violinconcertono3/iStock Editorial via Getty Images

Much has been written within the Seeking Alpha community about the fate and prospects of Citigroup Inc. (NYSE:C) over the past several months. The consensus is that the stock is a solid “Buy” among Seeking Alpha Authors. A scan of the Factor Grades shows high marks for Valuation, but low marks for Growth, Profitability and Momentum. This analysis will attempt to unravel the seemingly contradictory factors that result in an overall Buy rating on the stock, particularly when most economists believe that the economy will fall into a recession sometime within the next twelve months.

Under new CEO Jane Fraser, Citigroup has taken many steps to streamline its operations, reporting, and market segments. Just in the last 18 months, the company has announced it is exiting 14 consumer businesses in Asia, Europe, and Mexico. The company will maintain an institutional and wealth management presence in these regions. Additionally, the company is upgrading its risk and controls environment to be in sync with the digital age. These efforts should provide better data for shareholders, regulators, and clients. Many of these efforts should also improve the company’s overall profitability and efficiency, with a stated goal of sustaining 11% – 12% ROTCE over the next three to five years.

Coming out of the pandemic lockdown in 2020, the company ended 2021 in a very strong operating position. 2021 net income was $22 billion, including a $3.8 billion net benefit from loan loss provisions. ROTCE was 13.5% for the year, a sharp improvement over the pre-pandemic ROTCE of 12.2%. Tier 1 capital was 13.9%, trending upwards over the past several years. Deposit growth was 2.9% and loan growth was flat year over year. Book value per share and tangible book value per share both increased over 6%. On paper, the company looks like it is performing well. So why is it priced so much lower than its major bank peers?

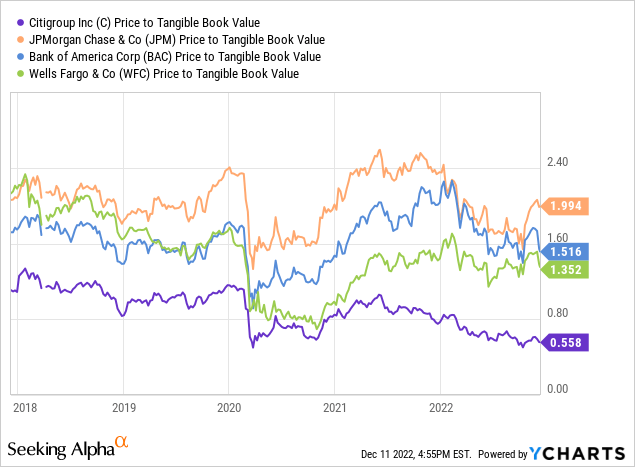

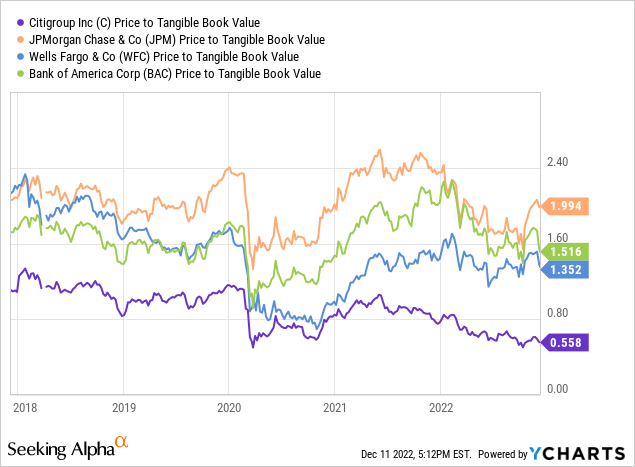

One may think that the economic environment over the past twelve months has a lot to do with it. But if you look at the last five years, C has been priced at a major discount to book value, while its peers have generally been priced at a premium.

So perhaps the problems from the financial crisis still linger. Even Wells Fargo (WFC) with all of its scandals, is priced at a pretty good premium to book value.

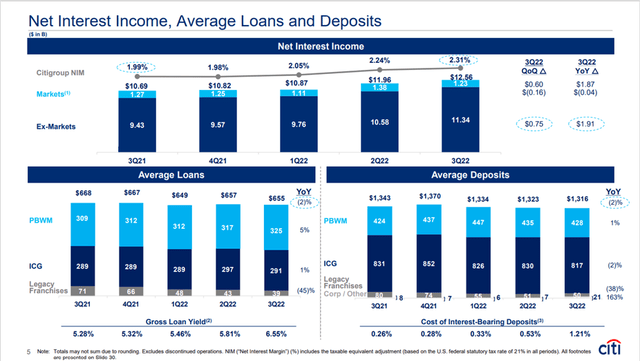

An inverted yield curve, war in Ukraine, high inflation, covid shut-downs, and continued supply chain disruptions have all played havoc on the global economic backdrop. Banks’ earnings reports have been very underwhelming, Citigroup included. The company has reported a 5.4% decline in non-interest revenues over the first nine months of the year. Commissions and fees have taken the biggest hit, down over 31% from the prior year period. Because of higher interest rates, however, net interest income has shown huge gains from the prior year. Interest income is up 29%, while interest expense is up over 122%, resulting in a 12% increase in net interest income. Even though interest rates are at levels not seen since before the financial crisis, the company is producing a bounty of interest income. Of course, interest expense has risen quite dramatically, but interest rates on deposits remain very, very low.

Citi NII, Avg Loans and Deposits (Citigroup)

One of the biggest changes we have seen in banks’ results is the flip from a benefit for loan losses in 2021 to a provision for loan losses in 2022, which has hurt companies’ bottom lines this year. In 2021, banks, including Citigroup, released many of the provisions that were booked as a result of the impacts from the pandemic in 2020. In 2022, Citigroup has reported a net build in the provision for loan losses. Year to date, the company has booked a provision of $3.4 billion, compared to a benefit of $3.3 billion in the same period last year, a $6.7 billion negative swing. It is expected that the build will continue in the fourth quarter, although I do not foresee the impact being anywhere near as large as what the company reported in the years before the pandemic. If the economy slows into a recession in 2023, we would expect the provisions for loan losses to increase quite a bit. For perspective, YTD provisions were $3.3 billion, or 6% of net revenues. In 2020, provisions were $17 billion, or 23% of net revenues, and in 2010, coming out of the financial crisis, provisions were $26 billion, or 30% of net revenues.

Operating expenses have increased 10.5% from the prior year period. Compensation has seen an 11% increase, while advertising and marketing have increased 12%. The efficiency ratio is 66.8% for 2022, compared to 63.2% for the same period in 2021. Historically, the company has averaged just under 60%, so this is one area that investors need to keep an eye on going forward. There are some reorganization expenses built into the recent numbers, but only about $107 million. Most of the increase is due to transformation investments, business-led investments, inflation effects and risk and control initiatives. The company did note in their presentation that about 8,000 people have been added in Technology, which is quite substantial. Overall, the company is expecting 7-8% year-over-year growth in expenses, excluding the divestiture related impacts. At that level of guidance, we would expect Q4 expenses to come in at around $12.8 billion excluding any divestiture expenses.

Over on the balance sheet, we have seen the company increase total assets at a 5% CAGR over the past five years ending 2021, with a further increase so far in 2022 of 1.4%. Loan growth has slowed quite a bit. In fact, net loans peaked at $687 billion in 2019 while ending the third quarter at $630 billion. Deposit growth, however, remains strong, this year notwithstanding. The company reported that the declines in loans and deposits are primarily due to the impact of foreign exchange translations and lower balances in the Legacy Franchises. Not a major cause of concern, yet, but certainly worth keeping an eye on moving forward. It should be noted that many other banks have reported that deposits have decreased due to consumers working down their savings to offset the impacts they are experiencing from inflation.

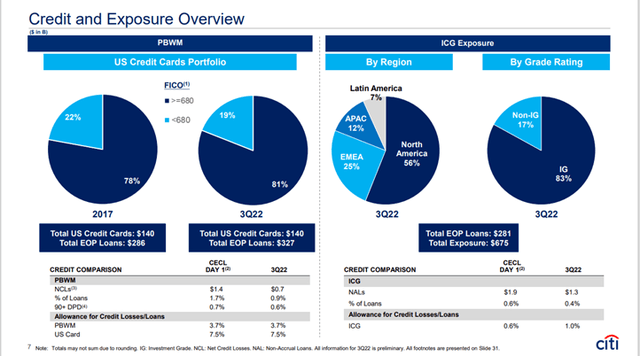

Loan quality remains very good. Citigroup along with many other banks have not yet seen the full impact of stressed consumers or businesses. The allowance for loan losses has been trending higher this year, but remains at 2.5% of total loans, slightly higher than at the end of 2021, but well below the level at the end of 2020.

Credit and Exposure Overview (Citigroup)

The company’s capital position remains adequate, with a CET1 ratio of 12.2%. The company has paused its share repurchases, citing upcoming increases in regulatory capital requirements, as well as macroeconomic uncertainty.

At the bottom line, net income has decreased 36% for the nine-month period compared to 2021. That is substantial, and at the lower end of the peer group.

| Company | Net income growth (YTD 22 YoY) | EPS Growth (YTD 22 YoY) |

| Citigroup | -35.8% | -32.3% |

| J.P. Morgan | -35.9% | -30.8% |

| Wells Fargo | -19.6% | -14.6% |

| Bank of America | -30.8% | -29.2% |

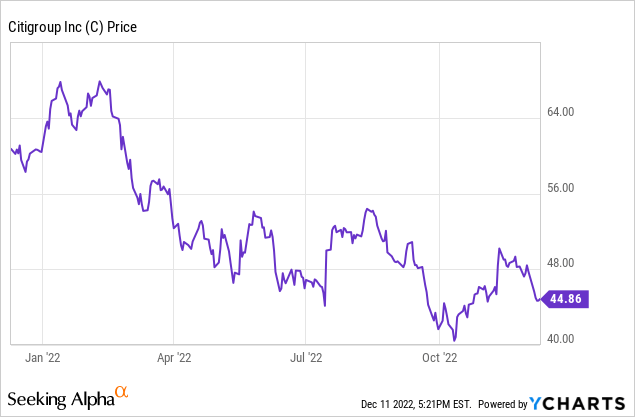

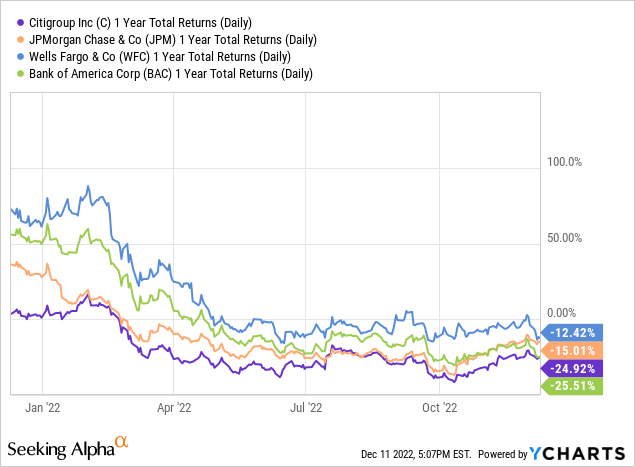

C, like most banks stocks, has faced a very difficult 12 months. At a recent price of $44.86, the stock is down 25% over the past year.

C was the worst performing stock among the major banks until this past week’s drop in BAC:

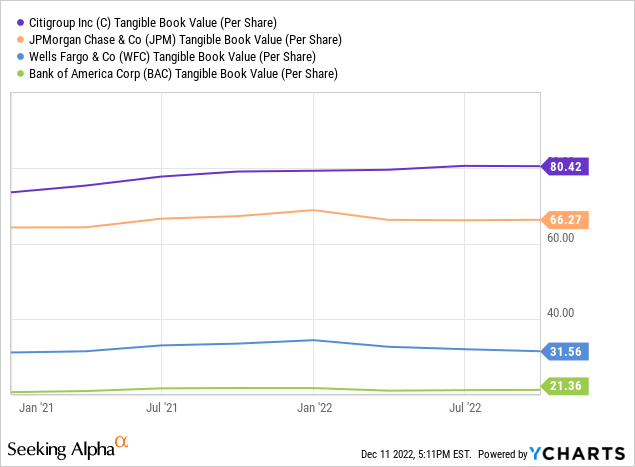

However, tangible book value is up 1.8% over the past 12 months, which is the highest among the peer group. In fact, it is the only one that has shown an increase:

C is currently trading at 0.6x tangible book value, which is much lower than the five-year average of 0.9x.

The five-year average price to tangible book value for JPM, BAC and WFC are 2.0x, 1.7x and 1.5x, respectively. Investors would be wise to remember the old Wall Street adage: buy banks when they are trading for less than book value.

Another metric that value investors consider is the Price/Earnings growth rate ratio (PEG ratio). Again, C is trading at 0.39, compared to the peer group of WFC 2.76, JPM 0.58, BAC 0.60.

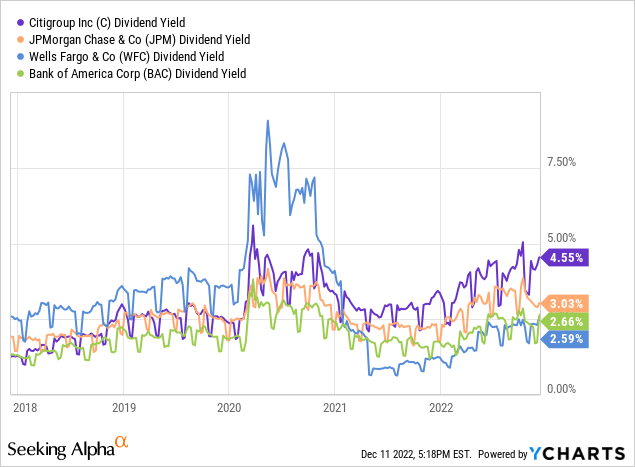

Finally, the company currently pays a nice dividend of 4.55%, much higher than the peer group. While the company has currently paused its share repurchases, the dividend appears relatively safe and provides a very nice income stream for investors.

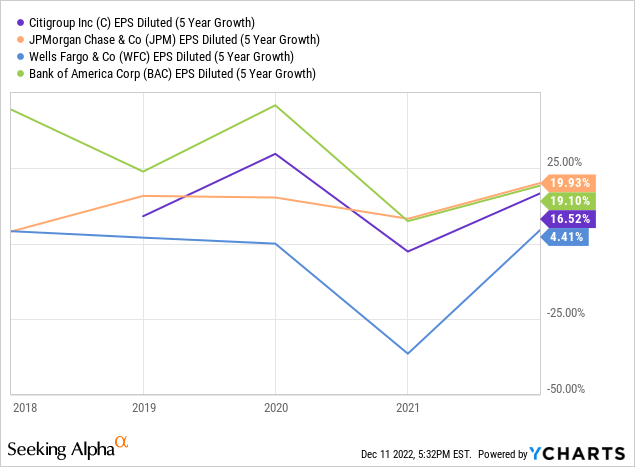

The 5 year annual EPS growth rates are interesting as well. It’s not like C is unable to generate growth. In fact, EPS growth is third highest among the banks and very healthy. It shows that the company can generate growth in earnings, albeit not as much as JPM or BAC, but still quite substantial.

Based on the above analysis and several valuation methods, I estimate the stock could be worth as much as $64, which would still represent a significant discount to tangible book value. The stock has been hammered, pricing in at least a mild recession in the near future. But, all of the bank stocks are down over the past year. The company is in good shape and appears to be well-capitalized to handle a recession. I think that C is still paying for its past issues. But it appears that many of those are in the past, and the future looks better for Citigroup than at any time in recent history. For investors looking for exposure to one of the largest banks in the world, it appears that C could provide good value for a company that has proven to increase EPS significantly and pays an above average dividend payment. Its peers are also very good companies, but it seems that Citigroup may be the best option despite what many feel is an imminent recession.

Be the first to comment