HJBC

One week after TotalEnergies’s (NYSE:TTE) investor day, we are back to comment on the release update and to implement the company’s numbers into our forecasted financials.

Total: One Week Ahead Of Its Strategy Update

Source: Mare Evidence Lab’s previous publication

In our Total’s comment preview, we forecasted:

- a higher CAPEX expenditure at the high end of the company’s range (approximately $16 billion);

- and a better and simpler excess capital allocation policy. There was no clear explanation of shareholder remuneration policy and it used to be declared based on a “surplus from cashflow”. We thought that there were dividend payments in $ to remove FX fluctuation and be more in line with BP (BP) and Shell (SHEL).

After having attended the Strategy & Outlook Day, to sum up, we were right. Bottomline, the company manages to increase its shareholder distribution and to increase its capital investments. However, we should note the following: higher CAPEX investments were towards low carbon activity and the dividend policy was confirmed on the Euro currency.

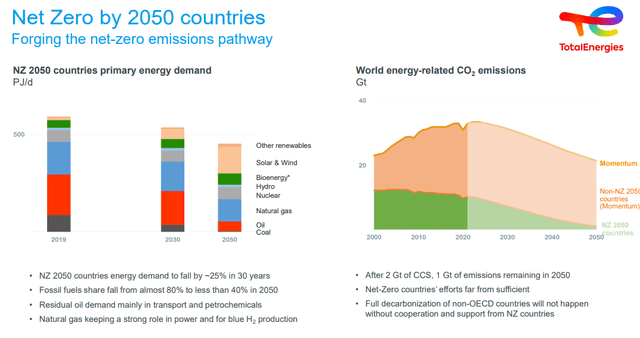

Going into the details, CAPEX increased in the range of $14 to $18 billion ($1 billion will be fully dedicated to the energy savings program). regarding investors’ sentiment, there were some expectations of higher investments toward E&P of gas and oil; however, Total’s focus is more on renewable energy generation where projects have a lower IRR. We believe this is the reason why Total is underperforming in the oil sector. Here at the Lab, even if we recognized that this oil environment will last, the Total long-term strategy is likely the right one – and what the current market dislikes is probably going to be the company’s clear competitive advantage in the future.

Source: TotalEnergies Energy Outlook 2022

Regarding shareholder distribution, the company modified its policy to a 35/40% payout through the cycle. In 2022, Total remuneration should exceed 35% and will remunerate the investors as follows:

- a new €1 per share special dividend that will be paid in December (announced during the strategy day);

- an ongoing buyback that should reach $7 billion. In addition, the CEO emphasized that they will use share repurchases as they believe Total’s shares continue to be undervalued;

- an increase in its quarterly DPS of 5%.

The company is implementing new CAPEX guidance and a higher shareholder remuneration policy, but what about the underlying business?

The company’s cash flow target is estimated to be +$4 billion more excluding Russia’s disinvestment. Here at the Lab, we already covered the topic – if you are interested have a look at TotalEnergies’ Russian Exposure publication. The cashflow target is below the previous communication target and is mainly due to higher investment in renewables and electricity activities. Plus, we should also consider the inflationary pressure at the OPEX level.

A full presentation was dedicated to LNG and the company’s US investment. There is a strong appetite to grow in the North American area. After building an important Russian hub that is now jeopardized, investors were concerned about Total’s portfolio repositioning. The US investments are already at more than 10% of the company’s capital employed, and even if this used to be the limit in the past, the CEO seems interested to invest more. There is a global deficit of LNG, and the French multi-energy company has a 10% market share. This is a key value too. Concerning the oil, we appreciate this discipline strategy. Total President of E&P declared that they are continuously screening for new projects with a break-even point of $20/30 per oil barrel.

Conclusion and Valuation

To the negative part, we are forecasting a $1 billion in additional tax on profit. We expect that taxation will impact the company’s excess capital allocation policy. There is no clear comment because this will depend on the regulator’s and EU commission’s next decision. Even if there are political risks, we still think that Total is pretty undervalued based on an EV/Debt-adjusted cash flow (5x versus peers’ average of 6x). Investors were concerned about renewable energy IRR versus the supportive oil & gas environment. We are long for the opposite reason.

Previous coverage on Total:

- Q2 results comment: Our Long-Term View Is Confirmed

- Total: Our Favourite Pick In The Renewable Energy Transition

Be the first to comment