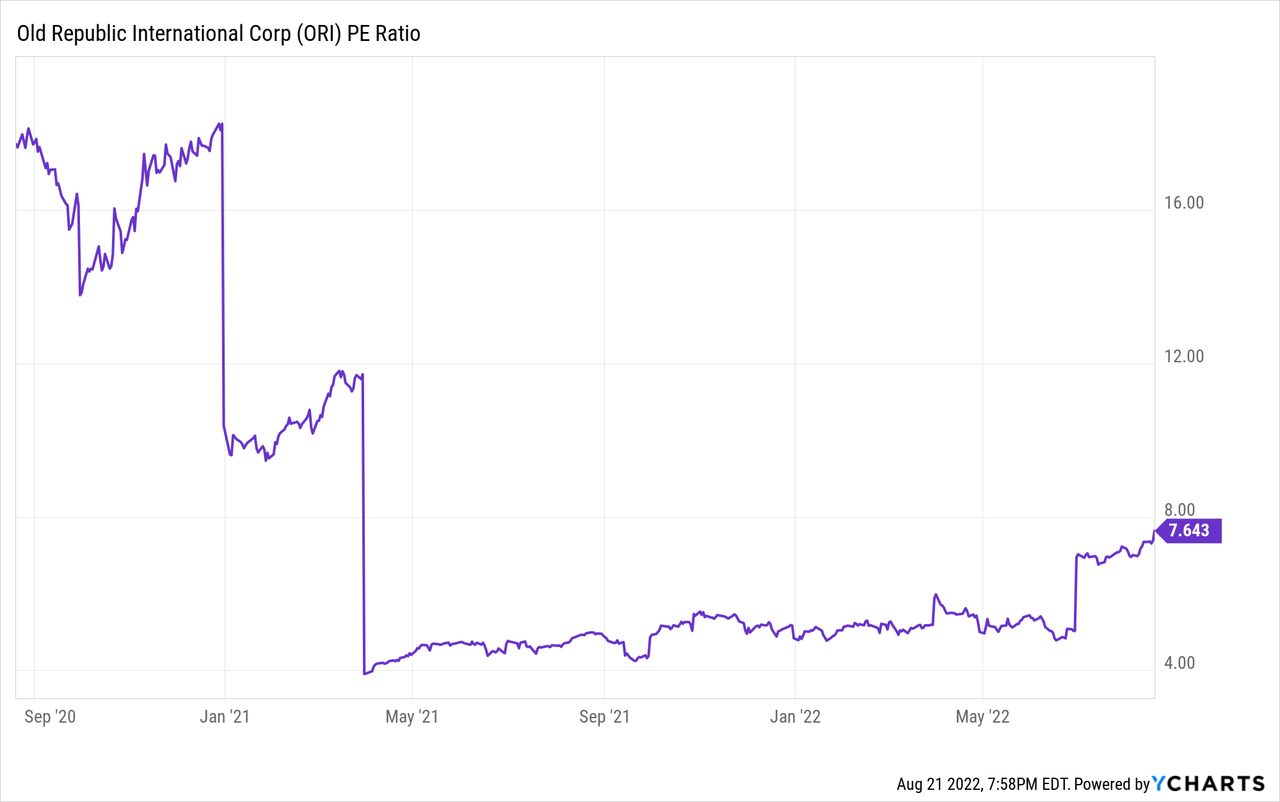

The P/E ratio shoots to infinity around the coronavirus crisis and during the 2007-2008 financial crisis. That is why I have taken two charts, which exclude these periods.

The start of the first chart starts on September 2020. The P/E ratio dropped from 16 to 4. Currently, the P/E ratio stands at 7.6.

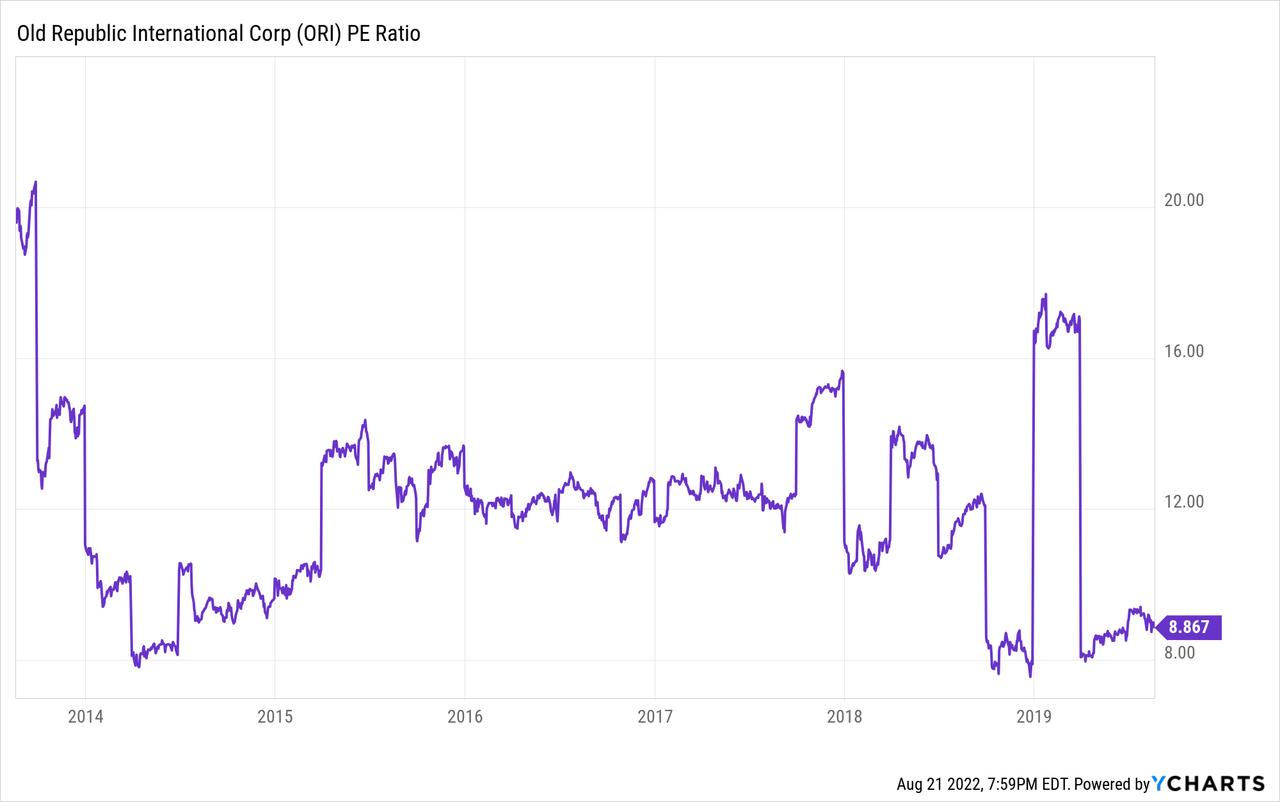

In the period from mid-2013 to mid-2019, the average P/E ratio was 12. During this period, inflation was at a normal level and there was no recession. From 2015, U.S. interest rates rose gradually, after which the P/E ratio fell, as can be seen in the following chart.

The current P/E ratio of 7.6 is lower than the average P/E ratio over the period mid-2013 to mid-2019. This makes the stock appear undervalued. Given the mixed outlook, I’ll wait until the Federal Reserve stabilizes U.S. interest rates and when the housing market shows good prospects before buying the stock.

Conclusion

Old Republic International underwrites insurance in the United States and Canada under three segments: General Insurance, Title Insurance, and the Republic Financial Indemnity Group Run-off Business.

The net written premiums are invested in bonds, which in turn generate more profit at higher interest rates. The bonds fall in value when interest rates rise, but that is not a problem because they are held until maturity. The general insurance segment comprises approximately 48% of the consolidated net premiums and benefits received.

With house prices at record levels, rising interest rates and falling transactions, this is a perfect storm for a fall in house prices. Falling home prices and few transactions are hurting Old Republic’s property insurance segment. Due to the mix between growth in the general insurance segment and decline in the title segment, it is unclear what the earnings per share will do in the coming years.

The stock has historically been attractively valued, but if there are no growth catalysts, the stock will show little movement in the coming years. The stock is a hold.

Be the first to comment