imaginima

Genesis Energy L.P. (NYSE:GEL) is one of the most unique midstream companies in the business because it owns and operates far more than pipelines, storage facilities, and other classic midstream assets. However, it does still possess many of the characteristics that investors typically like about midstream companies, such as stable cash flows and incredibly high yields. Indeed, Genesis Energy yields 7.49% as of the time of writing, which is certainly enough to grab the eye of any investor. With that said though, this company was one of the more affected ones by the outbreak of the COVID-19 pandemic as that event forced it to slash its distribution, an event from which it has never fully recovered. The company’s distribution has yet to be raised and unfortunately, its partnership units are down 20.44% over the past twelve months. Although the unit’s market performance is nowhere near as good as many of the upstream companies in the industry, most midstream companies are down over the past year so this is not as concerning as we may think. In fact, there may be some reasons to consider purchasing Genesis Energy today as the company does boast some very strong growth opportunities right now. However, caution may still be warranted since Genesis Energy has still not overcome the debt problems that have plagued it for many years but it has made some progress in this area. Let us investigate and see if taking a position in the company makes sense today.

About Genesis Energy

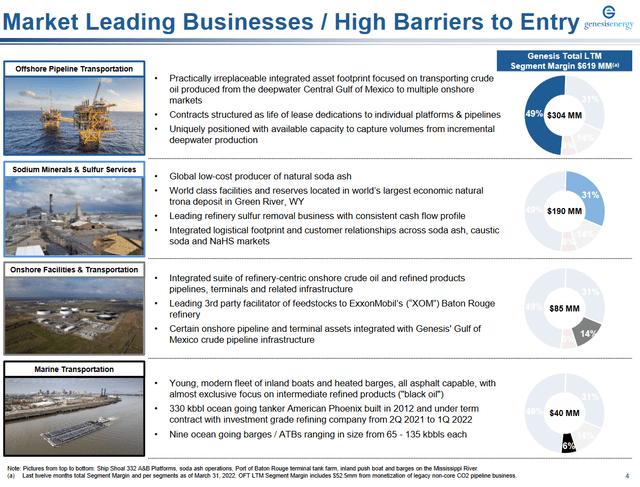

As stated in the introduction, Genesis Energy is one of the more unique midstream companies in the market today, as it operates much more than just pipelines, resource storage, natural gas processing, and similar facilities. The company operates in four separate business segments: Offshore Pipelines, Sodium Minerals & Sulfur Services, Onshore Facilities & Transportation, and Marine Transportation:

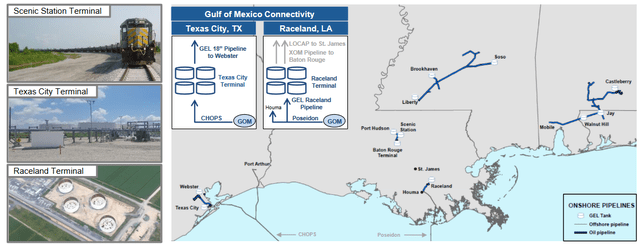

Of these four business units, the Onshore Facilities & Transportation unit is the most similar to the other midstream companies that I typically discuss on this site. This unit operates pipelines and terminals in Texas and Louisiana, but admittedly the infrastructure is not particularly extensive as it consists simply of a few relatively short pipelines and ten storage facilities:

By far the most important part of this business is the infrastructure surrounding Exxon Mobil’s (XOM) massive Baton Rouge refinery. This is one of the largest crude oil refineries in the United States and Genesis Energy’s infrastructure both brings resources to the facilities and carries them away from the refinery so that Exxon Mobil can sell them. As might be expected, Genesis Energy provides this service to Exxon Mobil under a long-term contract that calls for Genesis Energy to be compensated based on the volume of resources that it handles and not their value. When we consider that resource prices are irrelevant under this contract and that the Baton Rouge facility is very important to Exxon Mobil’s North American operations, we can see that this operation should be a relatively secure and stable source of cash flow for Genesis Energy. Unfortunately, this business unit is only a relatively small contributor to the company as a whole since it only accounts for 14% of the company’s total segment margin (analogous to gross profit).

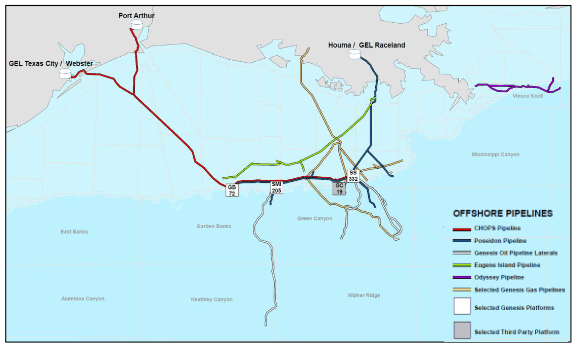

Genesis Energy’s largest business unit by far is its Offshore Pipelines business, which accounts for fully 49% of the company’s segment margin. Admittedly, this is not an area that we typically see midstream companies active in but it is a critical function in the energy industry. After all, upstream oil and natural gas producers have been operating in the Gulf of Mexico for a very long time and somebody needs to get those produced resources back to the land. This is the service that Genesis Energy is providing for its customers as the company operates an extensive pipeline transportation network stretching the breadth of the Gulf of Mexico:

Genesis Energy

In total, Genesis Energy owns a total of 2,400 miles of pipelines in the area that are primarily designed to transport crude oil from the offshore platforms to the shore. The sheer scale of this infrastructure makes Genesis Energy one of the largest midstream infrastructure operators in the Gulf of Mexico. The business model here is much the same as the company’s onshore pipelines. Genesis Energy provides pipeline transportation for its upstream customers under which the customer compensates Genesis Energy based on the volume of resources that the customer sends through the pipelines, not on the market price of the resources.

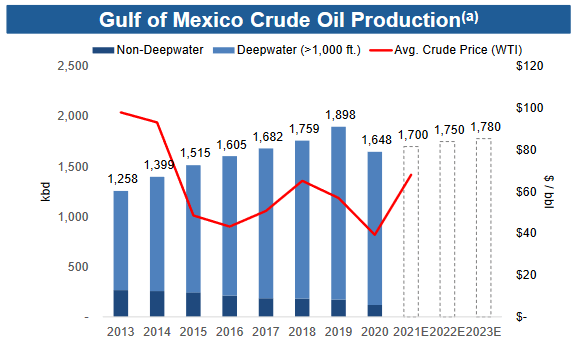

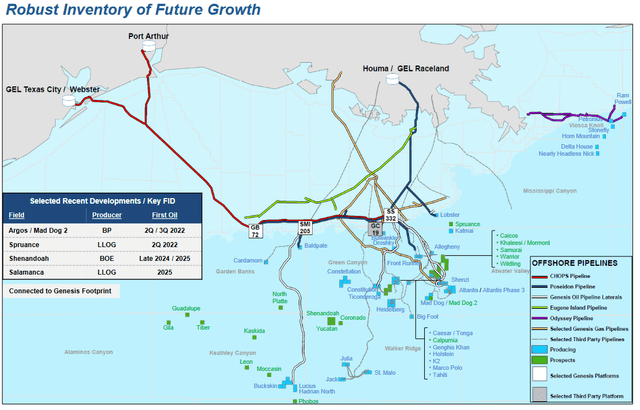

Fortunately, this volume-based business model could provide Genesis Energy with some growth potential in the coming years, which may be surprising to some readers. The production of crude oil in the Gulf of Mexico got something of a bad rap back in 2010 as a result of the Macondo disaster and although President Obama did take some actions that temporarily slowed down production growth in the Gulf, production has been growing over the past decade. In fact, crude oil production in the Gulf of Mexico has increased by 71% since 2013. This is expected to increase further over the next two years, although admittedly it will still remain below 2019 levels:

Genesis Energy

There are some reasons to believe that the expected production growth in 2022 and 2023 will actually occur. This is because it is being driven by projects that are already underway and nearing completion. For example, BP (BP) is bringing phase 2 of its massive Mad Dog project online in 2022 and LLOG will be bringing the Salamanca project online in 2025. This latter one could be especially important since Salamanca’s produced resources will be utilizing Genesis Energy’s infrastructure to get to shore. In fact, there are several projects that will be coming online within the next three years that may become users of Genesis Energy’s infrastructure:

As Genesis Energy’s revenues are dependent on volumes, these projects could increase the company’s cash flows as they come online due to the incremental resource volumes that could be sent through Genesis Energy’s infrastructure. The nice thing about this story is that we can be confident that at least some cash flow growth will actually materialize. This is because Genesis Energy has already received contracts from some of the operators of these projects to provide the necessary midstream takeaway service. The reason that the contracts are awarded in advance of the projects actually coming online is that Genesis Energy needs to ensure that it has the infrastructure in place to provide the needed services and there is no reason for Genesis Energy to spend the money to construct and upgrade infrastructure as needed without having a firm contract in place. With that said though, the company has not divulged exactly how much of an impact any of these new fields coming online will have on its volumes or cash flows so all we can confidently say right now is that the impact will be positive.

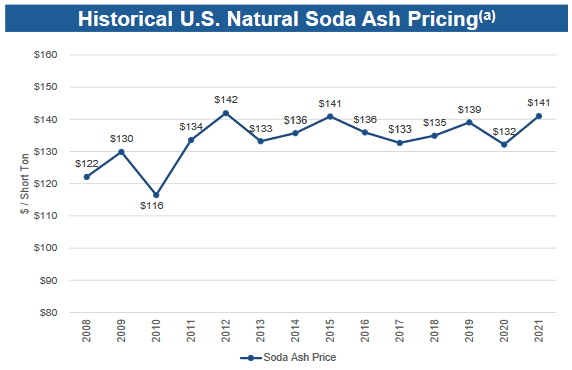

It is Genesis Energy’s Sodium Minerals & Sulfur Services business unit that truly makes the company unique, however. This is partly because Genesis Energy is the largest producer of natural soda ash in the United States. In fact, the company owns approximately 80% of the entire planet’s natural soda ash reserves. This is admittedly not a business that we would expect a midstream company to be in but fortunately, it does have some of the characteristics that the ordinary pipeline business possesses, including recession resistance and generally stable cash flows. This is largely because of the things that natural soda ash is used to produce. These items include soaps, detergents, glass, and other types of cleaning supplies. These are all things that tend to retain their demand even during recessions, which means that the natural soda ash itself will retain its demand. This is the characteristic that allows this business unit to be recession-resistant and generally stable since people and businesses always need cleaning supplies. As a result of this, the market price for natural soda ash tends to be remarkably stable regardless of the conditions in the broader economy:

Genesis Energy/Data from USGS

As we can clearly see, even the COVID-19 pandemic and ensuing lockdowns had a very minimal effect on the price of natural soda ash. This is something that is very nice to see because this is one of the very few areas of its business in which Genesis Energy is exposed to commodity prices and we generally need stable cash flows in order to provide support for the distribution. As the distribution is one of the reasons that investors purchase a company like this, we want every aspect of the business to provide as much support for it as possible.

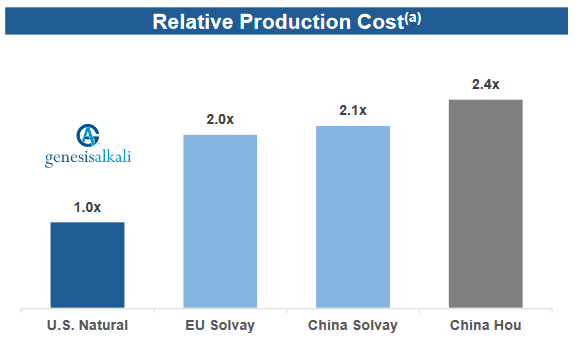

Genesis Energy also has some growth potential here as the global demand for natural soda ash is climbing rapidly. One reason for this is that it takes twice as much soda ash as it does lithium to make either lithium hydroxide or lithium carbonate. These are the primary compounds used in lithium-iron-phosphate batteries, which are beginning to see heavy use in electric vehicles and the battery storage technologies that are sometimes used alongside renewable electricity deployments. Thus, Genesis Energy is very well-positioned to profit off of the “green energy” revolution. With that said, in many cases, synthetic soda ash is being used for all of these purposes as opposed to the natural soda ash being produced by Genesis Energy. In fact, synthetic soda ash currently dominates about 80% of the global market for the compound. There are some reasons to believe that natural soda ash can displace some of the synthetic supply from the market. The biggest reason to believe this is economic. Basically, it costs twice as much to produce synthetic soda ash as it does natural soda ash:

Genesis Energy/Data from IHS and USGS

When we consider this enormous cost advantage, it seems logical that any purchaser would prefer to use natural soda ash if they can obtain it. This is supported by the fact that Genesis Energy has historically sold every ton of soda ash that it can safely produce. Thus, there would seem to be a significant opportunity for Genesis Energy here if it could manage to increase its production. The company is working to do exactly this. Genesis Energy is currently constructing an expansion to its Granger soda ash facilities that should increase its production of natural soda ash by 750,000 tons per year. This expansion is expected to come online sometime in the middle of next year and considering Genesis Energy’s cost and pricing advantages compared to the competition, it is likely that the company will have no real trouble selling this extra production. This will naturally give the company a boost to its revenues and cash flows at that time. When we combine this with the impending growth from the company’s offshore operations, we can see a very clear pipeline for growth for Genesis Energy.

Financial Considerations

For quite some time now, my biggest concern with Genesis Energy has been its high debt load. I discussed this in past articles on the company. My reason for this concern is that debt is a riskier way to finance a company than equity because the company has to make regular payments on its debt if it wishes to remain solvent. Thus, a decline in cash flows could push the company into financial distress. Genesis Energy is certainly no stranger to having its finances strained by debt as the stated reason for the company’s 2017 distribution cut was to pay down debt. While it has certainly made some progress at this, the debt load is still much higher than I really like to see.

One way that we can see that Genesis Energy’s debt load is too high is by looking at its leverage ratio, which is also known as the adjusted debt-to-adjusted EBITDA ratio. This ratio essentially tells us how long it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. As of March 31, 2022, this ratio stood at 5.10x based on the company’s trailing twelve-month adjusted EBITDA. This is quite a bit higher than the 5.0x that analysts consider to be reasonable. However, ever since the 2020 energy price collapse, many midstream companies have been trying to get their ratios under 4.0x in order to reduce their risks. That is also where I like to see this ratio, for the same reason. Although Genesis Energy has stated its intention to get its leverage down to that level, we can clearly see that it has a long way to go.

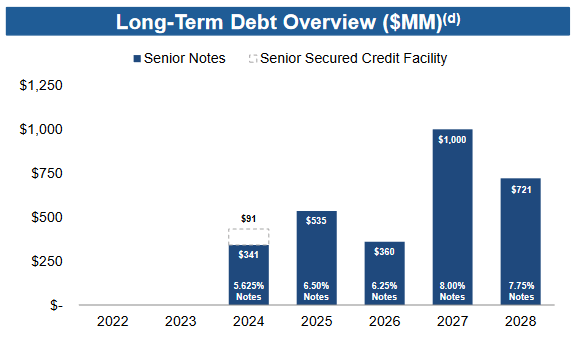

Fortunately for Genesis Energy, it does have a little while to go until its debt really becomes a problem. We can see this by looking at the company’s debt maturity schedule:

Genesis Energy

As we can see, Genesis Energy does not have any debt maturing until 2024, although the first big tranche comes due in 2025. As we have already seen, the company is likely to see a cash flow increase in 2023 so that should help it cover that maturity as it comes due. We should not get complacent though as a lot can happen in two years so we still want to keep an eye on this.

Distribution Analysis

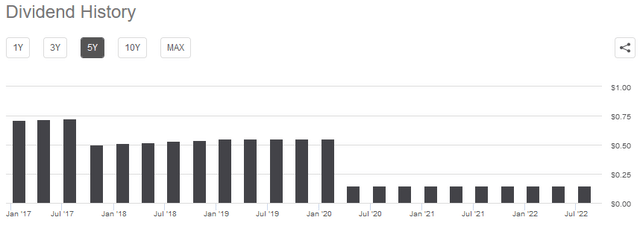

One of the main reasons that we purchase shares of midstream partners like Genesis Energy is because of the incredibly high yields that they typically possess. Genesis Energy is certainly no exception to this as the units yield 7.49% as of the time of writing. Unfortunately, Genesis Energy does not exactly have the best record of maintaining its distribution as the company has cut it twice in the past five years:

We can mostly forgive the distribution cut in 2020 since that was a time of great uncertainty for the industry despite its generally stable cash flows. This is because the collapse in oil prices meant that upstream companies cut back substantially on production growth and caused midstream companies to be uncertain about what could happen going forward. The cut back in 2017 is somewhat harder to forgive but as already mentioned, Genesis Energy took that action as part of an effort to get its debt under control. While that is a good reason, the company’s lack of consistency may prove somewhat off-putting to an investor looking to obtain a secure source of income to pay their bills or maintain their lifestyles. However, the important thing to remember is that anyone purchasing today will be receiving the current distribution and the current yield and will not be affected by the company’s past actions. Thus, it is critical that we examine Genesis Energy’s ability to maintain the distribution at its current level so that we can be confident that it will not be forced to cut again and reduce our incomes along with its own partnership unit price.

The usual way that we analyze a midstream company’s ability to afford its distribution is by looking at its distributable cash flow, which Genesis Energy calls “reported available cash before reserves.” Despite the different names, it is essentially the same thing as distributable cash flow. Basically, this item is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available for distribution to the limited partners. In the first quarter of 2022, Genesis Energy reported available cash before reserves of $55.727 million but only pays out $18.387 million in distributions quarterly. This gives the company a distribution coverage ratio of 3.03x. As a general rule, analysts consider anything higher than 1.20x to be reasonable and sustainable but I am more conservative and like to see this figure above 1.30x in order to add a margin of safety to the investment. As we can clearly see, Genesis Energy easily meets both of these requirements. Overall, this distribution should be quite safe and investors probably do not have to worry about a cut here.

Conclusion

In conclusion, Genesis Energy is one of the more unique companies in the midstream space but that could work to our advantage. This comes from the fact that two of the firm’s business units have some very real growth opportunities that are not available to the company’s more conventional peers. At least some of these growth prospects are likely to manifest themselves within the next year or two so anyone buying today will certainly be able to profit from them. However, these opportunities do come with some risks as Genesis Energy has yet to get its debt truly under control despite the promises that management has been making over the past five years. The company does boast a very sustainable and attractive yield though so at least we are well paid to take on these risks and can be patient as those distributions will roll in while we wait for the growth story to play out. Overall, this company may be worth considering today.

Be the first to comment