davidrasmus

Another Fed pivot attempt has been denied. The market is learning the hard way that the Fed is stuck and has to keep raising rates because, despite their best efforts to slow the economy, it’s just not happening. The economy may be improving, which is the biggest problem that the market fails to realize.

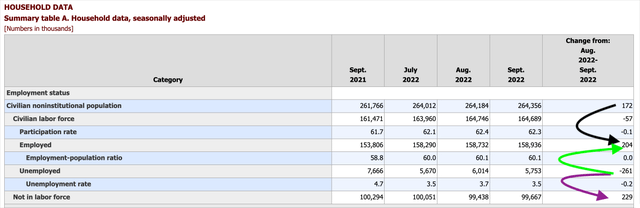

The jobs report was much stronger than it would seem, evident in the household survey. With a population growth rate of 172,000, everybody entering the workforce found a job, while 32,000 unemployed workers found work too. Additionally, 229,000 people left the workforce during the month.

BLS.gov

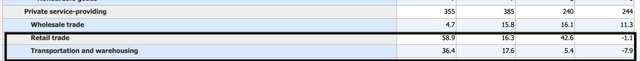

Additionally, the establishment survey reveals an interesting piece of information. The retail sector saw job losses, and with the holiday season coming, those losses are likely to turn into gains. For example, Amazon (AMZN) just announced it would hire 150,000 seasonal workers, and if other companies do the same, this could lead to a rebound in the job report over the next two months. While those gains would likely be temporary, they could still lead to further pressure on the unemployment rate.

BLS.gov

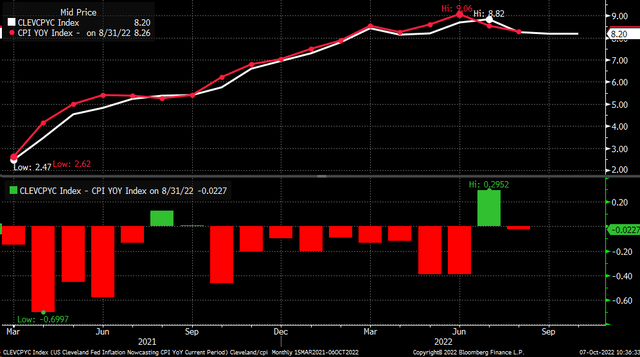

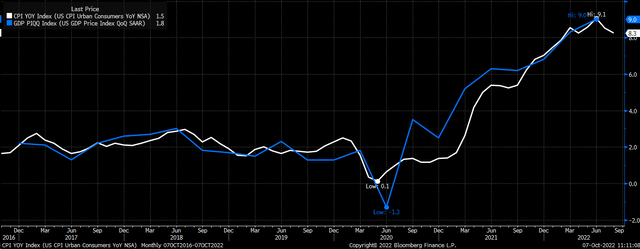

The most significant risk comes next week, with the CPI report, because estimates are for an increase of 8.1% y/y, while the Cleveland Fed is projecting CPI to rise by 8.2% y/y. The problem is that the CPI report has been hotter than the Cleveland Fed’s estimates 15 times since March 2021. That means consensus estimates for the CPI report may be too low.

Bloomberg

If you get a hot CPI report next week, coupled with an improving job report in November, it could mean that we aren’t looking at 125 bps worth of Fed hiking between now and the end of the year. We could be looking at 150 bps for Fed hiking by year-end, with the Fed hiking by 75 bps in November and another 75 bps in December.

Don’t think the market isn’t already thinking about it, either, because it is. The market is now pricing in more than five 25 bps rate hikes by the December meeting. But more importantly, that number is now rising; it had been around four late last week. The fact that it sees more than five hikes now means the market is starting to price in 150 bps worth of hikes by year-end, and a hot CPI report would likely push those odds even higher.

Bloomberg

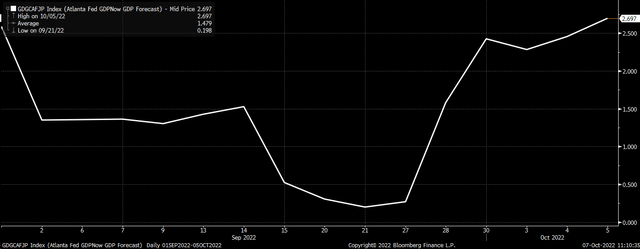

Improving GDP Growth

Additionally, it may very well be that the economy is improving. The Atlanta Fed GDPNow model suggests a real growth rate of 2.7% in the third quarter, which is a massive improvement from the first and second quarters.

Bloomberg

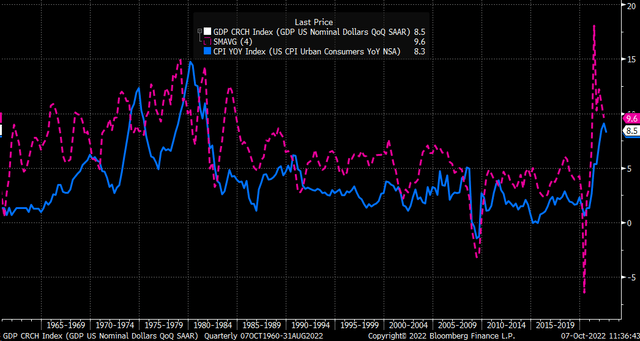

Given that the GDP price index follows CPI very closely and that CPI is tracking at what’s most likely greater than 8% in the third quarter, it seems there’s a high probability the GDP price index will be around 8%. That means the US economy is probably growing at nearly an 11% annualized growth rate in nominal terms for the third quarter. That would be a significant improvement from the 6.6% nominal annualized growth rate in the first quarter and the 8.5% growth rate in the second quarter.

Bloomberg

That’s the point when you realize there is no way the Fed can pivot anytime soon because if the Fed has any hope of inflation cooling, it needs nominal growth to head lower, and right now, nominal growth isn’t even heading in the right direction.

The chart below shows that when taking a four-quarter moving average of nominal GDP growth, a growth spike tends to lead to higher inflation rates. It was most noticeable in the 1970s, the early 2000s, and even today, with a four-quarter moving average of 9.6%. The GDP moving average is still too high and would need to fall to lower levels to bring the inflation rate. Based on the current data from GDPNow, it seems we will have three quarters of improving trends.

Bloomberg

The dovish pivot camp needs to call it quits because this isn’t the 2010 economic regime, and the market needs to start thinking very differently about everything.

Be the first to comment