Sergey Kharin/iStock via Getty Images

Introduction

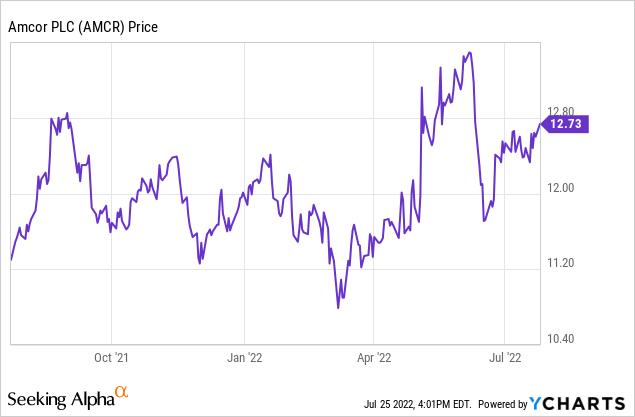

I like companies in the packaging industry as most goods that are sold require packaging. Sure, companies in the space are still hit by inflation-related issues but that usually is just a temporary issue as they can just pass on the price increases to their customers. Amcor (NYSE:AMCR) is one of the world leaders in the packaging industry and although the company definitely isn’t the cheapest (Berry Global (BERY) comes to mind as trading at lower multiples), Amcor is a very consistent performer and that allows it to trade at a premium to most of its competitors.

Amcor’s results in the first nine months of the year were good

The company’s financial year ends in June so the next set of financial results to be released by the company will be full-year results. However, considering we already have access to the 9M 2022 results, we can start figuring out what we can expect from Amcor in the financial year.

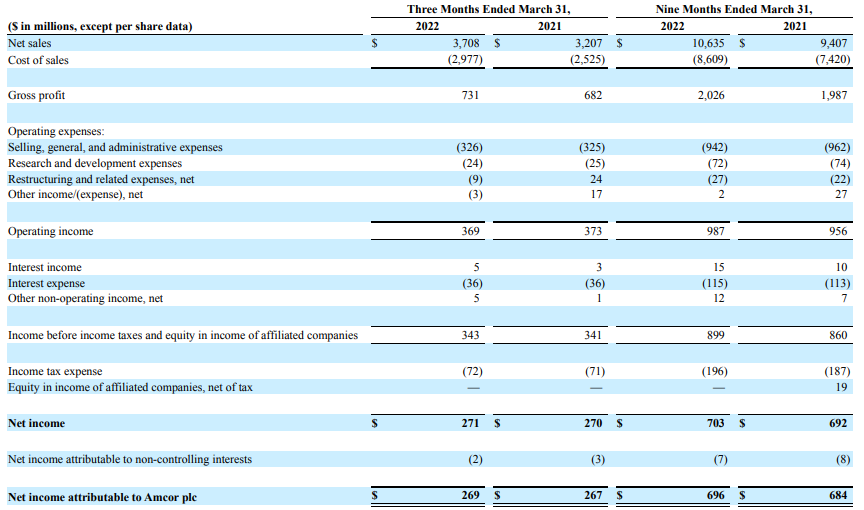

Of importance is the relatively strong performance in the first nine months of the year. Sure, margins are getting squeezed and in the first nine months of the year, the $1.2B revenue increase only resulted in a $31M operating income increase although the 9M 2021 results were boosted by a $25M higher result in the “other income” category.

Amcor Investor Relations

So on a more comparable basis, the operating income increased by 5.5% despite the gross profit increase of just around 2% and the damage was mainly mitigated by relatively lower SG&A and R&D expenses.

The net income came in at $703M of which $7M was attributable to non-controlling interests, resulting in a net attributable income of $696M for an EPS of just under $0.46. Keep in mind that’s based on the average share count and if we would use the share count as of the publication of the quarterly report, the EPS would have exceeded $0.46.

We also see the third quarter was actually pretty strong in absolute terms although it also was the quarter with the strongest revenue increase while reporting slightly higher operating income on an adjusted basis ($372M versus $356M excluding the “other” income and expenses).

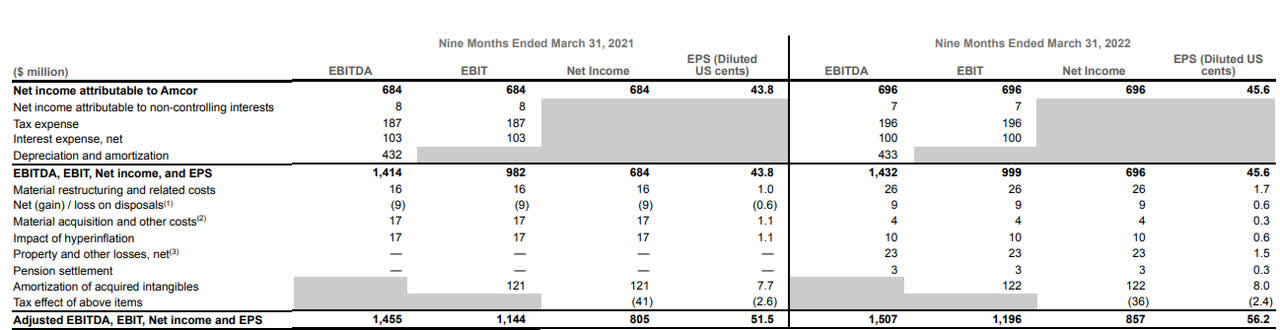

Also keep in mind Amcor likes to report on its “adjusted EPS.’ That’s the EPS excluding the amortization of acquired intangibles and other (smaller) elements. The table below shows the reconciliation from reported net income to adjusted net income. While this may confuse investors, I think it’s a fair way to show the underlying earnings power of the company.

Amcor Investor Relations

This also explains why the reported free cash flow tends to be substantially higher than the reported net income: An amortization is a non-cash expense so it doesn’t show up on the cash flow statement (other than it being added back to the operating cash flow).

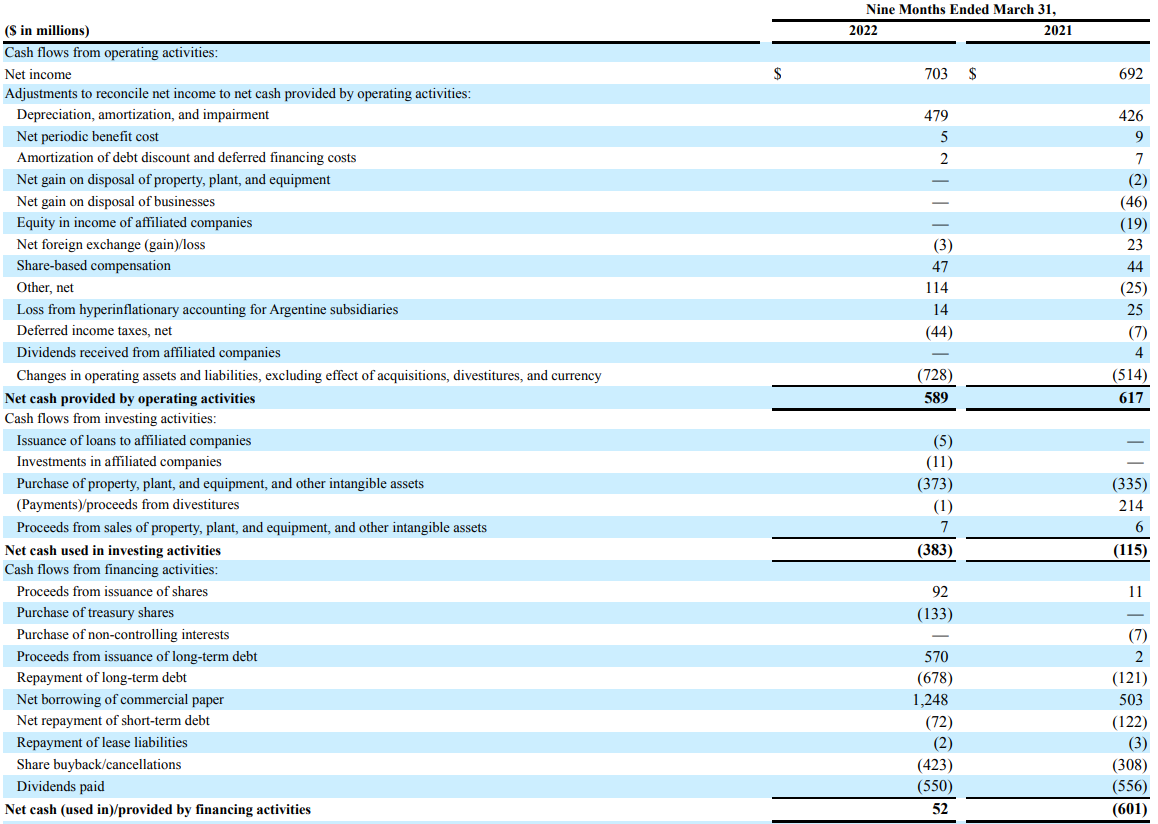

That’s also clearly visible below. The reported operating cash flow was $589M and after adding back the $728M in working capital changes, the adjusted operating cash flow was approximately $1.32B and after deducting the $373M in capex, the adjusted free cash flow was $942M.

Amcor Investor Relations

Divided over the current share count of 1.5B shares outstanding, the adjusted free cash flow per share was approximately 63 cents, slightly higher than the adjusted EPS thanks to the difference between capital expenditures and depreciation expenses.

Amcor expected to report a full-year adjusted EPS of $0.795-0.81 which indicates the adjusted EPS in the final quarter of the financial year will come in at $0.23-0.25 which would be a very reasonable result. The full-year free cash flow guidance was confirmed at $1.1B although Amcor uses a different calculation method which includes the proceeds from equipment sales and the changes in the working capital position.

That’s why I think the underlying free cash flow result will come in higher than the $1.1B projected by the company. Adjusted for changes in the working capital position, I think we can reasonably aim at $1.3-1.4B in underlying free cash flow.

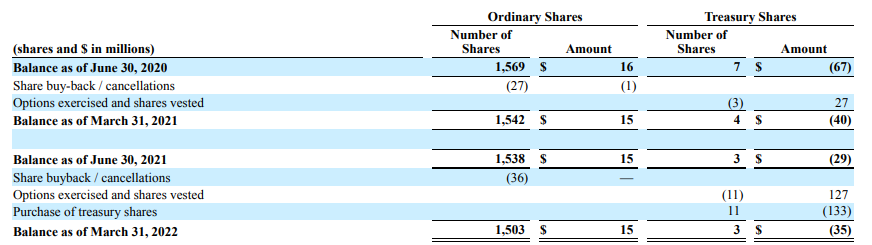

This entire amount will be spent on shareholder rewards. The quarterly dividend was recently hiked to $0.12 which means the dividend will cost the company in excess of $700M per year while it was also wrapping up a $600M share repurchase program ($423M had already been spent in the first nine months of the year to repurchase a total of 36 million shares).

Amcor Investor Relations

Investment thesis

I currently have no position in Amcor. The company has never been cheap enough for me to pull the trigger and I wish the company also was looking more toward debt reduction rather than solely focusing on shareholder rewards. Looking at the bond markets, a four-year bond issued by Amcor currently has a yield to maturity of approximately 4.7% while the six-year bonds have a YTM of 4.8%. Investors purely looking for income should perhaps consider Amcor’s bonds as the interest income exceeds the dividend yield.

Of course, then an investor would miss out on the potential capital gains. And while I do expect the adjusted EPS to increase as Amcor should be able to hike its prices, I’m not sure I’m willing to pay 16 times the FY 2022 adjusted EPS for this packaging giant.

Be the first to comment