Sundry Photography

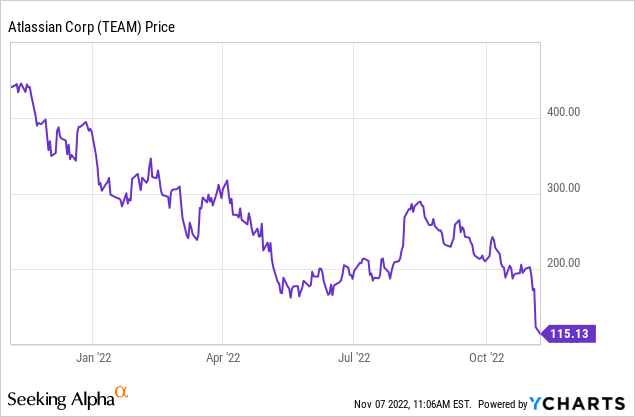

It’s not a common thing for a perennial highflier and Wall Street darling to suddenly become a penalty-box value stock, but this is exactly what just happened to Atlassian (NASDAQ:TEAM). This SaaS company, one of the best-known brand names in collaboration and DevOps software tools, took a massive plunge after reporting Q1 results.

Year to date, shares of Atlassian have now lost a jarring ~70% of their value, wiping multiple tens of billions of dollars in market cap from a company once thought to be one of the sturdiest names in software. Earlier, analysts and investors had praised Atlassian for its well-defended product stack, its largely word-of-mouth marketing plan that led to rich operating margins, and tremendous growth at scale.

The long-term bull case for Atlassian is still vibrant, once we get past the near-term softness

No company is immune to the shift in macro conditions, however, and Atlassian is feeling pressure from companies tightening their belts and reducing their capital spending. In its Q1 shareholder letter, the company wrote as follows:

1) We continued to see a slower rate of Free instances converting to paid plans; and 2) we started to see a slower rate of growth in paid seats from existing customers as companies slowed their pace of hiring. We’re not seeing any changes in our competitive position or in the inherent demand for our products. Looking across our customer base of 249,000+, there has been no overall decrease in usage or change in churn.”

Is this bad news? Certainly. But is not unexpected? Not entirely. Almost every other technology company has reported instances of slowing spend, particularly among enterprise customers, and especially when Atlassian’s primary business model has free and paid versions of its core software, it makes sense for the company to see a drop-off in conversions.

But this being said, I remain positive on the long-term bull case for Atlassian for two primary reasons:

- Atlassian’s existing install base is still massive, and churn isn’t rising – Atlassian becomes a fairly sticky, mission-critical piece of a company’s operations. Even if the company won’t be growing its base during a temporary recession, it is still sitting on a very powerful recurring revenue stream.

- Rich operating margins – Atlassian is also not taking down its profitability forecasts. The fact that its revenue comes in at a mid-80% pro forma gross margin, and the fact that Atlassian spends relatively little on direct sales (versus other SaaS companies) gives it the ability to “hunker down” during bad times and still generate profits.

In my view, Atlassian’s selloff has gone way too far. At current share prices near $115, Atlassian trades at a market cap of $29.48 billion. After we net off the $1.71 billion of cash (unencumbered of debt) on Atlassian’s most recent balance sheet, the company’s resulting enterprise value is $27.77 billion.

For the current fiscal year FY23, meanwhile, Wall Street analysts are expecting the company to generate $3.51 billion in revenue, or 25% y/y growth (still a heady growth rate for a company of Atlassian’s scale, keep in mind). At this estimate, Atlassian trades at 7.9x EV/FY23 revenue (compared to high-teens to low-20s at its peak).

Another triangulation point here is free cash flow. In FY22, Atlassian generated $810 million of FCF at a ~29% FCF margin. Assuming the company can hold onto its FCF margin profile this year (so far, Q1 FCF is up versus last year); the company would generate ~$1.01 billion of FCF this year and is trading at a relatively modest 27x FCF multiple.

The bottom line here: in my view, I think we finally have an attractive entry point for Atlassian. Use this dip as a well-timed buying opportunity and expect a rebound within a 9-12 month timeframe.

Q1 download

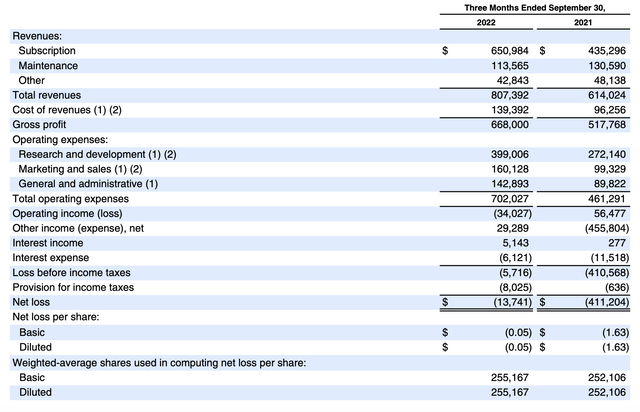

Despite relatively bearish macro commentary, Atlassian’s Q1 results weren’t entirely a bad-news story. Take a look at the results below:

Atlassian Q1 results (Atlassian Q1 shareholder letter)

Atlassian’s revenue grew 31% y/y to $807.4 million, matching Wall Street’s expectations but decelerating five points relative to 36% y/y growth in Q4. To a large extent, this slowdown was already anticipated – as Atlassian reported the trend of slower conversion rates in its earnings call last quarter.

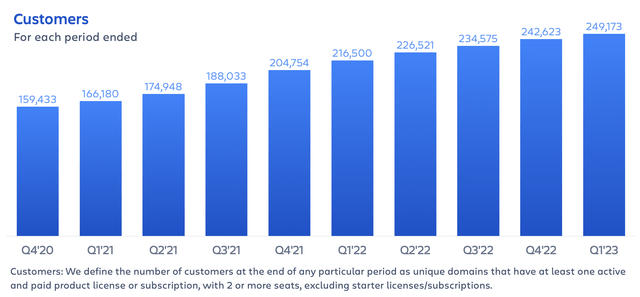

Customer base growth slowed down as well, though not markedly. The company still added 6.5k net-new customers to end Q1 at a record 249.1k base, up 15% y/y. This is only a minor slowdown from 8.0k net adds in Q4, though we do expect further deceleration ahead.

Atlassian customers (Atlassian Q1 shareholder letter)

Management also provided anecdotal commentary on the Q&A portion of the Q1 earnings call that net expansion rates remained above 130%, as existing customers continue to add seats (though not at as high of a pace as before) and churn remains at normal levels.

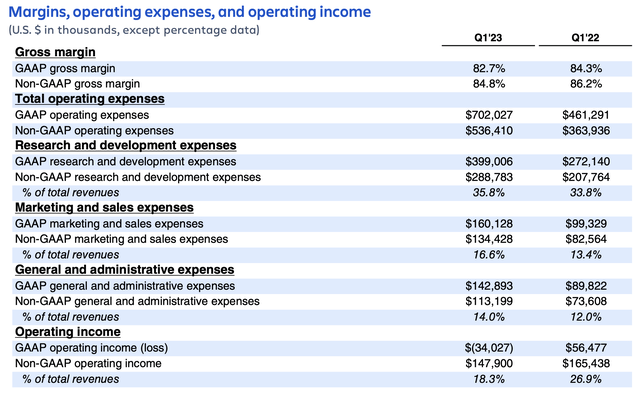

From a margin perspective, Atlassian’s pro forma gross margin remained elevated at 84.8%, down 140bps from the prior-year quarter, impacted primarily by the company’s ongoing push to move customers from server deployments to cloud.

Atlassian margin trends (Atlassian Q1 shareholder letter)

The company’s pro forma operating margins, meanwhile, shrank nine points to 18% due to the same opex inflation that all other companies are seeing. This is, however, consistent with the company’s previously issued guidance, which is still aiming for a mid-teens pro forma operating margin for FY23. Note that with >30% y/y revenue growth and an 18% pro forma operating margin, Atlassian still sits comfortably in the “Rule of 40” club.

Key takeaways

Amid heightened pessimism for an economic slowdown that impacts all companies proportionally, it’s a great time to buy into an iconic software brand like Atlassian at a sharp discount. It’s worth noting now that Atlassian is trading at levels below where it began the pandemic, despite the fierce growth that the company has achieved since then. Investors with strong stomachs can look forward to sharp rebound gains once overall sentiment turns around.

Be the first to comment