aydinmutlu/E+ via Getty Images

Investment Thesis

Reliance Steel & Aluminum (NYSE:RS) is up more than 30% in 2022. Even as steel prices have been falling since April.

What’s more, RS is profitable and cheaply valued. And confident enough about its prospects to buy back a significant amount of shares in Q3.

Oh, and did I mention there’s a small dividend too?

By my estimates, shareholders are getting a 7.0% total return from just holding on RS. There’s a lot to like here. So, let’s jump into it.

2023 Really That Bad?

I’m going to provide two different considerations for investors. One good and one bad.

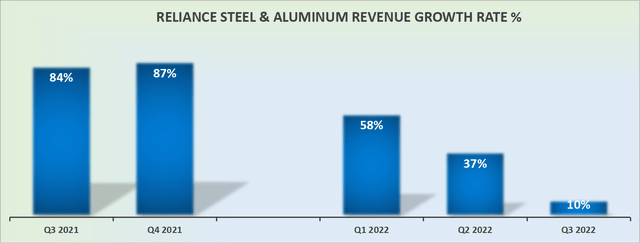

The positive consideration is that has just reported very strong results. More specifically, Q3 2022 revenues were up 10% against very tough comparables with the prior year.

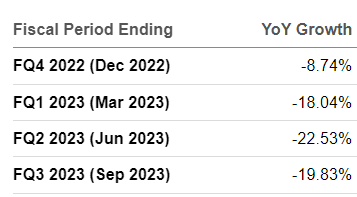

The bad news is that analysts fundamentally believe that from here on out, RS’s revenue growth rates are going to be moving in one direction. Negatively. And not only negatively, but stay down well into the summer of 2023.

RS analysts’ revenue estimates

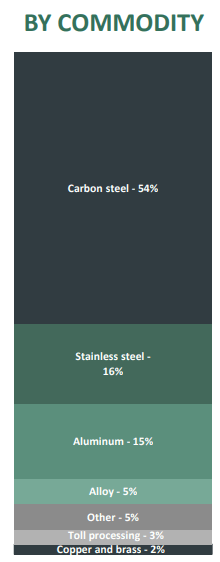

For my part, I simply don’t believe these estimates. Here’s why. Recall, RS’s revenues are predominantly steel based.

RS Q3 2022

As you can see above, steel makes up approximately 70% of the overall business. So what happens in steel has an overbearing impact on RS’ prospects.

What’s more, I believe that the cure for low prices are low prices. Hence, notwithstanding China’s lockdown, it appears to me that steel prices have found a bottom. And once China does reopen, as it inevitably will at some point, we’ll see steel commodity demand moving higher again.

And several investors have written to me that they believe that what happens in the steel market in China is irrelevant in the US. I can assure you that this is not the case. Steel is a commodity. And China, or more specifically, China’s real estate sector is its biggest consumer of global steel.

In sum, I believe that the steel sector is primed to do well in 2023.

What’s High Return on Capital? 7.0% Combined Return

I’m often told that tech companies are asset-light, high-ROE companies. But what I actually believe is that GAAP accounting poorly reflects economic value, as it fails to accurately reflect management’s compensation package.

As a counter-example, consider this. In Q3, RS repurchased approximately 10.9% of its market cap annualized. Or put another way, on an annualized basis, RS returned $1.3 billion to shareholders.

These Q3 repurchases, together with those in the prior quarters, have reduced RS’ total number of shares outstanding by 5.2% y/y. And then, on top of that shareholders also get a 1.7% dividend yield. Thus, altogether, investors are getting a 7.0% combined yield.

So, when I see fintech and other workflow SaaS companies talking about investing for growth, and then I compare those investment opportunities with those in steel, I am nothing but further compelled towards steel companies.

RS Stock Valuation – 7x EPS

Presently, analysts expect RS’ EPS to reach $4.46 in Q4 2022. This would mean that 2022 as a whole would see approximately $28.56. This puts RS priced at 7x this year’s EPS.

Consequently, this means that despite steel plummeting in price since April, the company is still profitable and eager to return capital to shareholders.

Of course, the big question is 2023. But I think that if RS can be profitable in 2023 with China’s real estate market in the doldrums, there’s a positive catalyst afoot that will keep steel prices supported in 2023.

Essentially, this is my point. In time, investors will come to view stocks priced at single digits as cheap and attractive. Particularly, those companies that are printing enough free cash flow that when they buy back shares actually reduce the total number of shares outstanding.

The Bottom Line

This is the takeaway, Reliance Steel & Aluminum is very cheaply valued, and its outlook is likely to improve.

Looking ahead to 2023, Karla Lewis will take the reins of the company as CEO. While we don’t know exactly how Lewis will fare going forward, what I do know is this:

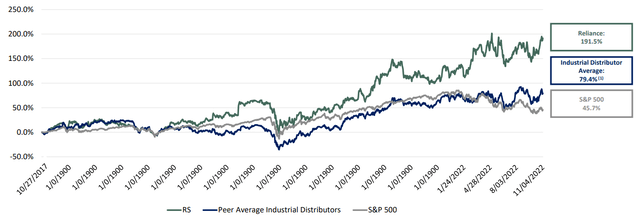

In the past 5 years, RS has substantially outperformed the S&P 500 (SPY). All the talk about tech being the place for growth investors, this fact clearly illustrates that false reasoning.

Lewis has been instrumental at RS for more than 20 years, holding various roles. I believe the company is left in good hands. And that investors will be rewarded here.

Be the first to comment